Ohio Owner Financing Contract for Home

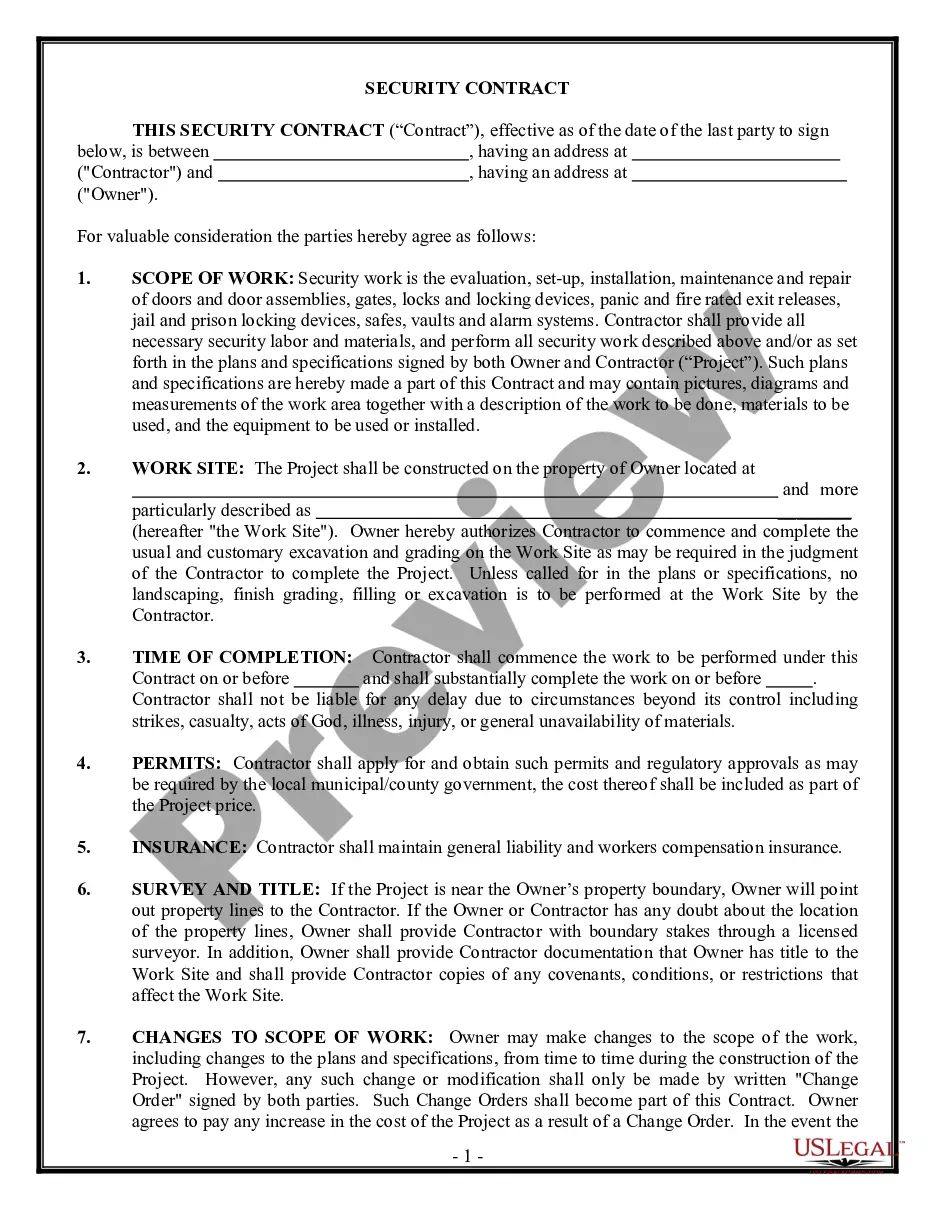

Description

How to fill out Owner Financing Contract For Home?

Selecting the appropriate legal document format can be a challenge.

Of course, there are numerous templates available online, but how do you locate the legal document you need.

Utilize the US Legal Forms website. The service offers thousands of templates, such as the Ohio Owner Financing Contract for Home, which can be utilized for both business and personal purposes.

You can preview the form using the Preview button and read the form description to confirm it is the right one for you.

- All the forms are reviewed by experts and comply with federal and state regulations.

- If you are already a user, Log In to your account and click the Download button to access the Ohio Owner Financing Contract for Home.

- Use your account to search for the legal forms you've previously purchased.

- Go to the My documents section of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps to follow.

- First, ensure you have selected the correct form for your city/state.

Form popularity

FAQ

While a contract for deed can offer flexibility, it has notable disadvantages. Firstly, the buyer may not obtain the legal title until all payments are complete, risking investment if the seller defaults. Secondly, if issues arise with the property, the buyer may face challenges in addressing them, as they do not hold full ownership rights until the contract concludes. Understanding these risks is essential when considering an Ohio owner financing contract for a home.

Finding seller financing deals can be an exciting journey when you know where to look. Start by networking with local real estate agents or joining online groups focused on real estate investment. Additionally, you can explore listings that specifically mention an Ohio Owner Financing Contract for Home, as sellers often advertise this option to attract interested buyers. Using resources like US Legal Forms can help you customize necessary documents once you discover a suitable deal.

An Ohio Owner Financing Contract for Home is usually set up by the property seller, often with the assistance of a real estate attorney or expert. Sellers structure the financing terms, including the interest rate and repayment periods, to meet their needs and attract buyers. It's beneficial for sellers to utilize platforms like US Legal Forms, which provide templates and legal guidance for creating these contracts. This ensures that both parties understand their responsibilities and rights under this financing model.

In an owner financing situation, the seller typically retains the deed until the buyer fulfills the payment obligations outlined in the contract. This means that legal title remains with the seller until the financing terms are met. It is essential to map out this aspect in your Ohio Owner Financing Contract for Home to ensure that both parties are aware of their rights and responsibilities.

Yes, seller financing counts as income for the seller, particularly the interest payments received from the buyer. This income must be reported to the IRS and can influence your overall tax liability. As you navigate an Ohio Owner Financing Contract for Home, keeping track of these payments can lead to more informed financial decisions.

In an owner financing arrangement, the buyer typically assumes responsibility for property taxes as part of their payments. This arrangement is usually outlined in the Ohio Owner Financing Contract for Home, ensuring clarity on tax obligations. It’s wise to specify this detail in your written agreement to avoid any misunderstandings in the future.

Seller-financed interest is reported as income on your tax return, typically on Schedule B. This interest forms part of the seller's overall earnings for the year, which is vital for accurate tax reporting. By utilizing an Ohio Owner Financing Contract for Home, you ensure that both the principal and interest aspects are documented, simplifying the process come tax season.

To report owner financing income, you must include the interest payments you receive from the buyer on your tax return. Typically, you report this income on Schedule B as part of your overall income for the year. When using an Ohio Owner Financing Contract for Home, it is smart to keep a detailed record of all payments received to make the reporting process smoother.

While owner financing offers unique advantages, it does come with potential downsides. The seller faces risks if the buyer defaults on payments, which may lead to costly foreclosure processes. Additionally, the buyer might receive less legal protection compared to traditional financing. Understanding these risks is essential when considering an Ohio Owner Financing Contract for Home, and clear terms can help mitigate concerns.