Ohio Assignment of Personal Property

Description

How to fill out Assignment Of Personal Property?

If you desire to compile, download, or print legal document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Take advantage of the site’s straightforward and user-friendly search to locate the documents you require. Various templates for business and personal purposes are organized by type and jurisdiction, or by keywords.

Utilize US Legal Forms to find the Ohio Assignment of Personal Property in just a few clicks.

Each legal document template you acquire is yours permanently. You will have access to every form you have downloaded in your account. Navigate to the My documents section and select a form to print or download again.

Compete, download, and print the Ohio Assignment of Personal Property with US Legal Forms. There are numerous professional and state-specific forms that you can utilize for business or personal needs.

- If you are an existing US Legal Forms user, Log In to your account and click the Download button to obtain the Ohio Assignment of Personal Property.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have chosen the form for the correct city/county.

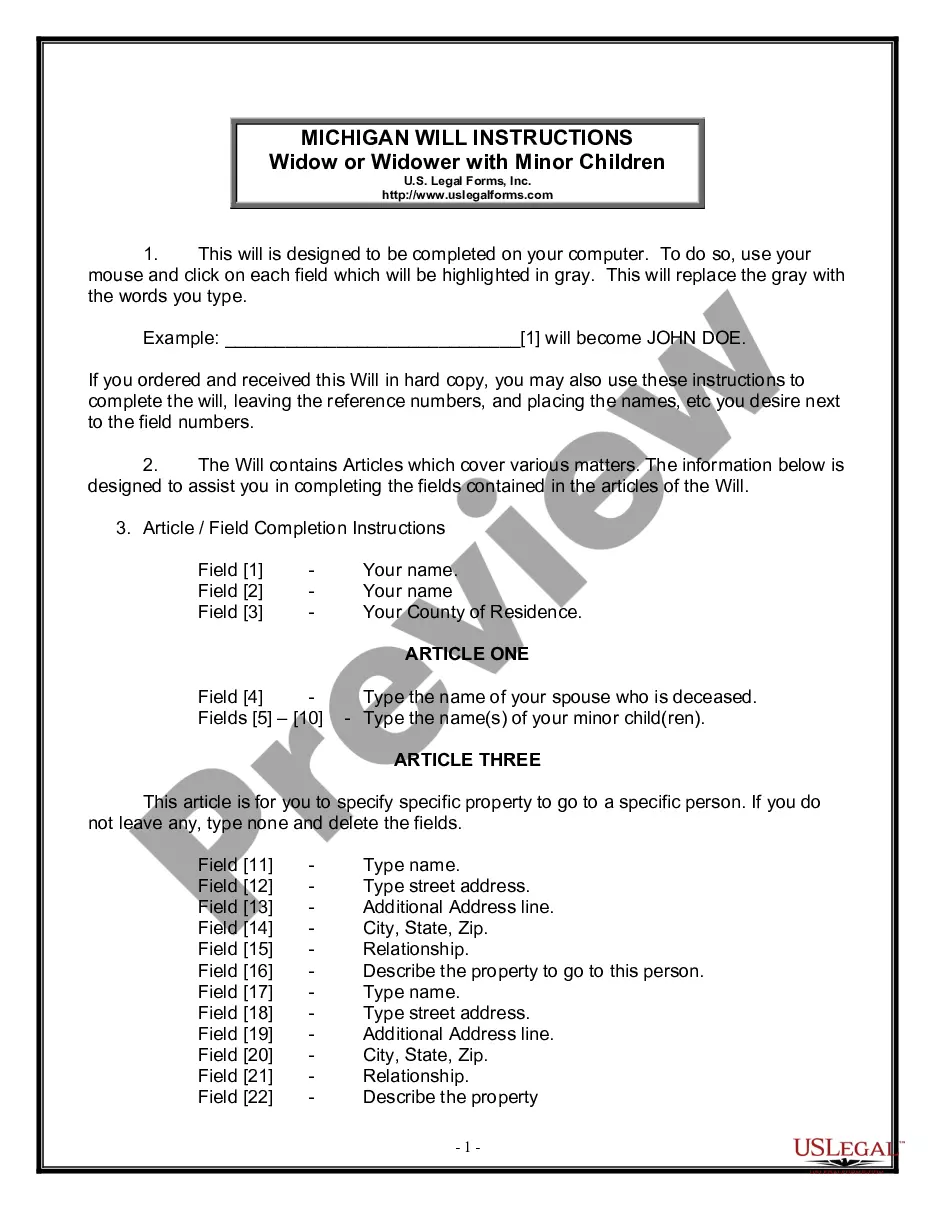

- Step 2. Use the Preview feature to review the content of the form. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal document template.

- Step 4. Once you have found the form you need, click the Download now button. Choose your desired pricing plan and provide your credentials to register for an account.

- Step 5. Complete the purchase. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Ohio Assignment of Personal Property.

Form popularity

FAQ

Ohio law allows individuals who do not need the estate administration benefits of a trust agreement to avoid Probate on the transfer of real property by executing a legal document called a Transfer-On-Death (TOD) Designation Affidavit.

Ohio's conveyance fee is $1.00 for each $1,000 of the real estate's valuetypically based on the purchase price of the transferred property. The seller is responsible for paying the conveyance fee unless the parties agree otherwise. Ohio law exempts 25 transfer types from the conveyance fee.

Typically, you need the property ownership document and the Will, or the Will with probate or succession certificate. In the absence of a Will, you may also need to prepare an affidavit along with a no-objection certificate from other legal heirs or their successors.

"Tangible personal property" means personal property that can be seen, weighed, measured, felt, or touched, or that is in any other manner perceptible to the senses.

Everything you own, aside from real property, is considered personal property. This includes material goods such as all of your clothing, any jewelry, all of your household goods and furnishings, and anything else that is movable and not permanently attached to a fixed location such as your home.

To sell real estate by consent, the executor or administrator must obtain the written authorization to sell the real estate from the decedent's surviving spouse and all of the beneficiaries under the Will or heirs at law.

Documents Required for property transfer after death of husbandWill/ testament.Probate or Letter of Administration.Certified copy of death certificate of the testator.property deed and the identity proof of the person(s) for which the transfer of will is executed.Partition deed executed among the legal heirs.More items...

Affidavit of self-adjudication, and deed of extrajudicial settlement of estate and adjudication of the estate (should be signed by all the heirs and afterward notarized before a Notary Public) Description of the property to be divided among the heirs. Bond fixed by the court, should there be personal property involved.

For purposes of this chapter and Chapter 5741, of the Revised Code, "tangible personal property" includes motor vehicles, electricity, water, gas, steam, and prewritten computer software.

Claims against the estate may be made up to six months from the date of death. A small estate that does not require the filing of a federal estate tax return and has no creditor issues often can be settled within six months of the appointment of the executor or administrator.