Ohio Exchange Addendum to Contract - Tax Free Exchange Section 1031

Description

How to fill out Exchange Addendum To Contract - Tax Free Exchange Section 1031?

If you require extensive, obtain, or print approved document formats, utilize US Legal Forms, the most extensive selection of legal templates available online.

Employ the site's user-friendly and convenient search functionality to find the documents you seek.

Numerous templates for commercial and personal use are categorized by groups and states, or keywords.

Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to discover alternative versions of the legal form template.

Step 4. Once you have found the form you want, click the Buy now button. Choose the payment plan you prefer and input your details to register for an account.

- Utilize US Legal Forms to acquire the Ohio Exchange Addendum to Contract - Tax-Free Exchange Section 1031 in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and then click the Download button to receive the Ohio Exchange Addendum to Contract - Tax-Free Exchange Section 1031.

- You can also access forms you have previously saved within the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

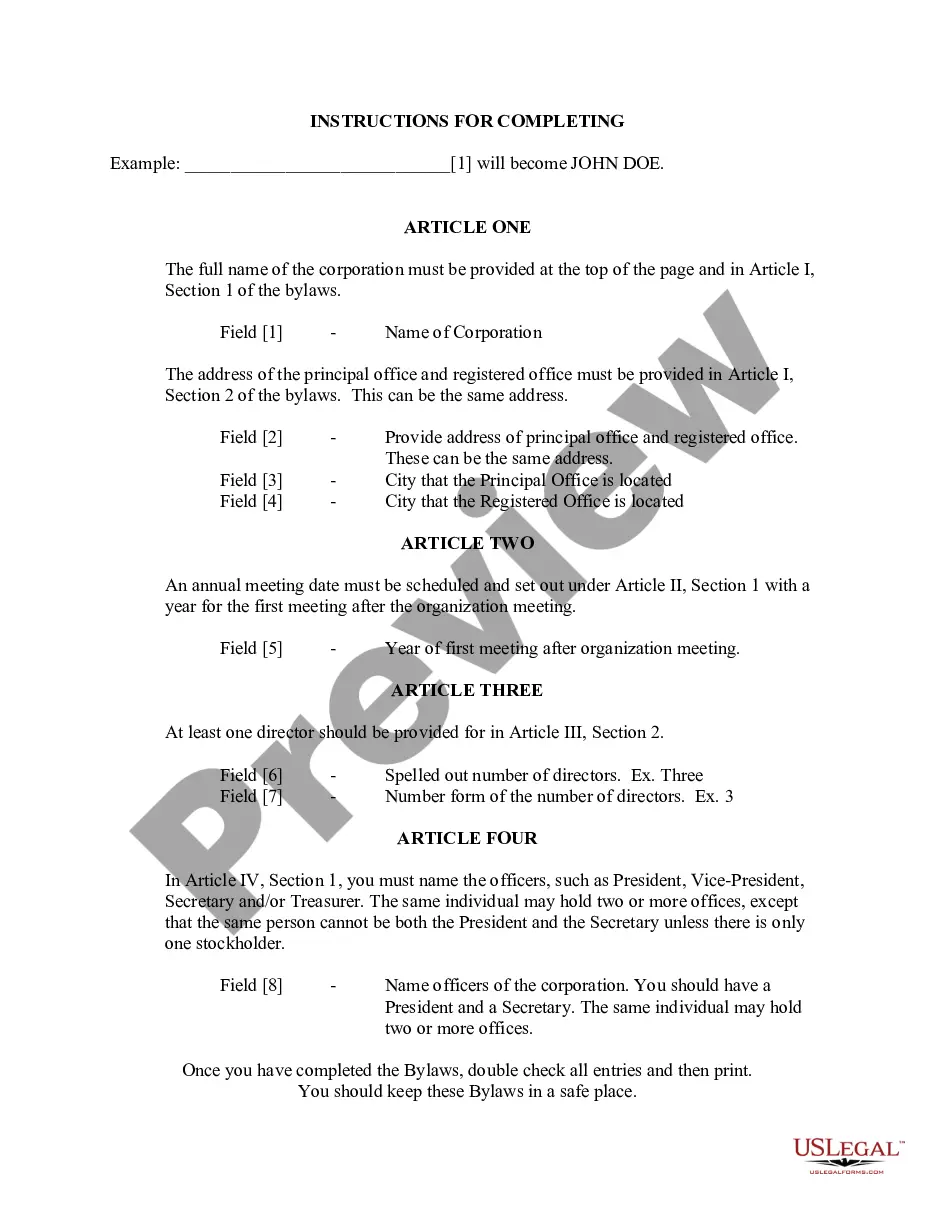

- Step 1. Ensure you have selected the form for the correct city/state.

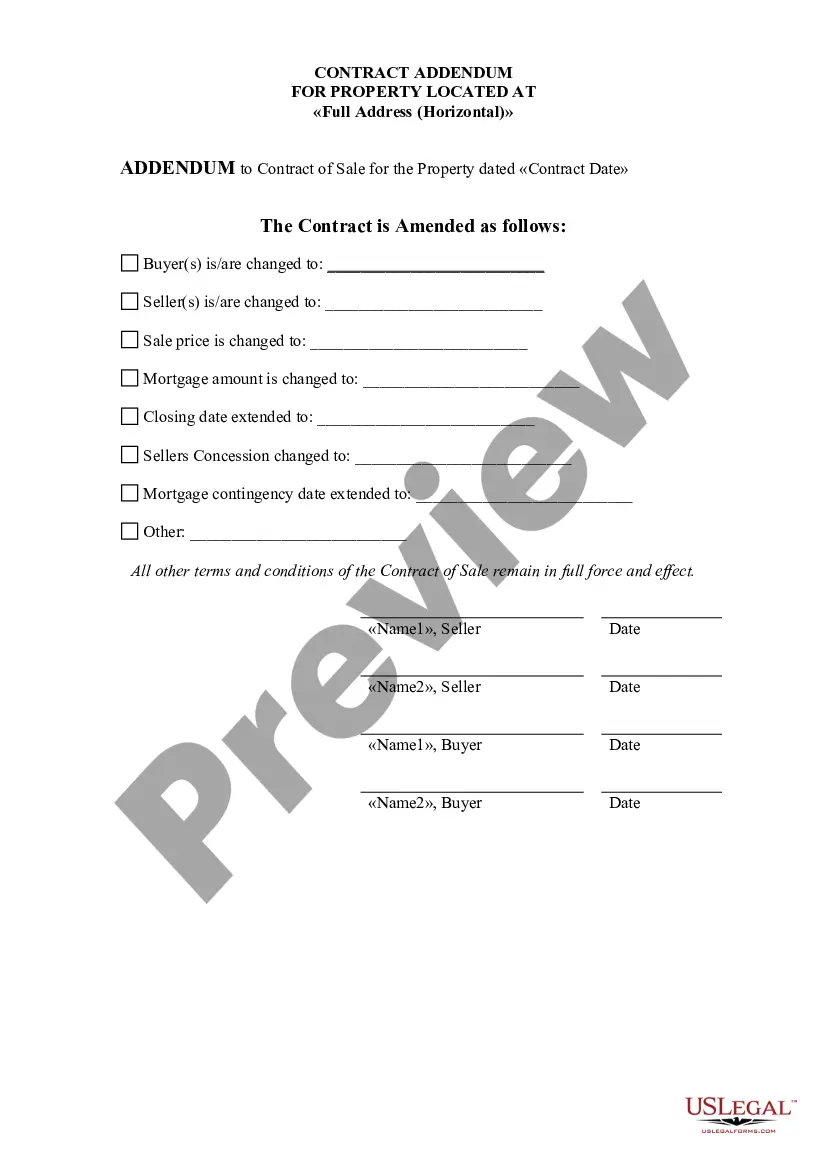

- Step 2. Use the Review option to examine the form’s content. Don’t forget to check the details.

Form popularity

FAQ

deferred exchange is a valuable investment tool that allows you to dispose of investment properties and acquire "likekind" properties while deferring federal capital gains taxes and depreciation recapture.

A 1031 addendum will normally clearly show intent to do a 1031 exchange, permit assignment, and advise the other party there will be no expense or liability as a result of the exchange. Sometimes there is cooperation language asserting that both parties to the contract will cooperate with a 1031 exchange.

While you can't do a 1031 exchange directly into a personal residence -- exchanges are limited to real property that is held strictly for investment or business purposes -- you can convert an investment property into personal property so long as you follow the IRS' rules to the letter.

A 1031 exchange allows you to sell one investment or business property and buy another without incurring capital gains taxes as long as the exchange is completed according to IRS rules and the new property is of the same nature or character (like kind).

Notes and the 1031 ExchangeThough a contract sale can be incorporated in an exchange, it may not be possible to accomplish this goal all the time. In order for a note to be used in an exchange, you, the Exchangor, must not have actual or constructive receipt of the note.

To receive the full benefit of a 1031 exchange, your replacement property should be of equal or greater value. You must identify a replacement property for the assets sold within 45 days and then conclude the exchange within 180 days.

In real estate, a 1031 exchange is a swap of one investment property for another that allows capital gains taxes to be deferred.