This form is an Application for Release of Right to Redeem Property from IRS After Foreclosure. Check for compliance with your specific facts and circumstances.

Ohio Application for Release of Right to Redeem Property from IRS After Foreclosure

Description

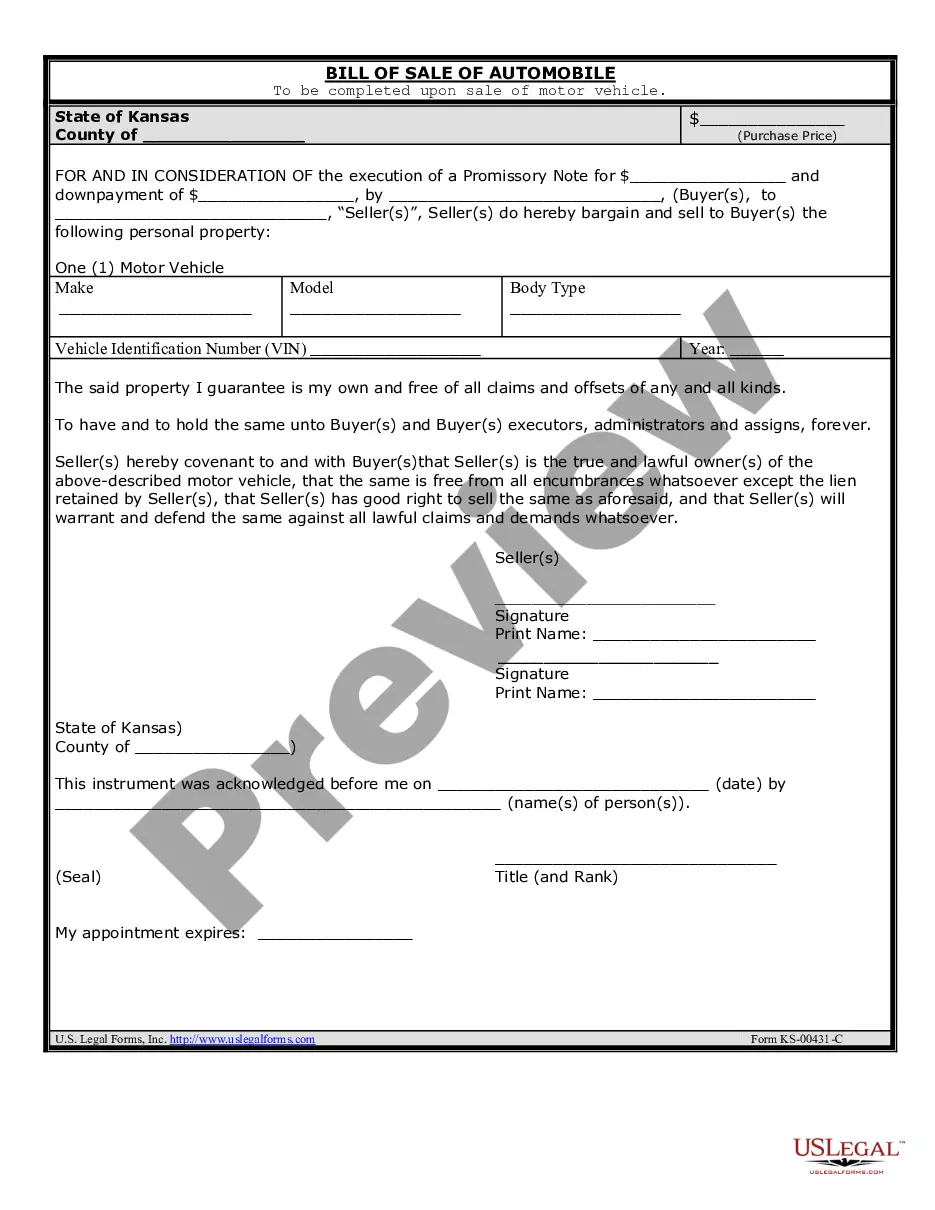

How to fill out Application For Release Of Right To Redeem Property From IRS After Foreclosure?

You can spend hours online searching for the legal document template that meets the federal and state requirements you need.

US Legal Forms offers a vast array of legal forms that have been reviewed by experts.

You can easily download or print the Ohio Application for Release of Right to Redeem Property from IRS After Foreclosure from our services.

If available, make use of the Preview option to check through the document template as well. If you want to find another version of your form, utilize the Search section to locate the template that fits your needs and requirements. Once you have identified the template you desire, click Buy now to proceed. Select the pricing plan you wish, enter your credentials, and register for an account on US Legal Forms. Complete the purchase. You can use your credit card or PayPal account to pay for the legal document. Choose the format of your document and download it to your device. Make modifications to the document if necessary. You can complete, edit, sign, and print the Ohio Application for Release of Right to Redeem Property from IRS After Foreclosure. Download and print a multitude of document templates using the US Legal Forms website, which provides the largest selection of legal forms. Utilize professional and jurisdiction-specific templates to address your business or personal needs.

- If you already possess a US Legal Forms account, you can Log In and then click the Download button.

- After that, you can complete, modify, print, or sign the Ohio Application for Release of Right to Redeem Property from IRS After Foreclosure.

- Every legal document template you purchase is yours permanently.

- To obtain another copy of any acquired form, visit the My documents tab and click the appropriate option.

- If you are using the US Legal Forms site for the first time, follow the simple instructions listed below.

- First, ensure that you have selected the correct document template for the county/region of your choice.

- Review the document details to confirm you have chosen the accurate form.

Form popularity

FAQ

The IRS 7 year rule refers to the timeframe in which certain tax liens may be removed from your credit report, typically seven years from the date they were filed. However, this rule does not eliminate the tax obligation itself. If you are considering the Ohio Application for Release of Right to Redeem Property from IRS After Foreclosure, be aware of how this rule could impact your financial situation.

To get a lien payoff from the IRS, you must request a payoff statement directly from the agency. This statement will detail the amount owed, including any interest and penalties. If you are dealing with an Ohio Application for Release of Right to Redeem Property from IRS After Foreclosure, understanding how to obtain this information is essential for resolving your tax lien.

In Ohio, the redemption period for tax liens typically lasts for one year from the date of the foreclosure sale. During this time, the property owner can reclaim their property by addressing any outstanding debts, including federal tax liens. If you need guidance on the Ohio Application for Release of Right to Redeem Property from IRS After Foreclosure, uslegalforms offers valuable assistance.

The right to redeem property after a foreclosure is the legal ability of the former owner to reclaim their property by paying off the debt owed. This right varies by state, and in Ohio, specific procedures must be followed. Using an Ohio Application for Release of Right to Redeem Property from IRS After Foreclosure can streamline this process and facilitate a successful redemption.

The IRS right of redemption in a foreclosure is the ability of the IRS to reclaim property within a certain timeframe after a foreclosure sale occurs. This right is significant because it allows the IRS to ensure that tax obligations are met, protecting their interests. To navigate this right effectively, you may want to explore the Ohio Application for Release of Right to Redeem Property from IRS After Foreclosure.

After a foreclosure, the federal tax lien may remain attached to the property unless it is satisfied. This means that even though the property has been sold, the tax liability stays in place until resolved. If you are facing this situation, filing an Ohio Application for Release of Right to Redeem Property from IRS After Foreclosure can be a critical step toward clearing your title.

The IRS right to redeem foreclosure allows the Internal Revenue Service to reclaim a property after a foreclosure sale if specific conditions are met. This right is designed to protect the government's interest in collecting taxes owed. If you need assistance with the Ohio Application for Release of Right to Redeem Property from IRS After Foreclosure, consider using resources like uslegalforms.

Foreclosure redeemed refers to the process where a homeowner regains ownership of their property after a foreclosure sale by paying off the outstanding debts. In Ohio, this can involve addressing any federal tax liens that may be in place. Understanding this concept is crucial for anyone dealing with an Ohio Application for Release of Right to Redeem Property from IRS After Foreclosure.

To request an IRS payoff letter, you need to complete Form 4506-T, which allows you to obtain your tax information. You can submit this form online or by mail, ensuring that you provide accurate details about your tax account. Once processed, the IRS will send you the payoff amount, which is crucial for completing the Ohio Application for Release of Right to Redeem Property from IRS After Foreclosure. If you want assistance with this process, consider using US Legal Forms, where you can find the necessary forms and guidance.