Ohio Farmers Market Application and Rules and Regulations

Description

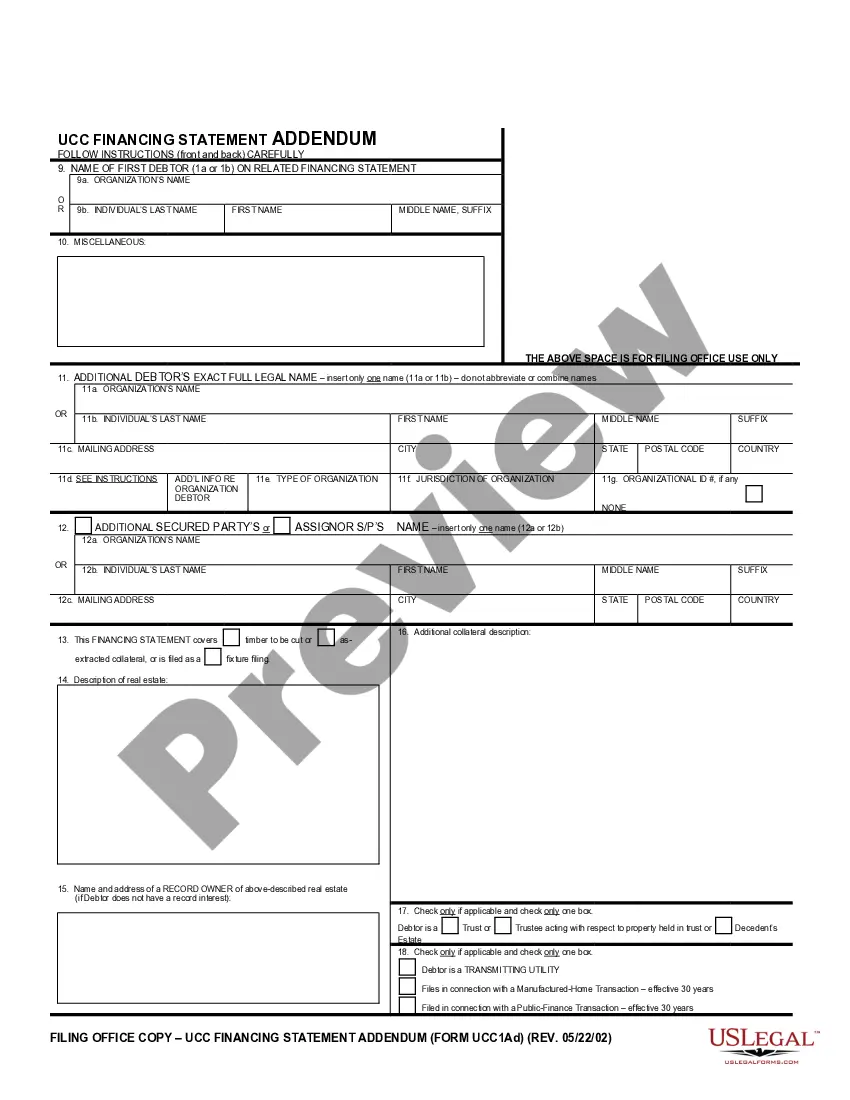

How to fill out Farmers Market Application And Rules And Regulations?

If you need to finalize, obtain, or print legal document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Leverage the site’s straightforward and user-friendly search to find the documents you need. A variety of templates for business and personal purposes are organized by categories and states, or keywords.

Utilize US Legal Forms to obtain the Ohio Farmers Market Application and Rules and Regulations in just a few clicks.

Step 5. Process the transaction. You can use your Visa or Mastercard or PayPal account to complete the purchase.

Step 6. Choose the format of the legal document and download it to your device. Step 7. Fill out, revise, and print or sign the Ohio Farmers Market Application and Rules and Regulations.

Every legal document template you purchase is yours permanently. You will have access to all forms you saved in your account. Visit the My documents section and select a form to print or download again.

Complete and obtain, and print the Ohio Farmers Market Application and Rules and Regulations with US Legal Forms. There are numerous professional and state-specific templates available for your business or personal requirements.

- If you are already a US Legal Forms client, sign in to your account and then click the Download button to obtain the Ohio Farmers Market Application and Rules and Regulations.

- You can also access forms you have previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you have chosen the form for your specific city/state.

- Step 2. Use the Preview feature to review the content of the form. Don’t forget to read the overview.

- Step 3. If you are unsatisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have located the form you need, click the Buy now button. Select the pricing plan you prefer and enter your details to register for an account.

Form popularity

FAQ

Yes, you must report any income earned at a farmers market. This income is subject to federal and state tax laws, meaning accurate record-keeping is essential. Understanding the Ohio Farmers Market Application and Rules and Regulations can help you stay compliant. Platforms such as uslegalforms can offer resources to help you document and report your earnings accurately.

When writing the term, 'farmers market' is the correct spelling and format. This refers to a public market where farmers sell their produce directly to consumers. If you’re looking to establish a farmers market, be sure to review Ohio Farmers Market Application and Rules and Regulations for guidance in your planning. Resources like uslegalforms can also provide you with templates that simplify the process.

The number of acres required to be considered a farm can vary. Generally, the IRS considers any property that produces agricultural products as a farm, regardless of size. In Ohio, consult the Ohio Farmers Market Application and Rules and Regulations for specific requirements. It’s a good idea to keep track of your sales and expenses, which uslegalforms can help you organize.

Yes, farmers must file taxes in accordance with federal, state, and local regulations. The specifics depend on your income level and what kind of business structure you have. If you earn income from operating a farm, you should consult the Ohio Farmers Market Application and Rules and Regulations to understand your tax obligations. Using platforms like uslegalforms can help simplify this process by providing necessary templates and guidance.

Establishing an LLC is not universally necessary for operating at farmers markets, but it can provide legal protection for your business. Depending on your state regulations and sales volume, forming an LLC could be advantageous. Always review the Ohio Farmers Market Application and Rules and Regulations to ensure you meet local requirements. Seeking advice from a legal expert can help clarify your options.

Setting up a local farmers market requires careful planning and community involvement. Begin by organizing a meeting with potential vendors and stakeholders, and then gather information on the Ohio Farmers Market Application and Rules and Regulations. Focus on securing a location, setting up a schedule, and marketing the event to attract customers. Building strong relationships within the community can lead to a successful market.

Yes, sales made at farmers markets are generally subject to taxation. You are responsible for reporting your earnings and paying the appropriate taxes, depending on your business structure. Familiarizing yourself with the Ohio Farmers Market Application and Rules and Regulations can help you understand your tax obligations better. It's wise to consult a tax professional for personalized guidance.

Having liability insurance is highly recommended when selling at a farmers market. This insurance protects you from potential claims related to your products or services. Referencing the Ohio Farmers Market Application and Rules and Regulations can help clarify if insurance is mandatory for your specific market. A solid insurance plan can instill confidence in you, your business, and your customers.

Yes, you need certain permits to sell at farmers markets in Ohio. The exact licenses required depend on the products you plan to sell and local regulations. Therefore, it is crucial to consult the Ohio Farmers Market Application and Rules and Regulations when preparing to set up your stall. This process ensures that you operate within legal boundaries and build trust with your customers.

While forming an LLC is not always a requirement for farmers markets, it offers legal protection for your personal assets. Depending on your business model and sales volume, an LLC can be beneficial. Always check the Ohio Farmers Market Application and Rules and Regulations to understand local requirements better. Consulting with a legal professional is advisable to understand the implications for your specific situation.