Ohio Account Stated Between Partners and Termination of Partnership

Description

How to fill out Account Stated Between Partners And Termination Of Partnership?

Are you within a placement in which you need to have documents for sometimes business or individual uses virtually every day? There are plenty of authorized document templates accessible on the Internet, but locating types you can rely isn`t easy. US Legal Forms provides 1000s of form templates, like the Ohio Account Stated Between Partners and Termination of Partnership, that happen to be published to fulfill state and federal needs.

When you are already familiar with US Legal Forms website and have your account, basically log in. Following that, you can acquire the Ohio Account Stated Between Partners and Termination of Partnership template.

If you do not provide an bank account and want to begin using US Legal Forms, adopt these measures:

- Discover the form you will need and make sure it is for that appropriate metropolis/county.

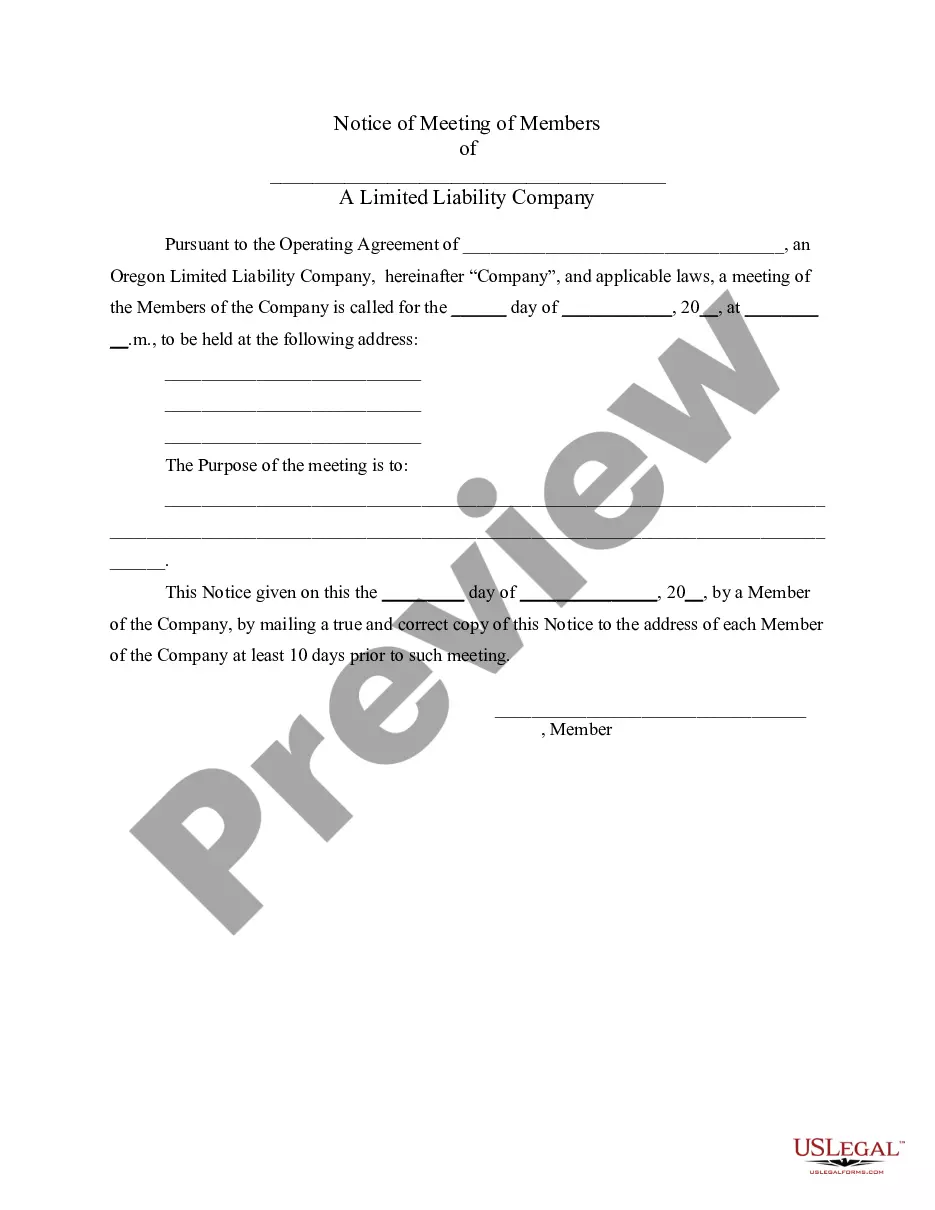

- Make use of the Review option to review the shape.

- Read the information to actually have chosen the appropriate form.

- In case the form isn`t what you`re searching for, take advantage of the Lookup area to find the form that fits your needs and needs.

- Whenever you obtain the appropriate form, click Get now.

- Opt for the costs program you want, submit the required information and facts to make your bank account, and pay for the transaction utilizing your PayPal or Visa or Mastercard.

- Choose a handy file formatting and acquire your version.

Find all of the document templates you have bought in the My Forms menus. You can get a extra version of Ohio Account Stated Between Partners and Termination of Partnership at any time, if possible. Just select the necessary form to acquire or produce the document template.

Use US Legal Forms, the most extensive variety of authorized kinds, to save lots of efforts and stay away from faults. The assistance provides professionally made authorized document templates that can be used for an array of uses. Create your account on US Legal Forms and begin making your life easier.

Form popularity

FAQ

When a partnership dissolves, the individuals involved are no longer partners in a legal sense, but the partnership continues until all debts are settled, the legal existence of the business is terminated and the remaining assets of the company have been distributed. [Read more about strategic partnerships.]

The vendor's license can be closed while filing the final return through the Ohio Business Gateway by selecting ?cancel my account?, or through the Tele-File system. If the final return has previously been filed, the Ohio Business Account Update Form can be used to request a date of cancellation.

While both words are concerned with the end of a business partnership, dissolution refers to the process itself, and usually to the departure (or death) of one or more individuals from the entity, while termination refers to the cessation of all operations, including the disposal of all assets.

Close your business Decide to close. Sole proprietors can decide on their own, but any type of partnership requires the co-owners to agree. ... File dissolution documents. ... Cancel registrations, permits, licenses, and business names. ... Comply with employment and labor laws. ... Resolve financial obligations. ... Maintain records.

5 Key Steps in Dissolving a Partnership Review your partnership agreement. While some partnerships don't require a formal or written agreement, most partners choose to have one anyway for protection. ... Discuss with other partners. ... File dissolution papers. ... Notify others. ... Settle and close out all accounts.

Call the State of Ohio Department of Taxation to cancel the old Vendor's License at 1-888-405-4039.

As provided in Ohio Revised Code Section 1776.65, a partner may file a Statement of Dissolution (Form 567), which signals the end of the partnership. Dissolution means the partnership will no longer be conducting new business, but concluding all existing business and ending the partnership's existence.

To dissolve an LLC in Ohio, you will need to comply with Ohio's revised code 1706.471. This involves filing a Certificate of Dissolution with the Ohio Secretary of State and a $50 filing fee.