Ohio Sales Representative Evaluation Checklist

Description

How to fill out Sales Representative Evaluation Checklist?

You have the ability to invest hours online looking for the legal document template that meets the federal and state requirements you desire.

US Legal Forms provides a vast array of legal documents that are reviewed by experts.

You can actually acquire or create the Ohio Sales Representative Evaluation Checklist through our service.

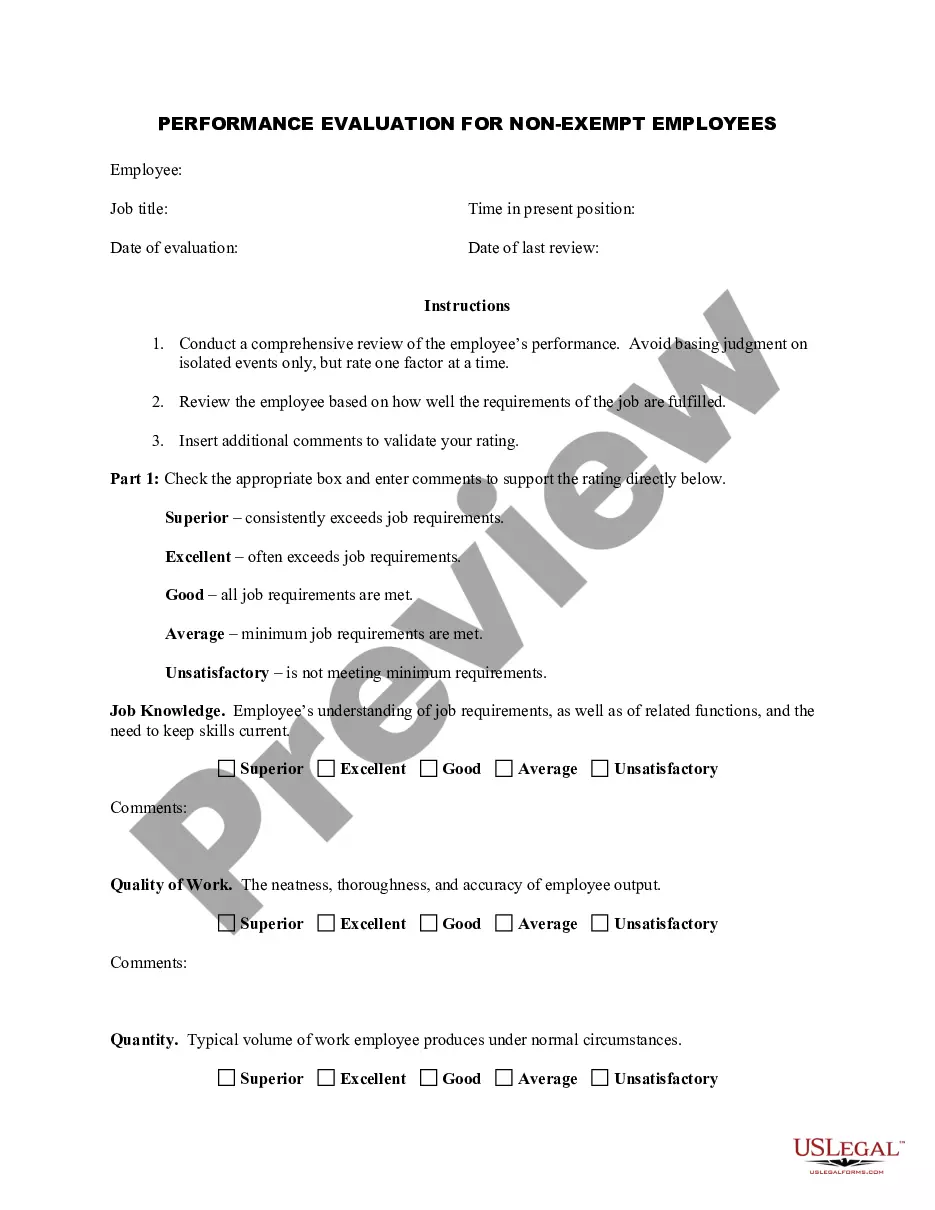

If available, utilize the Preview option to view the document template as well. If you wish to obtain another version of the form, use the Search field to find the template that fits your needs and requirements.

- If you already have a US Legal Forms account, you can Log In and select the Download option.

- After that, you can complete, modify, print, or sign the Ohio Sales Representative Evaluation Checklist.

- Every legal document template you obtain belongs to you permanently.

- To get another version of a purchased form, visit the My documents section and click the appropriate option.

- If this is your first time using the US Legal Forms website, follow the basic instructions below.

- First, make sure you have chosen the correct document template for the location/city of your choice.

- Review the form details to ensure you have selected the correct form.

Form popularity

FAQ

The minimum filing requirement for Ohio sales tax depends on your business's total sales tax liability. Typically, businesses are required to file at least once a year to remain compliant. To determine your obligations and ensure proper compliance, check the Ohio Sales Representative Evaluation Checklist, which specifies key filing thresholds you should be aware of.

To report Ohio sales tax, gather your sales records and complete the sales tax return form with the required figures. You can file electronically through the Ohio Department of Taxation’s website or by mail. Utilizing the Ohio Sales Representative Evaluation Checklist can streamline this process, helping you navigate through necessary steps and avoid errors in your reporting.

Reporting sales tax in Ohio involves filling out a state-specific sales tax form, which requires details on taxable sales and the amount of sales tax collected. You can file online or submit a paper return, depending on your preference. The Ohio Sales Representative Evaluation Checklist offers a clear step-by-step process to assist you in ensuring that your filing is accurate and complete.

In Ohio, the frequency of filing sales tax varies based on the amount of sales tax you collect. Businesses may file monthly, quarterly, or annually, depending on their total taxable sales and tax liability. To determine your specific filing frequency, refer to the Ohio Sales Representative Evaluation Checklist for guidance tailored to your situation.

To claim state sales tax, you typically need to complete a claim form provided by the Ohio Department of Taxation. Make sure to include all relevant details, such as the amount and reason for the claim. If you're unsure about the process, the Ohio Sales Representative Evaluation Checklist can serve as a useful guide and simplify the claiming procedure for you.

If you discover that you've reported incorrect sales tax, you need to amend your sales tax return. You should accurately calculate the correct amount and submit the amended return along with any additional payment if required. It's advisable to retain documentation supporting your corrections. The Ohio Sales Representative Evaluation Checklist helps guide you through this amendment process to avoid common pitfalls.

When you collect sales taxes, it’s essential to report them accurately on your sales tax return. You should keep detailed records of all sales transactions, including the amount of sales tax collected. On your next filing, list the total sales and the corresponding sales tax in the sections designated for Ohio sales tax. Following the Ohio Sales Representative Evaluation Checklist can ensure compliance with reporting requirements.

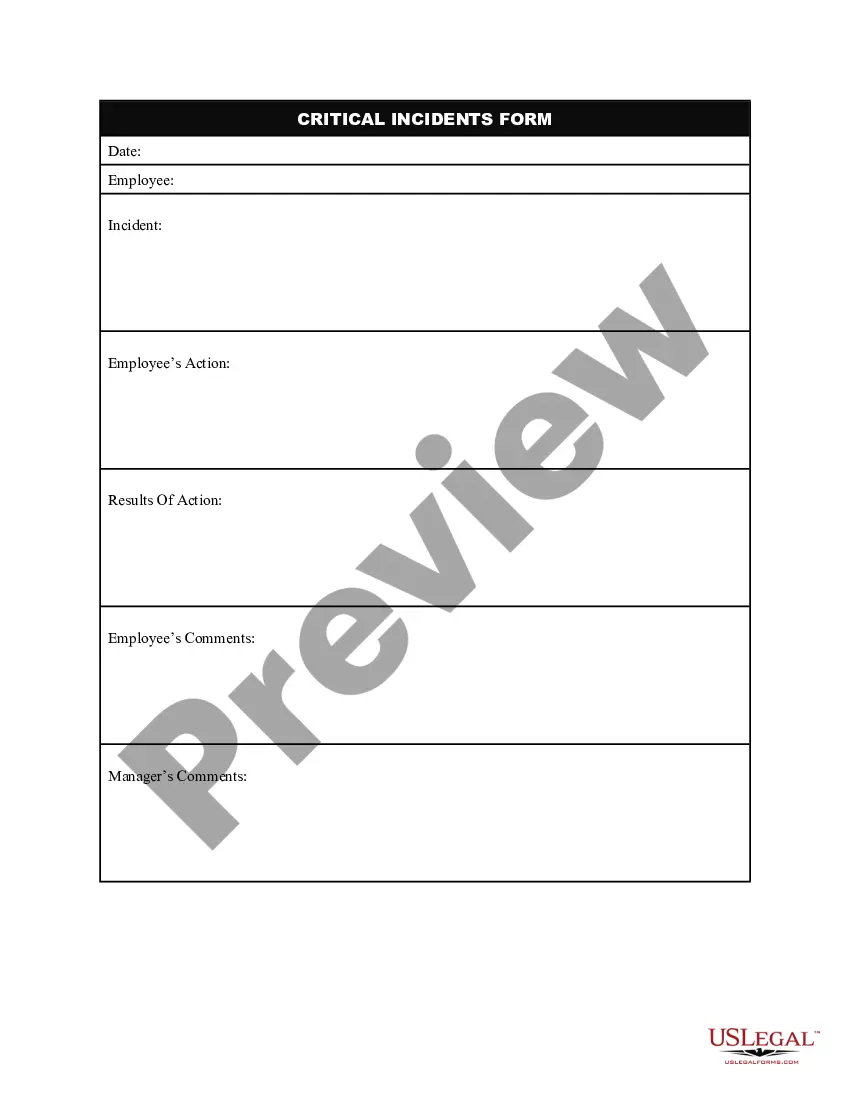

Sales performance evaluation is a systematic process that helps businesses assess the effectiveness of their sales representatives. Using an Ohio Sales Representative Evaluation Checklist allows managers to identify strengths and weaknesses in their sales strategies. This evaluation not only fosters improved sales techniques but also aligns team goals with overall business objectives. By regularly conducting evaluations, you can enhance team performance and drive better results.

A performance appraisal for a sales representative is a structured evaluation of their work over a specific period. It involves assessing their sales achievements, skills, and areas for improvement. Using the Ohio Sales Representative Evaluation Checklist allows you to create a clear, balanced appraisal focused on growth and development.

Measuring the performance of a salesperson requires tracking sales figures, customer engagement metrics, and feedback from clients. Gathering this data helps create a comprehensive overview of their effectiveness. Leverage the Ohio Sales Representative Evaluation Checklist to ensure you’re measuring all vital aspects of their performance.