Ohio Sample Letter for Tax Deeds

Description

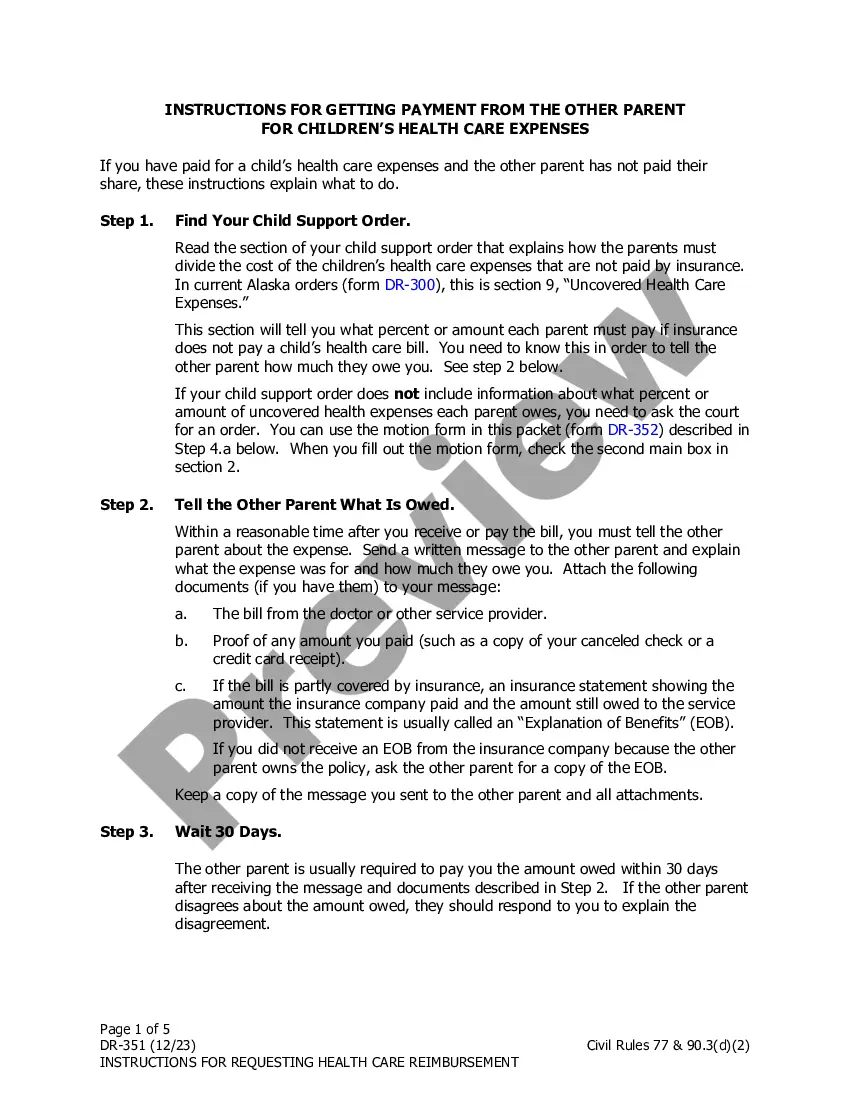

How to fill out Sample Letter For Tax Deeds?

You might spend hours online searching for the legal document template that fulfills the federal and state requirements you need. US Legal Forms offers thousands of legal forms that are reviewed by experts. You can obtain or print the Ohio Sample Letter for Tax Deeds from my services.

If you possess a US Legal Forms account, you can Log In and click the Acquire button. Subsequently, you can complete, modify, print, or sign the Ohio Sample Letter for Tax Deeds. Each legal document template you obtain is yours forever. To get another copy of any purchased form, navigate to the My documents section and click the appropriate button.

If you are using the US Legal Forms website for the first time, follow the simple instructions below: First, make sure you have chosen the right document template for your area/region of interest. Review the form details to ensure you have selected the correct form. If available, use the Preview button to view the document template as well.

- If you wish to find another version of the form, use the Search field to locate the template that meets your needs and criteria.

- Once you have found the template you want, click Acquire now to proceed.

- Select the pricing plan you prefer, provide your details, and sign up for your account on US Legal Forms.

- Complete the transaction. You can use your Visa or Mastercard or PayPal account to pay for the legal form.

- Choose the format of the document and download it to your device.

- Make edits to the document if necessary. You can complete, modify, sign, and print the Ohio Sample Letter for Tax Deeds.

- Download and print thousands of document templates using the US Legal Forms website, which offers the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

Form popularity

FAQ

After the tax lien sale, you get one year to pay off all lien charges and interest property. If you don't redeem during the one-year redemption period, the tax lien purchaser can foreclose on your Ohio property by filing a lawsuit with the court.

In summary, the payment of property taxes can create a presumption of ownership of a property. However, presumptive ownership of a property is not ?clean? title.

In Ohio a Tax Status Compliance Certificate is called a Form D5 and is issued by the Ohio Department of Revenue for a Company (Corporation or LLC) or Sole Proprietor which has met all of its Ohio tax obligations.

If your taxes are ?certified delinquent? Late property taxes may be certified delinquent. This means: You risk foreclosure. If you don't pay your property taxes within 60 days of the date that they are certified delinquent, your case could be sent to the county prosecutor to start the foreclosure process.

Unlike other states, Ohio law does not provide for the sale of individual tax lien certificates or "over-the-counter" liens. All Franklin County properties with delinquent taxes are eligible to be sold at the tax lien certificate sale.

The Department requires certain taxpayers to verify their identity in an effort to combat tax fraud and safeguard taxpayer dollars. Taxpayers are selected for identity verification using data analysis of information on the tax return and other factors.

All real property owners who are not specifically exempt are subject to the real property tax. The real property tax base is the taxable (assessed) value of land and improvements. The taxable value is 35 percent of true (market) value, except for certain land devoted exclu sively to agricultural use.

After the tax lien sale, you get one year to pay off all lien charges and interest property. If you don't redeem during the one-year redemption period, the tax lien purchaser can foreclose on your Ohio property by filing a lawsuit with the court.