Ohio Resolution of Meeting of LLC Members to Dissolve the Company

Description

How to fill out Resolution Of Meeting Of LLC Members To Dissolve The Company?

US Legal Forms - one of the largest collections of legal documents in the USA - provides a variety of legal form templates you can download or create.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can find the most recent documents such as the Ohio Resolution of Meeting of LLC Members to Dissolve the Company in just moments.

Read the form description to confirm you have chosen the right document.

If the form does not meet your requirements, use the Search field at the top of the page to find the one that does.

- If you already have a membership, Log In to obtain the Ohio Resolution of Meeting of LLC Members to Dissolve the Company from your US Legal Forms library.

- The Download button will be visible on each form you view.

- You have access to all previously saved forms in the My documents tab of your account.

- To utilize US Legal Forms for the first time, follow these straightforward steps to get started.

- Ensure you have selected the correct form for your city/state.

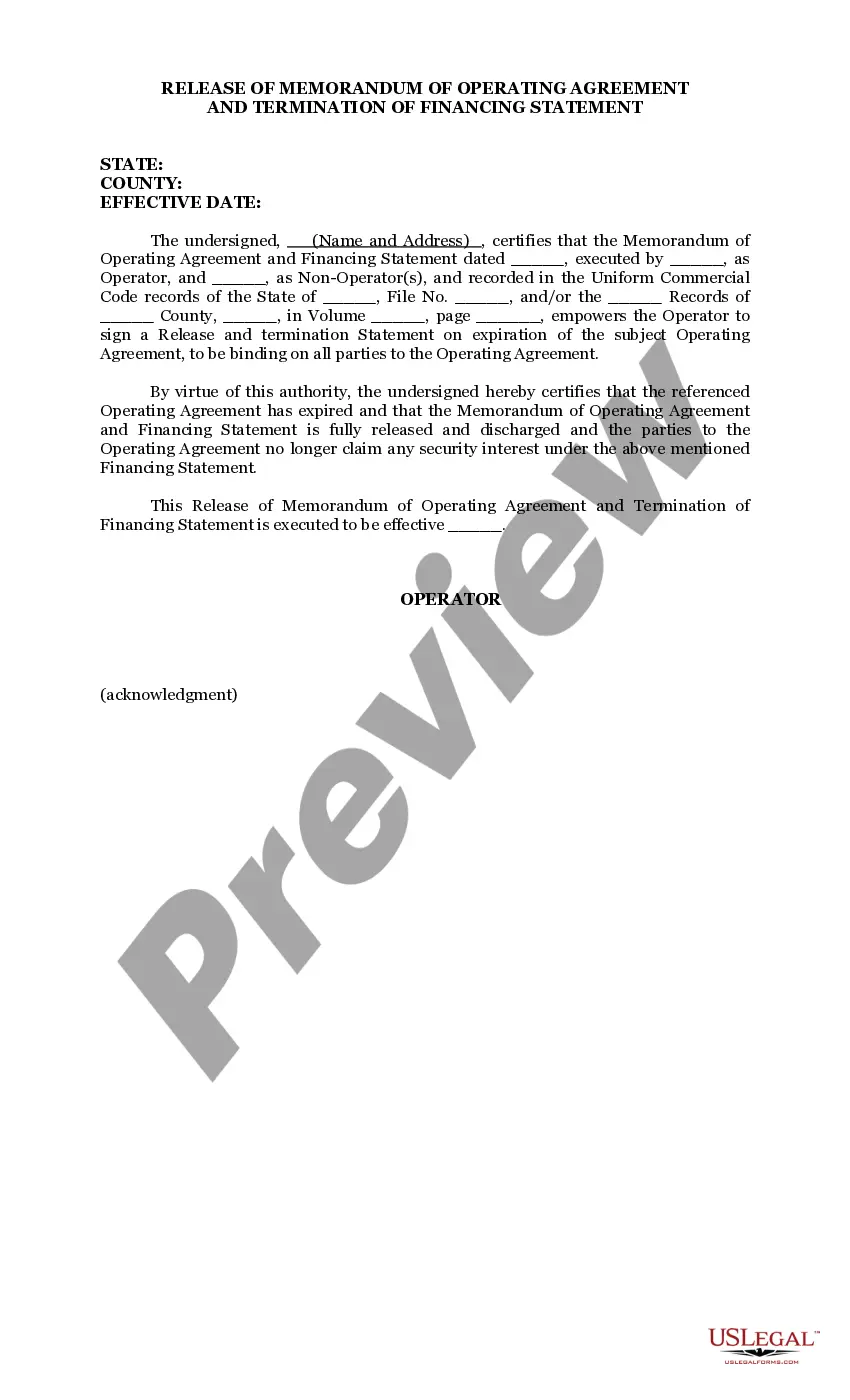

- Click the Preview button to review the content of the form.

Form popularity

FAQ

To close your business at the state-level of government, you may need to file a dissolution with the Secretary of State as well as close any business accounts you have with the state. There may be more to do at federal and local levels.

Members must dissolve an LLC to officially close it. This dissolution is essential to ending the corporation since LLCs are separate legal entities. In the state of Ohio, LLCs must comply with relevant dissolution procedures as stipulated in the Ohio Revised Code Title 17.

To dissolve your LLC in Ohio, you must provide the completed Certificate of Dissolution of Limited Liability Company / Cancellation of Foreign LLC form to the Secretary of State by mail, in person, or online. The Ohio Secretary of State does not require original signatures.

These terms are often used interchangeably, but have distinct legal meanings. Dissolution is the winding up of the affairs of the entity in advance of the termination of the entity. Termination of the entity occurs when the entity ceases to legally exist.

How to Dissolve an LLCConfirm the Company Is in Good Standing.Hold a Vote to Dissolve the Business.File LLC Articles of Dissolution.Notify the Company's Stakeholders.Cancel Business Licenses and Permits.File the LLC's Final Payroll Taxes.Pay Final Sales Tax.File Final Income Tax Returns.More items...?

There is a $50 fee to file the certificate. Your filing should be processed within about five business days. You may pay additional fees for expedited processing. The SOS has a certificate of dissolution form available for download.

The dissolution is initiated by a resolution by the board of directors who submit it at a meeting of the shareholders. The shareholders each vote and if the resolution is approved, the directors have the authorization to proceed with the dissolution process.

To dissolve your corporation in Ohio, you must provide the completed Certificate of Dissolution by Shareholders, Directors, or Incorporators form (561) to the Secretary of State by mail or in person. The certificate itself is not too complicated and instructions are included at the end of Form 561.

How to Dissolve an LLCVote to Dissolve the LLC. Members who decide to dissolve the company are taking part in something called a voluntary dissolution.File Your Final Tax Return.File an Article of Dissolution.Settle Outstanding Debts.Distribute Assets.Conduct Other Wind Down Processes.

To close an LLC completely, you need to file a final tax return with the state and the IRS. Make sure you check the box to show this is the final return for the LLC. Fill out Schedule K-1 and give a copy to each member so that they know what to report on their own personal taxes in terms of losses and gains.