Ohio Sample Letter for New Discount

Description

How to fill out Sample Letter For New Discount?

If you require to finalize, obtain, or print legal document templates, utilize US Legal Forms, the premier collection of legal documents that is accessible online.

Employ the site's straightforward and convenient search to retrieve the paperwork you need.

Countless templates for business and personal purposes are organized by categories and regions, or keywords.

Step 4. Once you have found the form you want, click the Buy now button. Select your preferred payment plan and enter your details to register for an account.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction. Step 6. Choose the format of your legal form and download it to your device. Step 7. Complete, modify, and print or sign the Ohio Sample Letter for New Discount. Each legal document template you obtain is your property permanently. You will have access to every form you have downloaded within your account. Click the My documents section and choose a form to print or download again.

- Utilize US Legal Forms to download the Ohio Sample Letter for New Discount in just a few clicks.

- If you are already a US Legal Forms client, Log In to your account and click the Obtain button to find the Ohio Sample Letter for New Discount.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have chosen the form for the correct city/state.

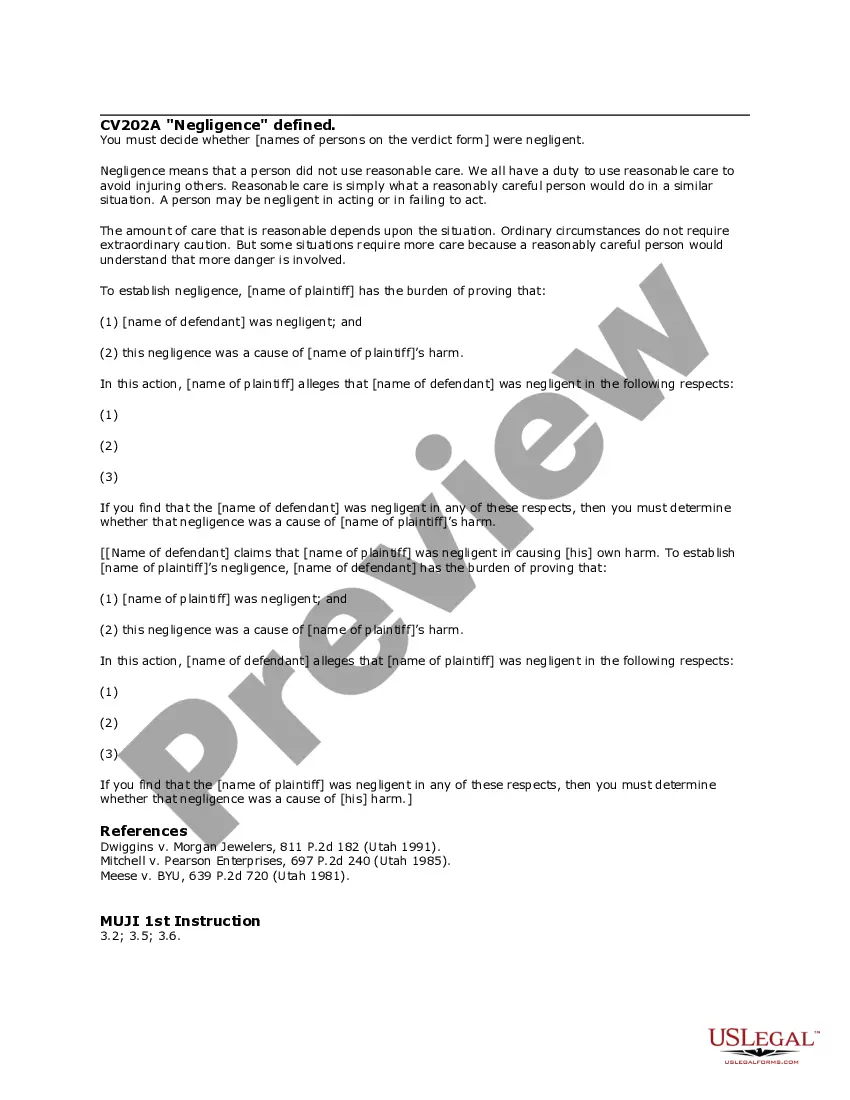

- Step 2. Use the Review option to browse the form's content. Don’t forget to read the description.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find alternative types of your legal form template.

Form popularity

FAQ

Certain organizations and purchases may qualify for sales tax exemption in Ohio. For example, non-profit organizations or entities purchasing for resale can often apply for exemption. It is crucial to ensure you have the proper documentation to validate your exempt status. The Ohio Sample Letter for New Discount can help businesses understand and apply for exemption, ensuring they meet all requirements.

Ohio taxes can be filed at various intervals, including monthly, quarterly, or annually depending on the business's sales volume. Generally, businesses with a higher volume of sales are required to file more frequently. Knowing your filing schedule is important to avoid late penalties. Resources like the Ohio Sample Letter for New Discount can offer valuable reminders to help you stay on track with your tax obligations.

Calculating sales tax in Ohio involves applying the state sales tax rate to the taxable sale amount. Currently, the state sales tax rate is 5.75%, with some local jurisdictions imposing additional taxes. Ensure you factor in all applicable rates when completing your sales transactions. For businesses looking to simplify this process, resources like the Ohio Sample Letter for New Discount could provide insights into tax management.

Ohio merchant tax refers to the tax imposed on the sales of merchandise within the state. This tax applies to businesses that sell tangible personal property at retail. Understanding this tax is crucial for budgeting and financial planning. Utilizing resources like the Ohio Sample Letter for New Discount can help vendors to navigate their tax obligations smoothly.

If you plan to engage in business in Ohio, you will need an Ohio vendor's license. This license is required for anyone selling goods or services at retail. It's essential to obtain this license for compliance with state regulations. Consider using the Ohio Sample Letter for New Discount to help streamline your application process.

Sales tax exemptions in Ohio qualify for certain purchases such as machinery used in manufacturing, non-profit organization purchases, and specific types of agricultural products. Each category has detailed criteria that must be met to qualify for exemption. It’s crucial to stay updated on these regulations to ensure compliance and savings. For assistance in understanding these guidelines, an Ohio Sample Letter for New Discount can be very helpful.

In Ohio, manufacturing equipment is generally exempt from sales tax when used directly in manufacturing. This exemption encourages investment in manufacturing facilities and promotes economic development. Understanding the specific conditions and documentation required is essential for proper compliance. If you're considering purchasing manufacturing equipment, use an Ohio Sample Letter for New Discount to clarify your tax stance.

The Ohio vendor discount is a benefit provided to registered vendors in the state. This discount allows vendors to keep a portion of the sales tax they collect, which helps offset administrative costs. This policy encourages compliance and supports local businesses. If you want to know how to apply for or maximize this discount, an Ohio Sample Letter for New Discount can guide you through the process.

Ohio offers several tax exemptions on specific items, including certain types of food, prescription drugs, and medical supplies. Additionally, some clothing and school supplies may also qualify for tax exemption during specific periods, such as the sales tax holiday. Understanding these exemptions is crucial for making informed purchasing decisions. An Ohio Sample Letter for New Discount can assist you in determining eligible items.

To request an additional discount, it is vital to present your case logically and respectfully. Start by acknowledging any existing discounts and explain why you believe an additional reduction is justified. Referencing an Ohio Sample Letter for New Discount may help you formulate your request effectively, demonstrating that you have done your homework and are serious about your appeal.