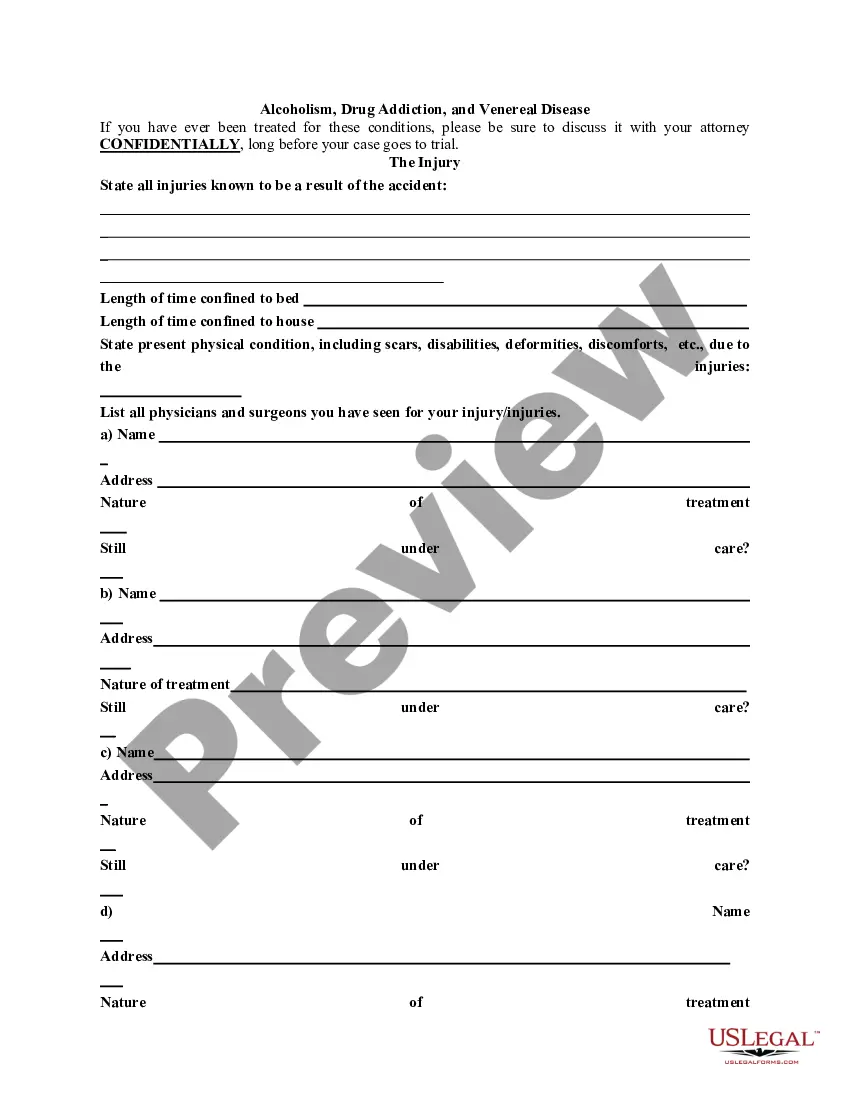

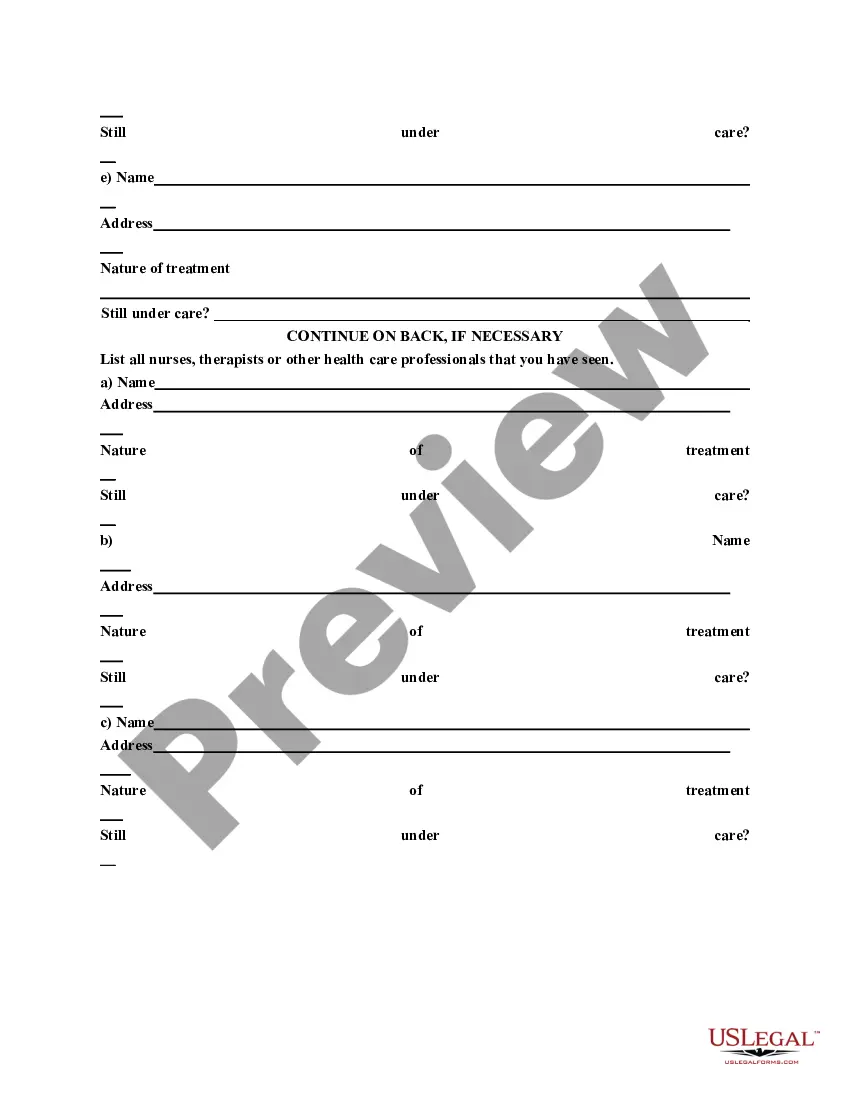

The first part of this questionnaire is designed to be useful in most civil and criminal representations. The last part can be used when screening prospective personal injury litigation clients. The questionnaire can be completed by the attorney during a first meeting with prospective clients or mailed to the client in advance and reviewed at a first meeting.

Ohio General Information Questionnaire

Description

How to fill out General Information Questionnaire?

Selecting the appropriate legitimate document template can be a challenge. Certainly, there are numerous templates available online, but how do you find the legitimate form you require? Utilize the US Legal Forms website. This service offers thousands of templates, including the Ohio General Information Questionnaire, that can be utilized for business and personal purposes. All documents are reviewed by professionals and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Download button to obtain the Ohio General Information Questionnaire. Use your account to browse the legal forms you have previously acquired. Navigate to the My documents section of your account and download another copy of the document you need.

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure that you have selected the correct form for your locality/region. You can preview the form by clicking the Review button and reading the form description to confirm it is the right one for you. If the form does not meet your requirements, utilize the Search field to find the appropriate form. Once you are confident the form is accurate, click the Get now button to acquire the form. Choose the payment plan you prefer and input the necessary information. Create your account and finalize the transaction using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, edit, print, and sign the obtained Ohio General Information Questionnaire.

This service simplifies the process of obtaining legal documents, making it accessible for everyone.

- US Legal Forms is the largest collection of legal forms where you can find numerous document templates.

- Utilize the service to download professionally crafted documents that adhere to state requirements.

- Thousands of templates are available for various business and personal needs.

- The documents are verified by experts to ensure compliance with legal standards.

- You can easily manage your previously downloaded forms through your account.

- Ensure you select the correct form for your area to avoid any issues.

Form popularity

FAQ

Who Should file the IT 1140? A qualifying PTE is required to file an IT 1140 when it is subject to withholding or entity tax on distributive shares of income issued to qualifying investors.

The tax rate will change. The Ohio Department of Taxation reports: for taxable years beginning in 2022, the IT 4738 tax rate is 5%; For taxable years beginning in 2023 and later, the tax rate is equal to the tax rate imposed on taxable business income pursuant to R.C. 5747.02 (A)(4)(a), which is currently 3%.

Ohio Income Tax Tables. For tax year 2022, Ohio's individual income tax brackets have been modified so that individuals with Ohio taxable nonbusiness income of $26,050 or less are not subject to income tax. Additionally, Ohio taxable nonbusiness income in excess of $115,300 is taxed at 3.99%.

Only business income earned by a sole proprietorship or a pass-through entity generally qualifies for the deduction. A pass-through entity includes partnerships, S corporations and LLCs (limited liability companies).

Form IT-1140 is a withholding return and must be completed for all qualified investors. The instructions give a detailed list of who is not a qualified investor, one of which is any partner that is included in the composite return (IT-4708). Resident partners will not get withholding.

The IT 4708 is a composite income tax return a PTE elects to file on behalf of its qualifying investors. It is filed in lieu of the IT 1140 (the PTE withholding return). Unlike the IT 1140, a PTE can use the IT 4708 to claim credits or payments made on its behalf by other PTEs.

Who Should file the IT 1140? A qualifying PTE is required to file an IT 1140 when it is subject to withholding or entity tax on distributive shares of income issued to qualifying investors.

All pass-through entities must use payment coupon Ohio form IT 4708ES. If income taxes are underpaid, the pass-through entity must add an interest penalty to the taxes for the taxable year at the rate per an- num prescribed by Ohio Revised Code section 5703.47.