US Legal Forms - among the biggest libraries of legal varieties in the States - gives an array of legal papers layouts you can acquire or produce. Using the website, you will get thousands of varieties for organization and individual purposes, categorized by groups, claims, or keywords and phrases.You can get the latest types of varieties just like the Ohio Renunciation and Disclaimer of Interest in Life Insurance Proceeds in seconds.

If you already possess a subscription, log in and acquire Ohio Renunciation and Disclaimer of Interest in Life Insurance Proceeds from the US Legal Forms local library. The Download switch can look on each and every develop you see. You have access to all previously saved varieties from the My Forms tab of your own accounts.

If you want to use US Legal Forms the first time, listed below are basic recommendations to help you get started out:

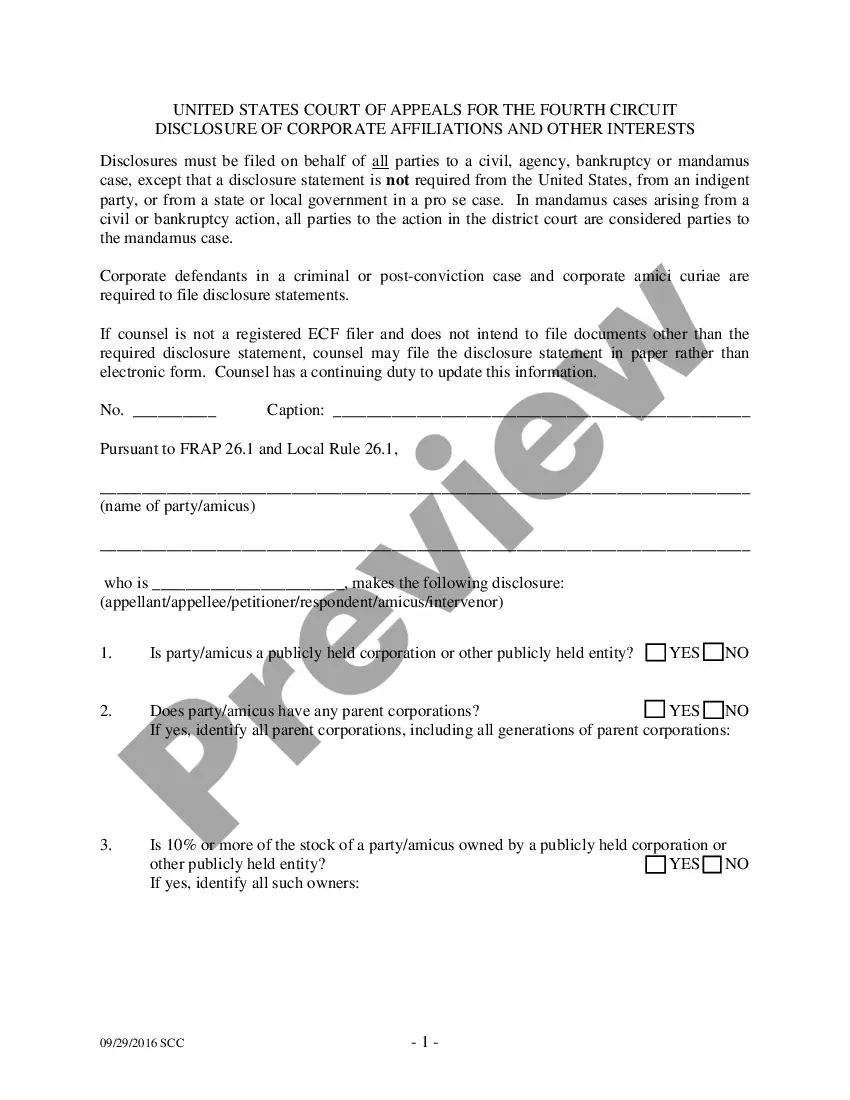

- Be sure to have picked the correct develop to your metropolis/county. Click the Review switch to check the form`s content. See the develop explanation to ensure that you have chosen the appropriate develop.

- In case the develop doesn`t satisfy your specifications, use the Search discipline towards the top of the screen to obtain the one who does.

- When you are content with the form, verify your choice by simply clicking the Get now switch. Then, select the pricing strategy you like and supply your qualifications to register for the accounts.

- Approach the deal. Make use of credit card or PayPal accounts to perform the deal.

- Find the structure and acquire the form on your own device.

- Make modifications. Fill out, modify and produce and sign the saved Ohio Renunciation and Disclaimer of Interest in Life Insurance Proceeds.

Each and every design you included in your money lacks an expiry day and is also yours for a long time. So, if you wish to acquire or produce an additional duplicate, just visit the My Forms area and then click in the develop you need.

Get access to the Ohio Renunciation and Disclaimer of Interest in Life Insurance Proceeds with US Legal Forms, one of the most comprehensive local library of legal papers layouts. Use thousands of skilled and express-particular layouts that fulfill your business or individual requires and specifications.