Ohio General Partnership for the Purpose of Farming

Description

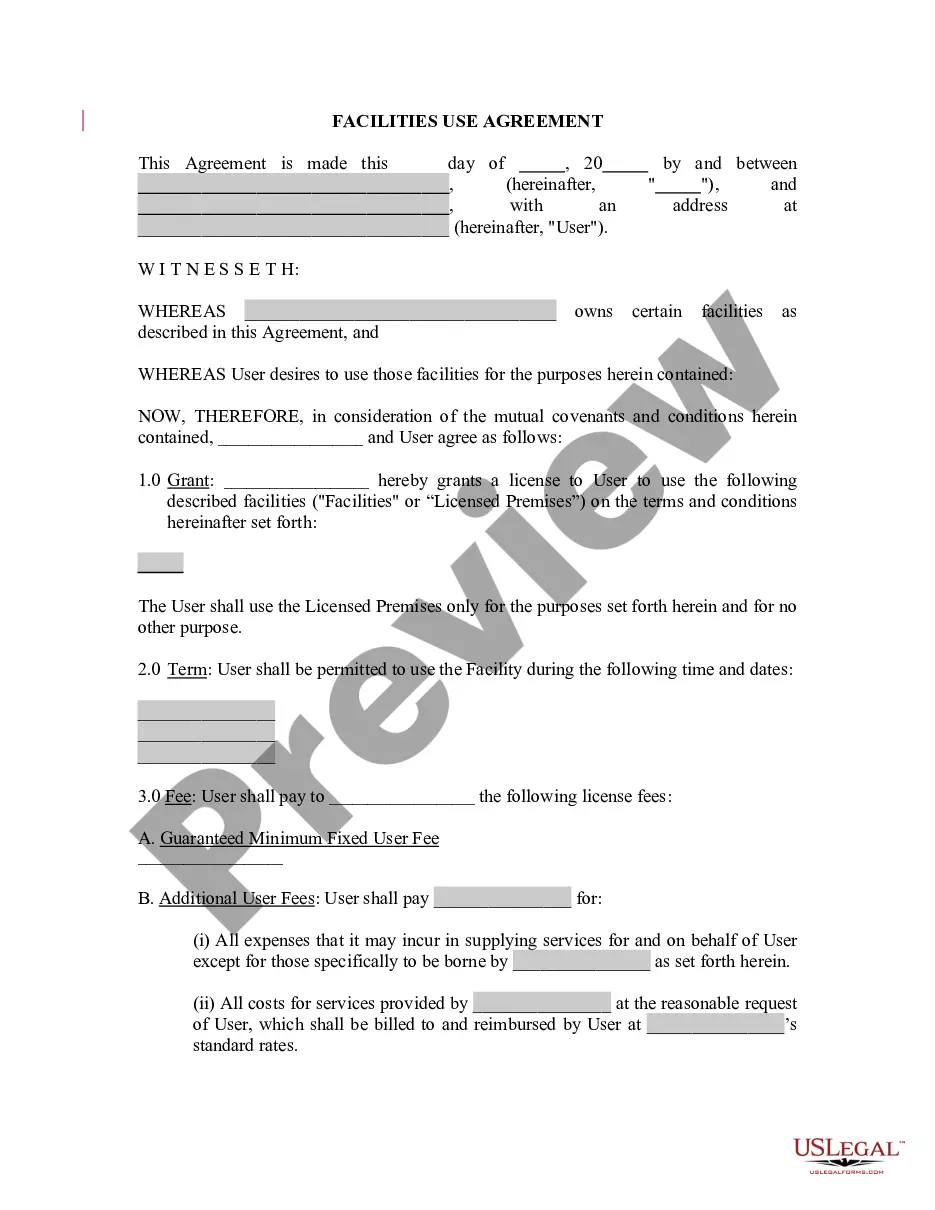

How to fill out General Partnership For The Purpose Of Farming?

US Legal Forms - one of the largest collections of legal templates in the USA - offers a variety of legal document formats you can obtain or create.

By utilizing the website, you will find a vast number of templates for corporate and personal use, organized by categories, states, or keywords.

You can acquire the most recent templates such as the Ohio General Partnership for Farming in just minutes.

Check the form summary to ensure that you have chosen the right document.

If the form does not fit your requirements, utilize the Search area at the top of the screen to find one that does.

- If you already have a membership, Log In and retrieve the Ohio General Partnership for Farming from your US Legal Forms library.

- The Download option will appear on each form you view.

- You can access all previously downloaded templates from the My documents section of your account.

- If you are using US Legal Forms for the first time, here are some simple steps to help you get started.

- Ensure you have selected the correct form for your area/region.

- Click on the Review option to examine the details of the form.

Form popularity

FAQ

Why many farms operate as a limited company Managing your farm as a limited company is more onerous in terms of the paperwork that must be completed and the requirements that must be followed. But despite that, there are many benefits to operating in this way. Primarily, it's often more tax efficient.

A Farm Partnership is where two or more farmers make an agreement to share resources so they can enjoy benefits such as economies of scale and improved work-life balance. Farmers can avail of a number of financial supports aimed at encouraging and maintaining the development of farm partnerships.

Small farms (earning less than $50,000 annually or occupying less than 180 acres) are now considered potentially lucrative as both rural and urban business opportunities. Entrepreneurs should consider ideas like bee farms, rooftop gardens, and microgreens when choosing among profitable ventures.

Farm is not business, but hobby. Hobby tax losses are not allowable on all tax years under examination. Taxable income increased by the amount of tax losses.

Having a partnership agreement in place also allows clarity regarding the ownership of business assets and enables families to clearly define the roles each partner will play in the day-to-day management of the farming business.

A farm partnership is a legal business arrangement where two or more individuals come together combining their respective resources to achieve mutual benefits.

What is a farming partnership agreement? A partnership is automatically created when two or more people decide to farm together with the intention of making a profit. No written agreement is required for the creation of a partnership (where none exists, this is called an 'oral partnership').

A farm partnership prevails when two or more people co-own an agricultural venture through an oral or written agreement. Although an oral agreement is binding, signing a written farm partnership agreement helps the partners avoid complications in future relationships.

There are three relatively common partnership types: general partnership (GP), limited partnership (LP) and limited liability partnership (LLP).

There are three forms of legal entities that farmers typically choose for their business: sole proprietorship, partnership, or limited liability company. In addition to the for-profit entities, a farm may choose to be a nonprofit corporation.