Ohio Special Needs Irrevocable Trust Agreement for Benefit of Disabled Child of Trustor

Description

How to fill out Special Needs Irrevocable Trust Agreement For Benefit Of Disabled Child Of Trustor?

Are you presently in a position that requires documentation for either business or personal purposes almost every day.

There are numerous legal document templates accessible online, but locating reliable ones can be difficult.

US Legal Forms offers a large selection of document templates, such as the Ohio Special Needs Irrevocable Trust Agreement for the Benefit of a Disabled Child of the Trustor, which can be customized to meet state and federal regulations.

Select a convenient document format and download your copy.

You can find all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Ohio Special Needs Irrevocable Trust Agreement for the Benefit of a Disabled Child of the Trustor at any time, if needed. Just click the desired template to download or print the document.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Once logged in, you can download the Ohio Special Needs Irrevocable Trust Agreement for the Benefit of a Disabled Child of the Trustor template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the template you need and ensure it is for the correct city/county.

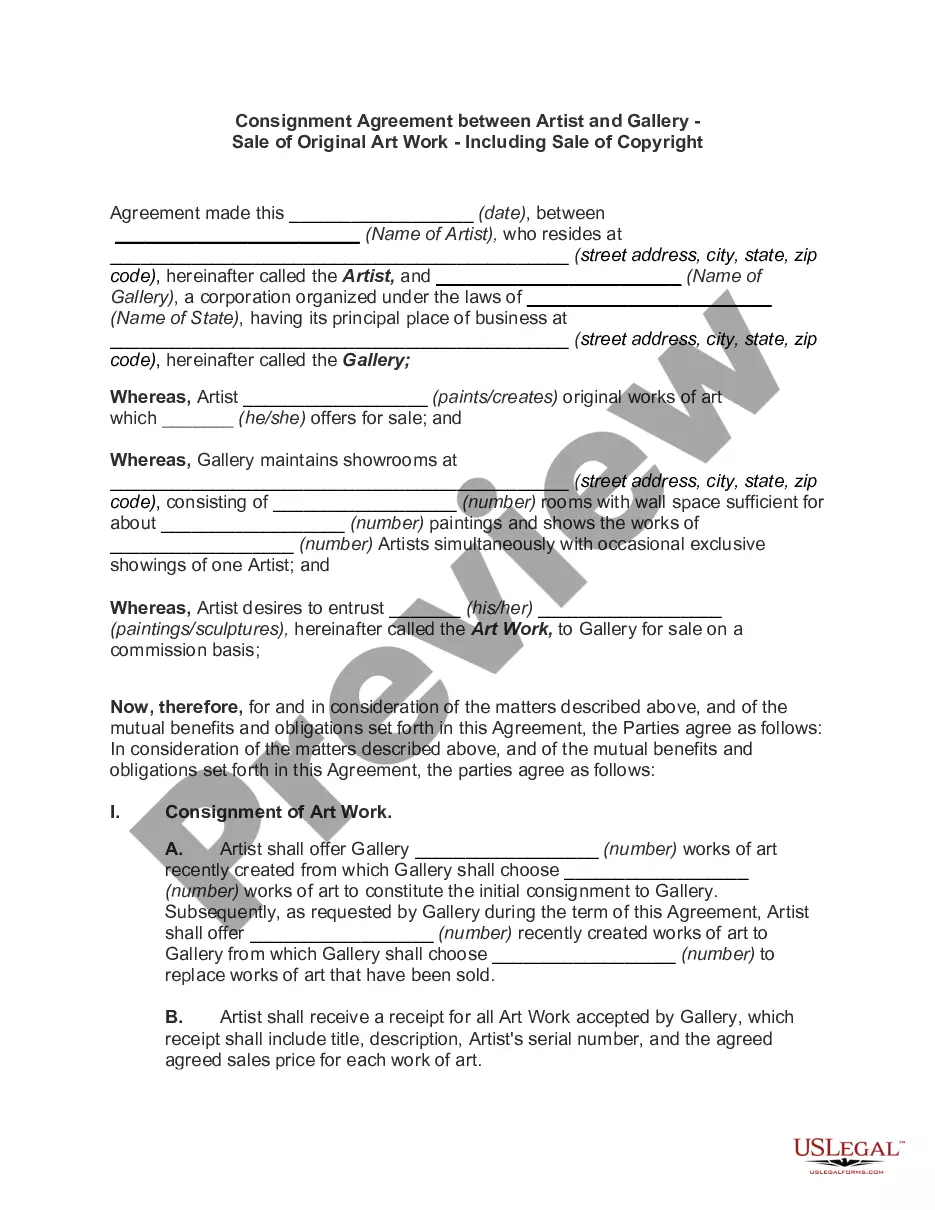

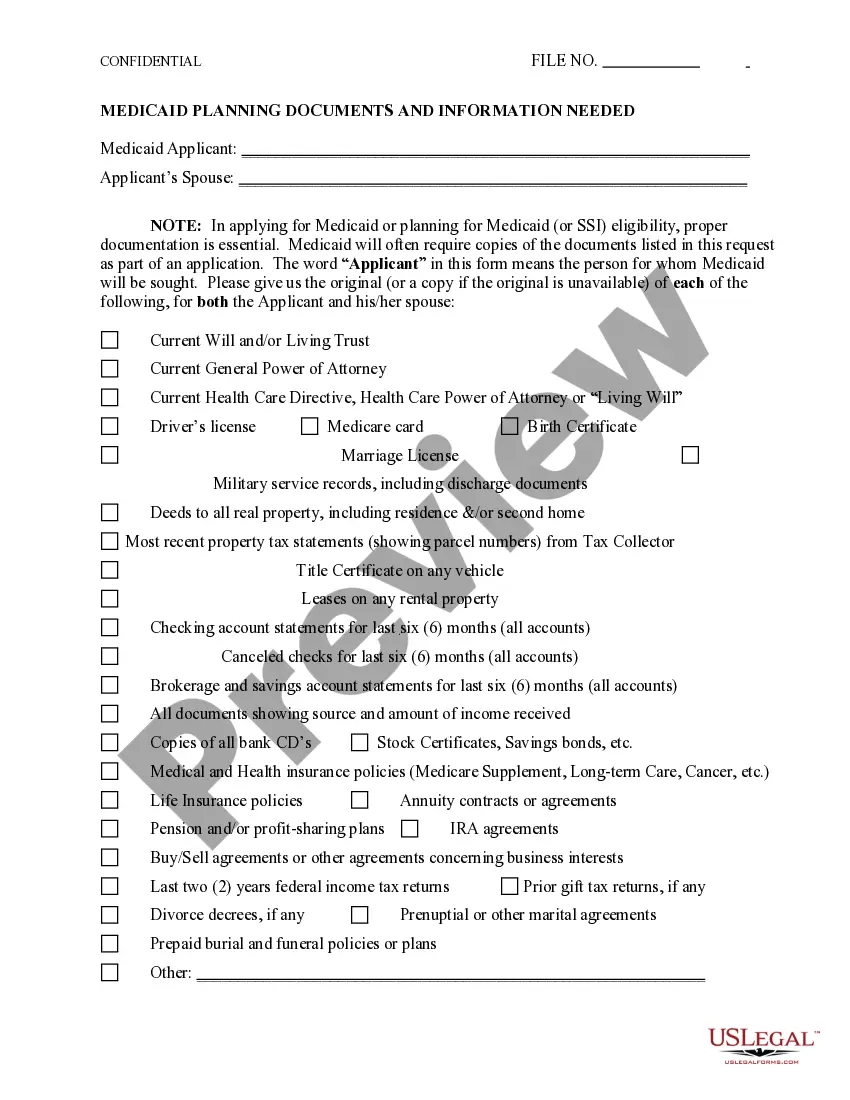

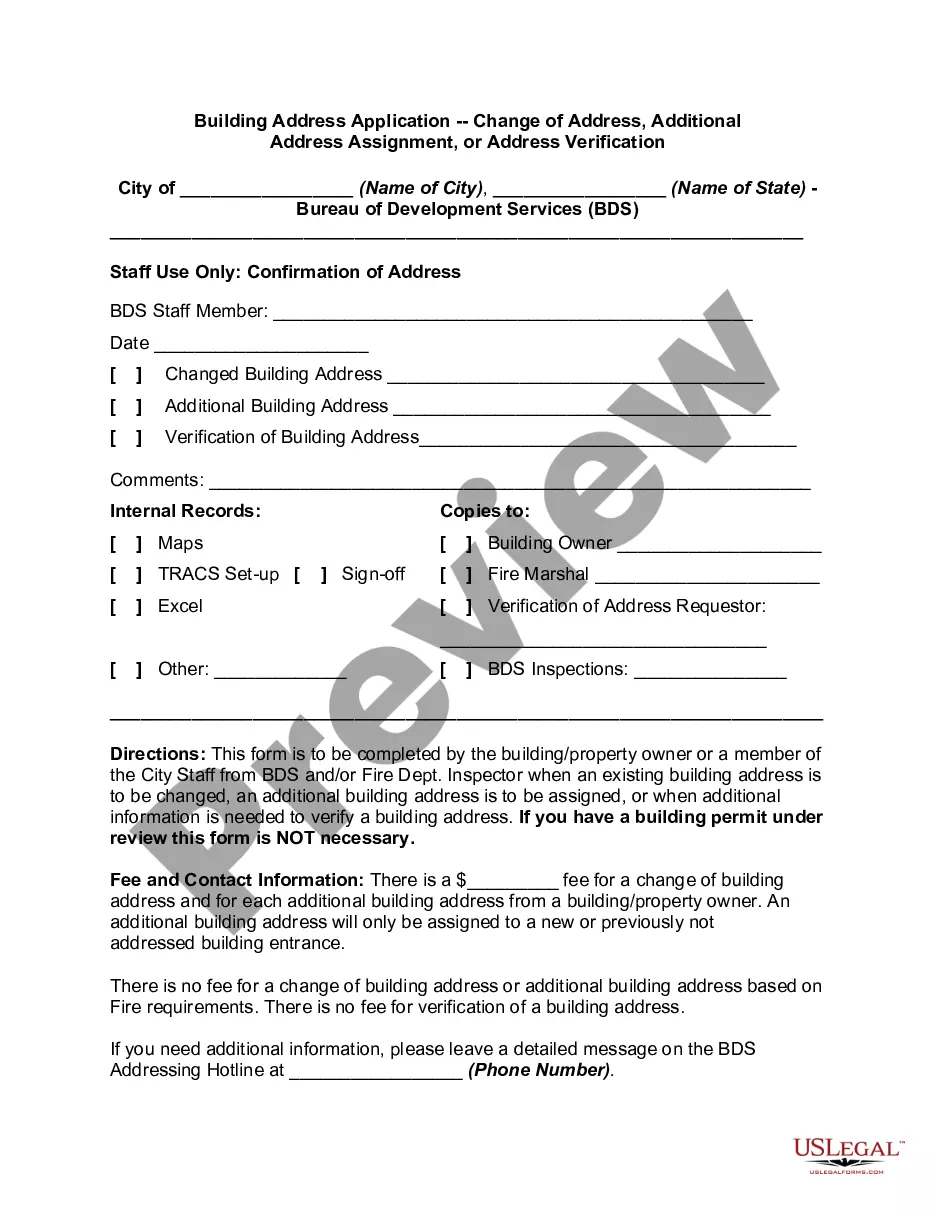

- Use the Review button to check the document.

- Read the description to confirm that you have selected the right template.

- If the document doesn’t match your needs, use the Search field to find the template that fits your requirements.

- Once you find the right template, click Acquire now.

- Choose the pricing plan you prefer, fill in the necessary information to create your account, and pay for the order using your PayPal or credit card.

Form popularity

FAQ

The term special needs trust refers to the purpose of the trust to pay for the beneficiary's unique or special needs. In short, the name is focused more on the beneficiary, while the name supplemental needs trust addresses the shortfalls of our public benefits programs.

Disadvantages to SNTCost. Annual fees and a high cost to set up a SNT can make it financially difficult to create a SNT The yearly costs to manage the trust can be high.Lack of independence.Medicaid payback.06-Sept-2012

Special Needs Trust: A Special Needs Trust is a Medicaid Payback Trust. This type of trust can be created for anyone with a disability, by the person with a disability, a parent, grandparent, legal guardian or a court. The trust must be funded before the beneficiary reaches age 65.

While public benefits, such as SSI, Medicaid, and HUD housing benefits, offer basic support for food, shelter, and medical care, a Special Needs Trust can be used to pay for other things. For example, money from the trust could be used to pay for your recreation expenses, telephone bill, education, and vacations.

A Special Disability Trust allows parents or other family members to leave assets in trust for an individual which can be used to fund ongoing care, medical expenses, accommodation, and some discretionary expenditure for that person into the future, without affecting their entitlement to a disability support pension.

A special needs trust is a trust set up for a beneficiary with special needs. Many people set them up as a way to plan for the future of a loved one. The person or financial institution that controls the money is a trustee. The trustee controls and manages the money for the beneficiary.

Some of the benefits of utilizing an SNT include asset management and maximizing and maintaining government benefits (including Medicaid and Supplemental Security Income). Some possible negatives of utilizing an SNT include lack of control and difficulty or inability to identify an appropriate Trustee.

A Special Needs Trust (SNT) allows for a disabled person to maintain his or her eligibility for public assistance benefits, despite having assets that would otherwise make the person ineligible for those benefits.