Ohio Employee Final Release to Employer

Description

How to fill out Employee Final Release To Employer?

Finding the appropriate legal document format can be a challenge.

Certainly, there are numerous templates available online, but how do you locate the legal form you need.

Utilize the US Legal Forms website. The service provides a multitude of templates, such as the Ohio Employee Final Release to Employer, that you can utilize for both business and personal purposes.

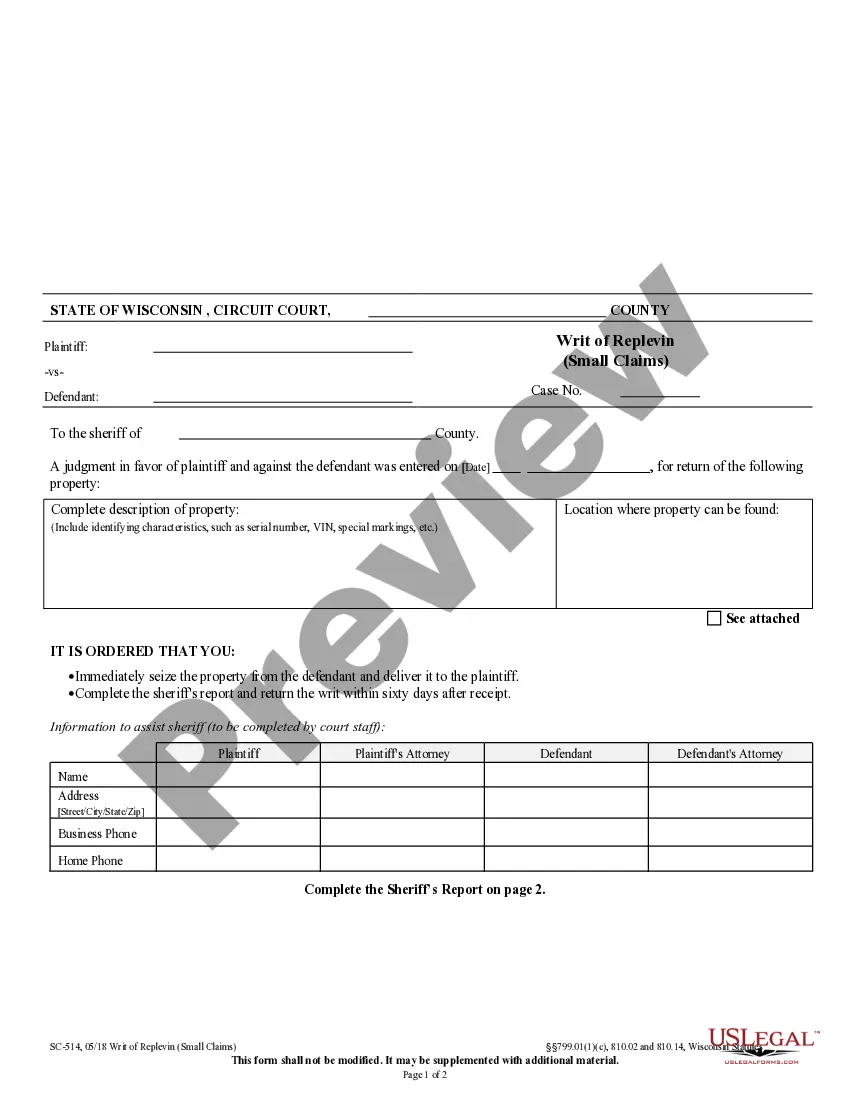

First, ensure you have selected the correct form for your city/state. You can browse the form using the Review option and examine the form description to confirm it is the appropriate one for you.

- All of the forms are reviewed by professionals and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to retrieve the Ohio Employee Final Release to Employer.

- Leverage your account to view the legal forms you have previously purchased.

- Visit the My documents section of your account to obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are some simple steps to follow.

Form popularity

FAQ

There are no circumstances under which an employer can totally withhold a final paycheck under Ohio law; employers are typically required to issue a final paycheck containing compensation for all earned, unpaid wages, as well as for any earned but unused vacation time.

The final paycheck should contain the employee's regular wages from the most recent pay period, plus other types of compensation such as commissions, bonuses, and accrued sick and vacation pay. Employers can withhold money from the employee's last paycheck if the employee owes your organization.

Is my employer required to pay me for holidays? No, the State of Ohio has no requirements for the payment of holiday, vacation, or sick time.

In Ohio, as in most other states, employment is at will. That means that under Ohio law, an employee is generally free to quit his or her job for any reason. Similarly, an employer may generally terminate an employee for any reasonor even for no reasonas long as the reason doesn't violate the law.

Ohio is an at-will employment state. This means that most employers may fire (terminate) or discipline an employee for any reason at any time, including a bad reason or no reason at all.

Are termination letters required? Most companies are not required by law to give employees letters of termination. The exceptions are those located in Arizona, California, Illinois and New Jersey. Most employers, however, do provide termination letters as a professional courtesy and a legal record.

As per Ohio Rev. Code Ann. § 4113.15, when an employee is fired, the employer must give a final paycheck to him or her on the next regularly scheduled pay date, or within fifteen (15) days, whichever is earlier.

There is no lawful requirement that an employee provide at least two weeks' notice before they end their employment. Although two weeks' notice is common and viewed as a polite manner to handle a separation, an employer cannot simply decide that it doesn't wish to pay an employee their final wages.

According to Ohio Revised Code §4113.15, a terminated employee must get their final paycheck on their next scheduled pay date or within fifteen days. The employee who was fired should receive their pay on whichever is earlier.

Notice: An employer does not legally have to give an employee notice of termination. Your personnel file: In Ohio, which is unlike some states, employees do not have a right to view their personnel file.