Ohio Credit Agreement

Description

How to fill out Credit Agreement?

Are you currently in a situation where you need documents for either business or personal reasons almost every day.

There are numerous legal document templates available online, but finding ones you can rely on isn’t easy.

US Legal Forms provides thousands of form templates, such as the Ohio Credit Agreement, that are designed to meet state and federal requirements.

Utilize US Legal Forms, the most comprehensive collection of legal forms, to save time and avoid errors.

The service offers professionally crafted legal document templates that you can use for a variety of purposes. Create an account on US Legal Forms and begin simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Ohio Credit Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Search for the form you need and ensure it is for the correct city/county.

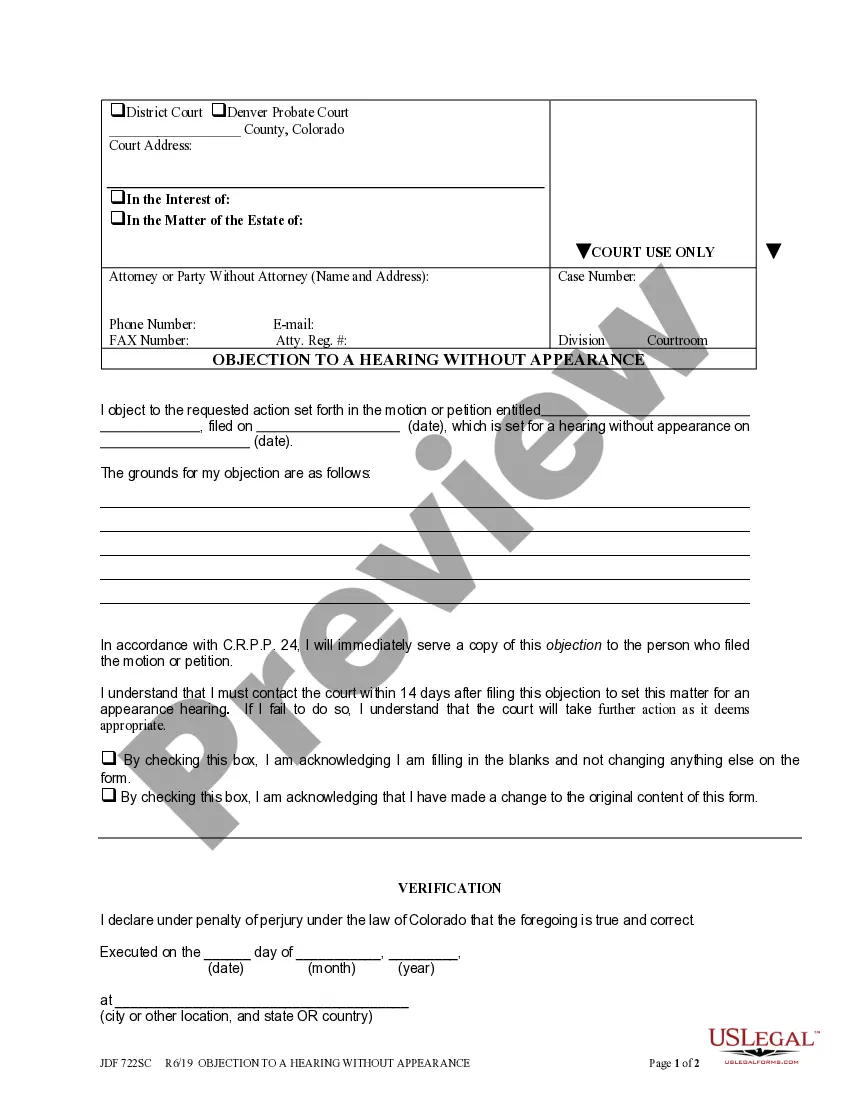

- Use the Review button to examine the form.

- Check the description to confirm that you have selected the right form.

- If the form isn’t what you’re seeking, utilize the Search section to find the form that meets your needs and requirements.

- If you find the correct form, simply click Acquire now.

- Choose the pricing plan you prefer, enter the necessary details to create your account, and complete the order using your PayPal or credit card.

- Select a convenient document format and download your copy.

- Access all the document templates you have purchased in the My documents list.

- You can obtain an additional copy of the Ohio Credit Agreement at any time, if needed.

- Click on the desired form to download or print the document template.

Form popularity

FAQ

A credit agreement is a legally binding contract documenting the terms of a loan, made between a borrower and a lender. A credit agreement is used with many types of credit, including home mortgages, credit cards, and auto loans. Credit agreements can sometimes be renegotiated under certain circumstances.

To draft a Loan Agreement, you should include the following: The addresses and contact information of all parties involved. The conditions of use of the loan (what the money can be used for) Any repayment options. The payment schedule. The interest rates. The length of the term. Any collateral. The cancellation policy.

A credit agreement is a legal document that outlines the terms of your loan, between you and the lender. Whether you're taking out a mortgage, a personal loan or Car Finance, the creditor is legally required to provide a credit agreement and it must be signed by both parties.

Loans and credits are different finance mechanisms. While a loan provides all the money requested in one go at the time it is issued, in the case of a credit, the bank provides the customer with an amount of money, which can be used as required, using the entire amount borrowed, part of it or none at all.

A loan gives you a lump sum of money that you repay over a period of time. A line of credit lets you borrow money up to a limit, pay it back, and borrow again.

The NCA does not require that a credit agreement must be in writing and signed by both parties to the agreement, although this is implied throughout the Act. A credit agreement can be (i) a credit facility; (ii) a credit transaction; (iii) a credit guarantee; or (iv) an incidental credit agreement.

Key Takeaways Credit agreements are legally binding; it outlines loan terms and conditions. However, the legal document requires signatures from both parties to be considered valid. The lender could charge a fixed interest rate or a floating interest rate.

A lending agreement (loan agreement) is a formal contract between a lender and a borrower. Lending agreements spell out all the details of the loan, such as the principal amount, interest rate, amortization period, term, fees, payment terms and any covenants.