Ohio Acknowledgment by Debtor of Correctness of Account Stated

Description

How to fill out Acknowledgment By Debtor Of Correctness Of Account Stated?

US Legal Forms - one of the premier collections of legal documents in the United States - provides a range of legal form templates that you can download or print.

By utilizing the website, you can obtain thousands of forms for business and personal use, categorized by type, state, or keywords. You can access the latest versions of forms such as the Ohio Acknowledgment by Debtor of Correctness of Account Stated in moments.

If you already possess an account, Log In and download the Ohio Acknowledgment by Debtor of Correctness of Account Stated from the US Legal Forms archive. The Download button will appear on every form you view. You can access all previously downloaded forms within the My documents section of your account.

Process the payment. Use your credit card or PayPal account to complete the payment.

Choose the format and download the form to your device. Edit. Complete, modify, print, and sign the downloaded Ohio Acknowledgment by Debtor of Correctness of Account Stated. Each template added to your account has no expiration date and is yours indefinitely. Thus, if you wish to download or print another copy, simply visit the My documents section and click on the form you require. Access the Ohio Acknowledgment by Debtor of Correctness of Account Stated with US Legal Forms, the largest collection of legal document templates. Utilize a multitude of professional and state-specific templates that cater to your business or personal needs and requirements.

- If you wish to use US Legal Forms for the first time, here are easy steps to get you started.

- Ensure you have selected the correct form for your city/county.

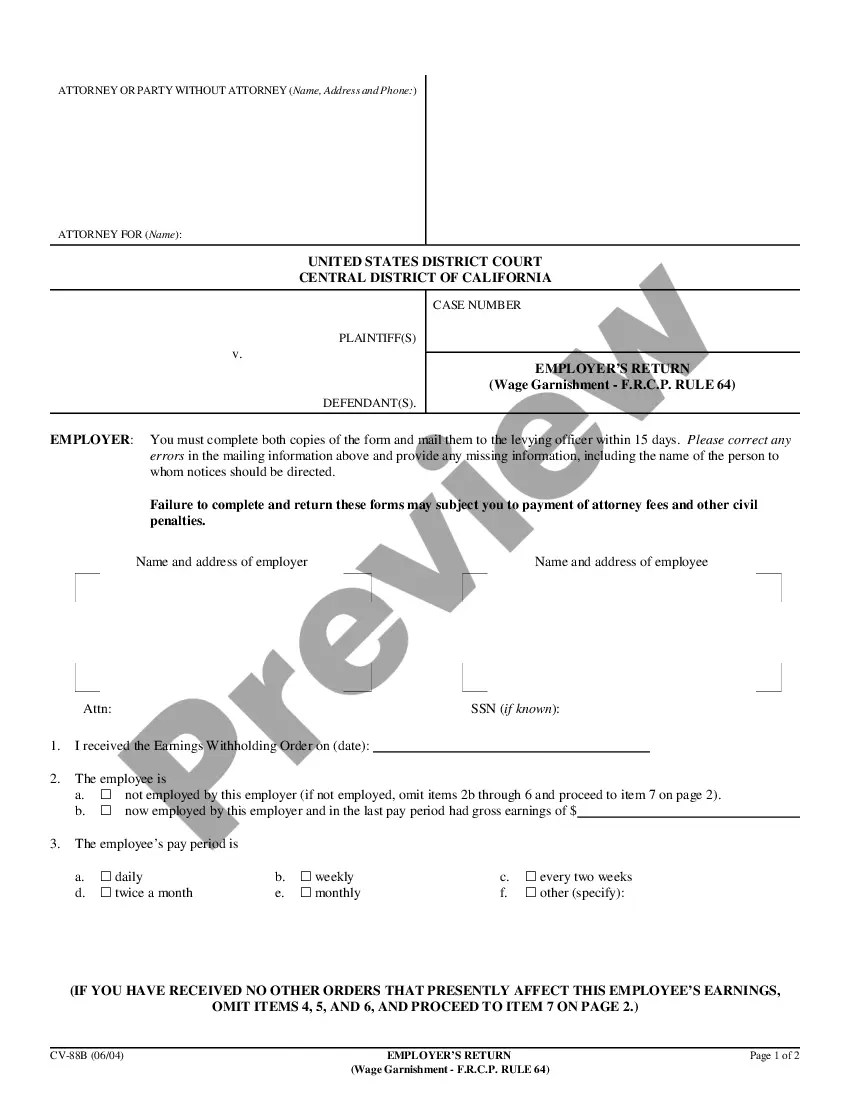

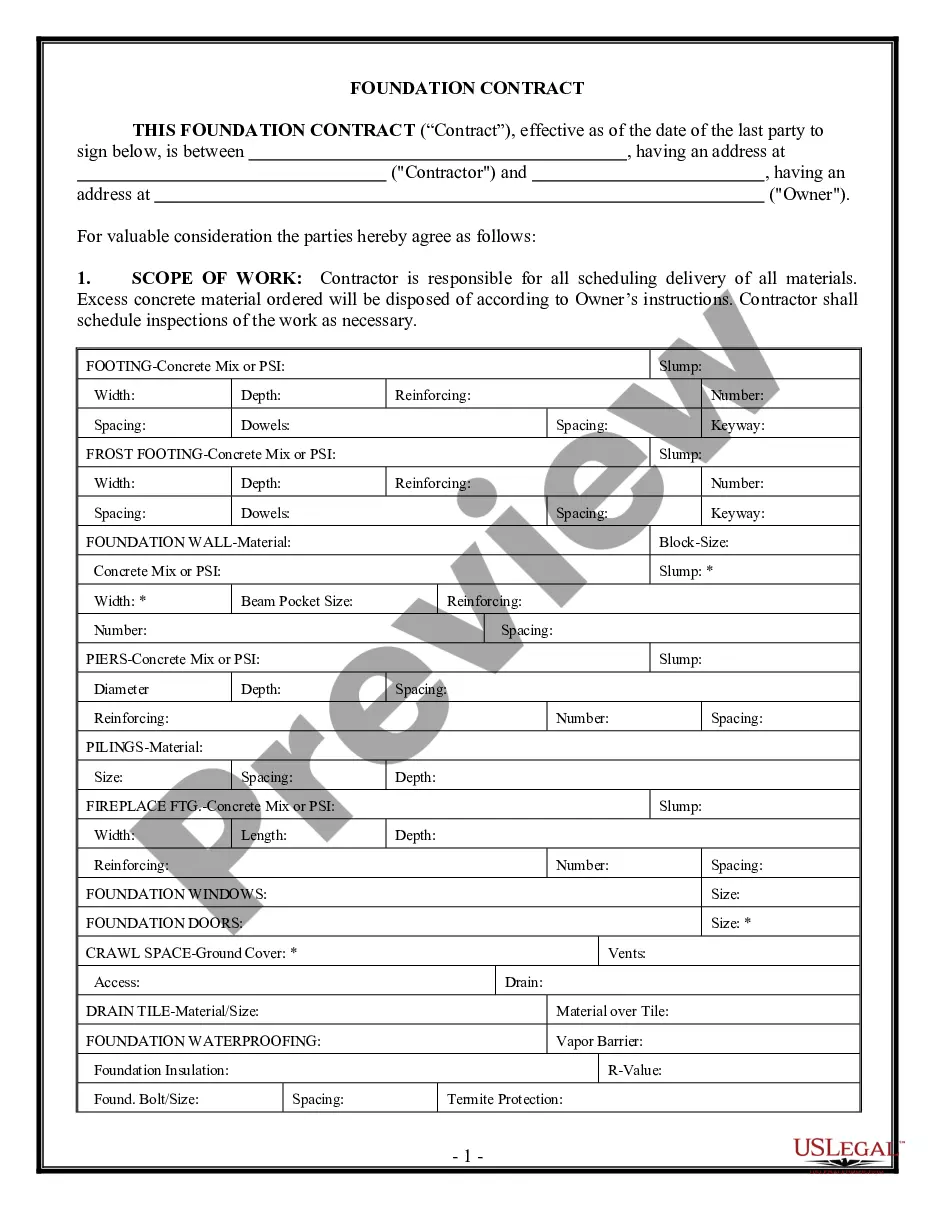

- Click the Review button to examine the form’s content.

- Check the form’s summary to confirm you have selected the appropriate form.

- If the form does not meet your needs, utilize the Search field located at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Get now button.

- Then, select the pricing plan you prefer and provide your credentials to register for an account.

Form popularity

FAQ

My County Court Judgment is over 6 years old, can I get it enforced? Your original County Court Judgment (CCJ) could only be enforced for up to 6 years after it was awarded by the Court. However, you can re-apply to your original Court to get permission to enforce a judgment that it is more than 6 years old.

Rule 4 - Process: Summons (A) Summons: issuance. Upon the filing of the complaint the clerk shall forthwith issue a summons for service upon each defendant listed in the caption. Upon request of the plaintiff separate or additional summons shall issue at any time against any defendant.

Time limitations The Statute of Limitation is three years in South Africa. Once this time period has elapsed the debtor can refuse to pay the outstanding account, unless summons has been issued by the courts prior to the expiration date.

In the UK, for most people, unsecured debts go away after a period of 6 years from the point when they started or 6 years from the point when they last made a payment to, or had contact with, their creditor. This period can be 12 years for some mortgage debts.

If you are at risk of being sued for an unpaid debt or you are already facing a lawsuit filed by a debt collector, you need to know your rights and options. Federal and state laws regulate what collectors can and can't do.

For most debts, the time limit is 6 years since you last wrote to them or made a payment. The time limit is longer for mortgage debts.

The Creditor's claim will only prescribe after the period of three years have lapsed from the date of the acknowledgement of debt, even if the debt was admitted without prejudice.

Ohio's statute of limitations is six years no matter the type of debt. And the six years is counted from the date a debt became overdue or when you last made a payment, whichever was more recent. If the timeframe is more than six years, a creditor cannot sue to collect the debt.

Creditor's rights can refer to many different aspects of creditor-debtor and creditor-creditor relations including a creditor's rights to place a lien on a debtor's property, garnish a debtor's wages, set aside a fraudulent conveyance, and contact the debtor and relatives.

If you are in debt you have the right to be protected from illegal behaviour from creditors and debt collectors. You have the right to: not be discriminated against.