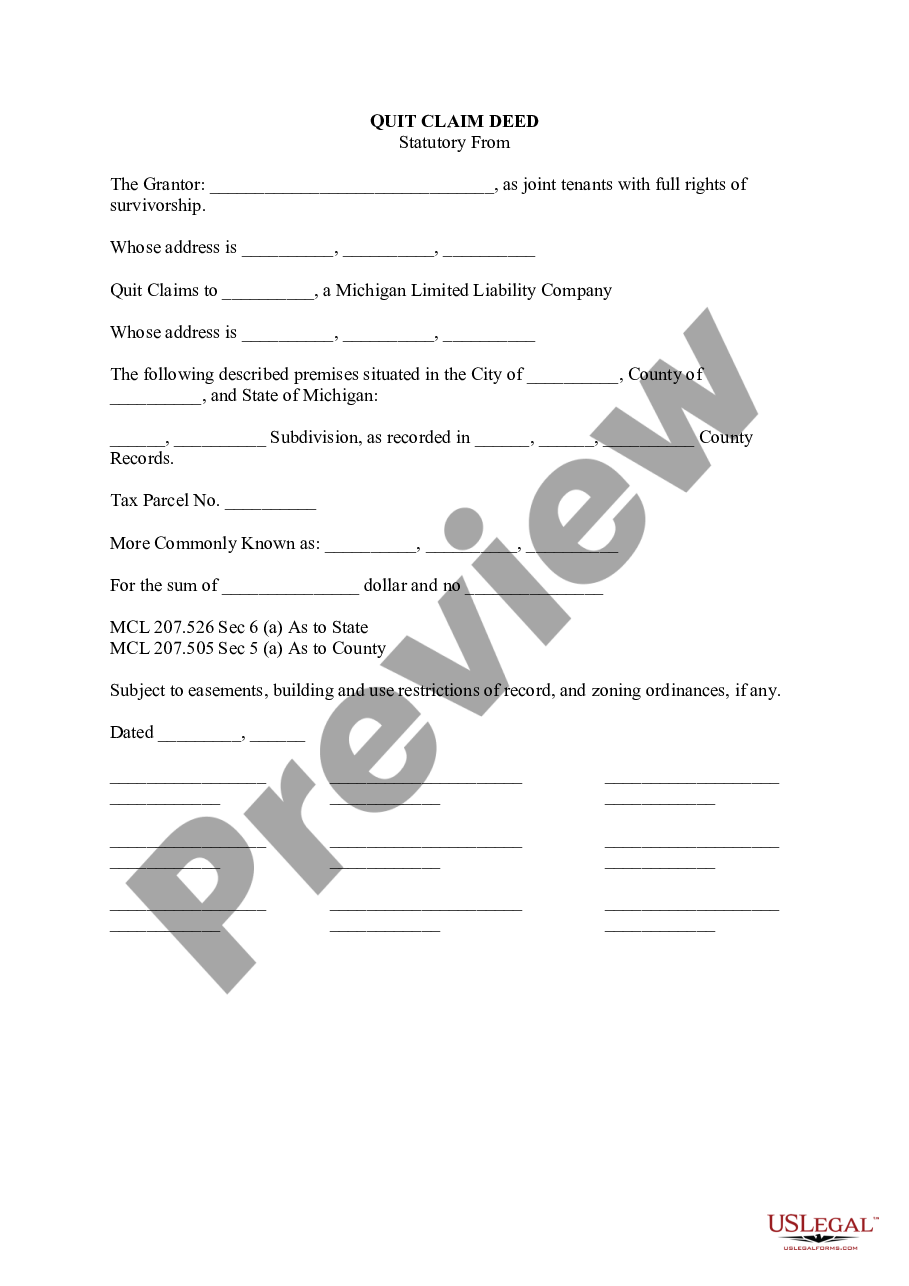

Ohio Sample Letter for Creditor Notification of Estate Opening

Description

How to fill out Sample Letter For Creditor Notification Of Estate Opening?

Discovering the right legitimate file format can be quite a battle. Naturally, there are a variety of themes available on the net, but how will you find the legitimate kind you will need? Utilize the US Legal Forms web site. The services gives a huge number of themes, such as the Ohio Sample Letter for Creditor Notification of Estate Opening, which you can use for business and personal requirements. All the types are checked by experts and fulfill federal and state requirements.

If you are already authorized, log in in your account and then click the Down load button to have the Ohio Sample Letter for Creditor Notification of Estate Opening. Make use of your account to look throughout the legitimate types you have acquired in the past. Check out the My Forms tab of your account and get an additional duplicate in the file you will need.

If you are a brand new end user of US Legal Forms, listed below are straightforward recommendations that you can stick to:

- Very first, make sure you have chosen the correct kind to your town/county. You can examine the shape utilizing the Review button and study the shape explanation to guarantee this is the best for you.

- If the kind will not fulfill your preferences, make use of the Seach area to find the right kind.

- When you are certain the shape is acceptable, go through the Get now button to have the kind.

- Choose the rates program you would like and type in the required information and facts. Make your account and buy the transaction using your PayPal account or bank card.

- Choose the file structure and acquire the legitimate file format in your system.

- Total, change and produce and indication the received Ohio Sample Letter for Creditor Notification of Estate Opening.

US Legal Forms will be the most significant local library of legitimate types where you can see different file themes. Utilize the service to acquire appropriately-created paperwork that stick to state requirements.

Form popularity

FAQ

There is a duty of competency, a duty of disclosure, a duty of loyalty, and a duty of impartiality. These duties are intended to defend the interests of the heirs of the Decedent's estate, the estate creditors, and the taxing authorities.

However, the deceased individual's estate may be liable for properly-presented claims. In Ohio, a creditor of a deceased person has 6 months from the person's date of death to formally present a claim for payment.

In Ohio, a creditor of a deceased person has 6 months from the person's date of death to formally present a claim for payment. The claim presentment procedure is specifically addressed in the probate statutes.

Claims must be filed within 3 months of the decedent's death. 2117.06(B): If any creditors (people to whom the decedent owed money) want to make a claim against the estate, this code explains that they must present them within six months after the decedent's death.

What the notice needs to say. There are three major points that a notice to creditors needs to contain: the name of the person who has passed away, the amount of time creditors have to come forward, and contact information for the executor or the executor's lawyer.

(B)(1) Every administrator and executor, within six months after appointment, shall render a final and distributive account of the administrator's or executor's administration of the estate unless one or more of the following circumstances apply: (a) An Ohio estate tax return must be filed for the estate.

To the executor or administrator in writing, and to the probate court by filing with it a copy of the written claim that has been filed with the fiduciary, or. By sending a written claim by ordinary mail addressed to the decedent if it is actually received by the fiduciary within 6 months of the date of death.

HOW LONG CAN YOU WAIT TO FILE PROBATE? Claims against the estate may be made up to six months from the date of death. Most people want to hurry the probate process and take care of everything immediately after the decedent's death. In all reality, however, it may be wise to wait six months before opening the estate.