Ohio Reduce Capital - Resolution Form - Corporate Resolutions

Description

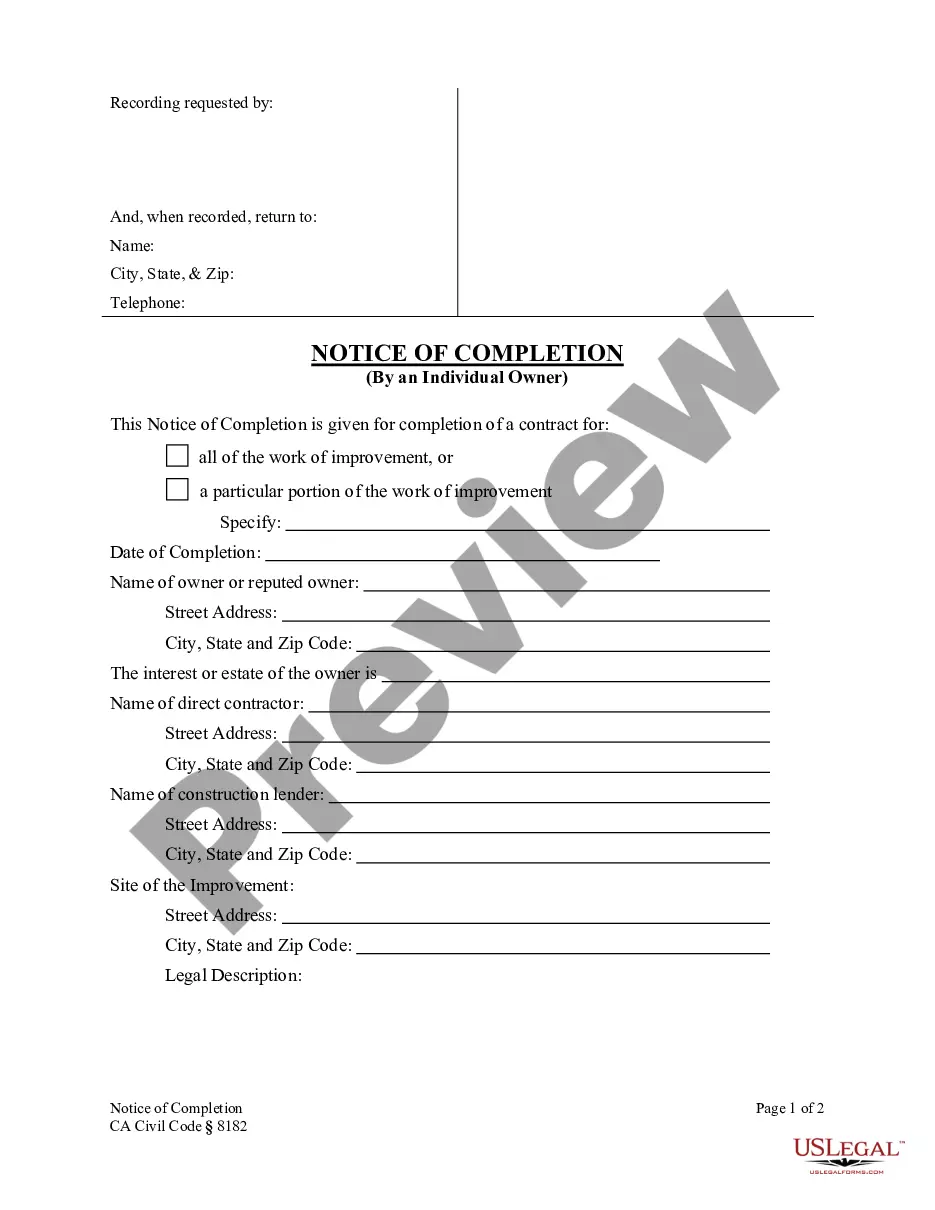

How to fill out Reduce Capital - Resolution Form - Corporate Resolutions?

Finding the appropriate legal document template can be quite challenging. Of course, there are numerous formats available online, but how can you locate the legal document you need.

Utilize the US Legal Forms website. This service provides a vast array of templates, such as the Ohio Reduce Capital - Resolution Form - Corporate Resolutions, suitable for both business and personal purposes.

All of the forms are reviewed by professionals and comply with state and national regulations.

Once you are certain the form is correct, choose the Get now button to retrieve the form. Select your preferred payment plan and input the necessary details. Create your account and process the payment using your PayPal account or credit card. Choose the file format and download the legal document template to your system. Complete, edit, print, and sign the obtained Ohio Reduce Capital - Resolution Form - Corporate Resolutions. US Legal Forms is the largest collection of legal forms where you can find a multitude of document templates. Use the service to acquire properly crafted documents that comply with state requirements.

- If you are already registered, Log In to your account and click on the Download button to access the Ohio Reduce Capital - Resolution Form - Corporate Resolutions.

- Use your account to browse the legal forms you have previously acquired.

- Go to the My documents section of your account to obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are some simple steps to follow.

- First, ensure that you have selected the correct form for your city/state. You can review the form using the Preview option and read the form description to ensure it meets your needs.

- If the form does not meet your requirements, use the Search field to find the appropriate form.

Form popularity

FAQ

The purpose of a corporate resolution is to provide clear documentation of decisions made by the board of directors. This ensures accountability and transparency within the corporation. By utilizing the Ohio Reduce Capital - Resolution Form - Corporate Resolutions, you can effectively record these critical decisions, safeguarding your corporation's legal compliance. Ultimately, these resolutions are essential for maintaining good governance and facilitating smooth business operations.

In Ohio, a resolution is a formal expression of the will of a corporation's board, often pertaining to internal governance or decisions affecting the company. An ordinance, on the other hand, is a law enacted by a municipal authority, usually involving rules that govern the public. Understanding the distinction is crucial, especially when using the Ohio Reduce Capital - Resolution Form - Corporate Resolutions, to clearly document corporate decisions without confusion with local or state laws.

To file a corporate resolution, begin by drafting the resolution itself, ensuring it meets all legal requirements. Once completed, it should be signed by the appropriate members of the board. For further assistance, the Ohio Reduce Capital - Resolution Form - Corporate Resolutions can simplify your filing process, providing a structured template that meets both compliance and governance needs. After signing, you typically need to maintain the resolution in your corporation's records as part of your official documentation.

An authorizing resolution for a corporation is a formal decision made by the board of directors. This document records the authorization of specific actions, such as financial transactions or changes in corporate structure. In the context of Ohio Reduce Capital - Resolution Form - Corporate Resolutions, these resolutions ensure that necessary decisions align with the company's governance framework. Properly documented resolutions protect your corporation's interests and comply with state laws.

The format of writing a resolution typically includes a title, a preamble stating the context or rationale, and the body outlining the specific decision. Use clear, direct language to convey the action being taken, and refer to the Ohio Reduce Capital - Resolution Form - Corporate Resolutions to maintain consistency and legality. It’s also essential to document the date and include signatures from all approving members, finalizing the resolution.

To complete a corporate resolution, first gather all necessary information about your LLC and the specific decision at hand. Write your resolution clearly, indicating the decision to be made, along with the reasons behind it. The Ohio Reduce Capital - Resolution Form - Corporate Resolutions simplifies this process, guiding you through each essential step. Lastly, ensure that all involved parties sign the document to formalize the resolution.

Filling out a corporate resolution form begins with identifying your LLC and the members involved. Next, specify the action you want to authorize, such as a capital reduction or a change in management. Utilize the Ohio Reduce Capital - Resolution Form - Corporate Resolutions for clarity and structure, ensuring all relevant sections are complete. Don’t forget to have the authorized members sign the form, which solidifies the decisions made.

To write a corporate resolution for an LLC, start by clearly stating the purpose of the resolution. Include the date and name of your LLC, followed by details about the specific action being authorized. Use the Ohio Reduce Capital - Resolution Form - Corporate Resolutions as a guide to ensure compliance with state regulations. Finally, provide a space for signatures from members or managers to validate the resolution.

You can find corporate resolutions by visiting our website, where we offer the Ohio Reduce Capital - Resolution Form - Corporate Resolutions. This form is designed to help you create essential corporate documents with ease. By using our platform, you gain access to user-friendly tools that streamline the process of drafting resolutions. Explore our resources to ensure your business remains compliant and efficient.

Filling out a corporate resolution form involves providing your LLC’s name, the effective date, and the specifics of the resolution. It is essential to carefully articulate the decisions made to ensure clarity. The Ohio Reduce Capital - Resolution Form - Corporate Resolutions offers a user-friendly structure that helps streamline this process and ensures compliance with Ohio regulations.