Ohio Demand for Payment of an Open Account by Creditor

Description

How to fill out Demand For Payment Of An Open Account By Creditor?

Are you in a situation where you require paperwork for possibly organization or specific functions almost every day time? There are a lot of authorized document themes available on the Internet, but locating versions you can depend on is not straightforward. US Legal Forms offers a huge number of type themes, just like the Ohio Demand for Payment of an Open Account by Creditor, which can be composed to satisfy federal and state specifications.

In case you are already knowledgeable about US Legal Forms site and possess an account, basically log in. Afterward, it is possible to download the Ohio Demand for Payment of an Open Account by Creditor template.

Unless you provide an profile and would like to start using US Legal Forms, follow these steps:

- Find the type you will need and ensure it is to the right metropolis/state.

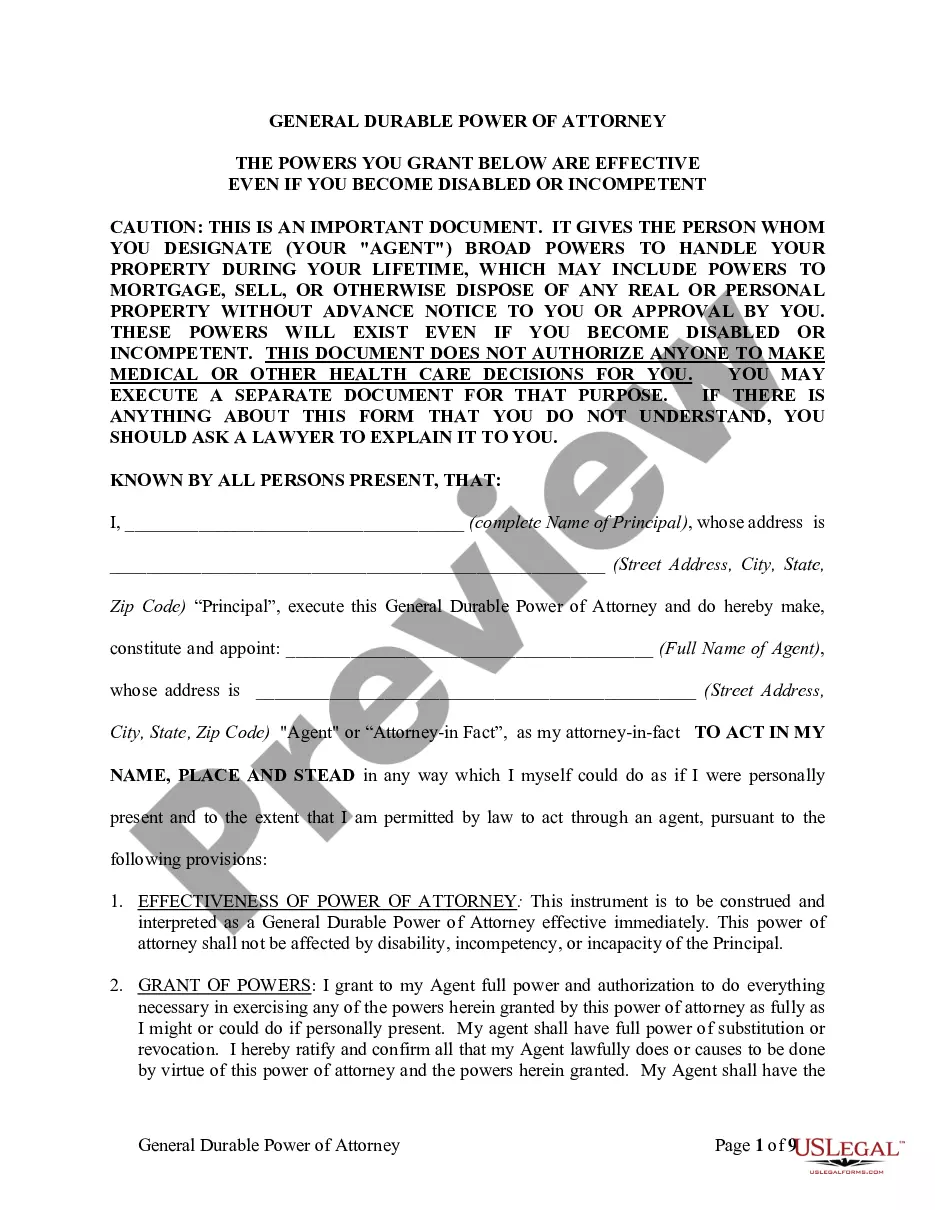

- Make use of the Preview key to review the form.

- Browse the information to ensure that you have selected the appropriate type.

- If the type is not what you`re searching for, use the Research industry to discover the type that meets your requirements and specifications.

- If you obtain the right type, click on Purchase now.

- Choose the costs program you want, submit the required details to produce your account, and purchase your order making use of your PayPal or charge card.

- Select a handy file format and download your version.

Discover each of the document themes you might have bought in the My Forms food list. You can get a extra version of Ohio Demand for Payment of an Open Account by Creditor any time, if needed. Just go through the necessary type to download or produce the document template.

Use US Legal Forms, probably the most considerable assortment of authorized types, to conserve time and steer clear of blunders. The support offers professionally manufactured authorized document themes which you can use for a range of functions. Produce an account on US Legal Forms and start creating your way of life a little easier.

Form popularity

FAQ

Section 2117.15 | Payment of debts - report of insolvency. If it appears at any time that the estate is insolvent, the executor or administrator may report that fact to the court, and apply for any order that the executor or administrator considers necessary because of the insolvency.

(A) A security interest attaches to collateral when it becomes enforceable against the debtor with respect to the collateral, unless an agreement expressly postpones the time of attachment.

Chapter 2117 | Presentment Of Claims Against Estate No part of the assets of a deceased shall be retained by an executor or administrator in satisfaction of the executor's or the administrator's own claim, until it has been proved to and allowed by the probate court.

(B) A person who obtains a judgment against another person may garnish the property, other than personal earnings, of the person against whom judgment was obtained, if the property is in the possession of a person other than the person against whom judgment was obtained, only through a proceeding in garnishment and ...

Section 1319.12 | Taking assignment of debts. (A)(1) As used in this section, "collection agency" means any person who, for compensation, contingent or otherwise, or for other valuable consideration, offers services to collect an alleged debt asserted to be owed to another.

No Probate for Very Small Estates: "Summary Release from Administration" No probate at all is necessary if the estate is worth less than $5,000 or the amount of the funeral expenses, whichever is less.

Non-Probate Property in Ohio Real estate held in joint or survivorship form. Assets and property with a transfer-on-death designation. Insurance proceeds with a named beneficiary. Payable-on-death bank accounts. Assets held in trust.

Section 2117.11 | Rejection of a claim. Notice by mail shall be effective on delivery of the mail at the address given. A claim may be rejected in whole or in part. A claim that has been allowed may be rejected at any time after allowance of the claim.