Ohio Transfer on Death Designation Affidavit - TOD from Individual to a Trust

Definition and meaning

The Ohio Transfer on Death Designation Affidavit allows an individual to designate a trust as the beneficiary of certain real property upon the individual's death. This legal document facilitates the transfer of property ownership without the need for probate, streamlining the inheritance process for heirs and ensuring the desired distribution of assets.

How to complete a form

Completing the Ohio Transfer on Death Designation Affidavit involves the following steps:

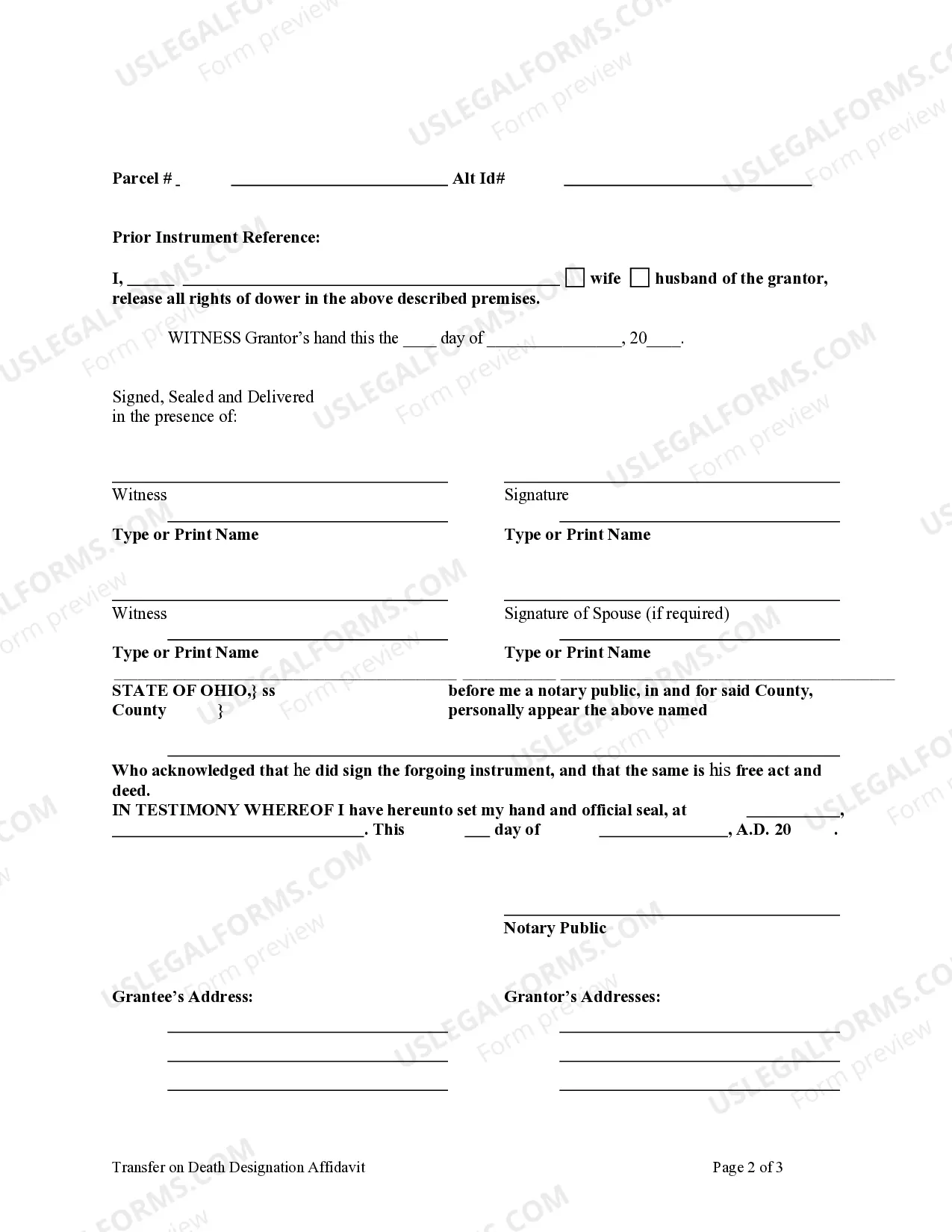

- Begin by filling in the owner’s name and the property details, including the legal description.

- Clearly name the trust and the trustee that will receive the title to the property after the owner’s death.

- Have the form signed by the owner and, if applicable, the spouse, in the presence of a witness.

- Ensure the document is notarized to validate the signatures and the intent.

Who should use this form

This affidavit is ideal for individuals in Ohio who wish to transfer their real estate property to a trust upon their death. It is particularly useful for those who want to avoid the probate process, ensuring a smoother transition of property ownership to beneficiaries while maintaining control over the assets during their lifetime.

Key components of the form

The Ohio Transfer on Death Designation Affidavit contains several essential components:

- Owner Information: Name and address of the property owner.

- Property Description: Detailed legal description of the property being transferred.

- Beneficiary Designation: Name of the trust and the trustee who will receive title upon death.

- Signature Section: Space for the owner's and, if required, spouse's signatures, plus witness signatures.

- Notary Acknowledgment: Certification by a notary public verifying the authenticity of the signatures.

Benefits of using this form online

Utilizing an online service for the Ohio Transfer on Death Designation Affidavit offers several advantages:

- Accessibility: Users can complete the form at their convenience without the need for in-person appointments.

- Guided Process: Online platforms often provide step-by-step guidance, reducing the likelihood of errors.

- Cost-effective: Downloading forms online can be more affordable than hiring legal counsel for simple transactions.

What to expect during notarization or witnessing

During the notarization process for the Ohio Transfer on Death Designation Affidavit:

- A notary public will confirm the identity of the signers.

- They will witness the signing of the document to ensure it is done voluntarily.

- The notary will then place their seal on the document, validating it for legal purposes.

It is essential to bring a valid photo ID to facilitate this process.

Form popularity

FAQ

Keep in mind that if you have a revocable living trust and name it as the beneficiary of your TOD accounts, each time you change the beneficiaries of the trust you will also change the TOD beneficiaries without having to change the designation you have on file with the investment company.

Yes. Ohio law allows individuals who do not need the estate administration benefits of a trust agreement to avoid Probate on the transfer of real property by executing a legal document called a Transfer-On-Death (TOD) Designation Affidavit.

Using an Affidavit of Death to Claim Real Estate from a California Transfer on Death Deed. Transfer on death deeds allow individual landowners to transfer their real estate when they die, without a will or the need for probate distribution.

Fill in information about you and the TOD beneficiary. provide a description of the property. check over the completed deed. sign the deed in front of a notary public, and.

A transfer on death (TOD) account automatically transfers its assets to a named beneficiary when the holder dies For example, if you have a savings account with $100,000 in it and name your son as its beneficiary, that account would transfer to him upon your death.

States that allow TOD deeds are Alaska, Arizona, Arkansas, California, Colorado, District of Columbia, Hawaii, Illinois, Indiana, Kansas, Maine, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Ohio, Oklahoma, Oregon, South Dakota, Texas, Utah, Virginia, Washington, West Virginia,

If you'd like to avoid having your property going through the probate process, it's a good idea to look into a transfer on death deed. A transfer on death deed allows you to select a beneficiary who will receive your property, but only when you've passed away.

Receiving an inheritance can be an unexpected windfall. In fact, transfer on death accounts are exposed to all the same income and capital gains taxes when the account owner is alive, as well as estate and inheritance taxes upon the owner's death.