Ohio Sample Letter for Judgment - Garnishment

Description

How to fill out Sample Letter For Judgment - Garnishment?

Discovering the right legitimate file format can be a have difficulties. Needless to say, there are plenty of themes available on the net, but how can you obtain the legitimate type you want? Use the US Legal Forms internet site. The assistance offers thousands of themes, like the Ohio Sample Letter for Judgment - Garnishment, that can be used for business and personal needs. Every one of the kinds are examined by pros and satisfy state and federal demands.

Should you be previously signed up, log in to your accounts and click the Download switch to obtain the Ohio Sample Letter for Judgment - Garnishment. Make use of accounts to appear with the legitimate kinds you may have acquired earlier. Go to the My Forms tab of your accounts and get another version in the file you want.

Should you be a new user of US Legal Forms, allow me to share basic guidelines that you should comply with:

- First, ensure you have chosen the appropriate type for your metropolis/state. You may examine the shape making use of the Review switch and read the shape description to make certain it is the right one for you.

- In the event the type does not satisfy your requirements, use the Seach discipline to obtain the right type.

- When you are positive that the shape is proper, select the Purchase now switch to obtain the type.

- Pick the prices prepare you desire and type in the required details. Create your accounts and purchase your order making use of your PayPal accounts or bank card.

- Choose the file format and down load the legitimate file format to your gadget.

- Total, edit and produce and indicator the received Ohio Sample Letter for Judgment - Garnishment.

US Legal Forms will be the biggest collection of legitimate kinds where you will find various file themes. Use the service to down load appropriately-created paperwork that comply with state demands.

Form popularity

FAQ

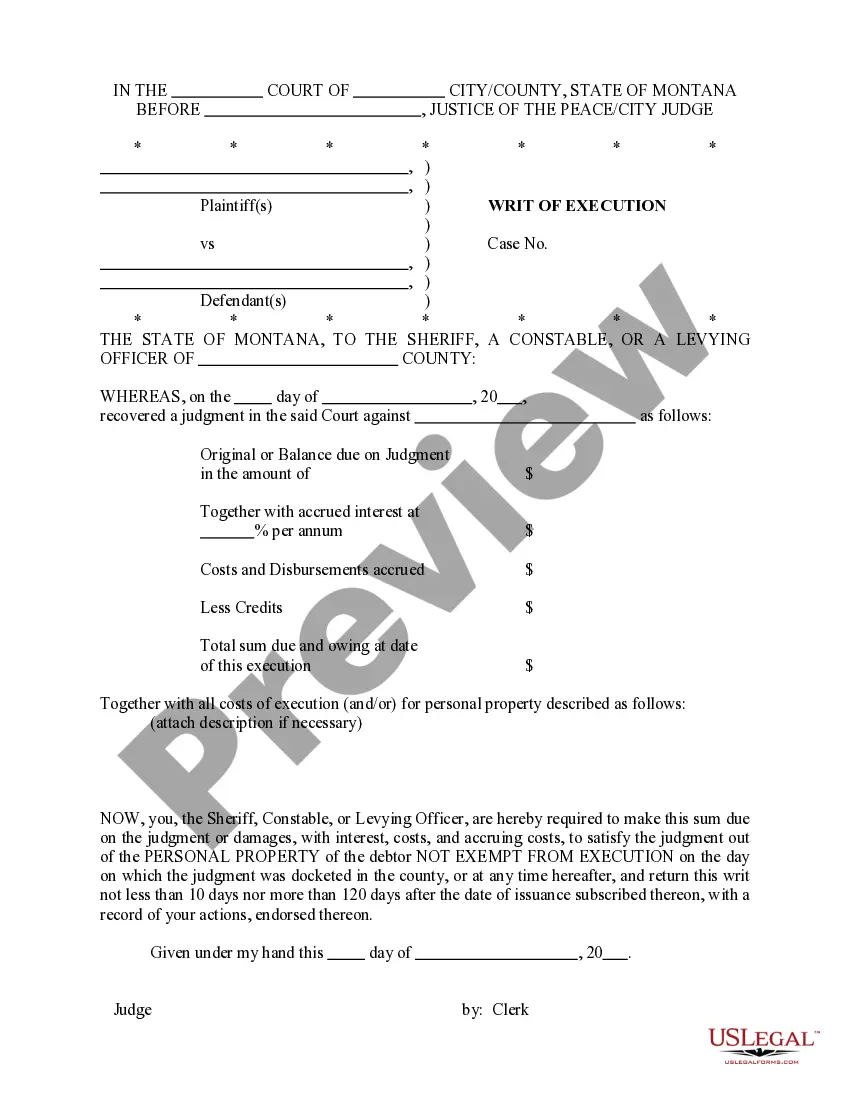

If the judgment debtor fails to pay, the judgment creditor may request that the court seize the debtor's property, sell it, and collect the judgment from the proceeds.

Collecting Your Judgment WAGE GARNISHMENT: You may have the wages of the Defendant garnished. ... EXECUTION OF PERSONAL PROPERTY: For a deposit of $450.00 or more as determined by the Court, you may attach nonexempt property of the defendant to satisfy your judgment. ... CERTIFICATE OF JUDGMENT:

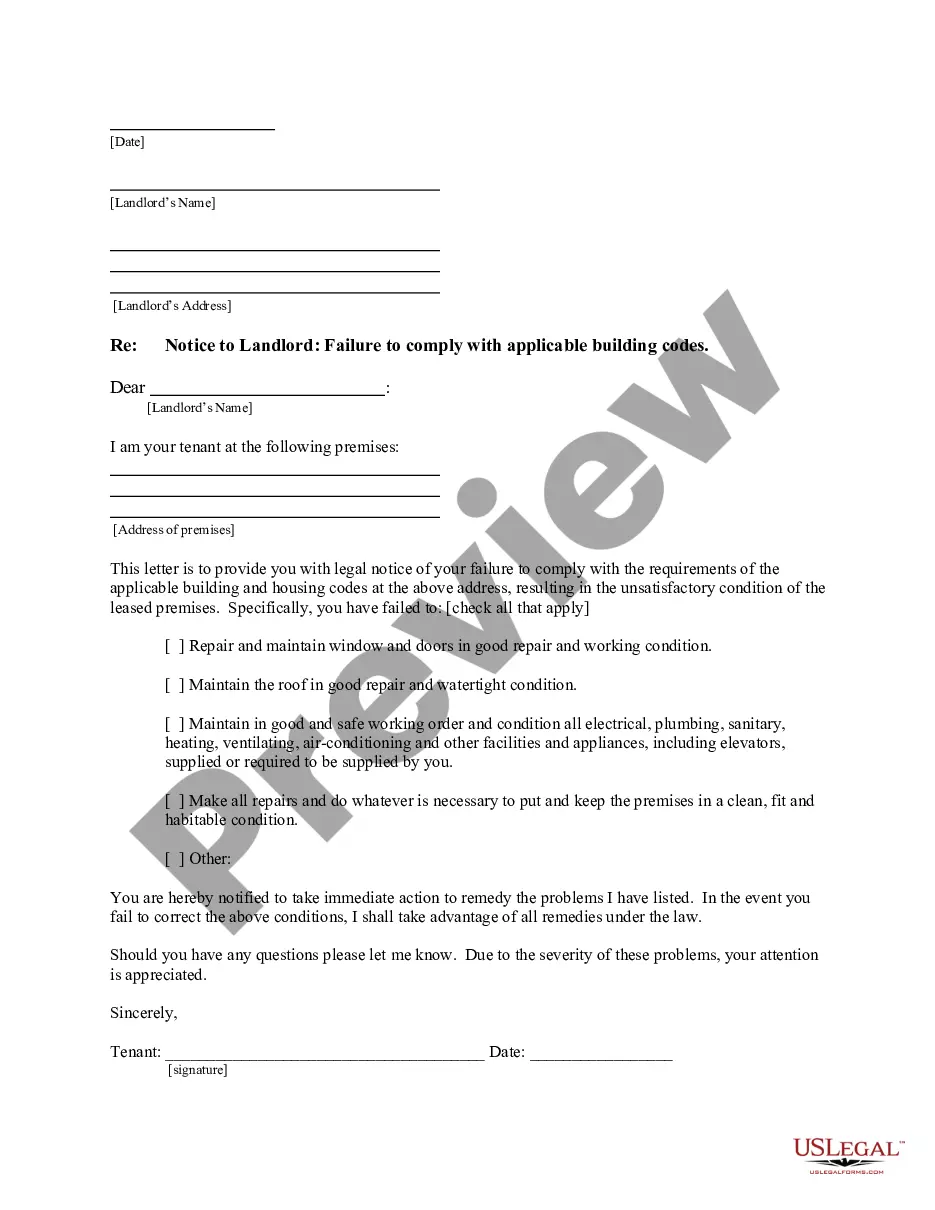

When a creditor gets a court order against you for collection, it must send you a letter between 15 and 45 days after the judgment informing you of the judgment and listing your options: pay the debt or expect wage garnishment.

At a minimum, your written objection to the garnishment should include the following information: the case number and case caption (ex: "XYZ Bank vs. John Doe") the date of your objection. your name and current contact information. the reasons (or "grounds") for your objection, and. your signature.

Regardless of whether any payments are made, your judgment does not last forever. In Ohio, judgments go ?dormant? in 5 years after the latter of: (a) when the judgment was issued, or (b) the last time it was used to create a lien, generate a seizure, obtain a garnishment order, or any other similar effort.

O.R.C. Section 2325.18(B). This means that although Ohio's statute of limitations for judgment enforcement is at least fifteen years, in reality the best practice is to act at least once every five years so that your judgment does not become dormant. Often judgments are against more than one judgment debtor.

And some states also allow judgment liens on the debtor's personal property -- things like jewelry, art, antiques, and other valuables. In Ohio, a judgment lien can be attached to real estate only (such as a house, land, or similar property interest).

If a judgment is entered against an individual and that individual pays the judgment, either in full or in an amount the judgment creditor agrees to accept as full payment, the creditor then files a satisfaction of judgment with the court.