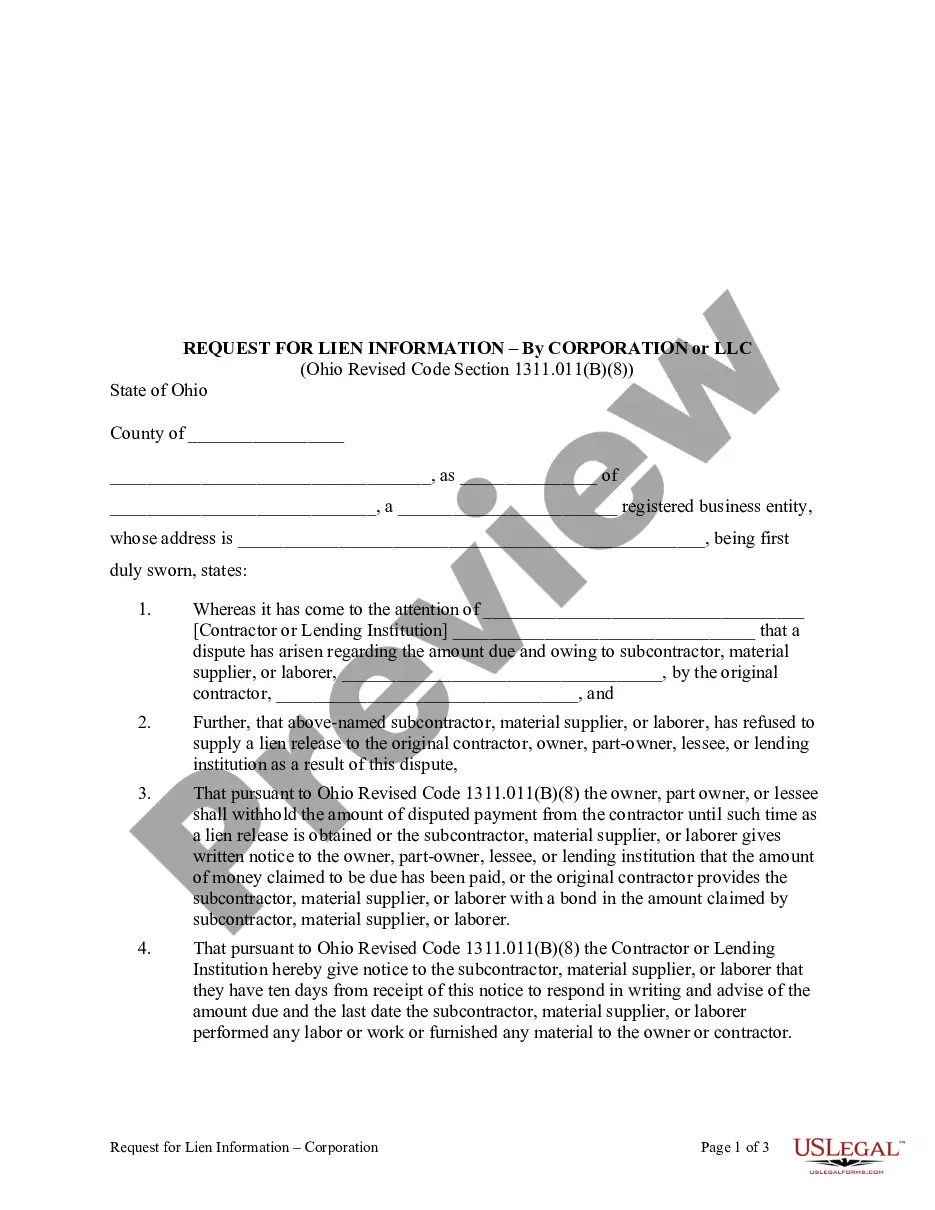

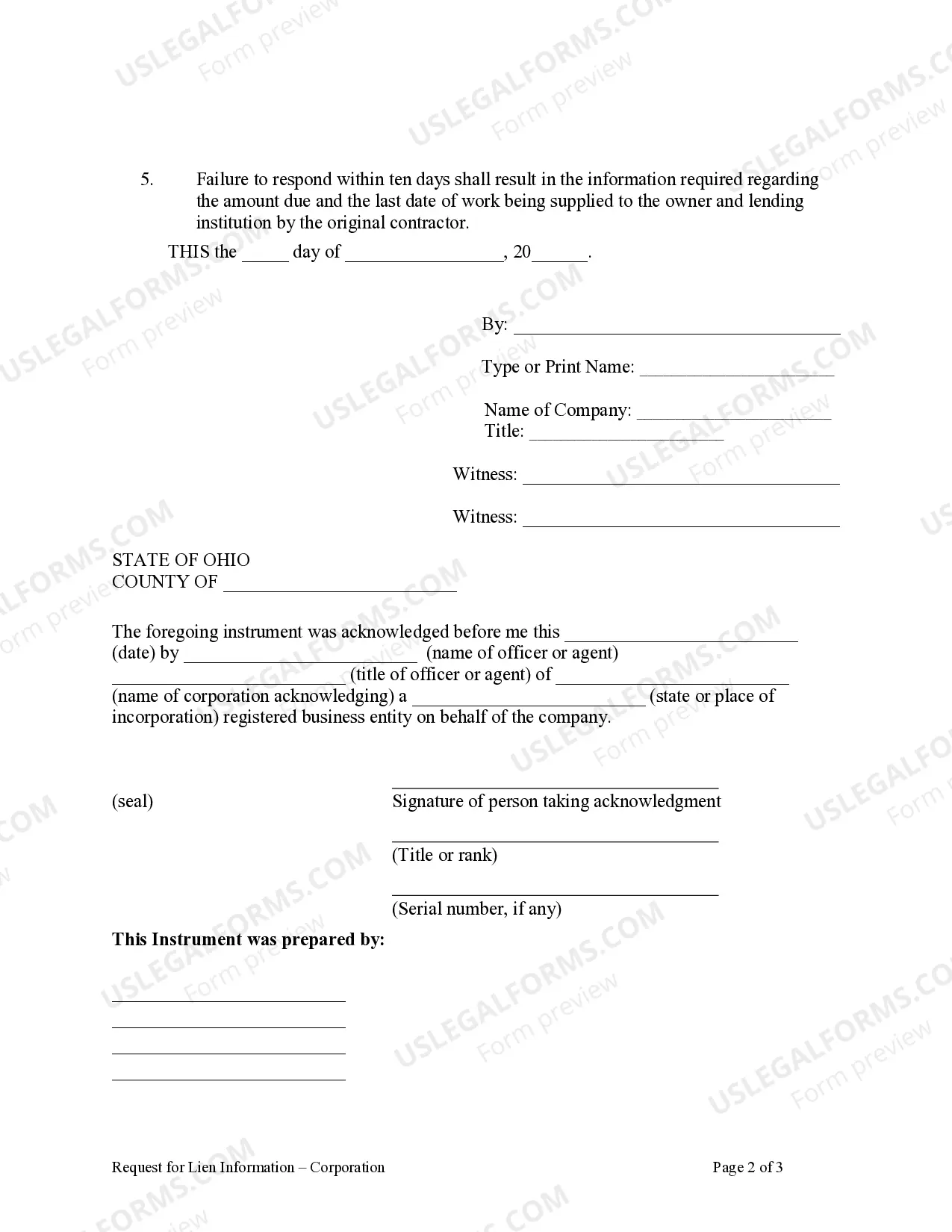

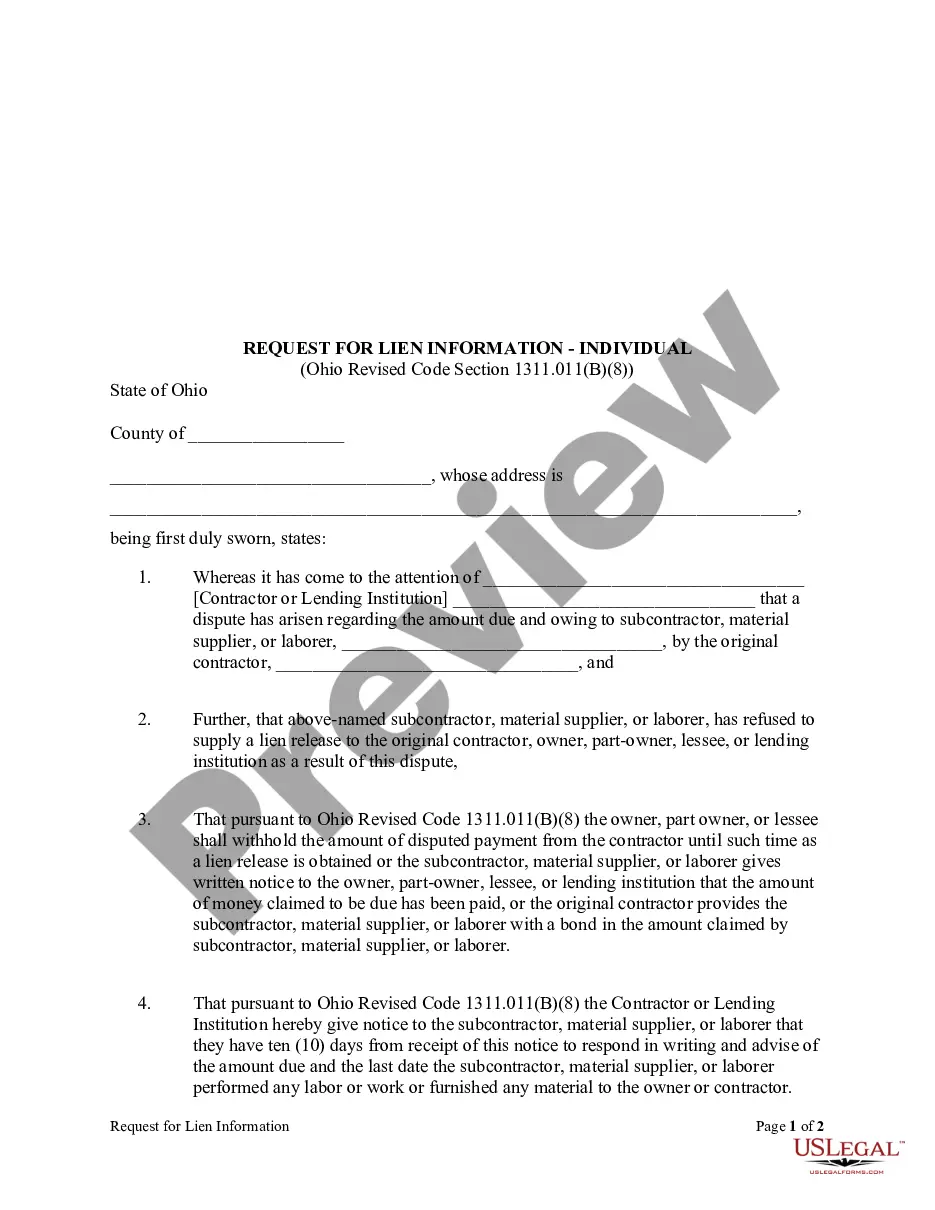

When a dispute arises over payment from the contractor to subcontractor, materialman, or laborer, and the subcontractor, materialman, or laborer refuses to release his or her lien as a result, the owner and/or lending institution may withhold payment from the contractor in the amount disputed. The amount to be withheld must be supplied by the subcontractor, materialman, or laborer, to the contractor within ten days of receipt of a request to supply this information. Failure of the subcontractor, materialman, or laborer to supply this information within ten days will result in the contractor submitting the amount to be withheld to the owner and/or lending institution.

Ohio Request for Lien Information - Corporation

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Ohio Request For Lien Information - Corporation?

When it comes to filling out Ohio Request for Lien Information - Corporation or LLC, you probably think about a long procedure that involves finding a ideal form among countless similar ones after which having to pay out a lawyer to fill it out to suit your needs. Generally speaking, that’s a sluggish and expensive choice. Use US Legal Forms and pick out the state-specific template within just clicks.

For those who have a subscription, just log in and click Download to find the Ohio Request for Lien Information - Corporation or LLC form.

In the event you don’t have an account yet but need one, stick to the point-by-point guide below:

- Make sure the file you’re getting applies in your state (or the state it’s needed in).

- Do it by reading the form’s description and also by clicking on the Preview function (if available) to view the form’s content.

- Click Buy Now.

- Select the appropriate plan for your budget.

- Subscribe to an account and choose how you would like to pay out: by PayPal or by card.

- Save the document in .pdf or .docx file format.

- Find the record on the device or in your My Forms folder.

Professional lawyers work on drawing up our templates to ensure after saving, you don't need to bother about modifying content outside of your personal details or your business’s info. Be a part of US Legal Forms and receive your Ohio Request for Lien Information - Corporation or LLC document now.

Form popularity

FAQ

An LLC Operating Agreement is Not Compulsory, but it is Highly Recommended. An LLC operating agreement is not necessarily compulsory, although this depends on the state where your business is based. You could get into a lot of unnecessary strife if situations change in your LLC.

Ohio does not require an operating agreement in order to form an LLC, but executing one is highly advisable.The operating agreement does not need to be filed with the state.

An operating agreement is a key document used by LLCs because it outlines the business' financial and functional decisions including rules, regulations and provisions. The purpose of the document is to govern the internal operations of the business in a way that suits the specific needs of the business owners.

An operating agreement is mandatory as per laws in only 5 states: California, Delaware, Maine, Missouri, and New York. LLCs operating without an operating agreement are governed by the state's default rules contained in the relevant statute and developed through state court decisions.

In Ohio you can find out if your property has a lien on it by simply checking the records of the local county recorder and the local clerk of courts.

Choose a Name for Your LLC. Appoint a Registered Agent. File Articles of Organization. Prepare an Operating Agreement. Comply With Other Tax and Regulatory Requirements.

Register Your Ohio DBA You can file online with the Secretary of State's website, or you can complete the Name Registration form. The application will ask for your new DBA name and legal information about your business, such as: Whether you are filing for a trade name or a fictitious business name.

A limited liability company (LLC) is not required to have bylaws. Bylaws, which are only relevant to businesses structured as corporations, include rules and regulations that govern a corporation's internal management.Alternatively, LLCs create operating agreements to provide a framework for their businesses.

To obtain more information about the lien, contact the Attorney General's Office. For business taxes call 1-888-246-0488, for individual taxes call 1-888-301-8885.