A disclaimer is a denial or renunciation of something. A disclaimer may be the act of a party by which be refuses to accept an estate which has been conveyed to him. In this instrument, the beneficiary of a trust is disclaiming any rights he has in the trust.

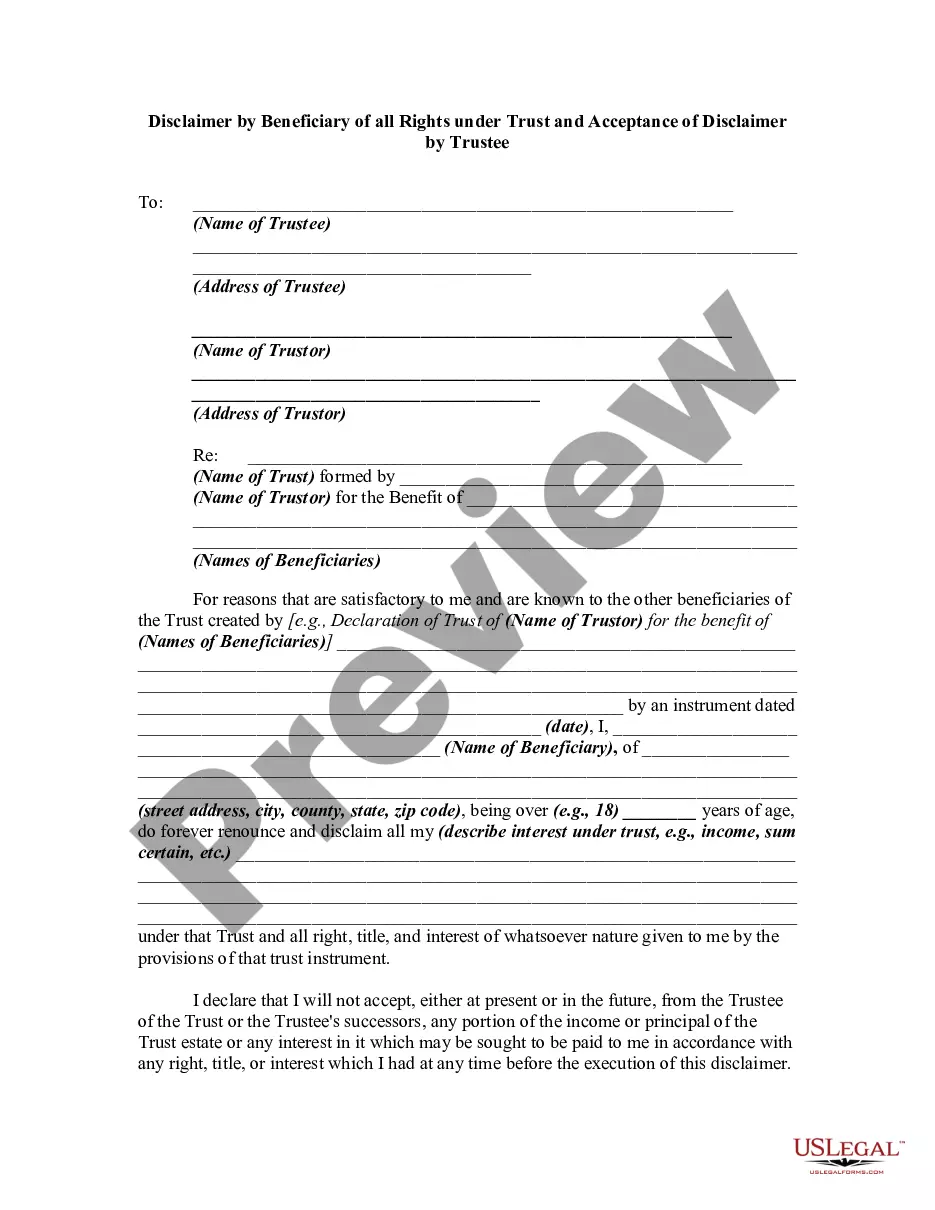

Ohio Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee

Description

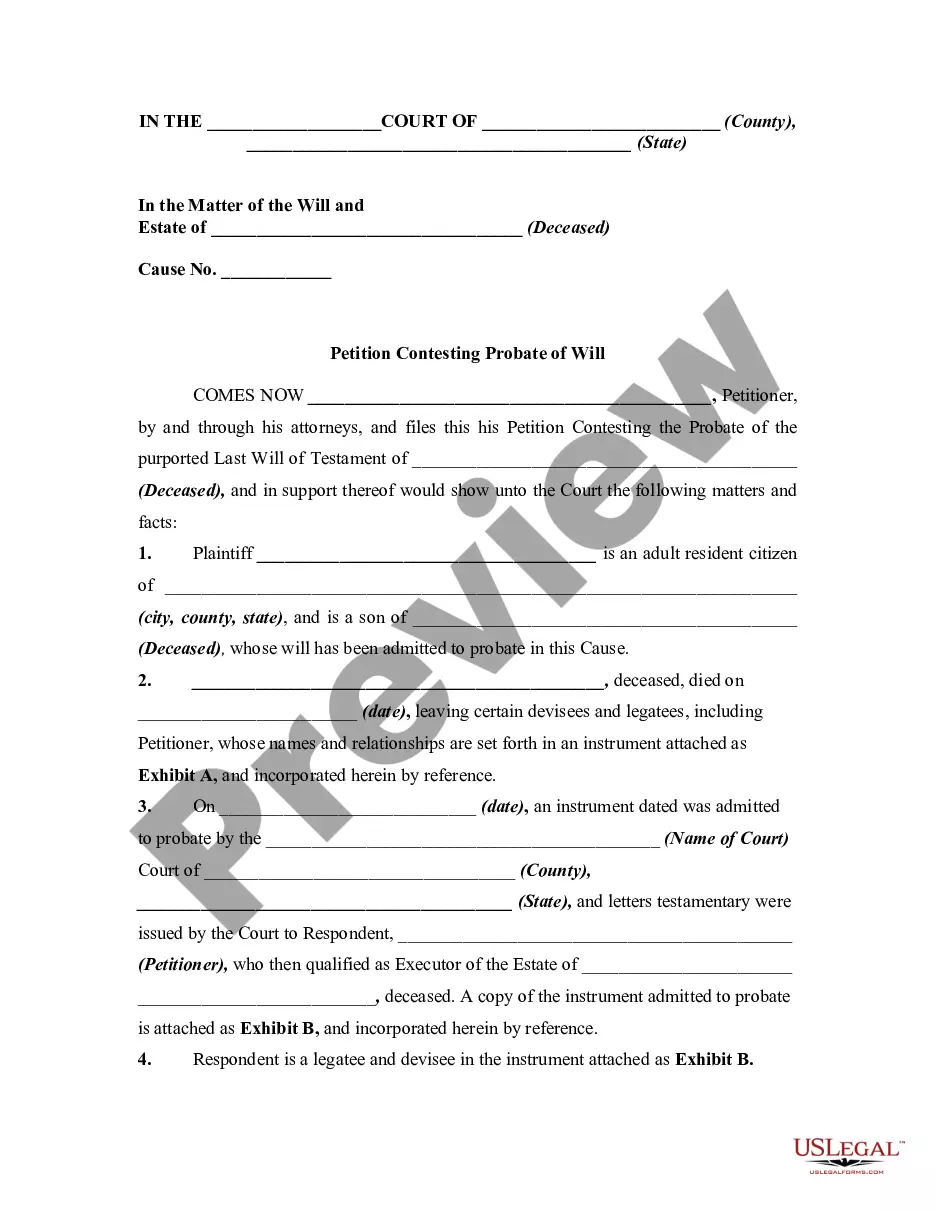

How to fill out Disclaimer By Beneficiary Of All Rights Under Trust And Acceptance Of Disclaimer By Trustee?

Are you currently in a scenario where you require documentation for both business or personal reasons nearly every day.

There are numerous legitimate document templates accessible online, yet finding versions you can trust is not easy.

US Legal Forms offers thousands of form templates, such as the Ohio Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee, which are designed to meet federal and state regulations.

Choose a convenient document format and download your copy.

Find all the document templates you have purchased in the My documents section. You can download another copy of Ohio Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee anytime, if needed. Just click the required form to download or print the template.

Use US Legal Forms, the most extensive collection of legitimate forms, to save time and avoid mistakes. The service provides professionally crafted legal document templates that you can use for various purposes. Create your account on US Legal Forms and start making your life a little easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Ohio Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

- Use the Preview button to review the form.

- Check the details to confirm that you have selected the right form.

- If the form is not what you are looking for, utilize the Search field to locate the form that suits your needs and requirements.

- Once you find the right form, click Purchase now.

- Select the pricing plan you want, provide the necessary information to create your account, and make the payment using your PayPal or Visa or Mastercard.

Form popularity

FAQ

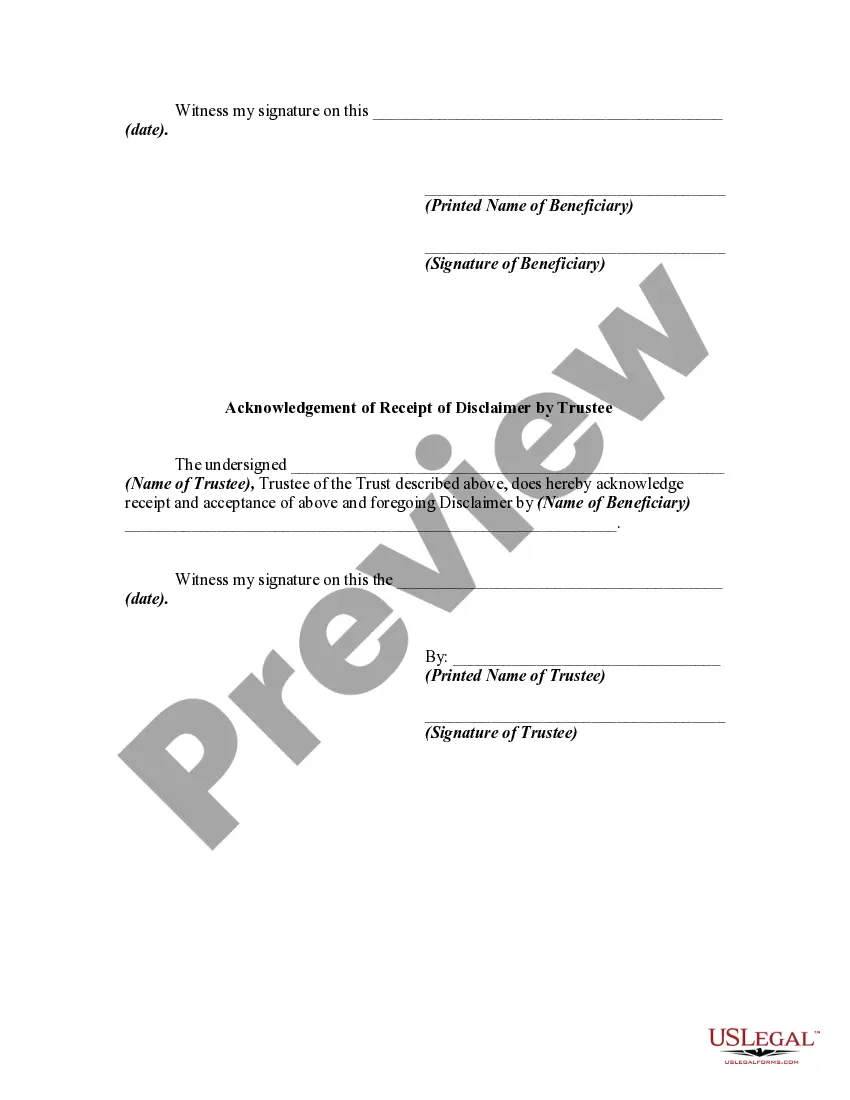

A trustee has a responsibility to communicate with beneficiaries, ensuring transparency regarding the trust. In the context of an Ohio Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee, this communication is crucial. Beneficiaries should be informed about their rights, changes in the trust, and any actions taken by the trustee. If you are navigating the complexities of trust administration, consider using USLegalForms to access resources tailored to your needs.

To decline an inheritance politely, communicate your decision directly to the executor or trustee in a respectful manner. You can express gratitude for the inheritance while explaining your reasons for declining. It's important to submit a written disclaimer to ensure that your wishes are documented, adhering to the Ohio Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee requirements. Effective communication helps maintain family relationships during this sensitive process.

If a trustee breaches their fiduciary duties, the beneficiary has several rights. They can demand an accounting of trust assets, seek removal of the trustee, or even sue for damages caused by the breach. Understanding your rights under the Ohio Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee is crucial, as it provides avenues for beneficiaries to protect their interests effectively.

A disclaimer by a beneficiary of a trust allows the beneficiary to refuse their interest in the trust assets. This process, governed by the Ohio Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee guidelines, ensures that assets can pass to the next beneficiary without tax implications. It’s essential to understand that this action is irrevocable, meaning once you submit the disclaimer, you cannot change your mind.

To renounce an inheritance in Ohio, you need to complete an official disclaimer form. This form must include your name, the decedent’s information, and a clear statement of the disclaimer. You can find these forms on various legal websites, such as UsLegalForms, which provide easy access to necessary documentation. Once completed, submit the form to the probate court for processing.

In Ohio, the disclaimer of inheritance must be made in writing and filed with the probate court. The beneficiary must not have accepted any benefits from the estate to ensure validity. Additionally, the Ohio Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee process requires that disclaimers be made within nine months of the decedent's death. This gives you time to consider your options and make informed decisions.

The disclaimer clause in a trust is a provision that permits beneficiaries to decline their inheritance, which can be particularly beneficial in complicated estates. It helps ensure the smooth transfer of assets to other beneficiaries and can minimize tax implications. Understanding this clause is essential when navigating the Ohio Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee, as it lays out the legal framework for disclaiming assets.

An example of a disclaimer of inheritance rights is when an heir, such as a child, opts not to accept their portion of a parent's estate due to personal financial reasons or to protect the family's interests. This decision can redirect assets to a sibling or another family member, ultimately benefiting the overall estate plan. The Ohio Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee serves as a guiding principle for making these decisions legally sound.

A beneficiary disclaimer is a legal document that allows individuals to refuse their share of an inheritance or benefits from a trust. By doing so, the assets will transfer to other specified beneficiaries according to the terms of the trust. This mechanism is crucial in an Ohio Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee and can facilitate better estate planning and resource allocation among heirs.

To write a beneficiary disclaimer letter, clearly state your intent to decline your inheritance in a formal format. Include essential information such as your name, the name of the trust, and your specific wishes regarding the disclaimer. Reference the Ohio Disclaimer by Beneficiary of all Rights under Trust and Acceptance of Disclaimer by Trustee to ensure your letter aligns with legal requirements, providing a sound foundation for the process.