Ohio Superior Improvement Form

Description

How to fill out Superior Improvement Form?

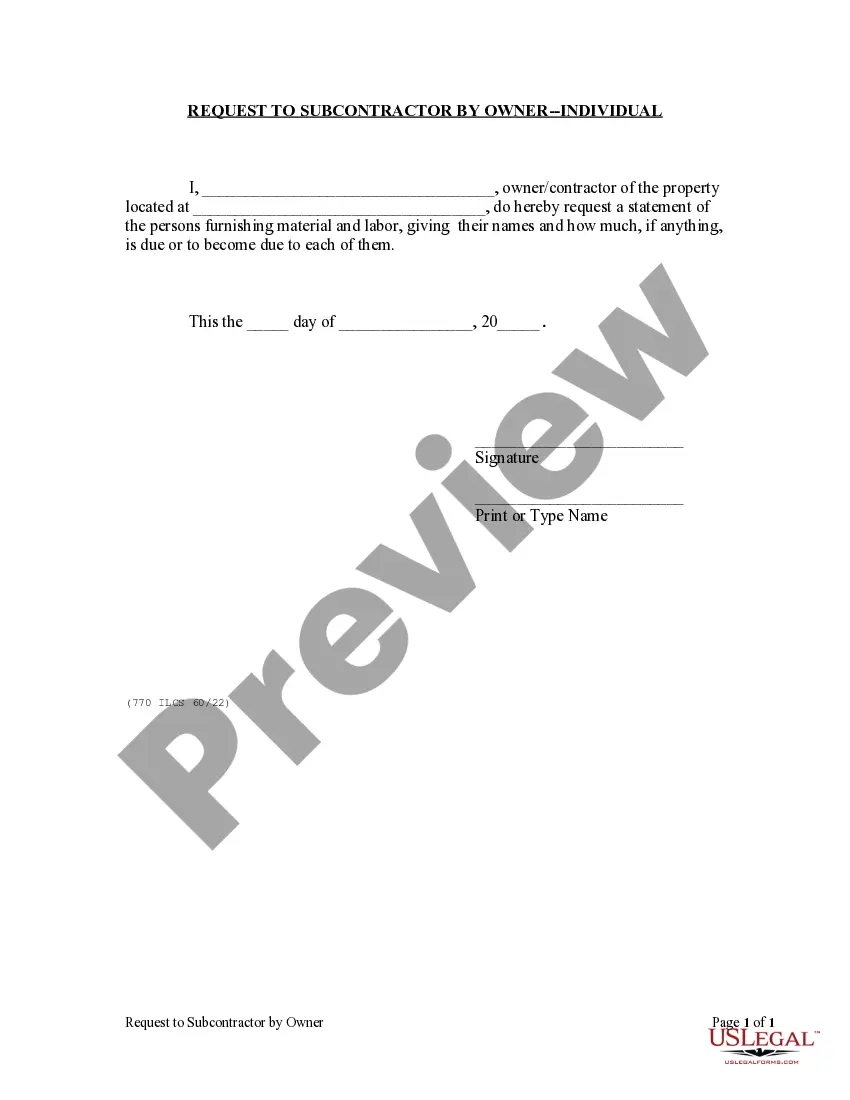

US Legal Forms - one of the largest collections of legal documents in the United States - provides a vast selection of legal form templates that you can download or print.

By using the website, you can acquire thousands of forms for business and personal use, organized by categories, states, or keywords. You will find the latest versions of forms like the Ohio Superior Improvement Form in moments.

If you already have an account, Log In and download the Ohio Superior Improvement Form from the US Legal Forms collection. The Download button will appear on each form you view. You can access all previously acquired forms in the My documents section of your account.

Complete the payment. Utilize your credit card or PayPal account to finalize the transaction.

Select the format and download the form to your device. Edit it. Fill out, modify, print, and sign the downloaded Ohio Superior Improvement Form. Each template you add to your account does not expire and is yours indefinitely. So, if you wish to download or print another copy, simply go to the My documents section and select the form you need. Access the Ohio Superior Improvement Form with US Legal Forms, the most extensive repository of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal requirements.

- First, ensure you have selected the correct form for your city/county.

- Click the Review button to check the form's content.

- Read the form description to ensure you have selected the right form.

- If the form does not meet your needs, use the Search field at the top of the screen to find a suitable one.

- If you are satisfied with the form, confirm your selection by clicking the Download now button.

- Then, choose the pricing plan you prefer and provide your details to create an account.

Form popularity

FAQ

The Ohio 4708 form must be filed by individuals or entities that receive income from a pass-through entity in Ohio. This includes partnerships, limited liability companies, and S corporations. To remain compliant with state regulations, make sure to understand your obligations regarding the Ohio Superior Improvement Form as well. For clarity on the filing requirements, uslegalforms provides comprehensive insights to guide you through the obligations.

Yes, Ohio offers a direct file option for residents and taxpayers. This allows you to electronically submit your information, including the Ohio Superior Improvement Form, saving time and effort. Such a convenient option reduces potential errors and ensures that your submission is processed quickly. For more details on how to utilize this feature, consider checking resources like uslegalforms.

To file an extension for Ohio State, you will need to complete the appropriate extension form provided by the state. This form allows you to request more time to submit your Ohio Superior Improvement Form. Make sure to file this extension by the original due date to avoid penalties. Resources like uslegalforms can guide you through the process, ensuring you don’t miss any important steps.

No, an Ohio vendor's license is not the same as a resale certificate. The vendor's license allows you to conduct business within Ohio, while the resale certificate allows for tax-exempt purchases of items you intend to resell. For clarity on your legal requirements, consider utilizing the Ohio Superior Improvement Form for organized documentation.

The Ohio School Improvement Process focuses on enhancing educational outcomes in schools across the state. It involves assessing school performance and implementing strategic plans for improvement. To stay updated or to navigate the related documentation, refer to the Ohio Superior Improvement Form as a helpful resource.

When filling out the back of an Ohio title, it is crucial to write the seller's and buyer's information accurately. Be sure to indicate the date of the transaction and any relevant odometer readings. Keeping a copy of this transaction with your Ohio Superior Improvement Form can help to maintain proper records.

To fill out a general resale certificate, start by entering your information, including your name and business address. Then, indicate the type of items you intend to resell. It’s important to keep this document handy for your records, and the Ohio Superior Improvement Form can assist you in organizing all necessary details effectively.

Filling out a sales tax exemption certificate requires you to provide relevant business information, including your name, address, and tax identification number. You should also describe the reason for the exemption clearly. Using a reliable resource like the Ohio Superior Improvement Form can help ensure you complete this document accurately.

In Ohio, the choice between 1 or 0 for tax withholding depends on your financial situation. If you expect to owe taxes, you may want to select 0 to withhold more. Conversely, if you anticipate a refund, selecting 1 might be appropriate. For specific guidance, consider utilizing the Ohio Superior Improvement Form as part of your documentation.

A RIMP, or Required Improvement Plan, is assigned to schools that do not meet performance standards. This plan outlines specific actions to help improve student outcomes and overall performance. Schools can leverage the Ohio Superior Improvement Form to create a focused RIMP and secure support from state resources.