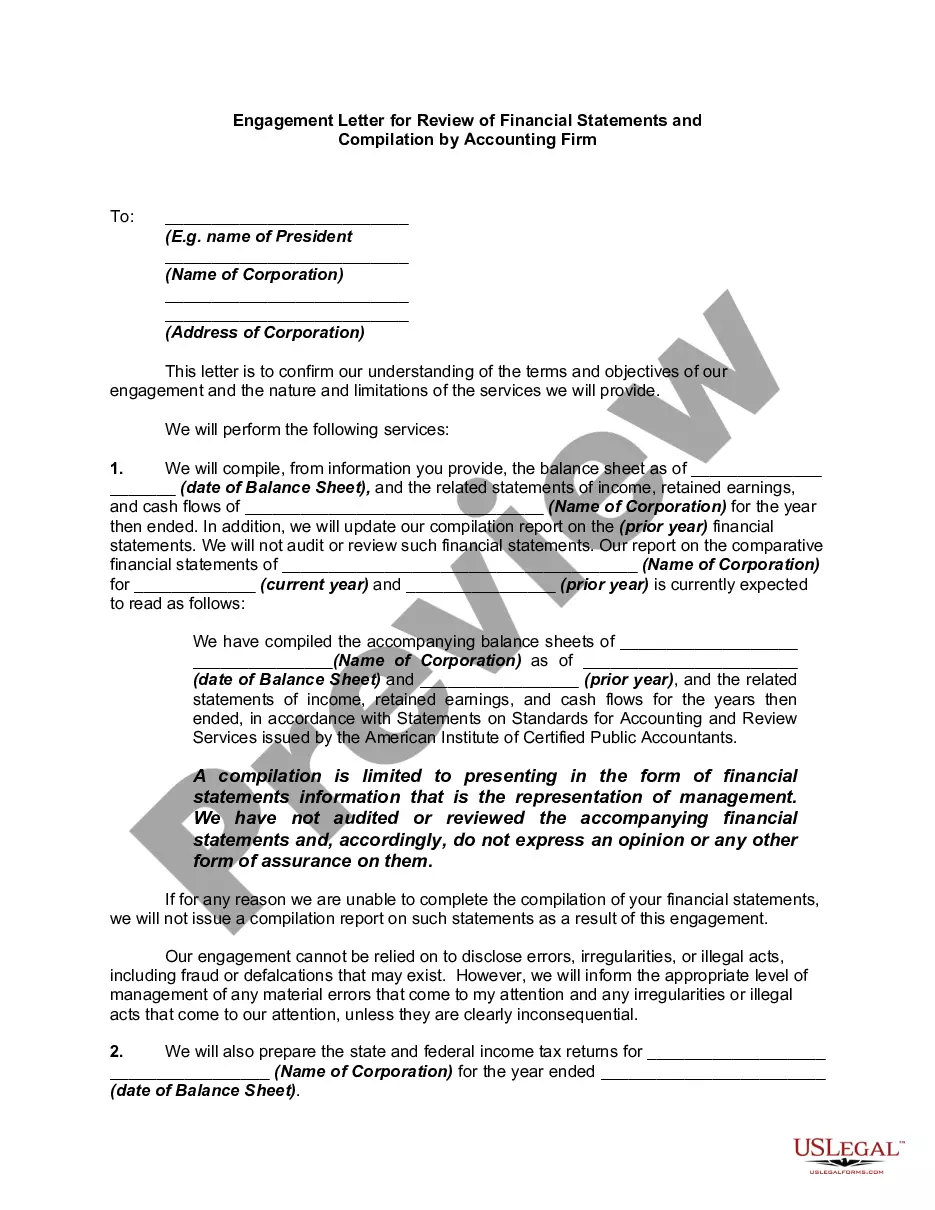

In a compilation engagement, the accountant presents in the form of financial statements information that is the representation of management (owners) without undertaking to express any assurance on the statements. In other words, using management's records, the accountant creates financial statements without gathering evidence or opining about the validity of those underlying records. Because compiled financial statements provide the reader no assurance regarding the statements, they represent the lowest level of financial statement service accountants can provide to their clients. Accordingly, standards governing compilation engagements require that financial statements presented by the accountant to the client or third parties must at least be compiled.

Ohio Report from Review of Financial Statements and Compilation by Accounting Firm

Description

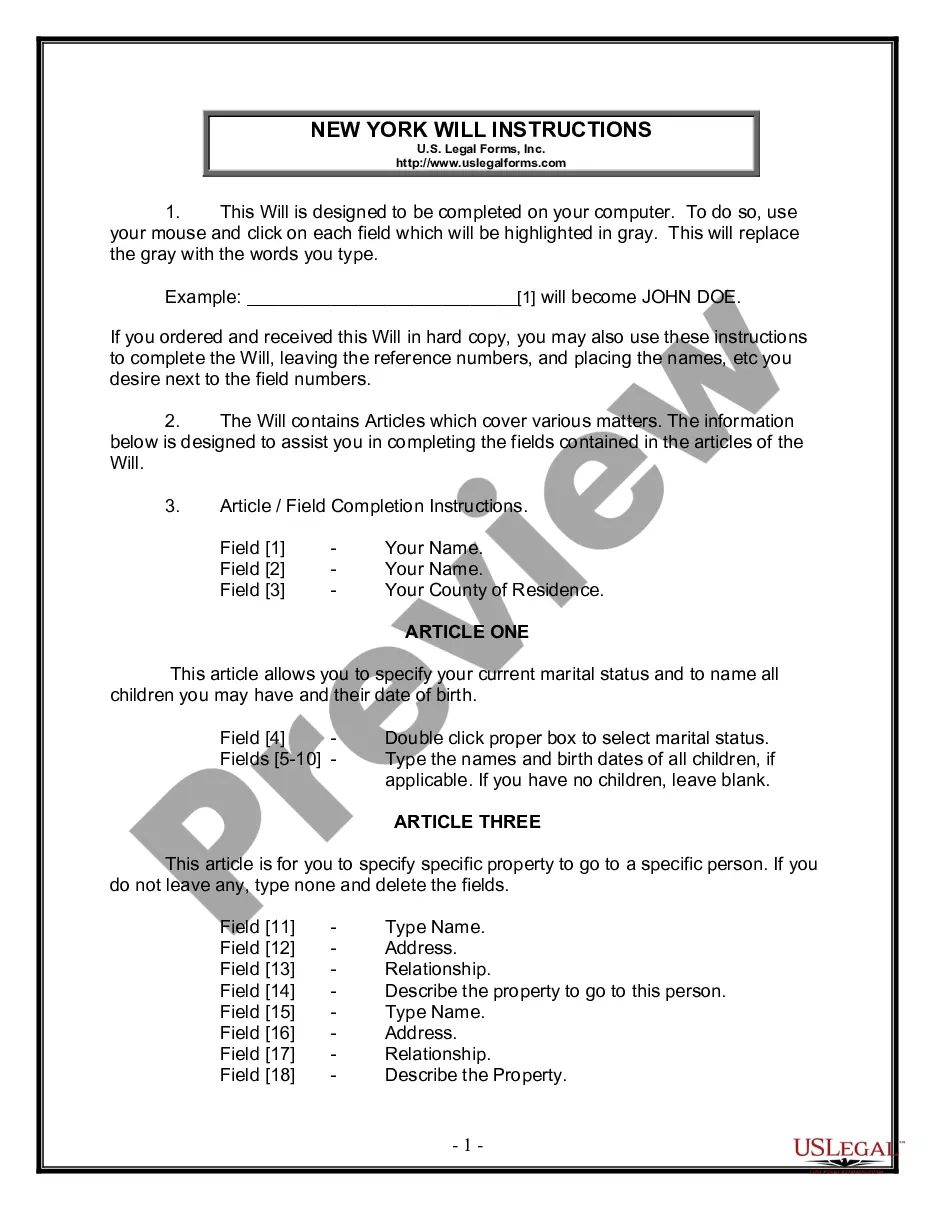

How to fill out Report From Review Of Financial Statements And Compilation By Accounting Firm?

If you need to be thorough, secure, or print certified document templates, utilize US Legal Forms, the most extensive compilation of legal forms, accessible online.

Take advantage of the site's user-friendly and efficient search to find the documents you require.

A variety of templates for business and personal purposes are categorized by types and states, or keywords.

Step 4. After locating the form you need, click the Purchase now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Use US Legal Forms to obtain the Ohio Report from Review of Financial Statements and Compilation by Accounting Firm with just a few clicks.

- If you are already a US Legal Forms member, Log In to your account and click the Download button to receive the Ohio Report from Review of Financial Statements and Compilation by Accounting Firm.

- You can also access forms you previously acquired in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the directions below.

- Step 1. Ensure you have selected the form for your specific city/state.

- Step 2. Use the Review option to check the contents of the form. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to look for other templates in the legal form catalog.

Form popularity

FAQ

The review of a company's financial statement by a CPA offers an assessment of financial performance and compliance with accounting standards. CPAs utilize analytical procedures to identify any unusual trends or discrepancies in the financial data provided. This thorough process helps businesses gain confidence in their financial reports, making the Ohio Report from Review of Financial Statements and Compilation by Accounting Firm an essential tool for strategic planning and investor relations.

Compilation, review, and audited financial statements represent different levels of financial reporting services provided by accounting firms. The compilation is the least intensive, offering basic financial statements based solely on client information. Reviews provide limited assurance, while audits involve a thorough examination of financial records. Each service, including the Ohio Report from Review of Financial Statements and Compilation by Accounting Firm, serves specific business needs and enhances transparency.

A review of a company's financial statements by a CPA firm involves analytical procedures to evaluate financial data and provide limited assurance regarding its reliability. This process is more in-depth than a compilation but less comprehensive than an audit. The Ohio Report from Review of Financial Statements and Compilation by Accounting Firm offers valuable insights into your company’s finances, enabling better decision-making for business growth.

A financial compilation report is a basic form of financial reporting prepared by an accounting firm. It involves compiling financial statements based on information provided by your company, without verifying its accuracy. This Ohio Report from Review of Financial Statements and Compilation by Accounting Firm helps business owners understand their financial position with less time and financial commitment than an audit.

Filling out a financial report involves gathering all relevant financial data, such as income statements and balance sheets, and accurately presenting that information in a clear format. It's crucial to ensure that all figures are correct and that the report follows generally accepted accounting principles. Using platforms like uslegalforms can simplify this process by providing templates and guidance for creating an Ohio Report from Review of Financial Statements and Compilation by Accounting Firm.

The main difference between compilation and review of financial statements lies in the level of assurance provided. A compilation offers no assurance, as it merely compiles financial data into a basic format. Conversely, a review, such as the Ohio Report from Review of Financial Statements and Compilation by Accounting Firm, includes analytical procedures that allow accountants to express limited assurance on the accuracy of the documents, providing more confidence in the financial information presented.

When financial statements are reviewed, it means that an accounting firm evaluates and assesses a company's financial documents to ensure accuracy and compliance with accounting standards. This process focuses on analytical procedures and inquiries rather than a comprehensive audit. An Ohio Report from Review of Financial Statements and Compilation by Accounting Firm provides an in-depth look at your financial performance, increasing trust among stakeholders.

To obtain your CPA license in Ohio, you must meet education requirements, pass the CPA Exam, and complete a specific amount of practical work experience. After satisfying these criteria, you can submit your application to the Ohio State Board of Accountancy. With your CPA license, you can provide essential services, including the Ohio Report from Review of Financial Statements and Compilation by Accounting Firm.

The new law for CPAs in Ohio focuses on enhancing continuing education requirements and ensuring strict adherence to ethical standards. This legislation supports transparency and integrity within the accounting profession. If you are involved in preparing an Ohio Report from Review of Financial Statements and Compilation by Accounting Firm, staying updated on these laws will help maintain compliance.

Transferring your CPA license to Ohio requires you to follow the specific guidelines set by the Ohio State Board of Accountancy. You must provide necessary documentation and meet any continuing education requirements. For accounting professionals in need of an Ohio Report from Review of Financial Statements and Compilation by Accounting Firm, the transfer process ensures that your certifications remain valid.