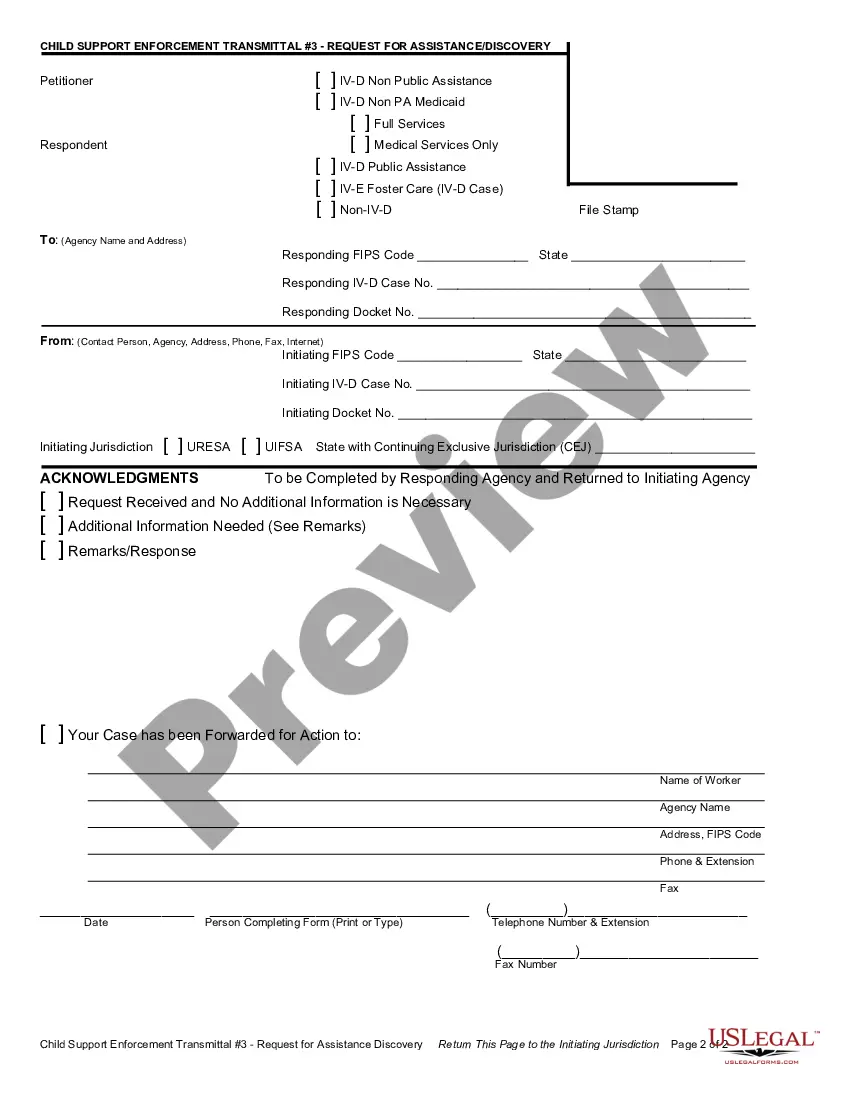

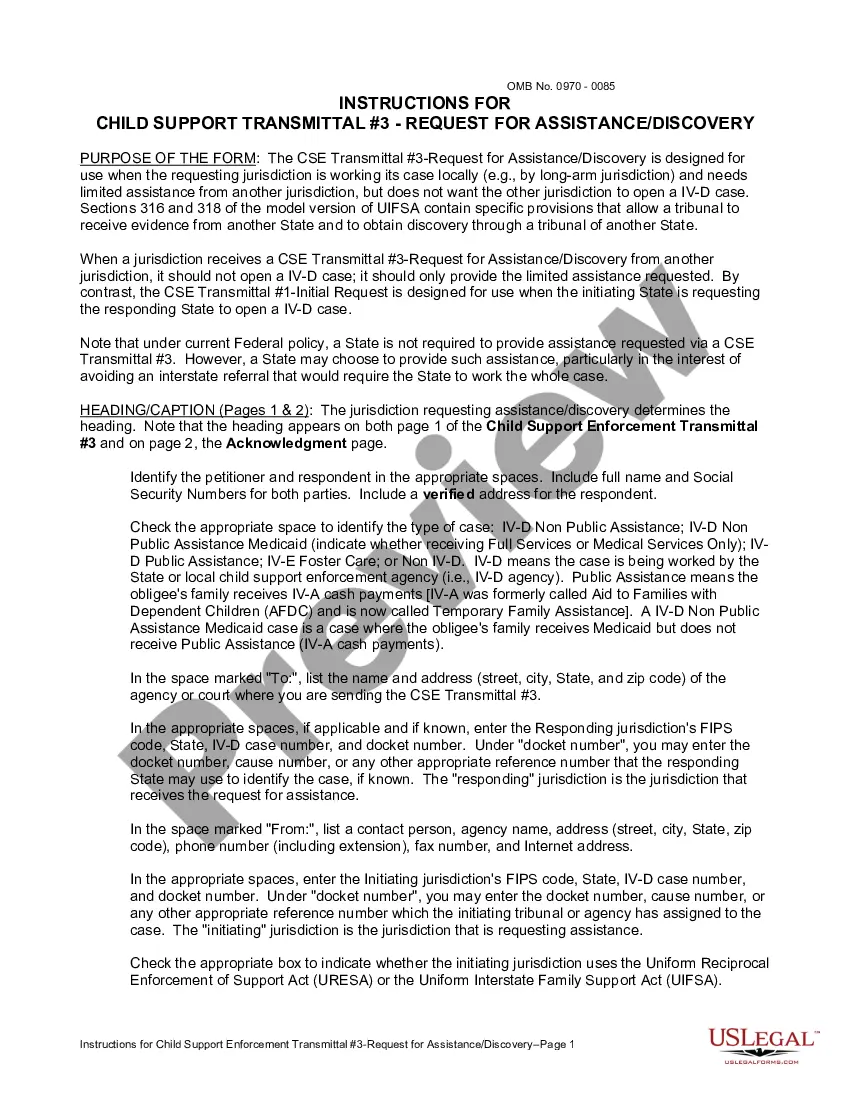

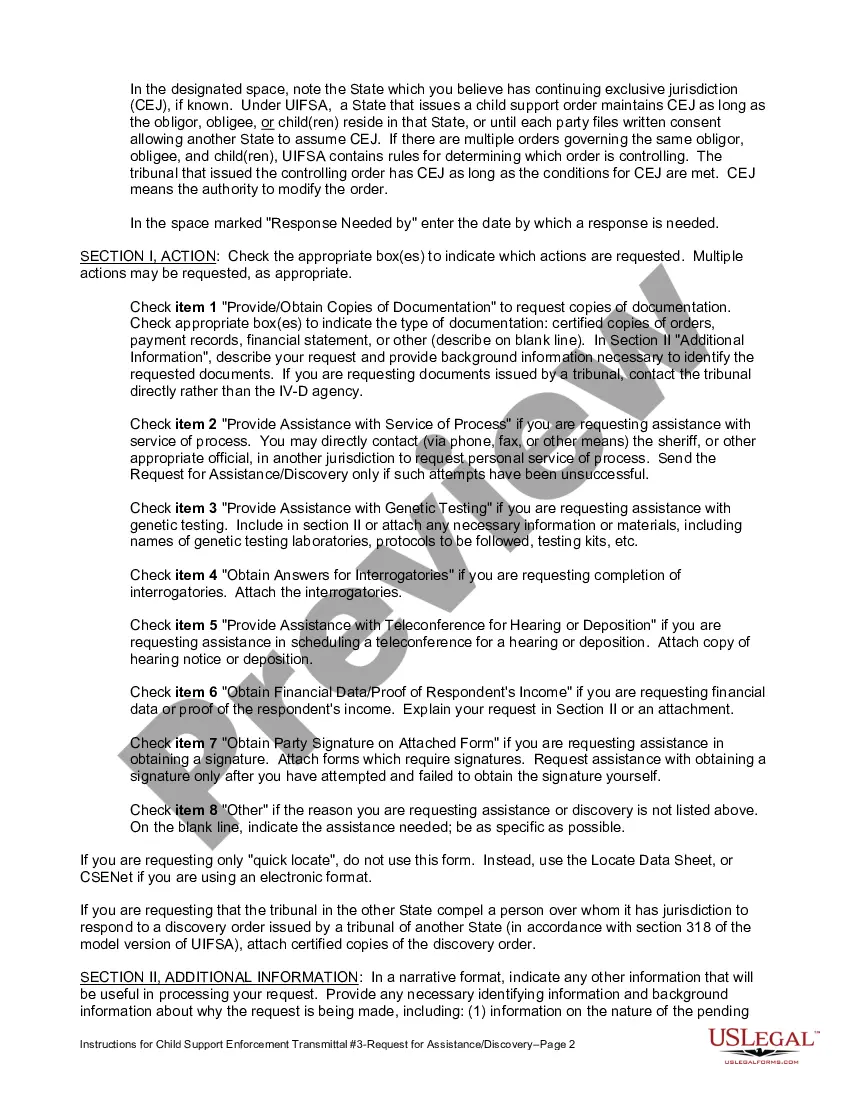

Illinois Child Support Enforcement Transmittal #3 - Request for Assistance - Discovery and Instructions

Description

How to fill out Child Support Enforcement Transmittal #3 - Request For Assistance - Discovery And Instructions?

If you need to be thorough, acquire, or create valid document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Leverage the site's straightforward and user-friendly search function to find the documents you need.

A selection of templates for commercial and personal purposes are organized by categories and regions, or keywords. Use US Legal Forms to locate the Illinois Child Support Enforcement Transmittal #3 - Request for Assistance - Discovery and Instructions in just a few clicks.

Every legal document template you purchase is yours indefinitely. You will have access to every form you downloaded in your account. Click the My documents section and select a form to print or download again.

Be proactive and download, and print the Illinois Child Support Enforcement Transmittal #3 - Request for Assistance - Discovery and Instructions with US Legal Forms. There are thousands of professional and state-specific forms you can use for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to obtain the Illinois Child Support Enforcement Transmittal #3 - Request for Assistance - Discovery and Instructions.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for your respective city/region.

- Step 2. Utilize the Review feature to verify the form’s details. Do not forget to read the summary.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the page to find other versions of your legal form template.

- Step 4. Once you have found the form you need, click on the Buy now button. Choose the pricing plan you prefer and enter your information to sign up for the account.

- Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finalize the purchase.

- Step 6. Choose the format of your legal form and download it onto your device.

- Step 7. Complete, modify, and print or sign the Illinois Child Support Enforcement Transmittal #3 - Request for Assistance - Discovery and Instructions.

Form popularity

FAQ

How do you enforce a support order? The court or Child Support Services enforces child support through a variety of punishments. They can do this by ordering the other party to pay or garnishing their wages where they take it right from their paycheck. The court can also do things like suspend their license. Child Support Enforcement in Illinois | Sterling Hughes, LLC sterlinglawyers.com ? illinois ? enforce-orders sterlinglawyers.com ? illinois ? enforce-orders

To report this information, visit the DCSS website at .childsupport.illinois.gov, or call the Child Support Customer Service Call Center at 1-800-447-4278. Persons using a teletypewriter (TTY) may call 1-800-526-5812. ?Child Support Services Program | HFS illinois.gov ? formsbrochures ? hfs1759 illinois.gov ? formsbrochures ? hfs1759

How will child support payments be collected? Illinois law requires that child support payments be withheld from the wages of the parent/obligor that is ordered to pay child support. After the child support order has been established, an Income Withholding for Support will be served on the NCP/obligor's employer.

The new child support laws in Illinois in 2022 require that the parents purchase or maintain health insurance for the child or children when dealing with a child support matter. This mandate is in effect whenever the parents deal with child support, such as a part of a divorce or a child custody case. Illinois Child Support Laws (2023) - Calculator & FAQs vantagegl.com ? articles ? family-law ? illinois-chi... vantagegl.com ? articles ? family-law ? illinois-chi...

Assuming 9% interest, child support arrears are calculated based on the amount of unpaid child support plus the accumulated interest. If a parent in Illinois fails to pay $1,000 in child support for one year, the parent's child support arrearage balance is $1,090 ($1,000 + 9% interest).

Criminal Prosecution ? If a non-custodial parent refuses to pay court-ordered child support for more than a six-month period or owes more than $5,000, the federal government can prosecute. What Happens If Child Support Is Not Paid in Illinois - Wolfe & Stec wolfeandstec.com ? unpaid-child-support-o... wolfeandstec.com ? unpaid-child-support-o...

Once a non-custodial parent does not pay child support over a six-month time period, or if the non-custodial parent owes the custodial parent more than $5,000, DCSS may initiate a request for state or prosecution of the non-custodial parent for failure to pay.

Illinois does not have a statute of limitations on collecting child support arrears. So, your ex-partner can be held accountable for what they owe you and your child. This is true even if the child is over 18.