This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Ohio Installment Promissory Note with Acceleration Clause and Collection Fees

Description

How to fill out Installment Promissory Note With Acceleration Clause And Collection Fees?

If you need to complete, acquire, or print legal document templates, use US Legal Forms, the largest collection of legal forms available online.

Utilize the site's straightforward and user-friendly search to locate the documents you require.

Various templates for business and personal purposes are categorized by types and states, or keywords.

Step 4. Once you have found the form you need, select the Purchase now button. Choose your preferred pricing plan and enter your information to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finish the purchase.

- Use US Legal Forms to locate the Ohio Installment Promissory Note with Acceleration Clause and Collection Fees in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Obtain button to retrieve the Ohio Installment Promissory Note with Acceleration Clause and Collection Fees.

- You can also access documents you have previously saved in the My documents section of your account.

- If you’re using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

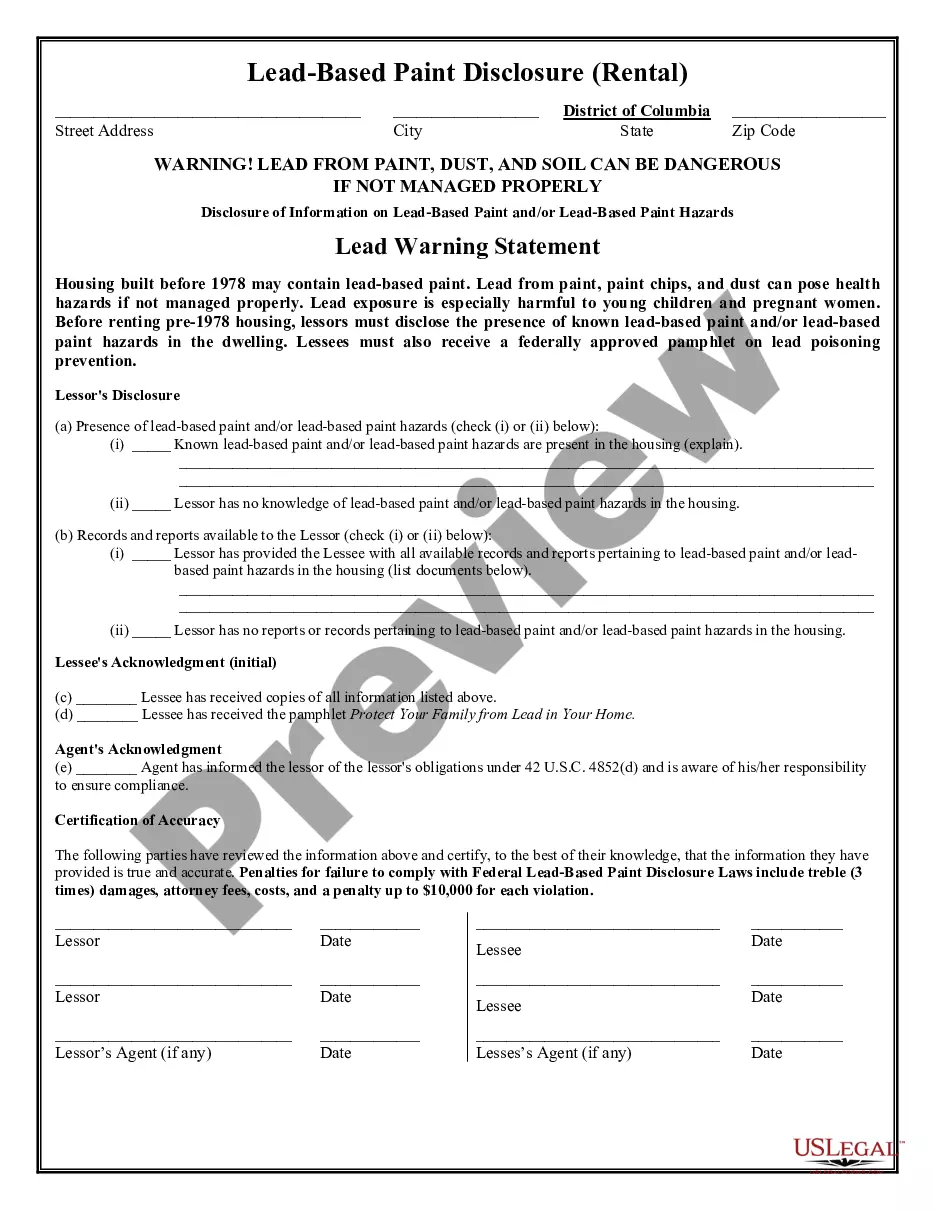

- Step 2. Use the Preview option to review the content of the form. Don’t forget to check the details.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find other versions of your legal form template.

Form popularity

FAQ

A promissory note can be deemed invalid for several reasons. For instance, if the document lacks essential elements like the borrower’s signature, the amount borrowed, or clear repayment terms, it may not hold up in court. Additionally, if the terms violate state law or public policy, such as an excessive interest rate, it could become unenforceable. To avoid pitfalls, use a correctly structured Ohio Installment Promissory Note with Acceleration Clause and Collection Fees from uslegalforms.

Yes, a lender can demand payment on a promissory note when the borrower fails to adhere to the agreed-upon terms. This demand is often facilitated by the acceleration clause included in the note, which helps the lender expedite the repayment process. If you are using an Ohio Installment Promissory Note with Acceleration Clause and Collection Fees, it is essential to understand when and how you can make this demand to protect your rights.

To legally enforce a promissory note, the lender typically needs to demonstrate that the terms of the note are clear and that the borrower has defaulted on payment obligations. This process often involves sending a formal notice and possibly filing a claim in court, particularly if the note includes an acceleration clause. Using the Ohio Installment Promissory Note with Acceleration Clause and Collection Fees can streamline this process and establish legal grounds for collection.

In Ohio, notarization is not required to make a promissory note valid; however, it can serve as beneficial evidence of authenticity. For an Ohio Installment Promissory Note with Acceleration Clause and Collection Fees, adding a notary can enhance the document's credibility if disputes arise. Using platforms like uslegalforms can assist in ensuring all necessary components are included, preparing you for any legal process.

A promissory note becomes legally binding when it meets all the necessary legal requirements in Ohio, such as clarity, mutual agreement between the parties, and consideration. For an Ohio Installment Promissory Note with Acceleration Clause and Collection Fees, documenting the terms and obtaining signatures from both parties is essential to enforceability. Proper execution ensures that all parties are obligated to adhere to the agreed-upon terms.

A promissory note may be deemed invalid if it lacks essential elements, such as a specified amount, identifiable parties, or clarity in repayment terms. Additionally, if the terms violate Ohio law or public policy, the document can be challenged. Therefore, it is vital to thoroughly review an Ohio Installment Promissory Note with Acceleration Clause and Collection Fees to ensure compliance.

To accelerate an Ohio Installment Promissory Note with Acceleration Clause and Collection Fees, the holder must invoke the acceleration clause when certain conditions are met. This typically occurs when the borrower defaults on payments or violates the agreement terms. It is crucial to provide written notice to the borrower to ensure compliance with the acceleration process.

Essential requisites for a valid promissory note include a clear identification of the parties involved, the amount owed, and the repayment terms. An Ohio Installment Promissory Note with Acceleration Clause and Collection Fees must also specify any interest rates and conditions under which acceleration may occur. Sustaining these elements secures the document's validity, reducing potential disputes.