Ohio Warranty Deed for Parents to Child with Reservation of Life Estate

About this form

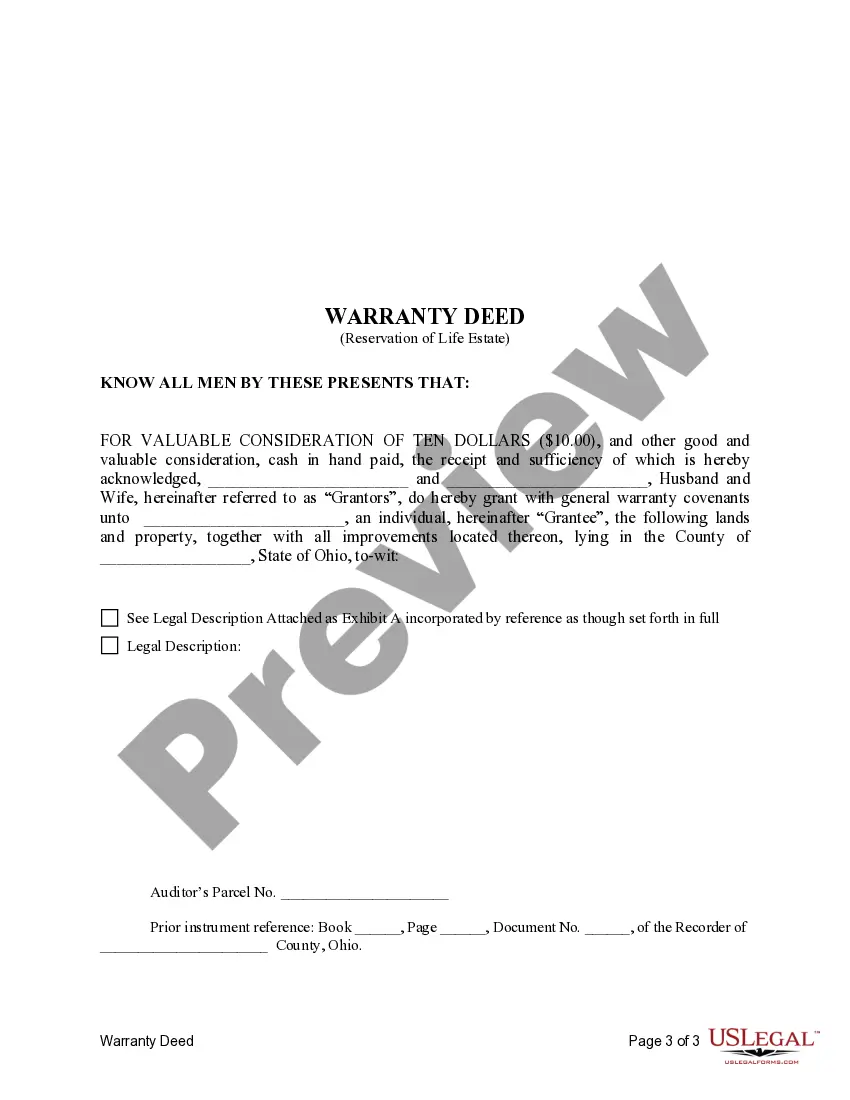

The Warranty Deed for Parents to Child with Reservation of Life Estate is a legal document that transfers property ownership from parents to their child while allowing the parents to retain the right to live in the property for the duration of their lives. This form is essential for individuals looking to legally convey property while ensuring they can continue to occupy it, distinguishing it from other types of deeds that do not incorporate life estates.

Key parts of this document

- Identification of the grantor(s) and grantee(s)

- Specific description of the property being transferred

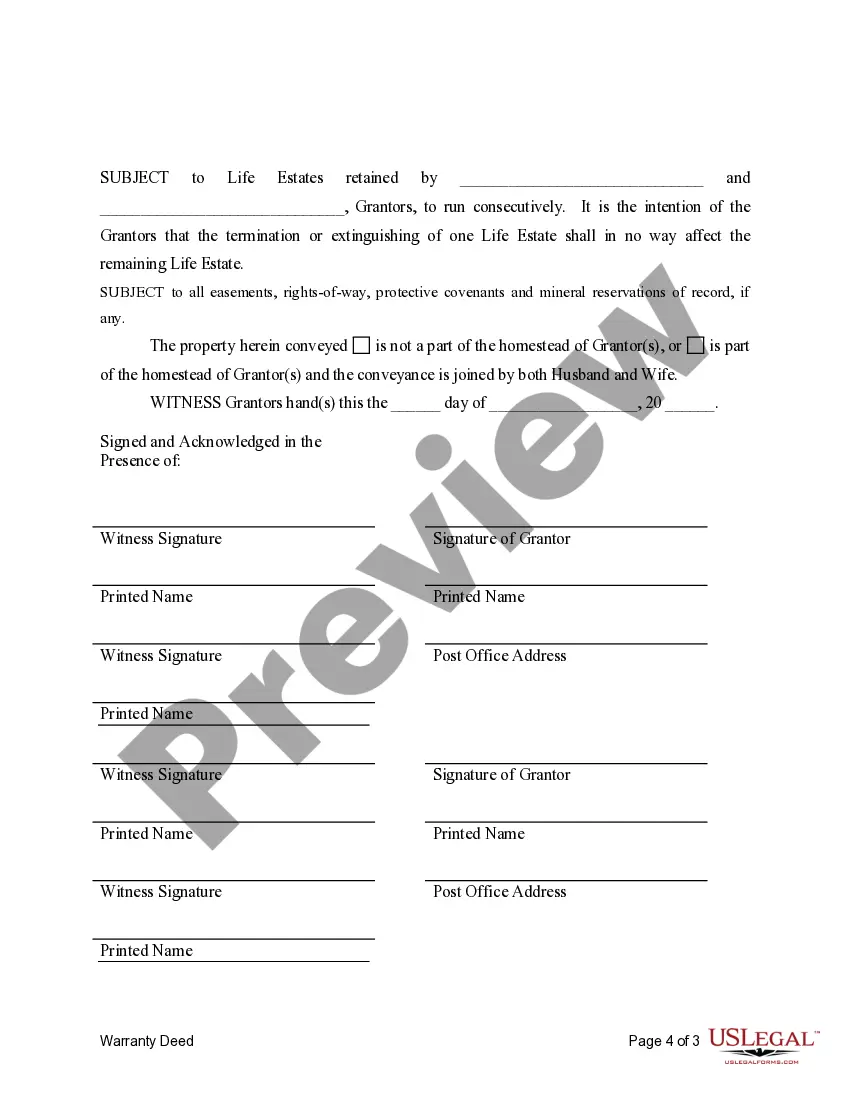

- Terms detailing the life estate retained by the grantor(s)

- Conditions regarding the termination of the life estate

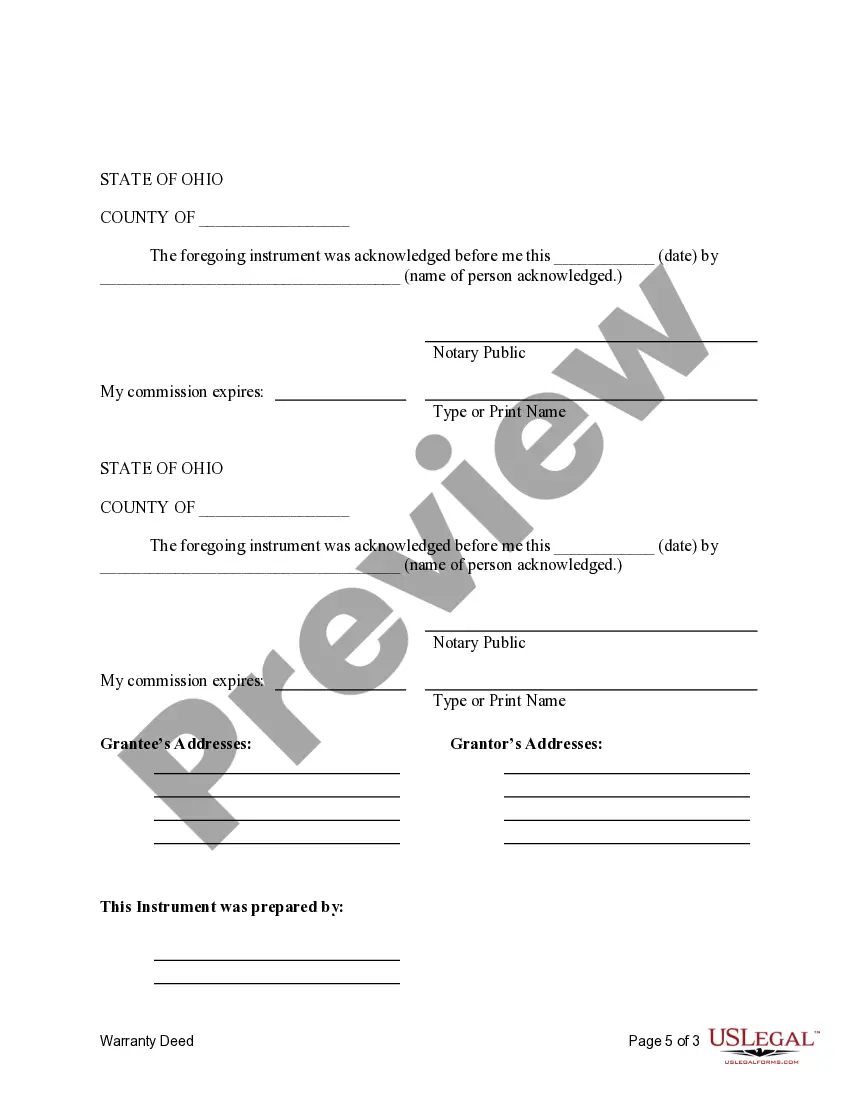

- Legal acknowledgments and signatures

Common use cases

This form is typically used when parents want to transfer ownership of a property to their child but wish to maintain the right to live in that property for their lifetime. It is particularly useful for estate planning, allowing parents to manage their assets while ensuring their housing needs are met as they age.

Who needs this form

- Parents seeking to transfer property to their children

- Homeowners who want to retain living rights after transferring ownership

- Individuals involved in estate planning who wish to simplify future property transfers

Instructions for completing this form

- Identify the parties involved, including the names of the grantor(s) and grantee(s).

- Specify the property being transferred by providing its legal description.

- Clearly state the terms of the life estate being reserved by the grantor(s).

- Enter the date of the transaction and ensure all parties sign the document in the presence of a notary, if applicable.

- Review the completed form for accuracy before filing or recording it with the appropriate county office.

Notarization guidance

This document requires notarization to meet legal standards. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

Mistakes to watch out for

- Failing to provide a complete and accurate legal description of the property.

- Not identifying all grantors and grantees correctly.

- Omitting necessary signatures or failing to have the document notarized when required.

- Not clarifying the terms and duration of the life estate retained by the grantor(s).

Why use this form online

- Convenience of downloading and completing the form at any time.

- Editability allows users to customize the form to their specific needs.

- Access to professionally drafted legal documents ensures reliability and compliance.

State-specific compliance details

This form is based on the legal framework of the State of Ohio. Users in Ohio should ensure compliance with local statutes and any specific formatting or filing requirements relevant to warranty deeds and life estates.

Form popularity

FAQ

Almost all deeds creating a life estate will also name a remaindermanthe person or persons who get the property when the life tenant dies.The life tenant is the owner of the property until they die. However, the remainderman also has an ownership interest in the property while the life tenant is alive.

A person owns property in a life estate only throughout their lifetime. Beneficiaries cannot sell property in a life estate before the beneficiary's death. One benefit of a life estate is that property can pass when the life tenant dies without being part of the tenant's estate.

What happens to a life estate after someone dies? Upon the life tenant's death, the property passes to the remainder owner outside of probate.They can sell the property or move into and claim it as their primary residence (homestead). Property taxes will not be reassessed.

This life estate deed is a document that transfers ownership of real property, while reserving access and use of the property for the duration of the grantor's life. It allows the original owner (grantor) to remain on the premises with full access to and benefits from the property.

A life estate deed permits the property owner to have full use of their property until their death, at which point the ownership of the property is automatically transferred to the beneficiary.In the right situations, it can be a streamlined and easy way to transfer ownership.

This life estate deed is a document that transfers ownership of real property, while reserving access and use of the property for the duration of the grantor's life. It allows the original owner (grantor) to remain on the premises with full access to and benefits from the property.

A life estate is a form of joint ownership that allows one person to remain in a house until his or her death, when it passes to the other owner.

The creation of a life estate is accomplished by the language to Recipient for life or, if it is to be a life estate pur autre vie, to recipient for the life of (another person). The holder of the life estate is called the life tenant. If the property is to return to the original owner after the death of the life

A transfer on death deed allows you to retain full ownership during your lifetime and conveys your full interest to the Grantee upon your death.Ultimately, the decision between a life estate and transfer on death deed is dependent on why you want to transfer the property.