An irrevocable trust established to qualify contributions for the annual federal gift tax exclusion for gifts of a present interest. The trust is named Crummey because of a case involving a family named Crummey. The trust contains Crummey Powers, enabling a beneficiary to withdraw assets contributed to the trust for a limited period of time.

Ohio Sprinkling Trust for Children During Grantor's Life, and for Surviving Spouse and Children after Grantor's Death - Crummey Trust Agreement

Description

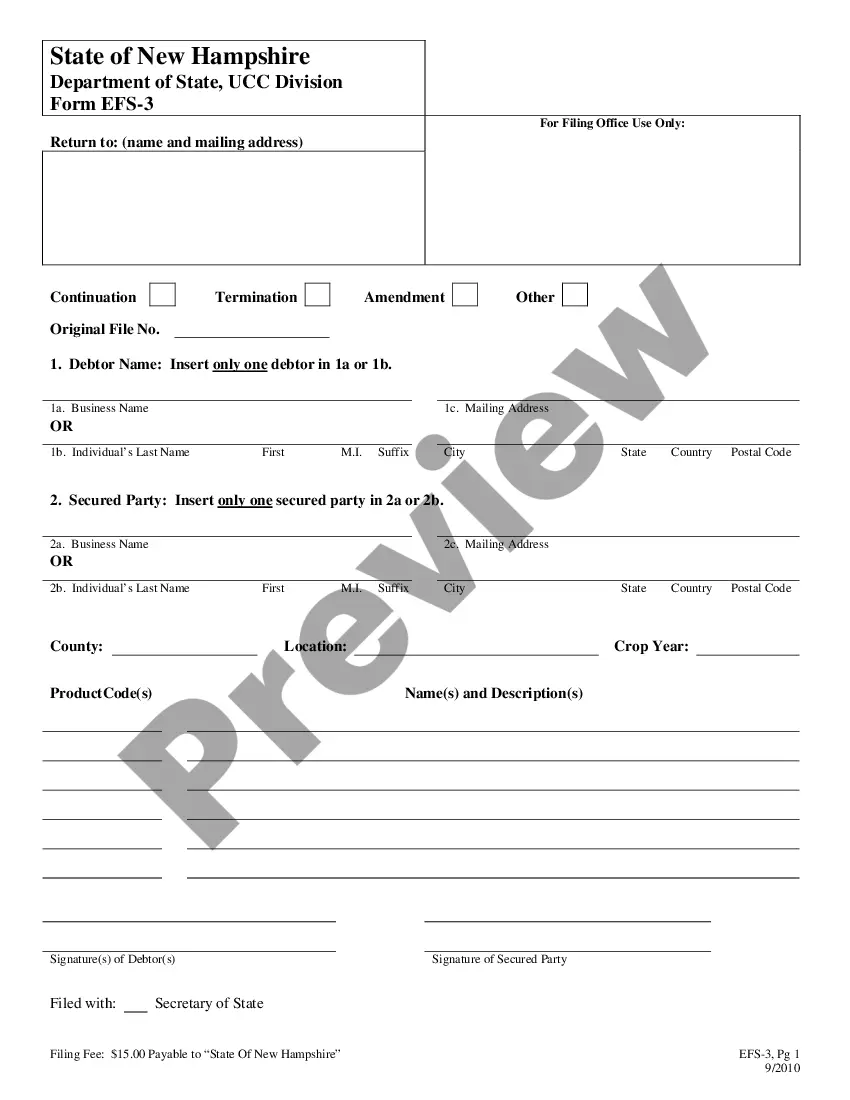

How to fill out Sprinkling Trust For Children During Grantor's Life, And For Surviving Spouse And Children After Grantor's Death - Crummey Trust Agreement?

Selecting the correct legal document template might be a challenge.

There are numerous designs accessible online, but how can you locate the legal form you require.

Utilize the US Legal Forms website. This service provides a vast array of templates, including the Ohio Sprinkling Trust for Minors During the Grantor's Lifetime, and for Surviving Spouse and Offspring following the Grantor's Passing - Crummey Trust Agreement, suitable for both business and personal purposes.

You can view the form with the Preview button and read the form description to confirm it is the correct one for you.

- All forms are reviewed by experts to ensure compliance with state and federal regulations.

- If you’re already registered, Log In to your account and click the Acquire button to download the Ohio Sprinkling Trust for Minors During the Grantor's Lifetime, and for Surviving Spouse and Offspring following the Grantor's Passing - Crummey Trust Agreement.

- Use your account to search for the legal forms you have previously purchased.

- Visit the My documents tab in your account to retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, ensure you have chosen the appropriate form for your specific region.

Form popularity

FAQ

The 5 and 5 rule generally allows beneficiaries to withdraw a certain amount from a trust without facing gift tax consequences. Specifically, beneficiaries can take the greater of $5,000 or 5 percent of the principal annually, providing both flexibility and financial access. This rule is especially pertinent in an Ohio Sprinkling Trust for Children During Grantor's Life, and for Surviving Spouse and Children after Grantor's Death - Crummey Trust Agreement, as it can significantly enhance the financial utility of the trust. Understanding this rule facilitates smoother financial planning for both grantors and beneficiaries.

The Crummey rules outline the requirements that allow contributions to a trust to qualify for the annual gift tax exclusion. This includes notifying beneficiaries of their withdrawal rights, which encourages them to take advantage of those rights promptly. In an Ohio Sprinkling Trust for Children During Grantor's Life, and for Surviving Spouse and Children after Grantor's Death - Crummey Trust Agreement, understanding these rules helps grantors maximize their tax benefits while providing support to their loved ones. Familiarity with these regulations is essential for effective estate planning.

The 5 and 5 rule for Crummey Trusts combines the concepts of withdrawal rights and limits. Beneficiaries can withdraw the greater of $5,000 or 5 percent of the trust's assets without incurring gift taxes, and they have a limited timeframe to do so. This rule is significant in the context of an Ohio Sprinkling Trust for Children During Grantor's Life, and for Surviving Spouse and Children after Grantor's Death - Crummey Trust Agreement as it encourages beneficiaries to manage their access to funds responsibly. It balances immediate needs with long-term asset preservation.

A surviving spouse trust is designed to provide financial security for a spouse after the other spouse passes away. In the context of an Ohio Sprinkling Trust for Children During Grantor's Life, and for Surviving Spouse and Children after Grantor's Death - Crummey Trust Agreement, this trust can help to manage assets and ensure that both the surviving spouse and children are provided for. This type of trust ensures that the needs of the surviving spouse are prioritized, allowing for sufficient support and resources. Ultimately, it helps maintain family stability during a challenging time.

The 5 5 lapse rule refers to a provision where beneficiaries can withdraw up to $5,000 or 5 percent of the trust's principal, whichever is greater, during a certain period. This rule applies to various trust types, including an Ohio Sprinkling Trust for Children During Grantor's Life, and for Surviving Spouse and Children after Grantor's Death - Crummey Trust Agreement. The lapse occurs if the beneficiary does not exercise this option, promoting financial access while ensuring some capital remains in the trust for future needs. It's a key feature for flexible financial planning.

The 5 percent rule allows trust beneficiaries to withdraw up to 5 percent of the trust's principal each year. This feature is particularly relevant in an Ohio Sprinkling Trust for Children During Grantor's Life, and for Surviving Spouse and Children after Grantor's Death - Crummey Trust Agreement. This rule helps ensure that beneficiaries have access to funds while maintaining the trust's integrity over time. Therefore, it balances the needs of the beneficiaries with the long-term goals of the trust.

Upon the grantor's death, the trust becomes irrevocable, and the assets are managed according to the terms established by the grantor. This structure in the Ohio Sprinkling Trust for Children During Grantor's Life, and for Surviving Spouse and Children after Grantor's Death - Crummey Trust Agreement assures that beneficiaries will receive their allocated benefits while safeguarding the grantor's intentions. The appointed trustee will be responsible for ensuring that all distributions adhere to the trust's directives, providing clarity and structure to the transition.

One disadvantage of a Crummey trust is that it requires ongoing administration and may incur additional costs. Additionally, beneficiaries may not fully understand the withdrawal rights, leading to misunderstandings or frustrations. The complexities inherent in the Ohio Sprinkling Trust for Children During Grantor's Life, and for Surviving Spouse and Children after Grantor's Death - Crummey Trust Agreement make it vital for grantors to ensure that their chosen platform, such as uslegalforms, guides them clearly through these potential pitfalls. Careful planning can mitigate these concerns.

The 5 by 5 rule allows beneficiaries to withdraw up to $5,000 or 5% of the trust's value each year, whichever is greater. This provision is beneficial when creating the Ohio Sprinkling Trust for Children During Grantor's Life, and for Surviving Spouse and Children after Grantor's Death - Crummey Trust Agreement because it can help the grantor meet annual gift tax exclusions. By encouraging limited access to trust assets, this rule lets beneficiaries enjoy the benefits while maintaining the trust's primary purpose. Managing this feature effectively can optimize both gifting and tax implications.

Yes, when one grantor of a joint trust passes away, the trust typically becomes irrevocable. In the context of the Ohio Sprinkling Trust for Children During Grantor's Life, and for Surviving Spouse and Children after Grantor's Death - Crummey Trust Agreement, this means that the remaining grantor can no longer change the trust terms, ensuring the original intent of the grantors is respected. This way, beneficiaries can anticipate their benefits without any abrupt alterations to the trust’s framework.