Ohio Complaint Against Drawer of Check that was Dishonored Due to Insufficient Funds (Bad Check)

Description

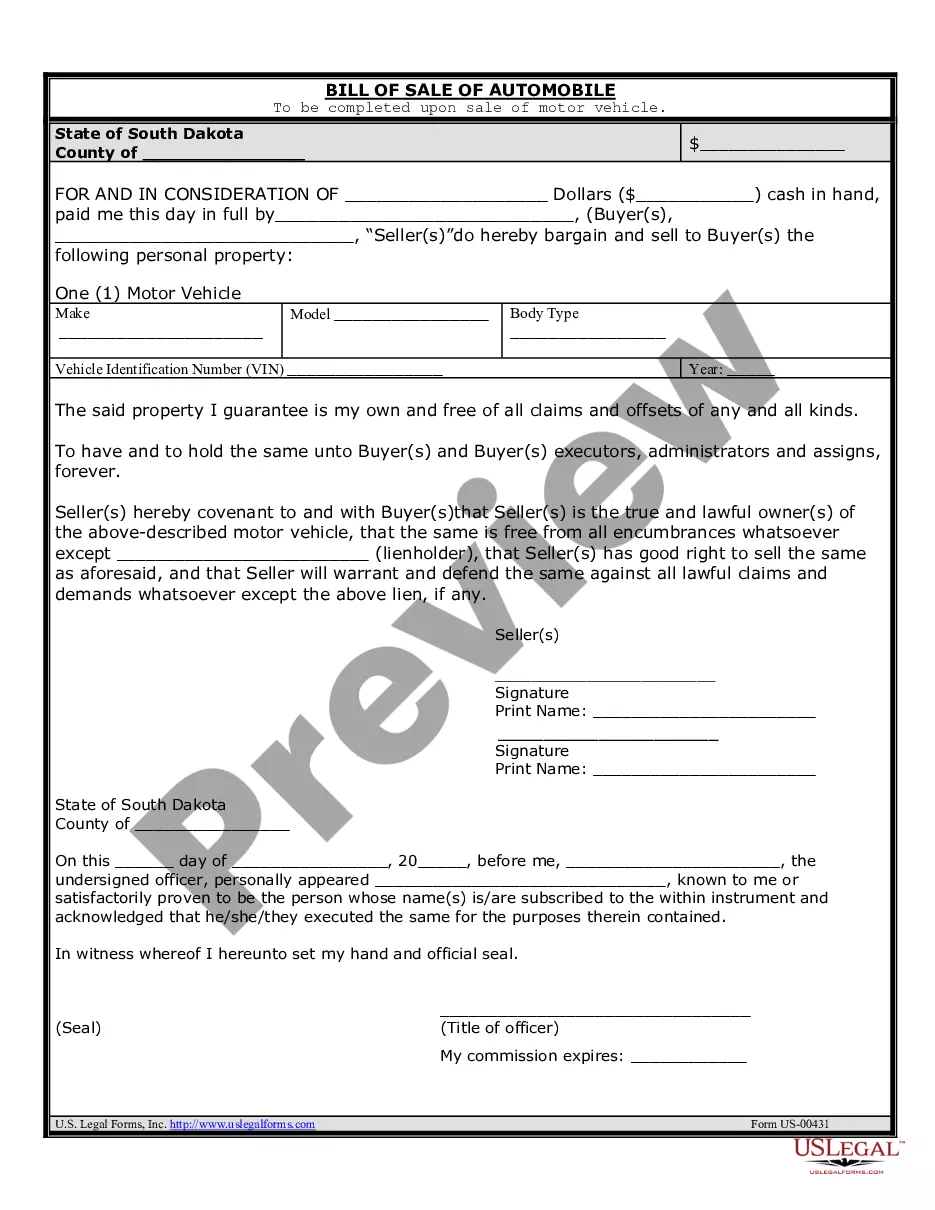

How to fill out Complaint Against Drawer Of Check That Was Dishonored Due To Insufficient Funds (Bad Check)?

It is possible to devote several hours on the Internet trying to find the lawful record template that suits the federal and state requirements you require. US Legal Forms gives thousands of lawful types that happen to be analyzed by pros. You can actually acquire or printing the Ohio Complaint Against Drawer of Check that was Dishonored Due to Insufficient Funds (Bad Check) from the support.

If you have a US Legal Forms account, it is possible to log in and click on the Obtain switch. After that, it is possible to complete, modify, printing, or signal the Ohio Complaint Against Drawer of Check that was Dishonored Due to Insufficient Funds (Bad Check). Every lawful record template you acquire is yours permanently. To get yet another backup associated with a acquired form, visit the My Forms tab and click on the related switch.

If you use the US Legal Forms site initially, adhere to the straightforward instructions listed below:

- Very first, be sure that you have selected the correct record template for that region/metropolis that you pick. Look at the form description to make sure you have picked the correct form. If offered, utilize the Review switch to check through the record template as well.

- If you would like get yet another model in the form, utilize the Lookup industry to discover the template that meets your requirements and requirements.

- Upon having discovered the template you want, simply click Get now to continue.

- Pick the prices program you want, type in your references, and sign up for your account on US Legal Forms.

- Total the deal. You can use your Visa or Mastercard or PayPal account to fund the lawful form.

- Pick the format in the record and acquire it in your gadget.

- Make adjustments in your record if required. It is possible to complete, modify and signal and printing Ohio Complaint Against Drawer of Check that was Dishonored Due to Insufficient Funds (Bad Check).

Obtain and printing thousands of record web templates while using US Legal Forms web site, which provides the largest assortment of lawful types. Use skilled and status-particular web templates to deal with your organization or individual requirements.

Form popularity

FAQ

Knowingly writing a bad check is an act of fraud and it's punishable by law. Criminal penalties for people who tender checks knowing that there are insufficient funds in their accounts can vary by state. Some states require an intent to commit fraud.

Writing a bad check is a crime if the check writer knew that there were insufficient funds to cover the check and intended to defraud you. It is also a crime to forge a check or write a check.

If the check or checks or other negotiable instrument or instruments are for the payment of seven thousand five hundred dollars or more but less than one hundred fifty thousand dollars, passing bad checks is a felony of the fourth degree.

Writing a check against an account with insufficient funds will always result in a bounced check and incur a fee. In fact, people who knowingly write a check against an account with insufficient funds may be committing a crime.

A bad check is a check the bank will not honor. There are three kinds of bad checks. Non-Sufficient Funds (NSF) checks: A check is NSF if there is not enough money in the account to pay it or the account is closed. Stop Payment checks: The person who wrote the check told the bank to stop payment.

The statute of limitations is one (1) year for checks under $500. These checks are considered misdemeanors. However, checks over $500 are felonies and do not have a statute of limitations.

Under California Penal Code Section 476a, the crime of writing a bad check while aware of insufficient funds with intent to defraud is punishable as a misdemeanor if the total amount of the checks written does not exceed $950.

A county treasurer may assess a fee not exceeding an amount equal to five dollars plus any amount passed on from a financial institution on a drawer or indorser for each check, draft, or money order returned or dishonored, or automatic bank transfer declined, due to insufficient funds or for any other reason.