In the absence of a provision in a trust instrument giving the trustee power to terminate the trust, a trustee generally has no control over the continuance of the trust. In this form, the trustee had been given the authority to terminate the trust. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Ohio Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary

Description

How to fill out Termination Of Trust By Trustee And Acknowledgment Of Receipt Of Trust Funds By Beneficiary?

If you wish to be thorough, download, or print official document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Make use of the site's straightforward and user-friendly search function to find the documents you need.

Various templates for business and personal purposes are categorized by types and jurisdictions, or keywords.

Step 4. Once you’ve located the form you need, click the Buy now button. Select the payment plan you prefer and enter your details to create an account.

Step 5. Complete the payment. You can use your credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to obtain the Ohio Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click on the Acquire button to obtain the Ohio Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure that you have chosen the form for the correct jurisdiction.

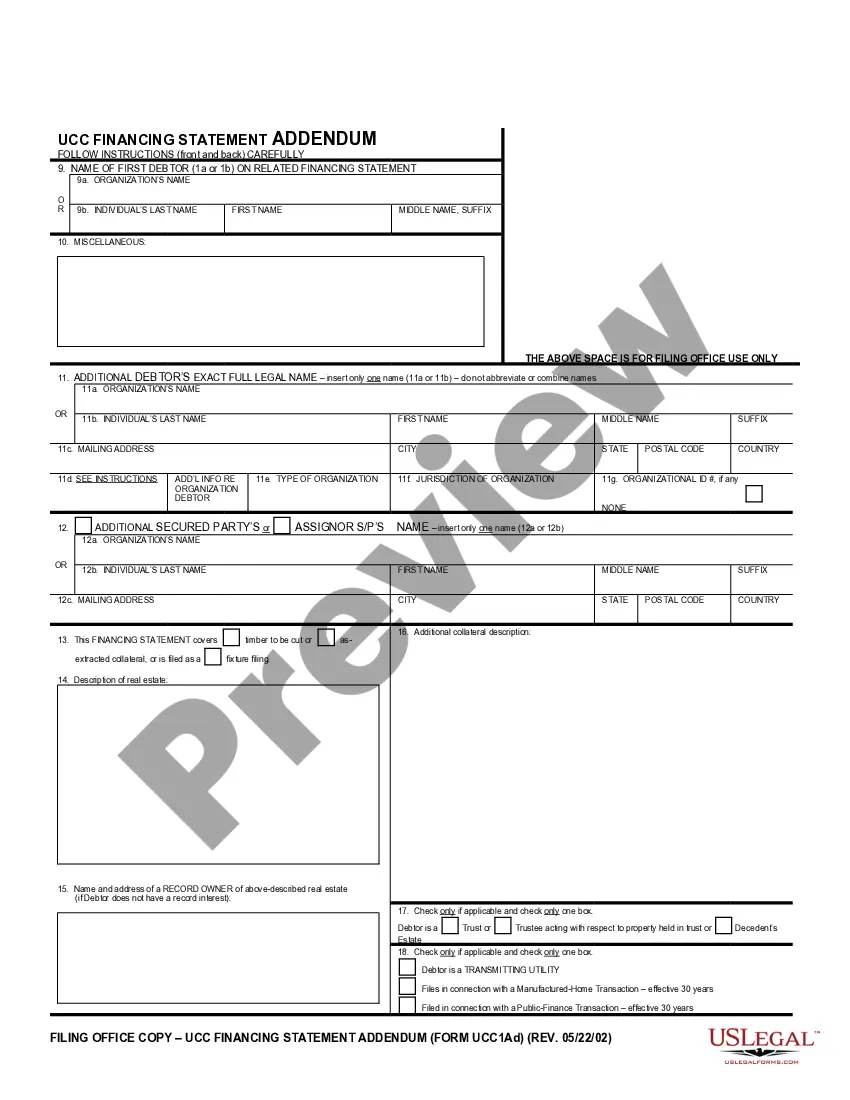

- Step 2. Use the Preview option to review the form's content. Don’t forget to read the details.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form layout.

Form popularity

FAQ

A beneficiary may initiate the termination of a trust by expressing their wishes and seeking the trustee's consent, provided that it aligns with the trust's guidelines. If unanimous consent is obtained from all beneficiaries, they can move forward with the termination. Legal approval may be necessary, especially for irrevocable trusts, and obtaining written acknowledgments of receipt of trust funds is essential throughout the process. Understanding Ohio Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary is crucial for achieving this objective.

To deactivate a trust, the trustee must undertake a careful review of the trust's terms and fulfill all obligations. This process includes satisfying any debts, resolving disputes, and distributing assets to beneficiaries. Importantly, documenting the acknowledgment of receipt of trust funds is vital for both the trustee and the beneficiaries. The steps toward Ohio Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary must be accurately followed to ensure a smooth transition.

Shutting down a trust involves the trustee settling all debts and liabilities before distributing any remaining assets to the beneficiaries. The trustee must ensure compliance with state laws and the terms of the trust itself. Additionally, it’s essential to provide beneficiaries with a formal acknowledgment of receipt of trust funds. Understanding the concept of Ohio Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary can help streamline this process.

Terminating an irrevocable trust in Ohio typically requires court approval or the consent of all beneficiaries involved. In many cases, the process includes filing a petition in court to request the termination. The court must agree that termination serves the best interests of the beneficiaries. Utilizing resources like uslegalforms can simplify the legal documentation needed for Ohio Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary.

To bring a trust to an end, the trustee must follow the legal procedures established in the trust document. Generally, this involves settling the trust’s obligations, distributing the assets to the beneficiaries, and obtaining any necessary releases or waivers. It is also crucial for the trustee to provide a formal acknowledgment of receipt of trust funds by each beneficiary. This process relates closely to Ohio Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary.

To terminate a revocable trust in Ohio, the grantor typically needs to execute a formal declaration of termination. This involves following the specified guidelines in the trust document, often requiring notifications to beneficiaries. Upon completion, the grantor must distribute the trust assets accordingly, which is a key part of the Ohio Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary procedure. For assistance, UsLegalForms provides a range of tools to help streamline the entire termination process.

Upon the termination of a trust, the trustee must settle all obligations and distribute assets to the beneficiaries as dictated by the trust document. This process, known as the Ohio Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary, requires careful management to ensure compliance with both legal and fiduciary responsibilities. Once all assets are distributed, the trust officially ceases to exist. Accessing resources from UsLegalForms can facilitate this distribution process and ensure proper documentation.

When a trustee wishes to step down, they must formally resign by providing written notice, typically to the beneficiaries and any co-trustees. This process may also involve the Ohio Termination of Trust By Trustee, particularly if the trust is being dissolved. The trustee should ensure that a successor trustee is appointed to manage the trust assets. Using UsLegalForms can help you navigate this transition smoothly with the right legal forms.

To initiate the Ohio Termination of Trust By Trustee, the trustee must follow the guidelines set forth in the trust document. This typically involves notifying all beneficiaries and obtaining their consent, unless the trust specifies otherwise. After consent is secured, the trustee can proceed with the official termination process, ensuring all distributions are made according to the trust's terms. Utilizing a service like UsLegalForms can simplify this process by providing the necessary templates and guidance.

While a trustee holds significant power, they are required to act in the best interest of the beneficiaries. Cheating beneficiaries is a breach of fiduciary duty and can lead to legal action. If you suspect mishandling of funds or decisions, it is essential to understand the implications of Ohio Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary. Consulting with legal professionals can help you address any concerns effectively.