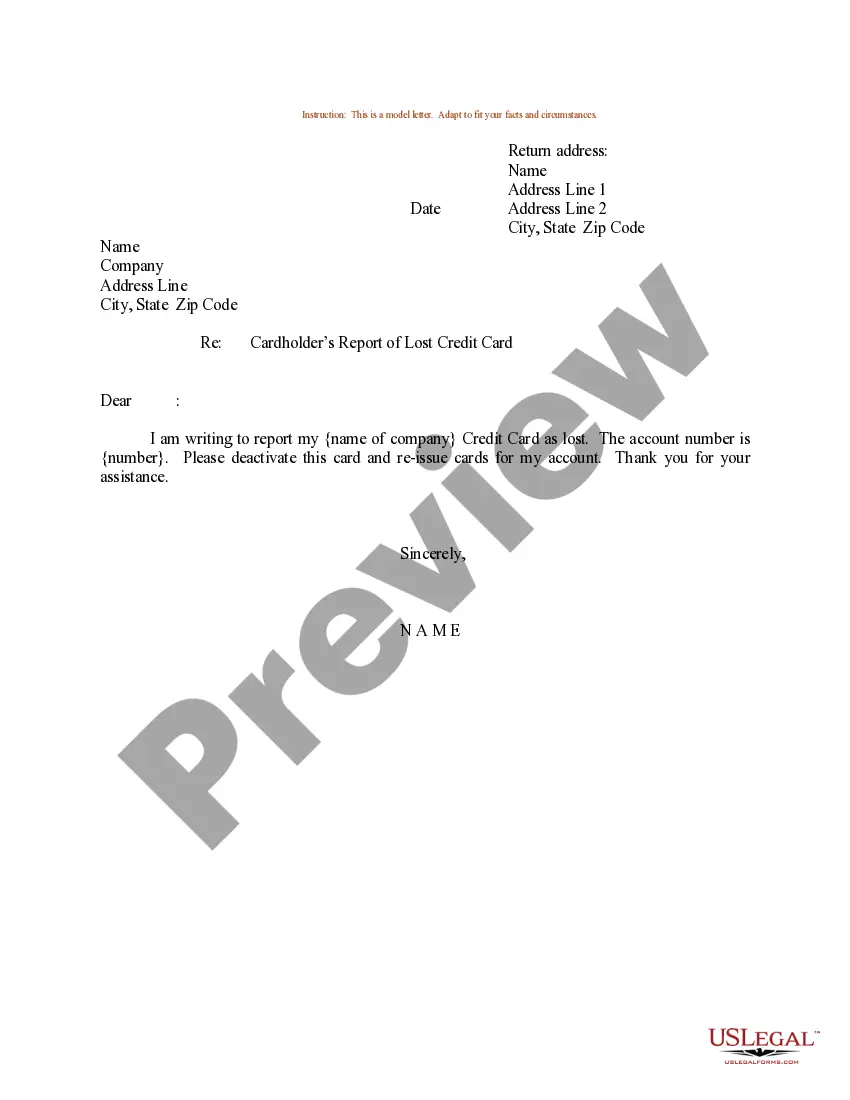

Ohio Sample Letter for Cardholder's Report of Lost Credit Card

Description

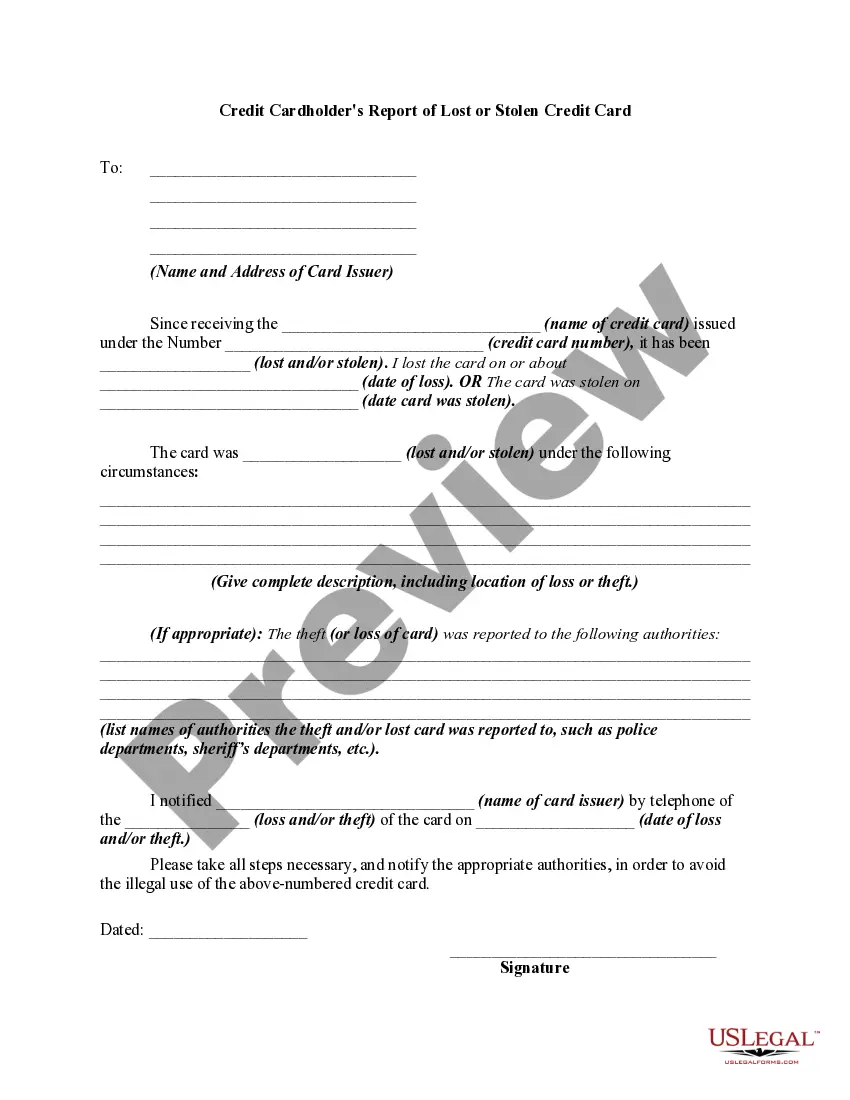

How to fill out Sample Letter For Cardholder's Report Of Lost Credit Card?

It is feasible to allocate time online looking for the appropriate legal document format that satisfies the state and federal requirements you seek.

US Legal Forms provides a wide array of legal templates that have been assessed by professionals.

You can easily obtain or print the Ohio Sample Letter for Cardholder's Report of Lost Credit Card from my service.

If available, utilize the Preview option to inspect the format as well.

- If you already have a US Legal Forms account, you can Log In and then select the Acquire option.

- Afterward, you can complete, modify, print, or sign the Ohio Sample Letter for Cardholder's Report of Lost Credit Card.

- Every legal document format you acquire is yours indefinitely.

- To obtain an additional copy of any purchased form, navigate to the My documents tab and click the appropriate option.

- If this is your first time using the US Legal Forms website, follow the straightforward instructions outlined below.

- First, ensure you have chosen the correct format for the county/region of your choice.

- Review the form description to confirm you have selected the appropriate document.

Form popularity

FAQ

Tips. Credit card companies can track where your stolen credit card was last used, in most cases, only once the card is used by the person who took it. The credit card authorization process helps bank's track this. However, by the time law enforcement arrives, the person may be long gone.

This is to inform you that I (Name) having a (name of credit card) credit card with your bank has lost the credit card bearing number (credit card number). I request you to kindly deactivate the card and stop all the transactions through the card to avoid misuse.

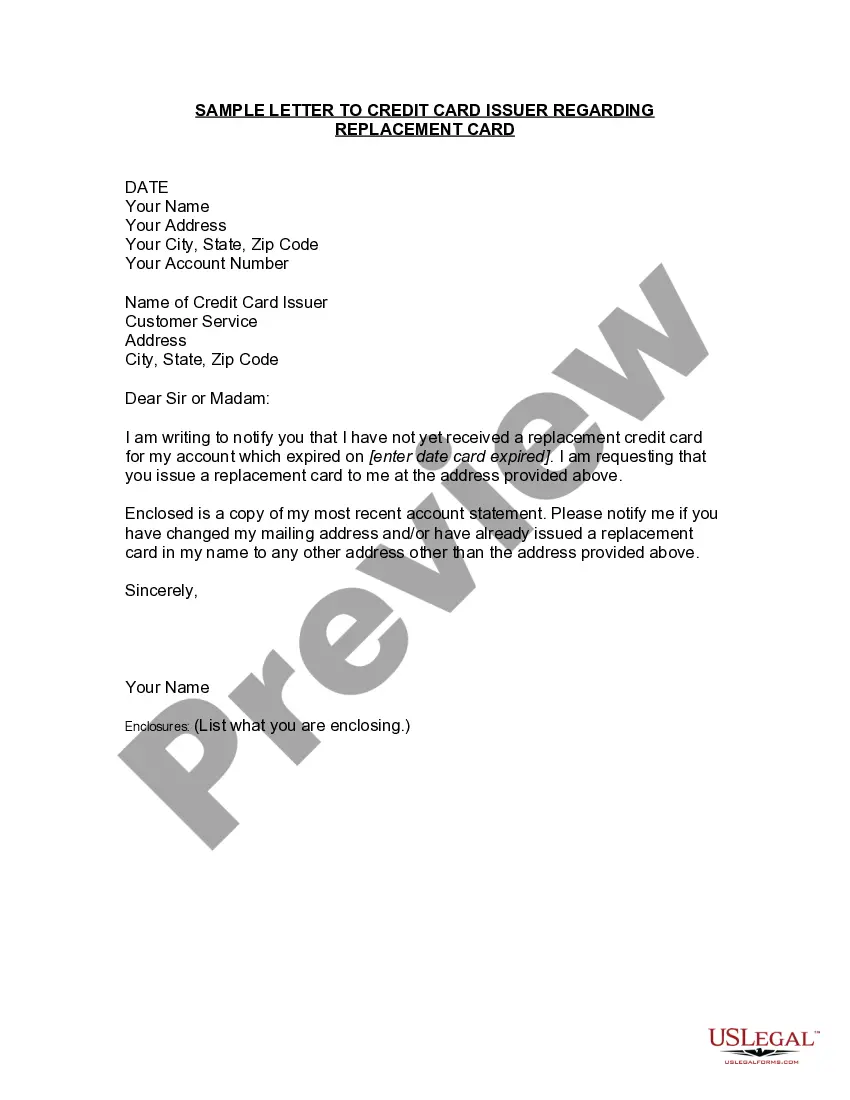

Firstly, inform the bank of the damaged Credit Card. You can call the Customer Care number and report that your Credit Card has been damaged. The bank will then hotlist the damaged Credit Card. Once you report the damaged Credit Card, you can raise a request with the bank to replace damaged Credit Card with a new one.

Respected Sir/Madam, I beg to state that my name is (Name) and I am a (Name of credit card) credit card holder of your bank having credit card number (Credit card number). I am writing this letter to complain about the charges being levied on my credit card.

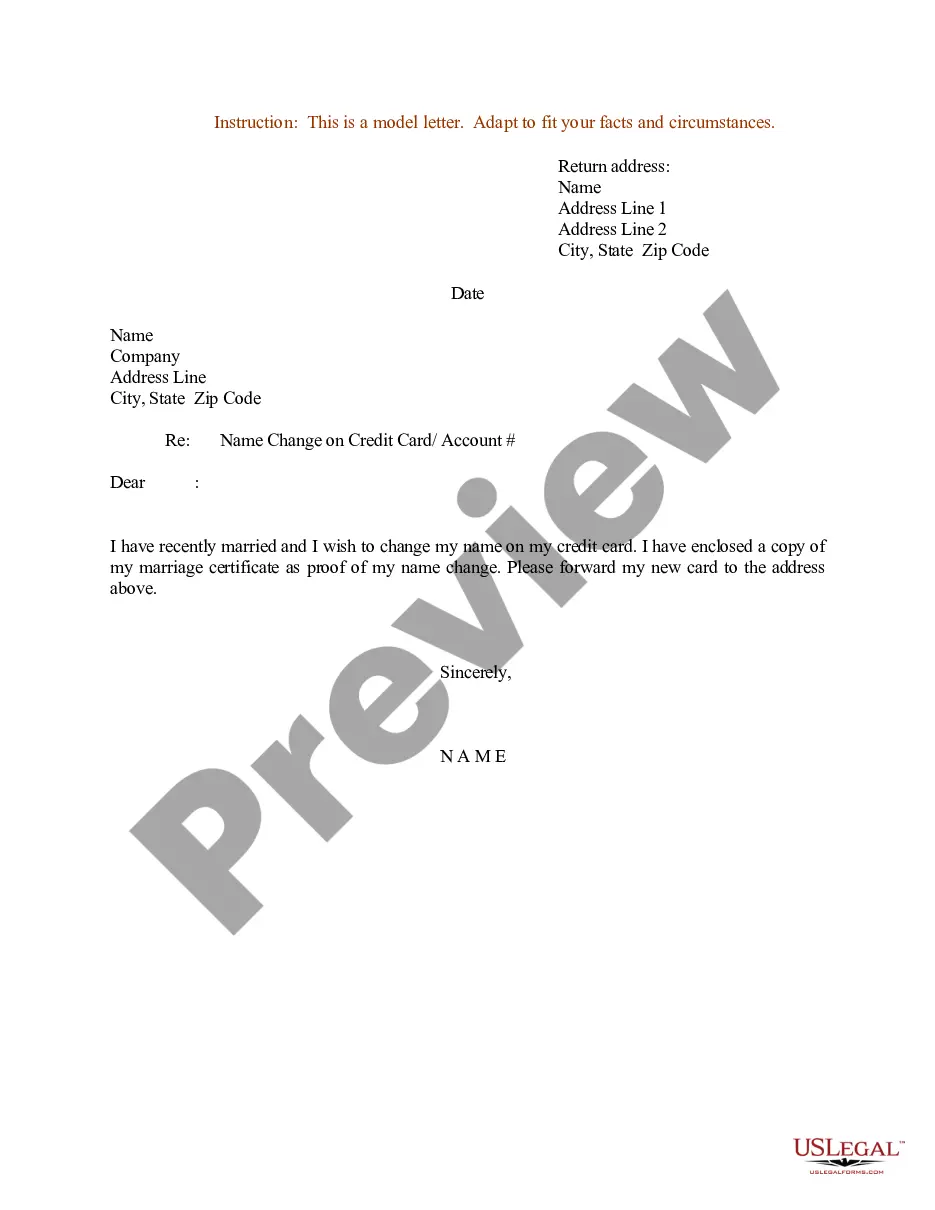

The primary cardholder has to add an authorized user. This can be done by calling the credit card issuer or logging onto the online account. Many issuers will issue a second card for the authorized user, but it will generally be mailed to the primary cardholder, who can choose to give it to the authorized user or not.

This is to inform you that I recently lost or misplaced my ATM Card which is connected with my savings account with A/c No.: 02/123456. The lost card bore the number 1234 1234 1234 1234. I request you to please cancel that card and issue me a replacement card as early as possible.

In general, he says a person who finds a card should either drop the card off in person at a bank or destroy it. Both options would prevent anyone else from getting their hands on the debit card and spending someone's hard-earned dollars.

I would like to inform you that I already have an account with your esteemed bank. However, I hadn't applied for a credit card at the time of account opening. I have realised a need for a credit card and would like to make a request for the same.

If you have a few minutes, call the credit card company Call the number on the back of the card and tell the credit card company that you found it. They'll contact the card's owner for you. It's possible that the card was already reported as lost anyway, and the card company will issue a new card with a new number.

Dear Sir or Madam: I am writing to dispute a fraudulent charge on my account in the amount of $....Sample LetterThe charge be removed.Any finance and/or other charges related to the fraudulent charge be credited to my account.I receive an accurate statement ASAP.16-Aug-2015