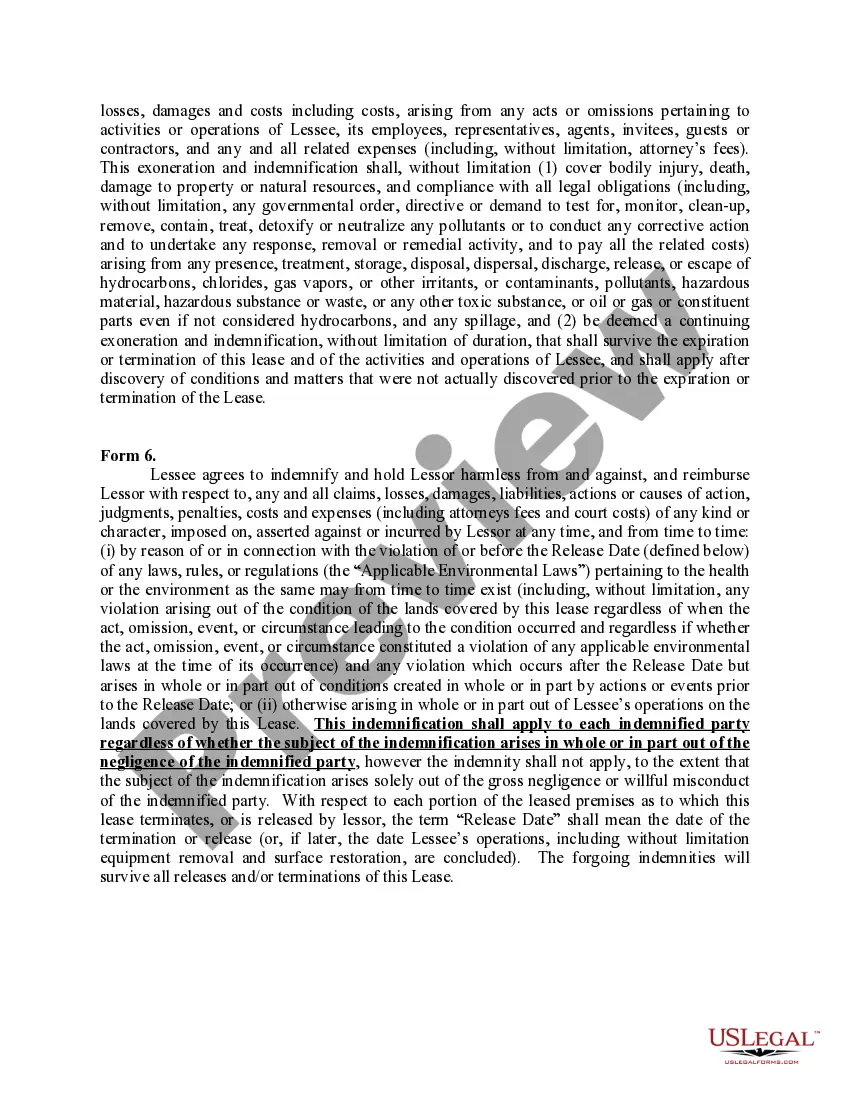

This lease rider form may be used when you are involved in a lease transaction, and have made the decision to utilize the form of Oil and Gas Lease presented to you by the Lessee, and you want to include additional provisions to that Lease form to address specific concerns you may have, or place limitations on the rights granted the Lessee in the “standard” lease form.

New York Indemnification of Lessor

Description

How to fill out Indemnification Of Lessor?

Are you currently within a situation that you require paperwork for sometimes company or person functions virtually every day? There are a lot of legal file templates available on the Internet, but locating ones you can rely is not effortless. US Legal Forms delivers a large number of type templates, much like the New York Indemnification of Lessor, which can be written to fulfill federal and state demands.

Should you be already acquainted with US Legal Forms website and possess a free account, simply log in. Following that, you can down load the New York Indemnification of Lessor format.

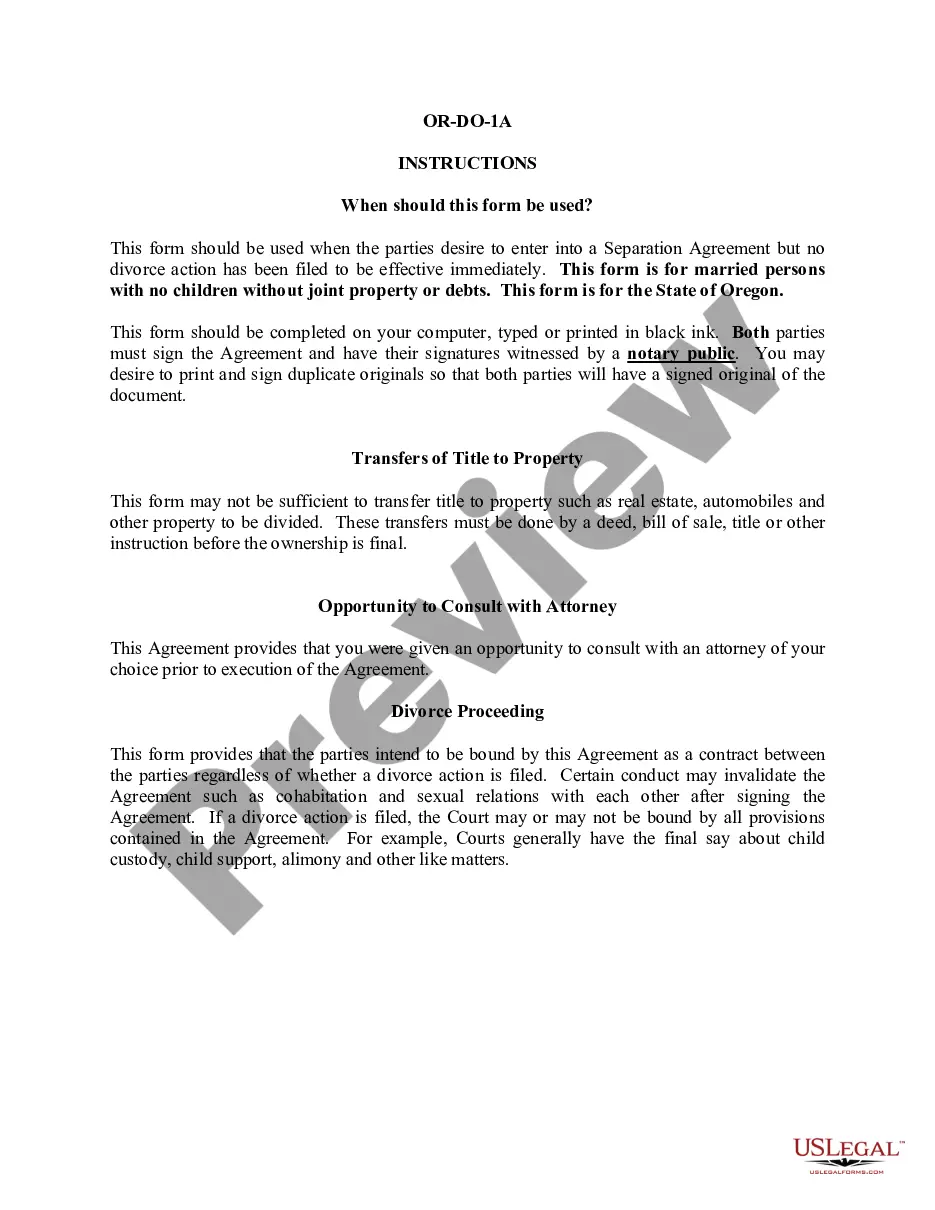

Unless you provide an accounts and would like to begin to use US Legal Forms, follow these steps:

- Find the type you require and make sure it is for your correct metropolis/county.

- Make use of the Preview switch to examine the form.

- Look at the explanation to ensure that you have selected the right type.

- In the event the type is not what you are looking for, take advantage of the Look for field to discover the type that meets your needs and demands.

- When you get the correct type, just click Acquire now.

- Select the pricing strategy you desire, submit the desired information and facts to create your bank account, and pay for the order using your PayPal or Visa or Mastercard.

- Pick a practical document structure and down load your copy.

Locate each of the file templates you possess purchased in the My Forms food selection. You can get a additional copy of New York Indemnification of Lessor any time, if required. Just click on the required type to down load or print the file format.

Use US Legal Forms, probably the most substantial assortment of legal types, to save time as well as avoid errors. The assistance delivers appropriately made legal file templates which can be used for an array of functions. Make a free account on US Legal Forms and commence producing your daily life a little easier.

Form popularity

FAQ

In an indemnity agreement, one party will agree to offer financial compensation for any potential losses or damages caused by another party, and to take on legal liability for whatever damages were incurred.

Common-law indemnity thus permits one who "is held liable solely on account of the negligence of another?to shift the entire liability to the one who was negligent." D'Ambrosio, 55 N.Y. 2d at 462, 450 N.Y.S.

New York's General Obligations Law §5-322.1 prohibits enforcement of an indemnification agreement for damage arising ?out of bodily injuries to persons or damage to property contributed to, caused by, or resulting from the negligence of the promisee, his agents or employees, or indemnitee, whether such negligence be in ...

The indemnification clause should clearly set forth the responsibilities of each party in clear and unambiguous terms, including: the covered property, the scope of covered claims, what actions the tenant is required to perform in the event of a complaint, and what landlord activity is excluded from the indemnification ...

Lessee shall indemnify Lessor against, and hold Lessor harmless from, any and all claims, actions, suits, proceedings, costs, expenses, damages, and liabilities, including attorneys fees, arising out of, connected with, or resulting from the equipment or the Lease, including without limitation, the manufacture, ...

The GOL§ 5-322.1 prohibits a party involved in the construction, alteration, maintenance or repair of a building from contracting with another to indemnify or hold it harmless for injuries arising out of its own negligence.

Indemnification is protection against loss or damage. When a contract is breached, the parties look to its indemnity clause to determine the compensation due to the aggrieved party by the nonperformer. The point is to restore the damaged party to where they would have been if not for the nonperformance.

Indemnification is the assumption of another party's liability under a contract, such as a lease. Therefore, under an indemnification clause, tenants typically agree to reimburse the landlord, or pay directly, ?all losses, claims, suits, liability, and expense? related to a liability situation.