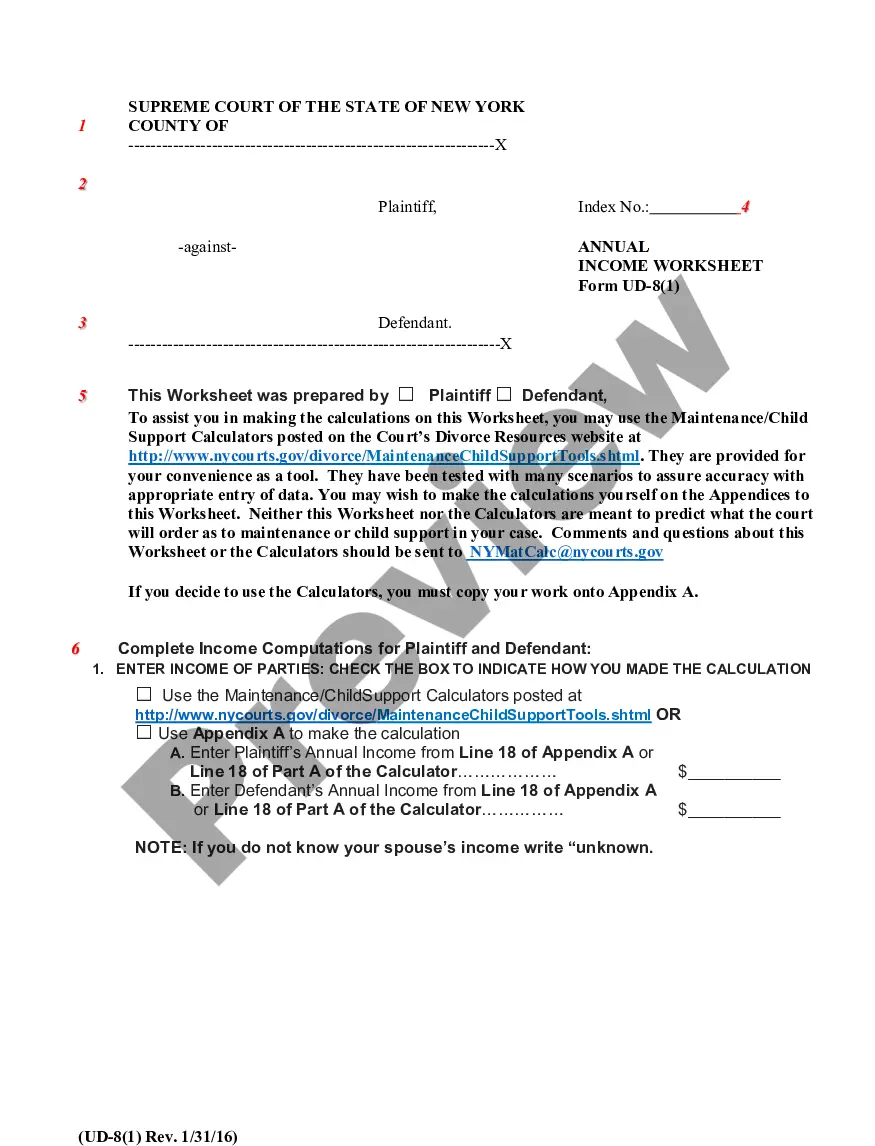

The New York Annual Income Worksheet (UD-8(1)) is a form used by New York taxpayers to calculate their income for a taxable year. It is part of the New York State Department of Taxation and Finance's annual income tax filing system. The form requires taxpayers to provide information on their gross income, deductions, and other income sources in order to calculate their New York State income tax liability. The form is divided into two parts: Part 1 is used to calculate the taxpayer’s income and Part 2 is used to calculate the taxpayer’s deductions. There are three types of New York Annual Income Worksheets (UD-8(1)): the Standard Form, the Nonresident and Part-Year Resident Form, and the Resident and Part-Year Resident Form.

New York Annual Income Worksheet (UD-8(1))

Description

How to fill out New York Annual Income Worksheet (UD-8(1))?

Preparing official paperwork can be a real stress if you don’t have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be confident in the blanks you obtain, as all of them correspond with federal and state regulations and are checked by our specialists. So if you need to complete New York Annual Income Worksheet (UD-8(1)), our service is the perfect place to download it.

Getting your New York Annual Income Worksheet (UD-8(1)) from our service is as easy as ABC. Previously authorized users with a valid subscription need only sign in and click the Download button after they locate the proper template. Later, if they need to, users can use the same document from the My Forms tab of their profile. However, even if you are new to our service, registering with a valid subscription will take only a few minutes. Here’s a quick instruction for you:

- Document compliance verification. You should carefully review the content of the form you want and check whether it satisfies your needs and meets your state law requirements. Previewing your document and reviewing its general description will help you do just that.

- Alternative search (optional). Should there be any inconsistencies, browse the library through the Search tab on the top of the page until you find a suitable blank, and click Buy Now once you see the one you want.

- Account creation and form purchase. Sign up for an account with US Legal Forms. After account verification, log in and choose your most suitable subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your New York Annual Income Worksheet (UD-8(1)) and click Download to save it on your device. Print it to complete your paperwork manually, or take advantage of a multi-featured online editor to prepare an electronic copy faster and more efficiently.

Haven’t you tried US Legal Forms yet? Sign up for our service today to get any formal document quickly and easily every time you need to, and keep your paperwork in order!

Form popularity

FAQ

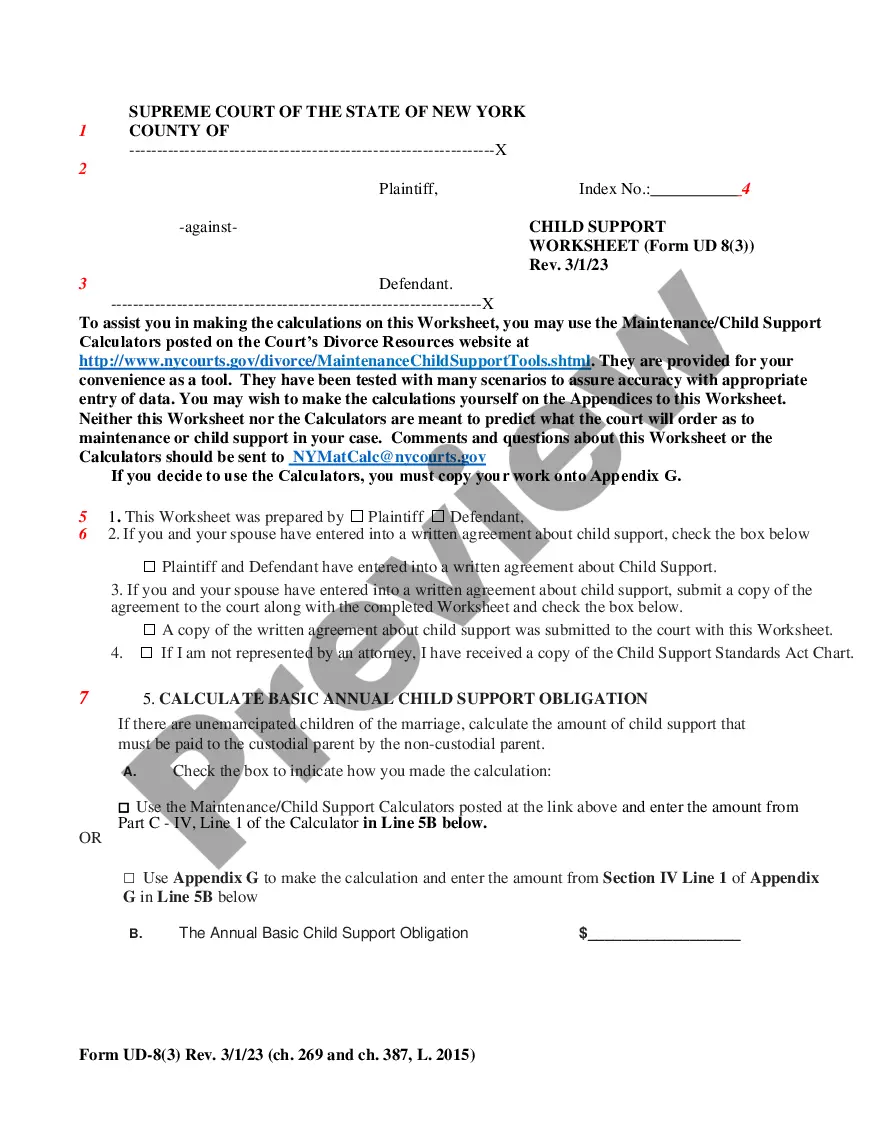

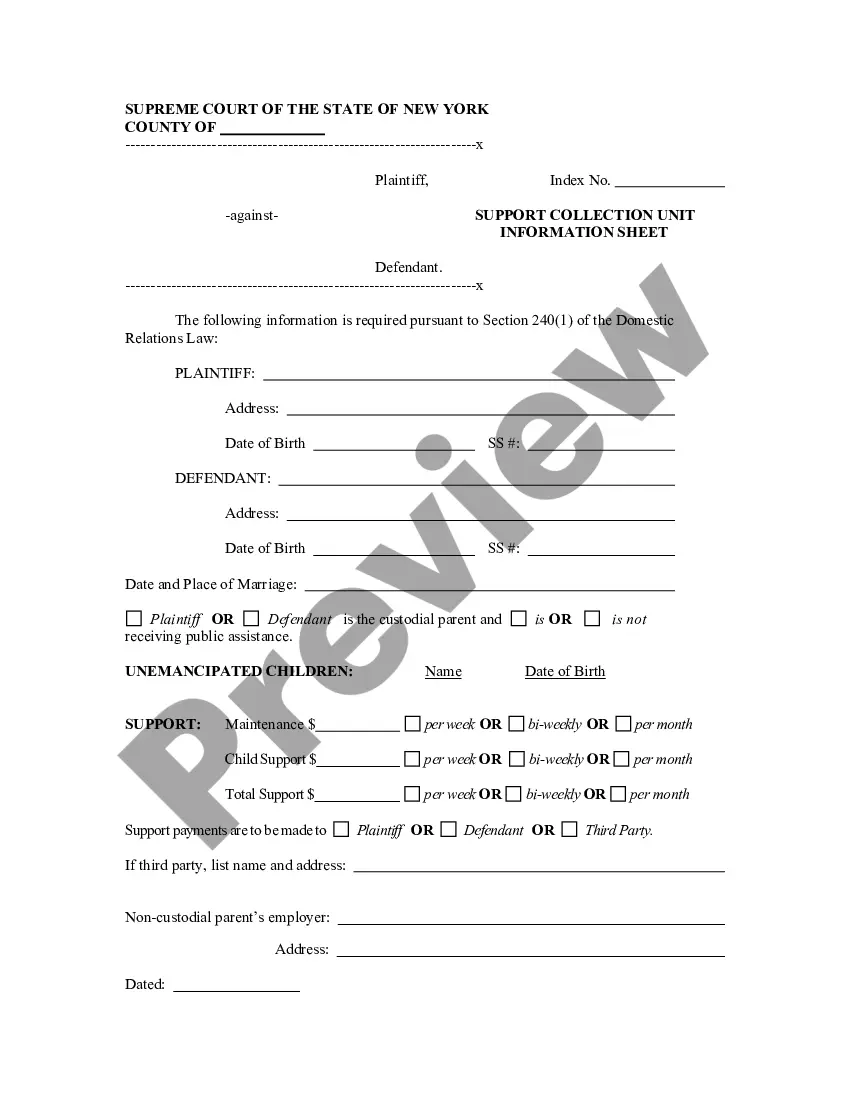

For one child, you take 17% of the parents' combined income, for two children you take 25%, for three children you take 29%, for four children you take 31% and for five children you take no less than 35% of the parents' combined income and this percentage amount represents the basic child support obligation.

Effective March 1, 2022 through December 31, 2023, the income cap for child support calculations will be $163,000 (up from $154,000) and the income cap for maintenance will be $203,000 (up from $192,000). Child support is calculated using the formula in the Child Support Standards Act DRL §240, FCA §413.

Ing to the New York Civil Practice Law and Rules (CPLR) section 5241 and the Consumer Credit Protection Act (CCPA), the maximum amount that can be withheld for child support is between 50% - 65% of your disposable earnings, depending on your situation.

Income is the first criteria used to calculate child support payments, with the child support being calculated as a percentage of gross income. This amount is usually taken from the latest tax return filed.

The court adds the income of both parents together. Second, the court multiplies the combined income by a percentage: 17% for one child. 25% for two children.

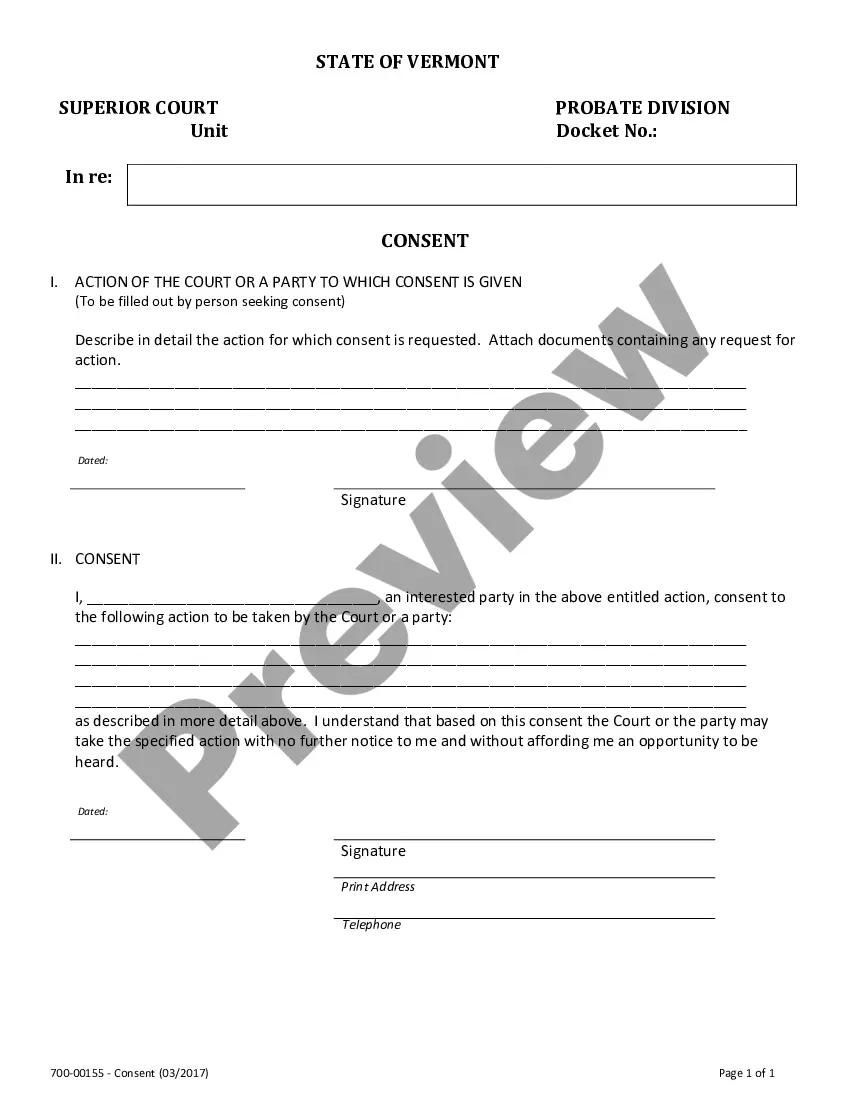

A form that is filed in New York state court and served on all parties confirming that the parties have completed necessary discovery proceedings and the case is trial ready (CPLR 3402(a)). It is the paper that gets the case on the court's trial calendar.

The formula multiplies the parties' combined parental income (up to $163,000) by a certain percentage depending on the number of children ? 17% for one child, 25% for two children, 29% for three children, 31% for four children, 35% for five or more children.