Ohio Telecommuting Worksheet

Description

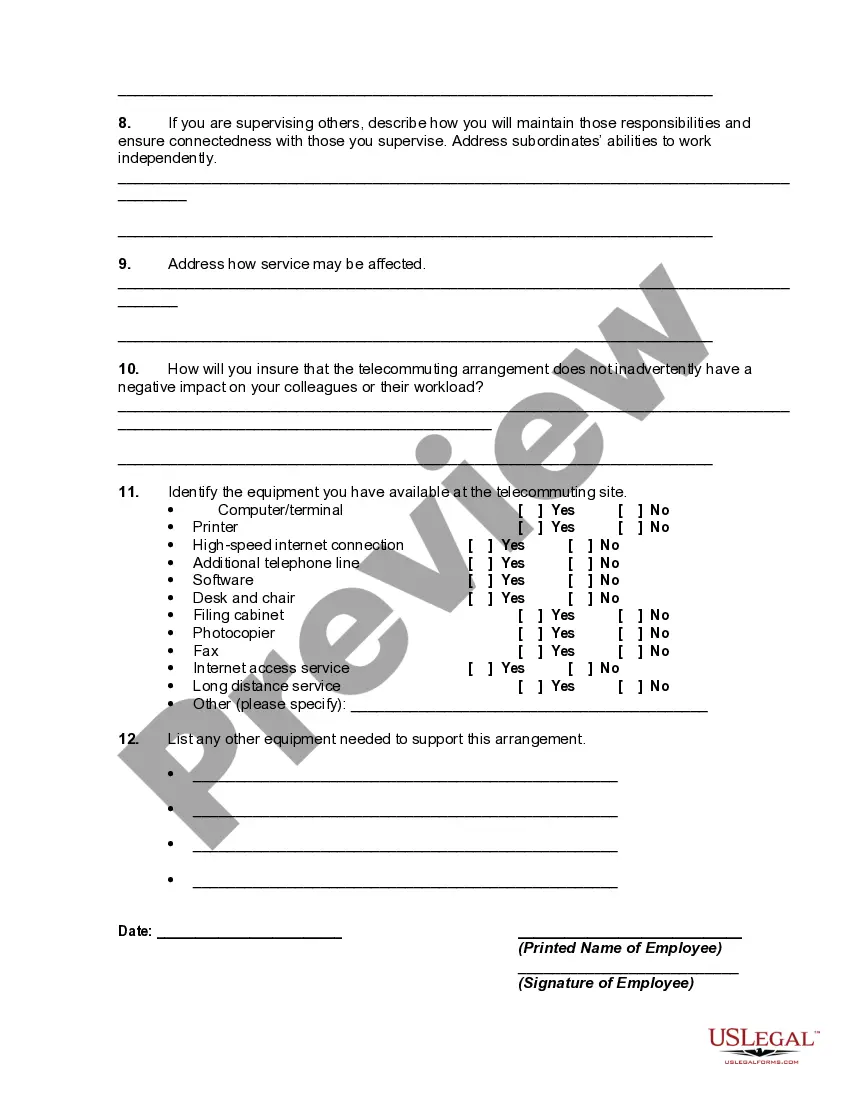

How to fill out Telecommuting Worksheet?

Locating the appropriate legitimate document format can be challenging.

Certainly, many templates exist online, but how can you obtain the official version you need.

Utilize the US Legal Forms site. The service provides thousands of templates, including the Ohio Telecommuting Worksheet, suitable for both professional and personal purposes.

If the document does not meet your requirements, use the Search field to find the suitable form. Once you are confident the form is correct, click the Get Now button to obtain the document. Select the pricing plan you desire and provide the necessary information. Create your account and complete the purchase using your PayPal account or credit card. Choose the file format and download the official document to your device. Fill out, revise, print, and sign the acquired Ohio Telecommuting Worksheet. US Legal Forms represents the largest repository of legal documents, offering a multitude of file templates. Use the service to download professionally crafted documents that comply with state requirements.

- All the documents are reviewed by experts and comply with federal and state regulations.

- If you are already a member, sign in to your account and click the Download button to access the Ohio Telecommuting Worksheet.

- Use your account to review the legal forms you have previously purchased.

- Visit the My documents tab in your account to obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps to follow.

- First, ensure you have chosen the correct document for your city/county. You can preview the form using the Review button and examine the document description to confirm it suits your needs.

Form popularity

FAQ

Positions that can be regularly performed remotely are those that: o Don't require a traditional office or clinical space to interact with internal and external customers. o Have access to required systems and software associated with the position responsibilities. o Have remote access to files. o Have supervisors who

When people started working from home in large numbers in 2020, Ohio legislators passed a temporary rule that told companies to withhold income taxes the way they normally did based on where employees were working ahead of the pandemic.

Unless you get an extension from your home city, you may have to pay taxes there before your refund from the workplace city arrives. 5. In 2022 the withholding rules return to their pre-pandemic state, meaning employers are obligated to withhold municipal income taxes where employees actually work.

They had to file to their city of residence and possibly pay tax to both cities. The benefit for those who work exclusively from home is that now employees are required to pay taxes only to one city because their work city is the same as their residence, she said.

Employees who work from home can no longer claim tax deductions for their unreimbursed employee expenses or home office costs on their federal tax return. Prior to the 2018 tax reform, employees could claim these expenses as an itemized deduction.

Starting Jan. 1, 2022, Ohio introduced new rules for municipal income tax withholding by employers for their employees who work remotely at least part of the time. These rules are a return to the pre-COVID rules that were in effect prior to March 9, 2020.

In general, if you're working remotely you'll only have to file and pay income taxes in the state where you live. However, in some cases, you may be required to file tax returns in two different states. This depends on your particular situation, the company you work for, and the tax laws of the states involved.

In general, if you're working remotely you'll only have to file and pay income taxes in the state where you live. However, in some cases, you may be required to file tax returns in two different states. This depends on your particular situation, the company you work for, and the tax laws of the states involved.

In a situation where an employee begins working remotely (e.g., from home), Ohio ordinarily follows a "20-day rule" under which an employer doesn't need to withhold tax for a municipality if the employee is working in the municipality for 20 or fewer days.

Employers must comply with many different types of local payroll taxes. These taxes are based on where your employees work and/or live. Certain types of local taxes are only imposed on employers doing business in a locality.