Ohio Order Refunding Bond

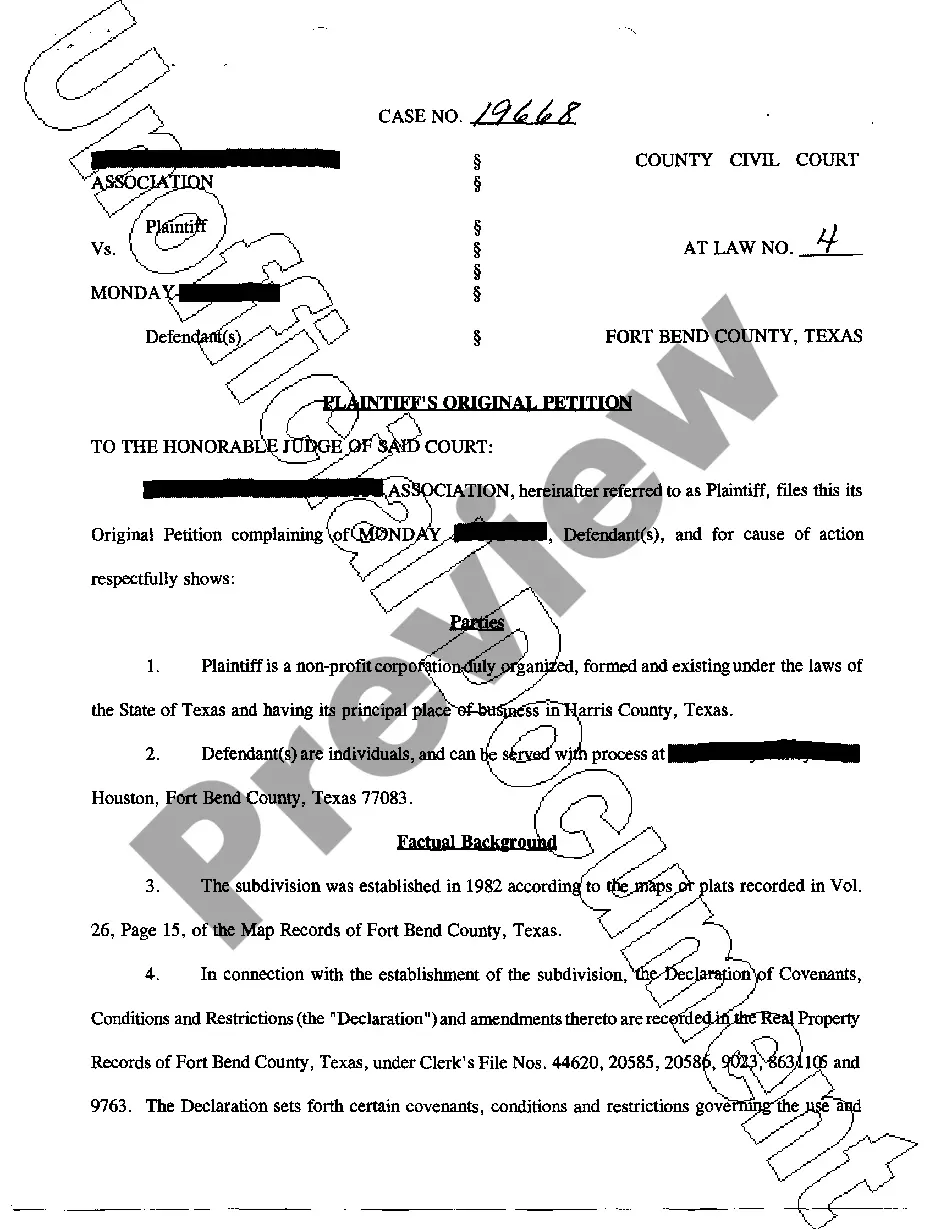

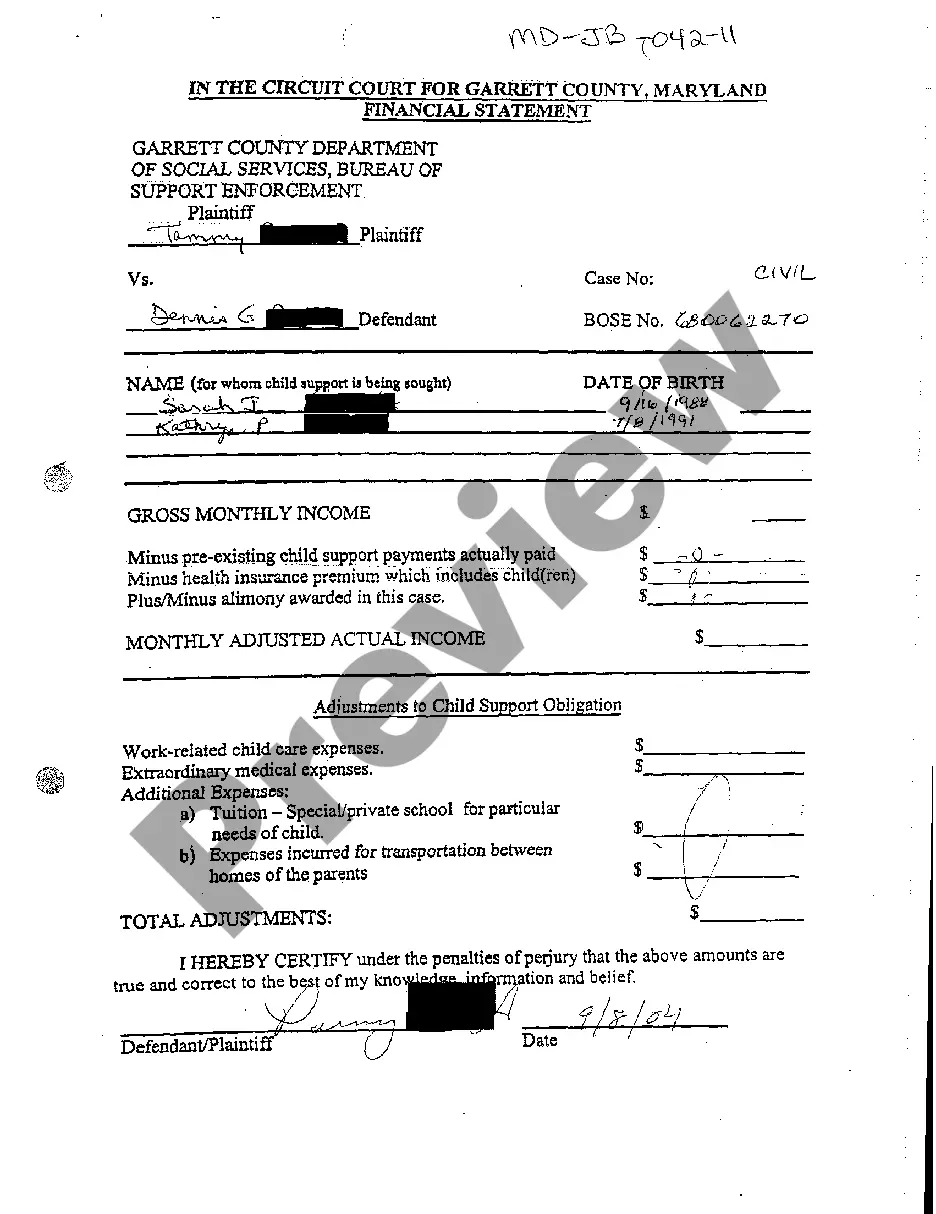

Description

How to fill out Order Refunding Bond?

Are you presently in a scenario where you require documents for either business or personal reasons almost every day.

There are numerous legal document templates accessible online, but locating ones you can trust isn’t straightforward.

US Legal Forms provides thousands of form templates, such as the Ohio Order Refunding Bond, which are designed to comply with federal and state regulations.

If you find the correct form, click Acquire now.

Choose the pricing plan you prefer, complete the necessary information to create your account, and pay for your order using your PayPal or credit card. Select a convenient file format and download your copy. Locate all of the document templates you have purchased in the My documents section. You can obtain an additional copy of the Ohio Order Refunding Bond whenever necessary. Just follow the required form to download or print the document template. Use US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors. The service offers properly crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Ohio Order Refunding Bond template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for your correct city/region.

- Utilize the Review option to examine the form.

- Check the outline to ensure that you have selected the right type.

- If the form isn’t what you are looking for, use the Search field to find the form that suits your needs and requirements.

Form popularity

FAQ

Four years from the date of overpayment (not based on due date of return). The amendment of a return, resulting in an overpayment, does not preserve statute. A refund claim must be filed.

If a seller does not have a refund policy posted, the consumer is entitled to a refund, if the consumer requests it. Ohio law does not prohibit restocking fees, or fees for returning an item to the shelves.

Penalties and Interest The failure to file penalty is the greater of $50 per month, but not exceeding $500, or 5% per month, but not exceeding 50% of the total tax that is due. This penalty will be assessed for each month, or fraction of a month, that the tax return is late.

A completed Application for Sales/Use Tax Refund (Ohio form ST AR). The original and one copy of the ST AR must be provided. Only one set of back-up documents is needed.

The vendor or seller must refund to the customer or credit the customer's account with the full purchase price of the tangible personal property returned or the service rejected plus the full amount of sales or use tax applicable thereto.