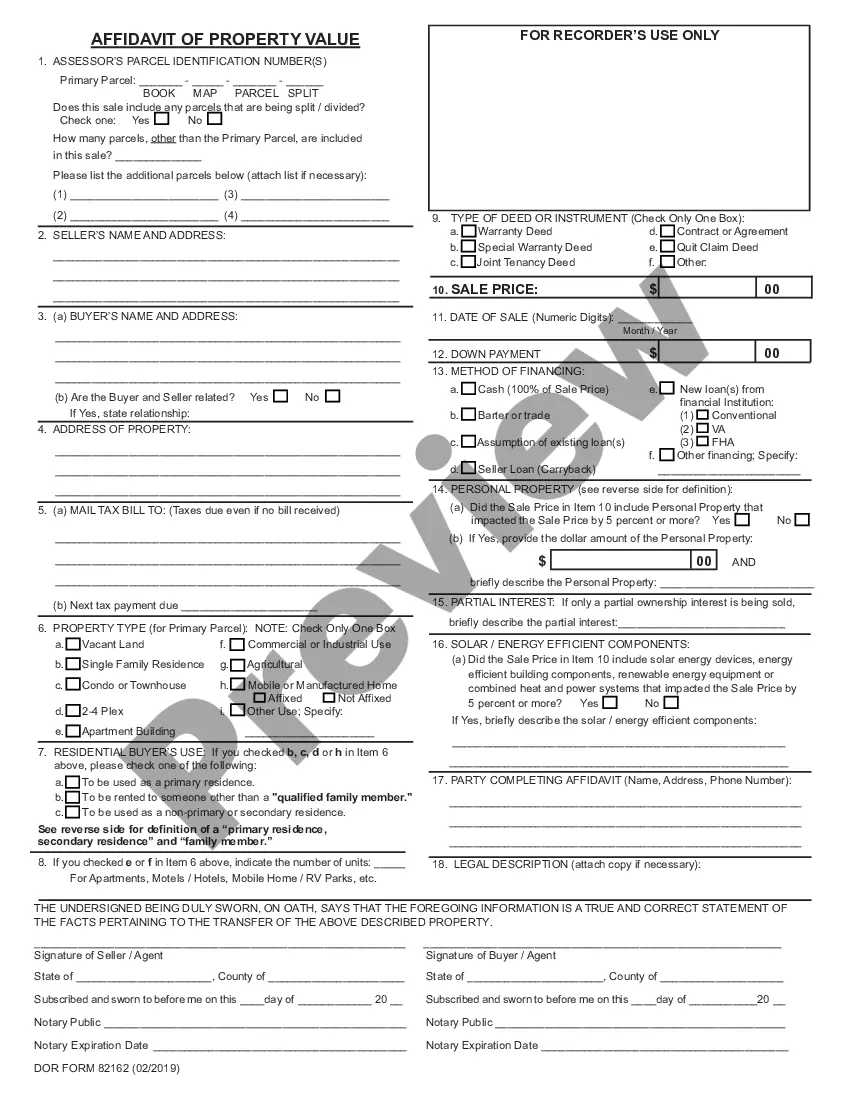

This form is a sample of a release given by the trustee of a trust agreement transferring all property held by the trustee pursuant to the trust agreement to the beneficiary and releasing all claims to the said property. This form assumes that the trust has ended and that the beneficiary has requested release of the property to him/her. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Ohio Release by Trustee to Beneficiary and Receipt from Beneficiary

Description

How to fill out Release By Trustee To Beneficiary And Receipt From Beneficiary?

Are you currently in a situation where you require paperwork for either business or specific needs virtually every day.

There are numerous legitimate document templates accessible online, but finding forms you can trust isn't easy.

US Legal Forms offers thousands of form templates, such as the Ohio Release by Trustee to Beneficiary and Receipt from Beneficiary, that are designed to meet federal and state regulations.

Once you locate the appropriate form, click Buy now.

Select the pricing plan you prefer, fill in the required information to create your account, and complete your purchase using PayPal or a credit card. Choose a convenient file format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Afterward, you can download the Ohio Release by Trustee to Beneficiary and Receipt from Beneficiary template.

- If you do not have an account and wish to begin using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct locality/region.

- Use the Preview option to review the form.

- Read the description to confirm that you have selected the right form.

- If the form isn't what you're looking for, utilize the Lookup area to find the form that satisfies your needs and requirements.

Form popularity

FAQ

A release from beneficiaries is a formal document indicating that a beneficiary agrees to accept a distribution from a trust, acknowledging the transfer of assets. In this context, an Ohio Release by Trustee to Beneficiary and Receipt from Beneficiary serves as a crucial component, protecting the trustee from future claims. This release not only finalizes the distribution process but also ensures that beneficiaries understand their rights and responsibilities concerning the assets they receive.

Transferring assets from a trust to a beneficiary involves several steps, including the preparation of necessary documents, such as an Ohio Release by Trustee to Beneficiary and Receipt from Beneficiary. It is essential to ensure that the trustee has the authority to distribute assets according to the trust terms. By following legal protocols and using the right forms, the transfer process can be seamless, and beneficiaries can receive their intended assets without hassle.

Distributions from a trust can be taxable to beneficiaries, often depending on the type of trust and the nature of the distributions. When a trustee issues an Ohio Release by Trustee to Beneficiary and Receipt from Beneficiary, it is crucial to understand that some distributions may be classified as income, while others may represent a return of principal. To simplify this process, consulting with a tax advisor can help clarify any tax obligations related to trust distributions.

In Ohio, beneficiaries generally have the right to request a copy of the trust document. This transparency is part of the legal framework designed to protect beneficiaries and ensure proper administration of trusts. When managing trusts, beneficiaries should consider the Ohio Release by Trustee to Beneficiary and Receipt from Beneficiary, as these documents play a critical role in verifying trust distributions. For reliable assistance, platforms like USLegalForms can help guide you through the necessary documentation.

While trustees hold a fiduciary duty to act in the best interests of the beneficiaries, they also have specific responsibilities to fulfill. This means that trustees must consider beneficiary input, especially in processes like the Ohio Release by Trustee to Beneficiary and Receipt from Beneficiary. However, trustees maintain the authority to make final decisions based on the trust's terms. Effective communication between can lead to better trust management.

A beneficiary release form is a legal document that provides formal consent from a beneficiary to a trustee. This form is essential in the context of an Ohio Release by Trustee to Beneficiary and Receipt from Beneficiary. It ensures that beneficiaries acknowledge receipt of their share and release the trustee from further obligations. Using this form makes the process smoother and protects both parties involved.

A letter of release to beneficiaries serves as official documentation that a trustee has fulfilled their obligations. This letter confirms that the beneficiary has received their distribution from the trust, aligned with the Ohio Release by Trustee to Beneficiary and Receipt from Beneficiary. The letter helps prevent future claims by documenting the transfer of assets and can be essential during estate settlement processes. Utilizing a platform like uslegalforms simplifies this process, providing templates and guidance specific to Ohio.

Writing a trust distribution letter involves clear communication regarding the distribution of assets. Start by including the date and your contact information as the trustee. Clearly state the purpose of the letter, referencing the Ohio Release by Trustee to Beneficiary and Receipt from Beneficiary. Finally, ensure to list the specific assets or funds being distributed and provide instructions on how the beneficiary can acknowledge the receipt.

Getting releases signed by the beneficiaries is vital for preventing future disputes over trust distributions. These signed documents protect the trustee by confirming that the beneficiaries have received their intended shares and acknowledge satisfaction with those distributions. Without these releases, a trustee may face unexpected claims, making the Ohio Release by Trustee to Beneficiary and Receipt from Beneficiary an essential tool in trust management.

A receipt of beneficiary of a trust is a formal acknowledgment from a beneficiary that they have received their distribution from the trust. This document is important because it acts as proof for the trustee that the beneficiary has accepted their share. With an Ohio Release by Trustee to Beneficiary and Receipt from Beneficiary, both parties can ensure their interests are protected and documented.