Ohio Contract with Independent Contractor to Work as a Consultant

Description

How to fill out Contract With Independent Contractor To Work As A Consultant?

US Legal Forms - one of the preeminent collections of legal documents in the United States - offers a vast selection of legal document templates that you can download or print.

By utilizing the website, you can find thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can discover the latest versions of forms such as the Ohio Contract with Independent Contractor to Work as a Consultant within minutes.

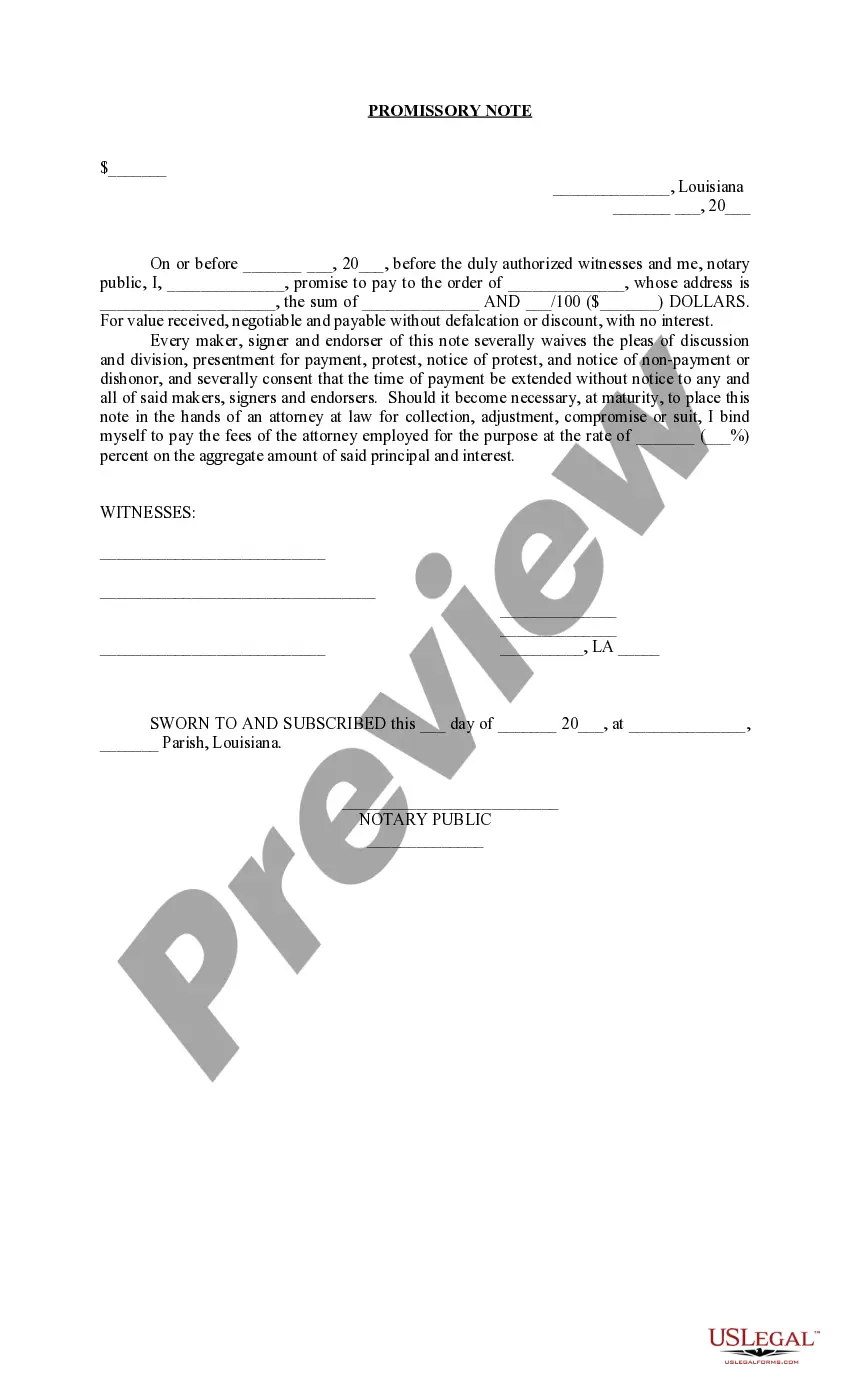

Click on the Review button to examine the contents of the form. Check the form details to make sure you have chosen the right one.

If the form doesn’t meet your requirements, make use of the Lookup field at the top of the screen to find the one that does.

- If you are a subscriber, Log In to download the Ohio Contract with Independent Contractor to Work as a Consultant from your US Legal Forms library.

- The Download button will appear on each form you access.

- You can access all previously saved forms in the My documents section of your account.

- To use US Legal Forms for the first time, follow these straightforward instructions to get started.

- Ensure you have selected the appropriate form for your locality/region.

Form popularity

FAQ

While your clients do not take taxes out of your pay, they do report your 1099 earnings to the IRS. Your clients are required to send you a 1099 when you earn $600 or more in a year.

Freelancers and consultants are known as "independent contractors" in legal terms. An independent contractor (IC) is a person who contracts to perform services for others without having the legal status of an employee.

Businesses will need to use Form 1099-NEC if they made payments totaling $600 or more to a nonemployee, such as an independent contractor, freelancer, vendor, consultant, or other self-employed individual.

Freelancers and consultants are known as "independent contractors" in legal terms. An independent contractor (IC) is a person who contracts to perform services for others without having the legal status of an employee.

When you do consulting work in the U.S., you can be paid two different ways: as an employee on a W-2 tax basis, or on a 1099 tax basis as an independent contractor. As a consultant, being paid on a 1099 tax basis is a huge plus for two key reasons: You save more for retirement.

Even if you don't get a 1099 from a client, report the income on Form Schedule C, along with your business expenses and carry over the net profit or loss to your From 1040 as self-employment income on line 12. If that amount is more than $400, you'll owe self-employment tax, which requires you to also file Schedule SE.

While your clients do not take taxes out of your pay, they do report your 1099 earnings to the IRS. Your clients are required to send you a 1099 when you earn $600 or more in a year.

To report your income, you should file a Schedule C with your business income and expenses. Also, you should pay a self-employment tax. Without a 1099 Form, independent contractors who earned cash should keep track of their earnings, estimate them and file them at the end of the year no matter what.

Contractor vs. The big difference is that contractors actually perform work to complete a task, and consultants create solutions to guide how a company can conduct its workflow.

At that point the Consultant may be said to become a Contractor. The terms have also become blurred as industry has incorporated them into employee job titles. Generally, a Consultant is a self-employed independent businessperson who has a special field of expertise or skill.