Ohio Ground Lease for Land on which Cabin is Built as a Non-Permanent Structure - Real Estate Rental

Description

How to fill out Ground Lease For Land On Which Cabin Is Built As A Non-Permanent Structure - Real Estate Rental?

Are you presently in a position where you require documents for either organizational or individual purposes nearly every day.

There are numerous legal document templates available online, but finding ones that you can rely on isn't easy.

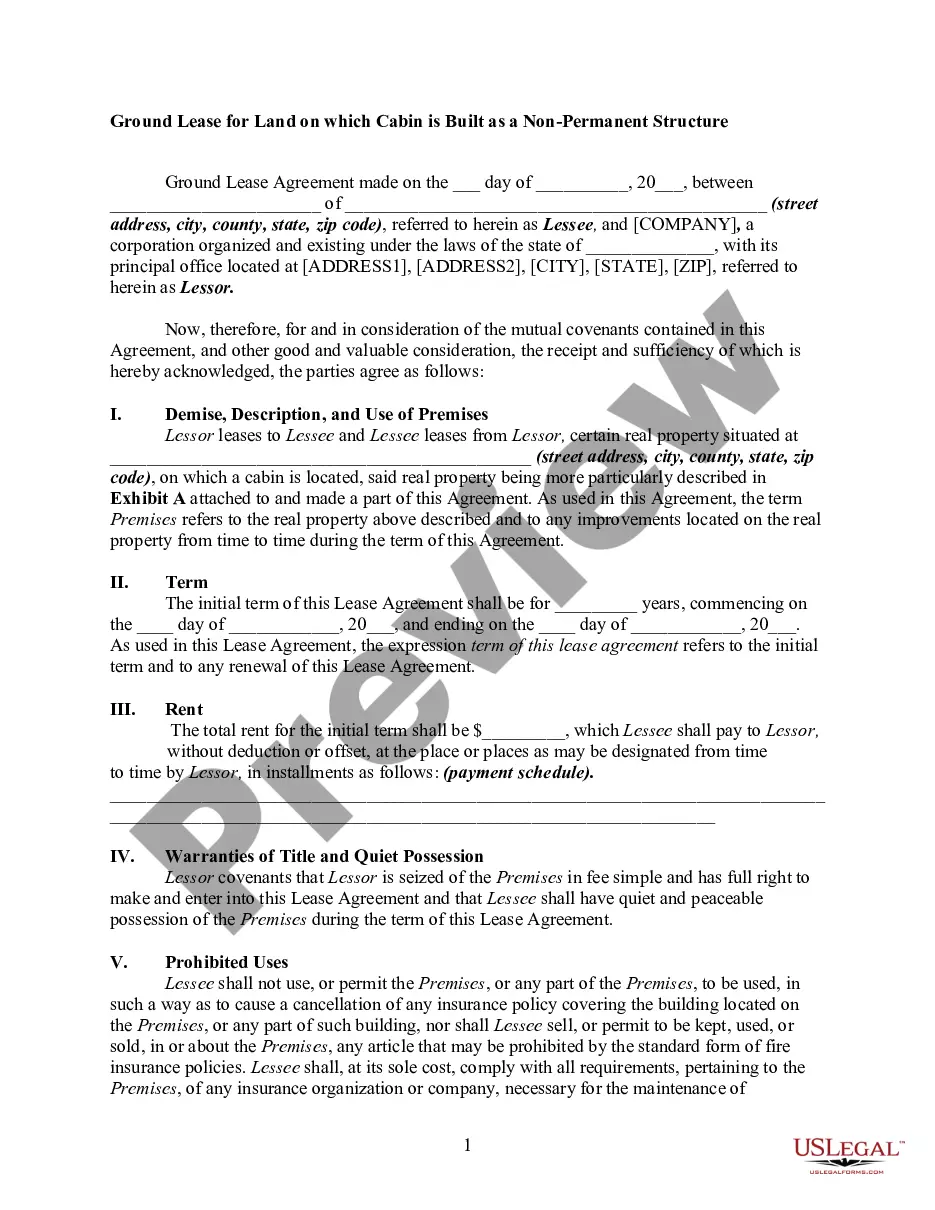

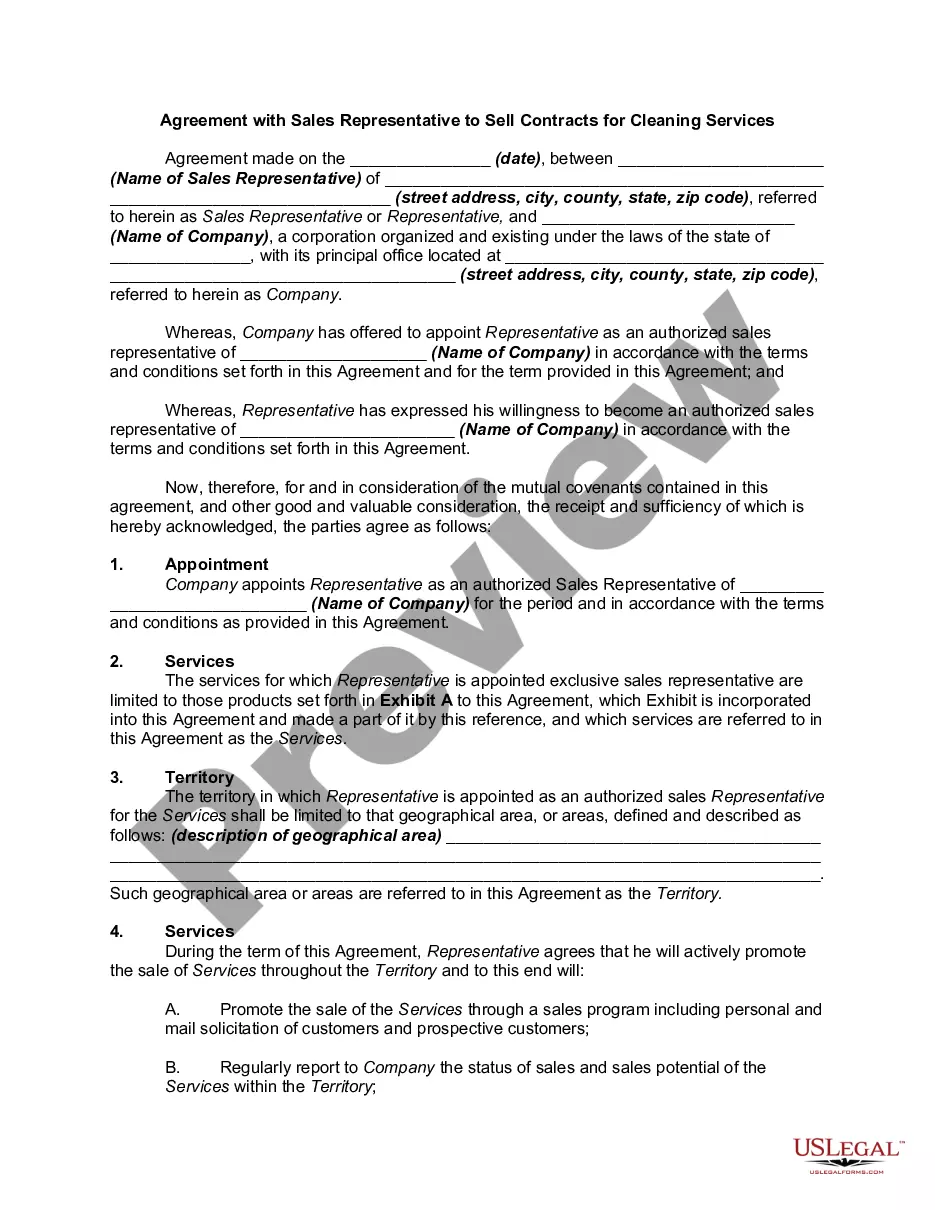

US Legal Forms provides thousands of document templates, including the Ohio Ground Lease for Land on which a Cabin is Constructed as a Non-Permanent Structure - Real Estate Rental, which are designed to comply with state and federal requirements.

Once you find the correct document, click Purchase now.

Select the pricing plan you prefer, fill in the necessary information to create your account, and pay for your order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Ohio Ground Lease for Land on which a Cabin is Constructed as a Non-Permanent Structure - Real Estate Rental template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the document you need and ensure it is for the correct city/state.

- Use the Review button to evaluate the form.

- Read the description to ensure you have selected the right document.

- If the document isn’t what you are looking for, use the Search field to find the form that suits your needs.

Form popularity

FAQ

surface lease refers to an agreement where the rights to the land’s resources, such as minerals or natural gas, are leased independently from the land itself. This type of lease allows for resource extraction without altering the surface of the land. In the context of the Ohio Ground Lease for Land on which Cabin is Built as a NonPermanent Structure Real Estate Rental, it offers an option for landowners to retain rights to subsurface resources while allowing for the development of cabins and similar structures above ground. This arrangement serves both landowners and renters effectively, creating numerous possibilities.

The most common type of lease for residential property in Ohio is the standard residential lease agreement. This agreement typically allows tenants to occupy the property for a defined period, such as one year. While a standard lease is prevalent, the Ohio Ground Lease for Land on which Cabin is Built as a Non-Permanent Structure - Real Estate Rental provides flexibility for landowners and renters. It allows individuals to build on leased land without the long-term commitment of owning the property.

A ground lease is a long-term rental agreement for land, typically for commercial or residential development. In the context of an Ohio Ground Lease for Land on which Cabin is Built as a Non-Permanent Structure - Real Estate Rental, this arrangement allows you to lease the land while retaining ownership of the cabin. This structure can be beneficial for both property owners and developers, as it provides stability and reduces the upfront costs. To explore more about such transactions, consider using the services offered by uslegalforms, which can guide you in navigating ground lease agreements.

In a net lease, tenants take on additional responsibilities beyond rent, such as property taxes, insurance, and maintenance costs. By using an Ohio Ground Lease for Land on which Cabin is Built as a Non-Permanent Structure - Real Estate Rental, tenants should be prepared for these obligations, as they can add significant costs. This structure allows landlords to mitigate their risk and provide a more predictable income. Understanding these liabilities safeguards both parties.

Yes, you can lease a portion of land, which is particularly valuable in scenarios like an Ohio Ground Lease for Land on which Cabin is Built as a Non-Permanent Structure - Real Estate Rental. This allows tenants to occupy and develop only a part of the property while providing the landowner the ability to retain control over the remainder. This arrangement can optimize land use and provide rental income without losing the entire property.

The three main types of leases include gross leases, net leases, and percentage leases. A gross lease means the landlord covers all property expenses, while in a net lease, the tenant pays for some or all costs beyond rent, like property taxes. A percentage lease lets landlords earn based on the tenant's revenue, commonly used in retail. Understanding these types is vital for anyone considering an Ohio Ground Lease for Land on which Cabin is Built as a Non-Permanent Structure - Real Estate Rental.

When entering an Ohio Ground Lease for Land on which Cabin is Built as a Non-Permanent Structure - Real Estate Rental, both the landlord and tenant share certain liabilities. The tenant generally assumes responsibility for maintenance, property taxes, and insurance. However, the landlord still holds some liability, especially concerning the structural safety of the land. Understanding these responsibilities helps both parties manage risk effectively.

Calculating ground rent for an Ohio Ground Lease for Land on which Cabin is Built as a Non-Permanent Structure - Real Estate Rental involves determining the annual rent based on the property's value, lease terms, and any local regulations. Typically, the formula includes the property's assessed value multiplied by a percentage rate, which often ranges from 4% to 10%. This approach ensures that both parties understand the financial commitment. Additionally, consulting resources like uslegalforms can provide valuable guidance and templates for accurately structuring the lease.