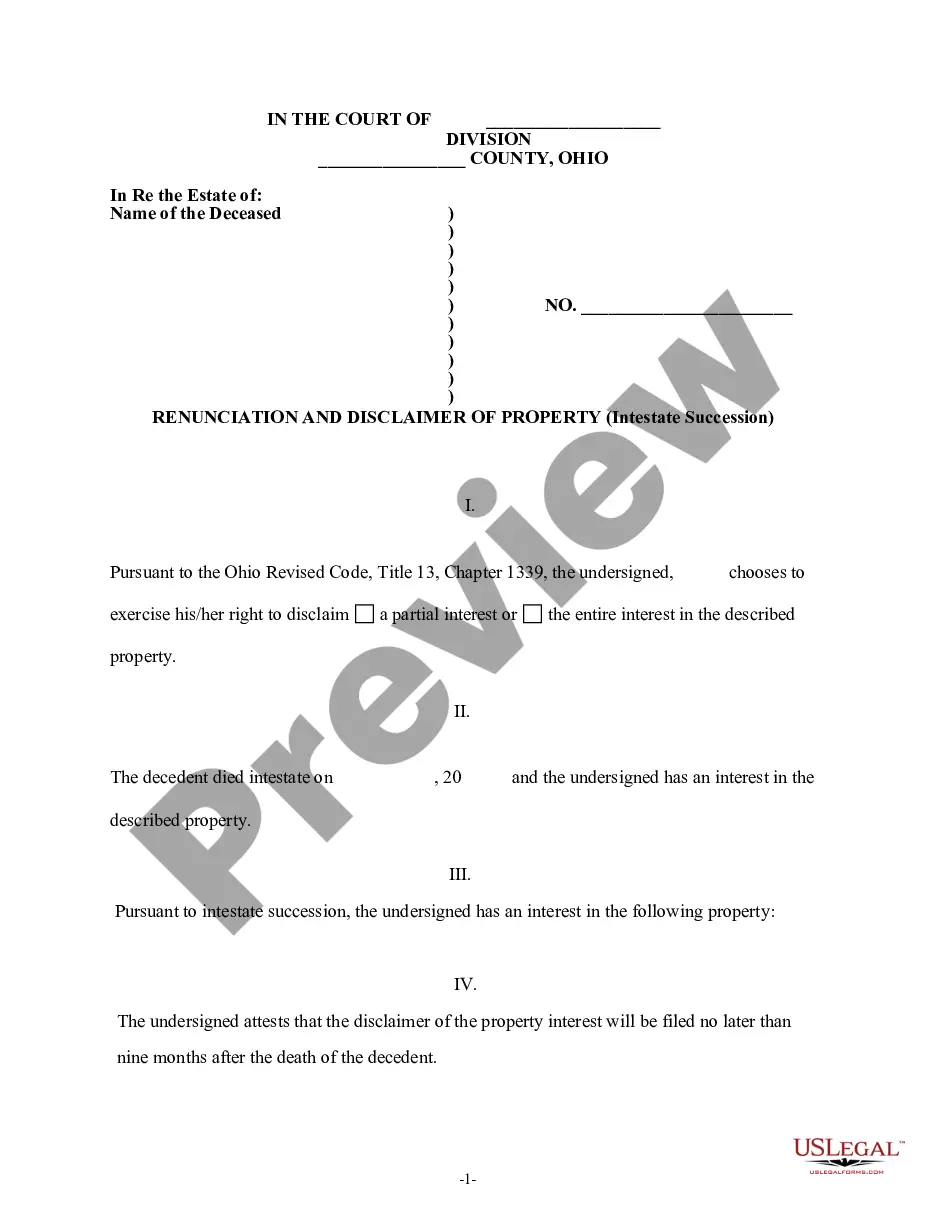

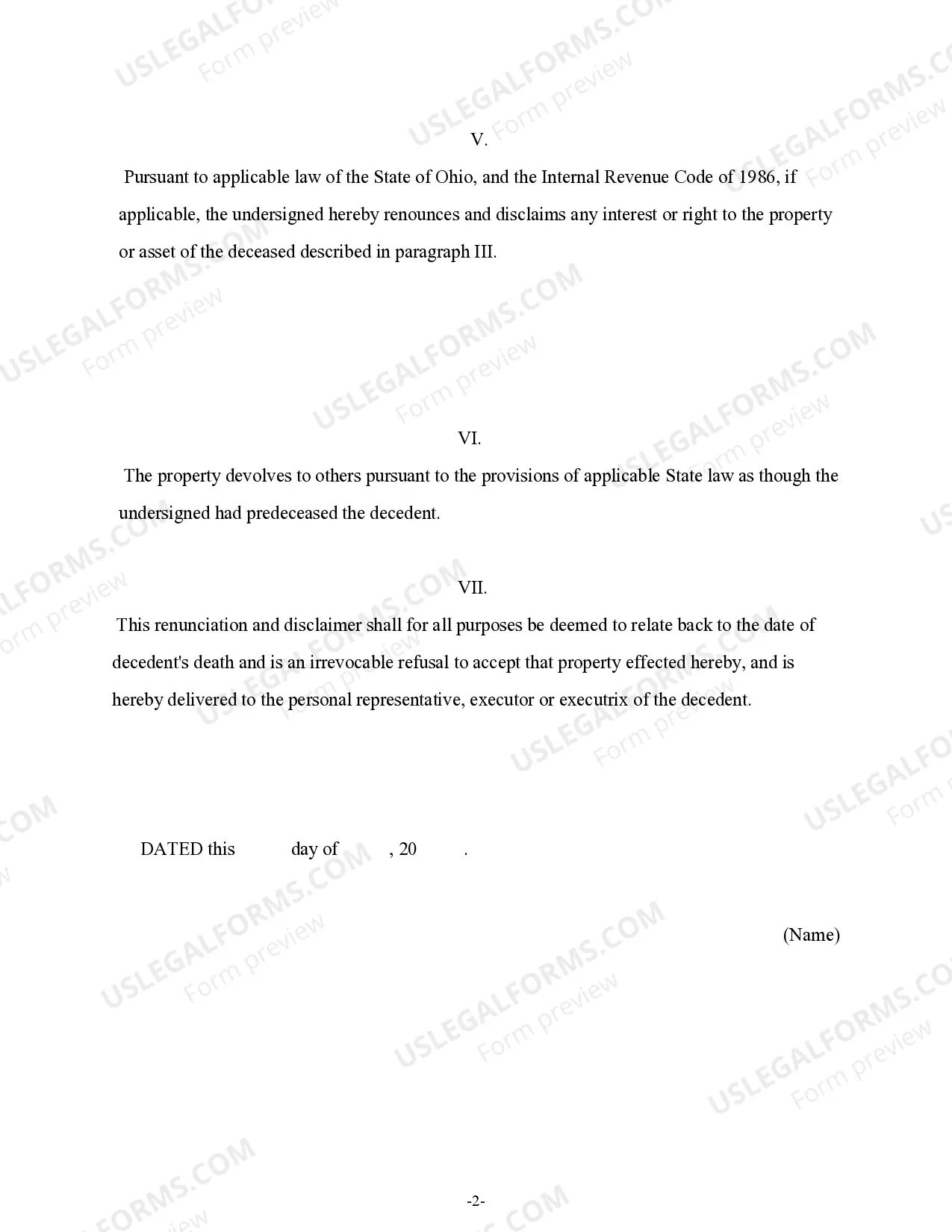

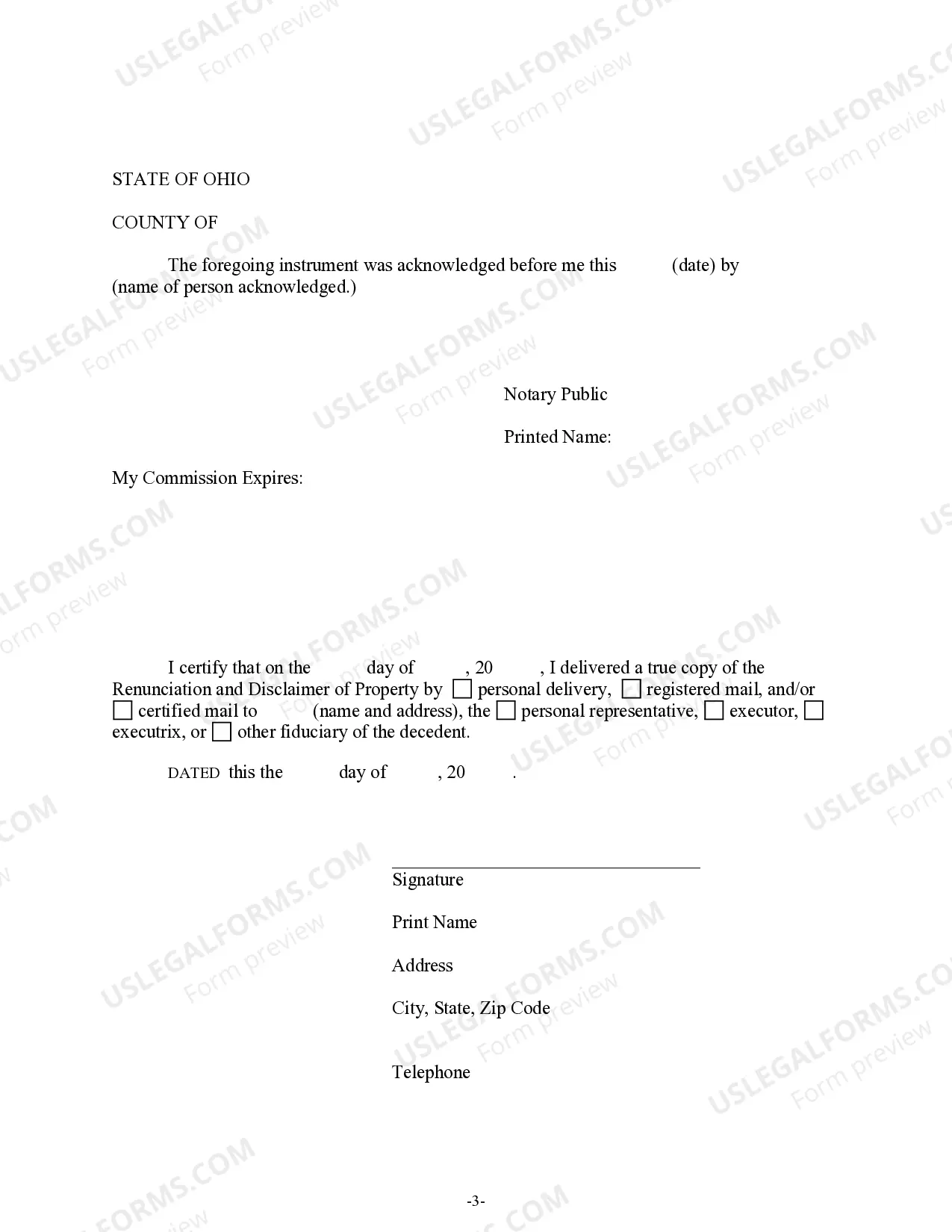

This form is a Renunciation and Disclaimer of Property acquired through Intestate Succession where the decedent died intestate (without a will) and the beneficiary gained an interest in the property, but, pursuant to the Ohio Revised Code, Title 13, Chapter 1339, has decided to disclaim a portion of or the entire interest in the property. The property will now devolve to others as though the beneficiary predeceased the decedent. The form also includes a state specific acknowledgment and a certificate to verify document delivery.

Ohio Renunciation And Disclaimer of Property received by Intestate Succession

Description

Key Concepts & Definitions

Renunciation and disclaimer of property received involves a formal refusal by an heir or beneficiary to accept an inheritance or a gift. This decision might be motivated by various reasons including tax implications, personal beliefs, or a desire to pass the inheritance to another beneficiary. In the United States, various laws and procedures govern this process, making compliance crucial.

Step-by-Step Guide

- Evaluate Reasons for Renunciation: Consider why renouncing your inheritance might be necessary or beneficial. Common reasons include avoiding tax burdens or passing benefits to other beneficiaries.

- Understand Legal Requirements: Familiarize yourself with state-specific laws concerning the renunciation of property or inheritance. States may have different deadlines and required forms for filing a disclaimer.

- Consult with an Attorney: Seek legal advice to ensure the process is handled correctly and to minimize potential negative consequences.

- Submit a Formal Disclaimer: Complete the necessary forms to officially renounce the property. This typically involves a written statement filed with the relevant legal body or court.

- Notify Interested Parties: Inform the estates executor or trustee and any other relevant parties about your decision to disclaim the property.

Risk Analysis

- Legal Risks: Failing to properly file a disclaimer can result in unintentional acceptance of the property, legal complexities, and possible financial liabilities.

- Tax Implications: Incorrect handling might lead to unexpected tax consequences, potentially negating some of the financial benefits of renunciation.

- Relationship Impact: Renouncing an inheritance might affect personal relationships with other family members or entities depending on the circumstances surrounding the renunciation.

Key Takeaways

Key Takeaways include: Understanding the process and implications of renunciation, ensuring compliance with state laws, consulting professionals, and considering the effects on personal taxes and relationships.

Pros & Cons

- Pros: Potentially avoids high tax burdens; allows for the redirection of the inheritance to others who may need or want it more.

- Cons: May strain family relationships; requires careful legal and tax planning to ensure benefits outweigh the drawbacks.

Best Practices

- Early Consultation: Engage with legal and financial advisors early to discuss your options and the best way to proceed.

- Documentation: Ensure all communications and decisions are well-documented to avoid disputes or misinterpretations down the line.

- Comprehensive Review: Regularly review your decisions in the context of evolving legal and financial situations.

FAQ

- What is a renunciation of property? Renunciation of property involves legally declining to accept an inheritance or gift, usually to avoid taxes or redistribute the property to other beneficiaries.

- How do I legally disclaim property? To legally disclaim property, fill out the appropriate disclaimer form and file it with the necessary legal body before the deadline set by state law.

- Can disclaiming property affect my taxes? Yes, disclaiming property can affect your taxes and it is vital to consult with a tax advisor or attorney to understand these implications.

How to fill out Ohio Renunciation And Disclaimer Of Property Received By Intestate Succession?

In terms of submitting Ohio Renunciation And Disclaimer of Property received by Intestate Succession, you most likely visualize an extensive procedure that involves choosing a suitable sample among a huge selection of similar ones then needing to pay legal counsel to fill it out for you. Generally, that’s a sluggish and expensive choice. Use US Legal Forms and choose the state-specific document within clicks.

In case you have a subscription, just log in and then click Download to find the Ohio Renunciation And Disclaimer of Property received by Intestate Succession sample.

If you don’t have an account yet but want one, follow the step-by-step guide listed below:

- Be sure the document you’re saving is valid in your state (or the state it’s required in).

- Do this by looking at the form’s description and by clicking on the Preview option (if readily available) to see the form’s content.

- Click Buy Now.

- Select the proper plan for your financial budget.

- Sign up for an account and select how you would like to pay out: by PayPal or by credit card.

- Download the file in .pdf or .docx format.

- Get the file on your device or in your My Forms folder.

Skilled legal professionals work on creating our templates to ensure that after downloading, you don't have to worry about editing content material outside of your individual information or your business’s details. Be a part of US Legal Forms and receive your Ohio Renunciation And Disclaimer of Property received by Intestate Succession document now.

Form popularity

FAQ

A qualified disclaimer is a part of the U.S. tax code that allows estate assets to pass to a beneficiary without being subject to income tax. Legally, the disclaimer portrays the transfer of assets as if the intended beneficiary never actually received them.

Disclaim the asset within nine months of the death of the assets' original owner (one exception: if a minor beneficiary wishes to disclaim, the disclaimer cannot take place until after the minor reaches the age of majority, at which time they will have nine months to disclaim the assets).

Put the disclaimer in writing. Deliver the disclaimer to the person in control of the estate usually the executor or trustee. Complete the disclaimer within nine months of the death of the person leaving the property. Do not accept any benefit from the property you're disclaiming.

The answer is yes. The technical term is "disclaiming" it. If you are considering disclaiming an inheritance, you need to understand the effect of your refusalknown as the "disclaimer"and the procedure you must follow to ensure that it is considered qualified under federal and state law.

The beneficiary can disclaim only a portion of an inherited IRA or asset, allowing some to flow to the contingent beneficiary(s). Partial disclaiming is either a specific dollar or percentage amount as of the date of death.The balance will go to the next beneficiary(s).

Put the disclaimer in writing. Deliver the disclaimer to the person in control of the estate usually the executor or trustee. Complete the disclaimer within nine months of the death of the person leaving the property.

Disclaim Inheritance, DefinitionDisclaiming means that you give up your rights to receive the inheritance. If you choose to do so, whatever assets you were meant to receive would be passed along to the next beneficiary in line.

You can head off an inheritance by renouncing or disclaiming it. This involves notifying the executor or personal representative of the estate the individual charged with guiding it through the probate process and settling it that you don't want the gift. You must do so in writing, and it's an irrevocable decision.