Ohio Assignment and Transfer of Stock

Description

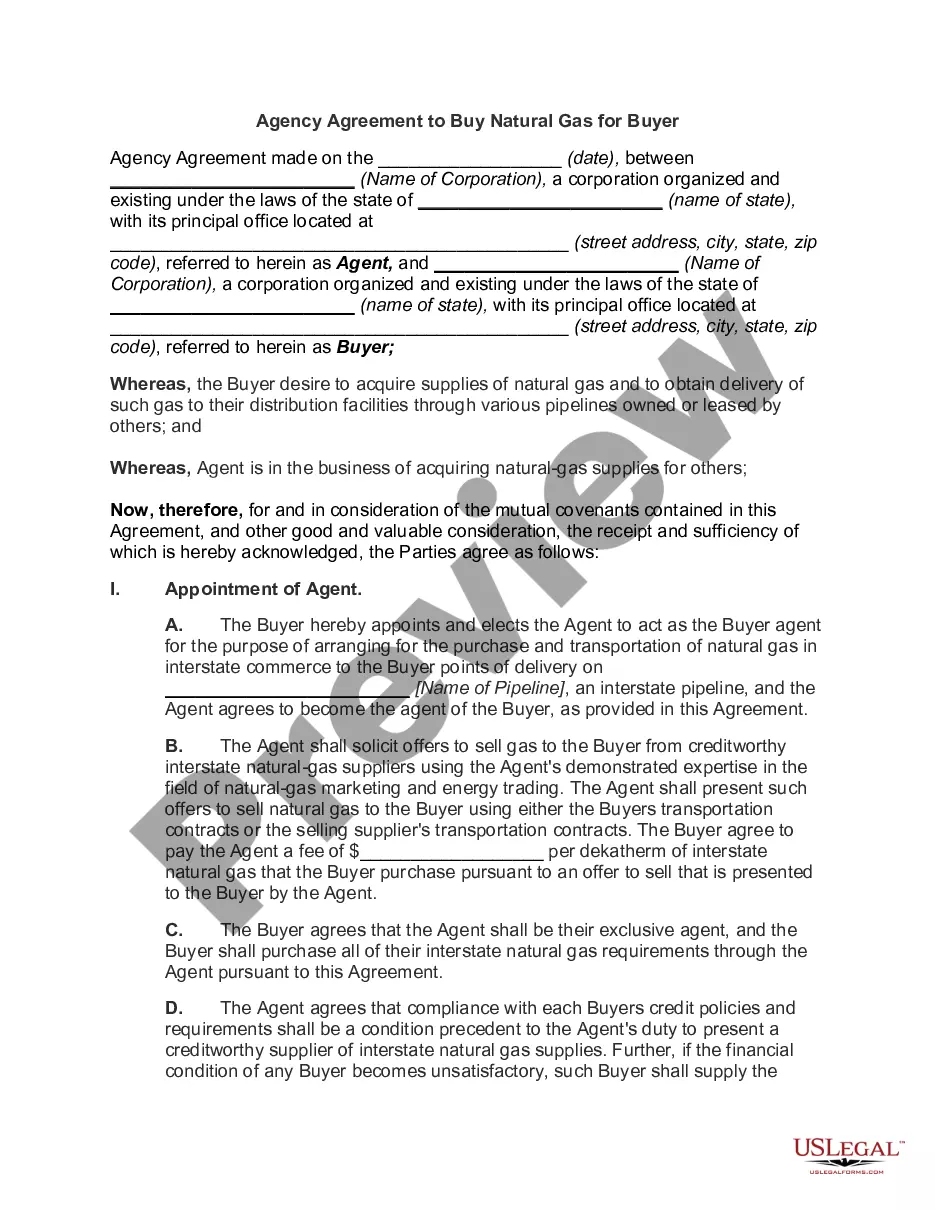

How to fill out Assignment And Transfer Of Stock?

Are you in a location where you require documents for either business or personal purposes almost every working day.

There are numerous legal document templates accessible online, but finding versions you can trust isn't simple.

US Legal Forms provides a vast selection of form templates, including the Ohio Assignment and Transfer of Stock, which are designed to meet state and federal regulations.

Once you find the correct form, click Purchase now.

Choose the payment plan you prefer, provide the necessary information to create your account, and make your purchase using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms site and possess an account, simply Log In.

- Then, you can download the Ohio Assignment and Transfer of Stock template.

- If you do not have an account and wish to begin using US Legal Forms, follow these instructions.

- Obtain the form you need and verify it is for the correct city/state.

- Utilize the Preview feature to review the form.

- Read the description to confirm that you have selected the correct form.

- If the form isn't what you're searching for, use the Lookup field to find the document that fits your needs.

Form popularity

FAQ

To change your business name in Ohio, submit an application for a name change to the Secretary of State. Make sure your chosen name follows legal guidelines and is not already registered by another business. Additionally, if your business involves any stockholder transactions related to the Ohio Assignment and Transfer of Stock, review and update necessary records promptly. USLegalForms offers useful tools to help ease your transition.

To change the name of your business in Ohio, you must file an amendment with the Secretary of State. Begin by choosing a new name that adheres to Ohio's business naming rules and is not already taken. Keep in mind that if your business involves stock transfers regarding Ohio Assignment and Transfer of Stock, notifying stockholders about the name change is critical. You can simplify the process with the help of services like USLegalForms.

Yes, you can change your business name without changing your LLC in Ohio. Simply update your business name through the state’s Secretary of State office, while your LLC's structure remains the same. However, if your change impacts stockholders or involves the Ohio Assignment and Transfer of Stock, you may need to notify them of these updates. Utilizing resources from platforms like USLegalForms can help you with the paperwork involved.

To change the name of your existing business in Ohio, you will typically need to file a name change application with the Secretary of State. Be sure to check Ohio's business name regulations to ensure your new name is available and complies with naming conventions. Additionally, updating your stockholder records might be necessary if you're dealing with the Ohio Assignment and Transfer of Stock, ensuring that all legal documents accurately reflect your new business name. Using a platform like USLegalForms can streamline this process.

True, shareholders must approve a merger of the corporation in Ohio. This approval process empowers shareholders, allowing them to participate in pivotal decisions affecting their investments. Understanding this requirement is essential for navigating the intricacies of the Ohio Assignment and Transfer of Stock.

Absolutely, shareholder approval is typically mandatory for a merger in Ohio. This requirement safeguards the interests of shareholders by ensuring they have the opportunity to vote on significant corporate decisions. It plays a vital role in the successful execution of the Ohio Assignment and Transfer of Stock.

Yes, the assignment of contracts is generally legal in Ohio, provided that the original contract does not prohibit it. Parties can transfer their rights and obligations under a contract as long as they follow the stipulated conditions. When it comes to the Ohio Assignment and Transfer of Stock, understanding the implications of contract assignments is crucial.

Yes, in most cases, mergers require approval from shareholders in Ohio. This process ensures that shareholders have a voice in significant changes to the company structure. By securing shareholder consent, companies facilitate a smoother transition in the Ohio Assignment and Transfer of Stock.

Shareholder approval is typically required for major corporate actions such as mergers, acquisitions, or amendments to the articles of incorporation. These decisions significantly affect the company and its shareholders. Knowing when shareholder approval is necessary is essential for compliant and effective management of the Ohio Assignment and Transfer of Stock.

The Ohio Revised Code 322 governs the assignment and transfer of stock in Ohio. It outlines the legal framework and processes for shareholders when transferring shares of stock. Understanding these regulations is crucial for anyone involved in the Ohio Assignment and Transfer of Stock, ensuring compliance and clarity in stock transactions.