Ohio Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time

Description

How to fill out Irrevocable Trust For Future Benefit Of Trustor With Income Payable To Trustor After Specified Time?

If you desire to thoroughly, download, or generate legal document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Take advantage of the site's simple and convenient search to find the documents you need.

Various templates for business and personal use are organized by categories and regions, or keywords.

Step 4. Once you have located the form you need, click on the Buy now button. Choose the payment plan you prefer and enter your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Use US Legal Forms to find the Ohio Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to obtain the Ohio Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time.

- You can also access forms you previously downloaded within the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for your appropriate city/state.

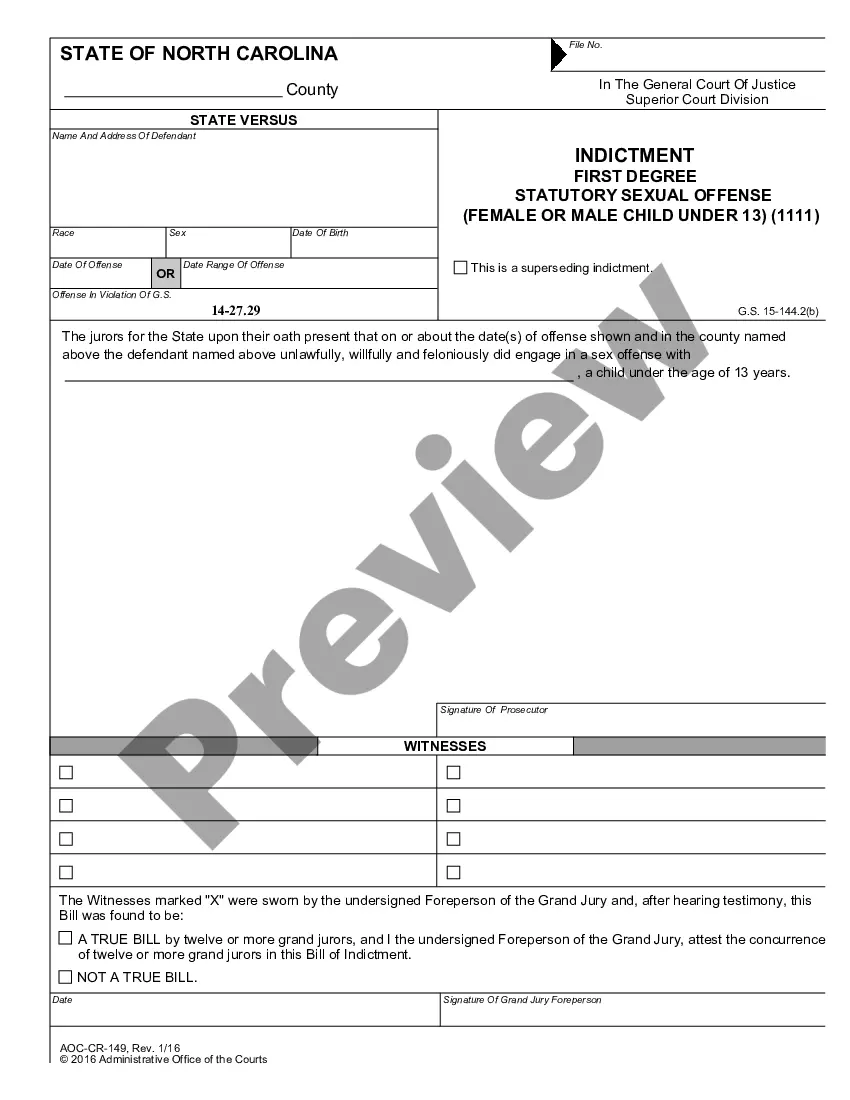

- Step 2. Use the Review option to examine the content of the form. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

The grantor (as an individual or couple) transfers their assets to an irrevocable trust. However, unlike other irrevocable trusts, the grantor can be the income beneficiary. Their children or spouse would be the residual beneficiaries.

UDT stands for under declaration of trust," and this indicates that the grantor and the trustee are the same individual. The grantor maintains control over the assets they've placed into the trust, and they can only do that if the trust is revocable.

The trustee of an irrevocable trust can only withdraw money to use for the benefit of the trust according to terms set by the grantor, like disbursing income to beneficiaries or paying maintenance costs, and never for personal use.

Year Trust, also known as a Legacy Trust or Medicaid Asset Protection Trust, can be established to protect assets from being spent down on long term care in a nursing home. The assets you place in the Legacy Trust will become exempt from the Medicaid spend down requirements after a 5 year look back period.

A perpetual trust is irrevocable. Once the Trust has been set up, and assets have been transferred into the Trust, then the Trustor cannot change their mind. Therefore, an individual setting up a perpetual trust should be careful not to use any property they might need during their lifetime to fund the Trust.

The 65-day rule relates to distributions from complex trusts to beneficiaries made after the end of a calendar year. For the first 65 days of the following year, a distribution is considered to have been made in the previous year.

An irrevocable trust may automatically terminate on a specific date if the grantor specified a termination date in the trust document. If the grantor did not provide a termination date, an irrevocable trust may be terminated for other reasons.

Under California's Rule Against Perpetuities, an interest in an irrevocable trust must vest or terminate either within 21 years after the death of the last potential beneficiary who was alive when the trust was created or within 90 years after the trust was created.

When a trust is irrevocable but some or all of the trust can be disbursed to or for the benefit of the individual, the look-back period applying to disbursements which could be made to or for the individual but are made to another person or persons is 36 months.