Ohio Business Management Consulting or Consultant Services Agreement - Self-Employed

Description

How to fill out Business Management Consulting Or Consultant Services Agreement - Self-Employed?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a diverse selection of legal form templates available for download or printing.

By utilizing the website, you can discover numerous forms for business and personal purposes, organized by categories, states, or keywords.

You can obtain the latest versions of forms such as the Ohio Business Management Consulting or Consultant Services Agreement - Self-Employed in just a few minutes.

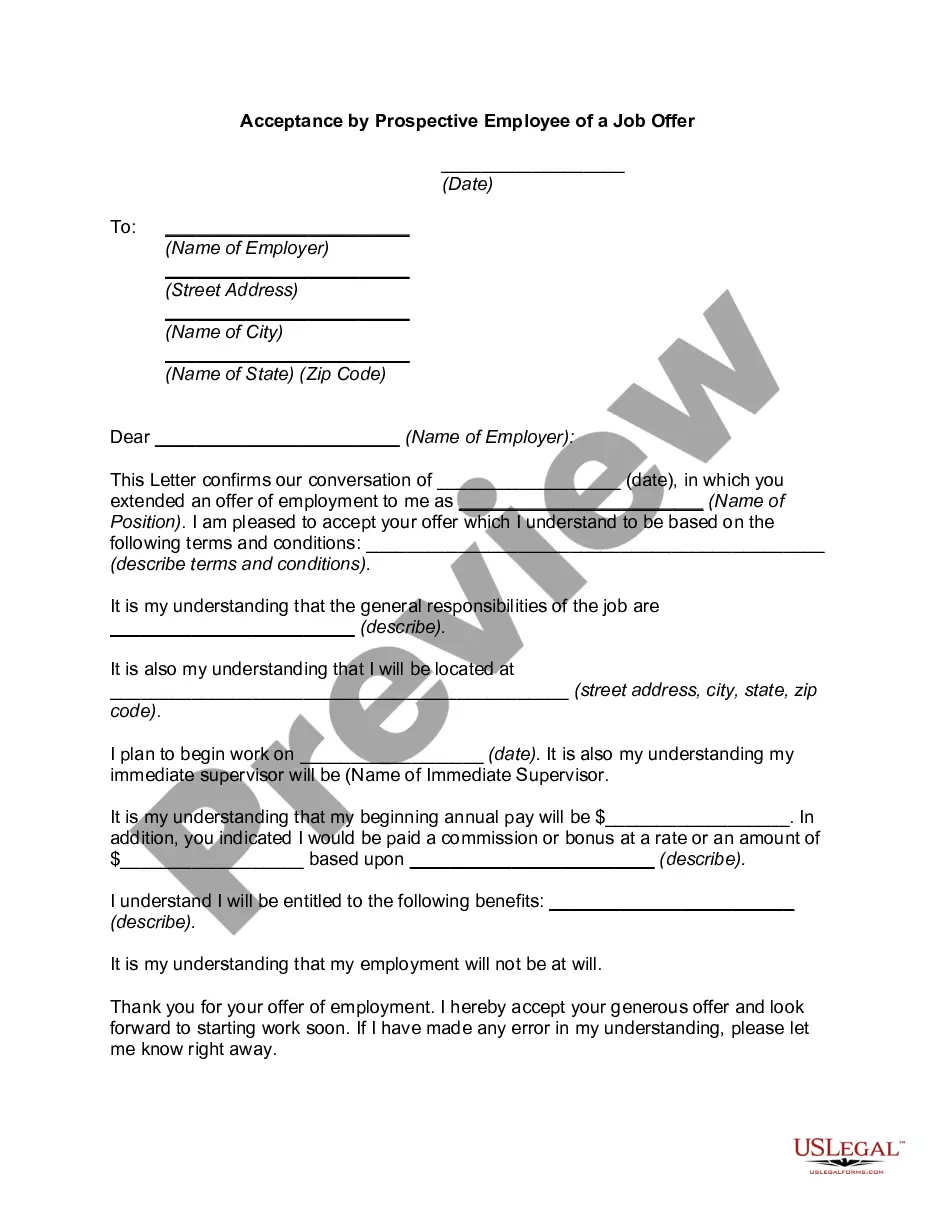

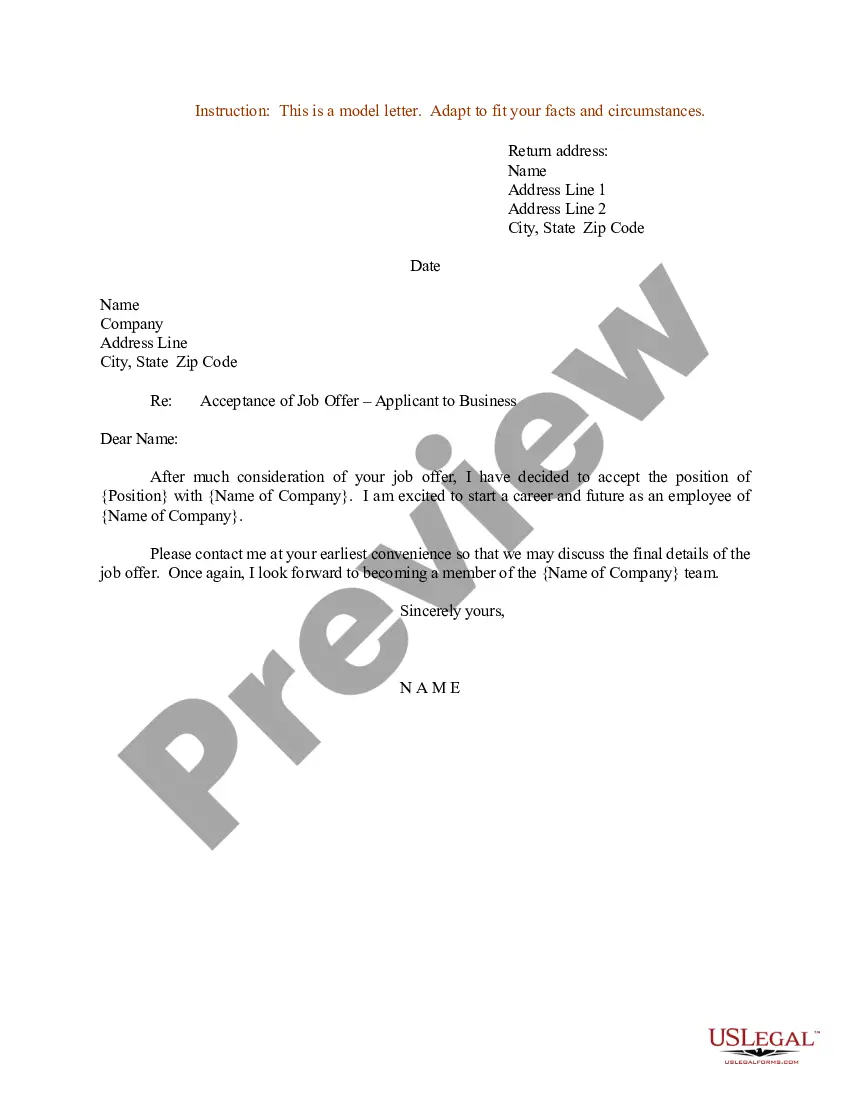

Click the Preview button to examine the form's content. Check the form details to verify that you have chosen the correct form.

If the form doesn’t meet your needs, use the Search box at the top of the screen to find one that does.

- If you currently have a monthly subscription, Log In and download the Ohio Business Management Consulting or Consultant Services Agreement - Self-Employed from your US Legal Forms library.

- The Download button will appear on every form you view.

- You can access all previously downloaded forms within the My documents tab of your account.

- If you want to use US Legal Forms for the first time, here are straightforward instructions to help you get started.

- Ensure you have selected the correct form for your city/county.

Form popularity

FAQ

A consulting agreement is a legal document that outlines the terms under which a consultant provides services to a client. It typically includes details about the project scope, compensation, and confidentiality obligations. Having a well-drafted consulting agreement is vital in Ohio Business Management Consulting, as it serves to protect your interests and establish clear expectations. A carefully constructed agreement can help avoid conflicts and ensure a productive working relationship.

To protect yourself as a consultant, establish a clear Consulting Services Agreement that outlines the terms of your engagement. This agreement should cover important aspects such as confidentiality, liability, and payment terms. Additionally, consider obtaining liability insurance to further safeguard your business. By being proactive, you reduce potential risks associated with Ohio Business Management Consulting.

Consultants typically bill clients based on hourly rates, project fees, or retainers. These billing methods should be outlined in the Consulting Services Agreement to ensure clarity. It’s crucial to establish a payment schedule that works for both parties, promoting a smooth financial transaction process. In Ohio Business Management Consulting, transparency about billing practices fosters trust and strong client relationships.

employed consultant operates independently, providing expert advice or services to clients in various industries. They manage their own business operations and often work on a contractual basis. In Ohio Business Management Consulting, selfemployed consultants offer valuable insights that help businesses improve efficiency and profitability. This status allows flexibility and the potential for higher earnings compared to traditional employment.

Consultants should have a Consulting Services Agreement tailored to their specific situation. This agreement clearly defines the scope of work, payment terms, and responsibilities. Additionally, it ensures both parties understand their obligations, which is essential in Ohio Business Management Consulting. By having a standard contract in place, you can prevent disputes and clarify expectations upfront.

Yes, an independent contractor can serve as a consultant, given that they offer expert advice or strategic solutions. However, the terms of the engagement should be defined clearly in an Ohio Business Management Consulting arrangement or a Consultant Services Agreement - Self-Employed. This distinction ensures that both parties have a mutual understanding of expectations and deliverables throughout their collaboration.

The key difference between an independent contractor and an independent consultant lies in their roles. An independent contractor completes specific tasks directed by a client, while an independent consultant focuses on providing expert advice and insights. If you are considering entering into agreements, exploring Ohio Business Management Consulting or a Consultant Services Agreement - Self-Employed can clarify the distinctions and assist with your needs.

To write a consulting contract agreement, start by defining the scope of work, payment terms, and deadlines. Clearly outline the responsibilities of both parties to avoid future misunderstandings. Incorporating elements from Ohio Business Management Consulting services ensures that your contract aligns with best practices, ultimately leading to a successful partnership.

The difference between a consultant and a contractor primarily lies in the scope of their work. A consultant provides guidance and advice to improve business processes, while a contractor executes specific projects based on directed tasks. Utilizing Ohio Business Management Consulting or a Consultant Services Agreement - Self-Employed can help clarify these roles and expectations in your agreements.

While both independent contractors and consultants offer specialized services, they are not identical. An independent contractor may perform tasks related to various trade services, while a consultant typically provides expert advice in a specific field. In Ohio Business Management Consulting, the distinction is essential, as the nature of the work and expectations may vary considerably between the two roles.