New York Affidavit of Heirship for Small Estates

Description

How to fill out Affidavit Of Heirship For Small Estates?

Have you been in the place in which you require documents for possibly business or individual functions nearly every day? There are tons of lawful document web templates available online, but discovering versions you can rely is not effortless. US Legal Forms offers thousands of develop web templates, just like the New York Affidavit of Heirship for Small Estates, that happen to be written in order to meet federal and state needs.

When you are presently knowledgeable about US Legal Forms website and possess your account, simply log in. After that, you can download the New York Affidavit of Heirship for Small Estates template.

If you do not come with an profile and wish to begin to use US Legal Forms, abide by these steps:

- Get the develop you want and ensure it is for your proper metropolis/state.

- Utilize the Review switch to analyze the shape.

- Browse the information to actually have chosen the appropriate develop.

- When the develop is not what you`re searching for, utilize the Search area to discover the develop that suits you and needs.

- If you find the proper develop, just click Buy now.

- Pick the costs plan you need, fill in the desired details to create your money, and pay for the order with your PayPal or credit card.

- Decide on a convenient data file file format and download your duplicate.

Locate each of the document web templates you might have purchased in the My Forms food list. You can obtain a more duplicate of New York Affidavit of Heirship for Small Estates any time, if necessary. Just click on the necessary develop to download or print out the document template.

Use US Legal Forms, one of the most substantial assortment of lawful forms, to conserve time as well as avoid faults. The support offers expertly produced lawful document web templates which you can use for a variety of functions. Generate your account on US Legal Forms and commence generating your daily life a little easier.

Form popularity

FAQ

Are any assets exempt from probate in New York? Jointly owned assets are not subject to probate because they automatically pass to the surviving owner. Assets with a named beneficiary also bypass probate because the beneficiary is legally entitled to the asset.

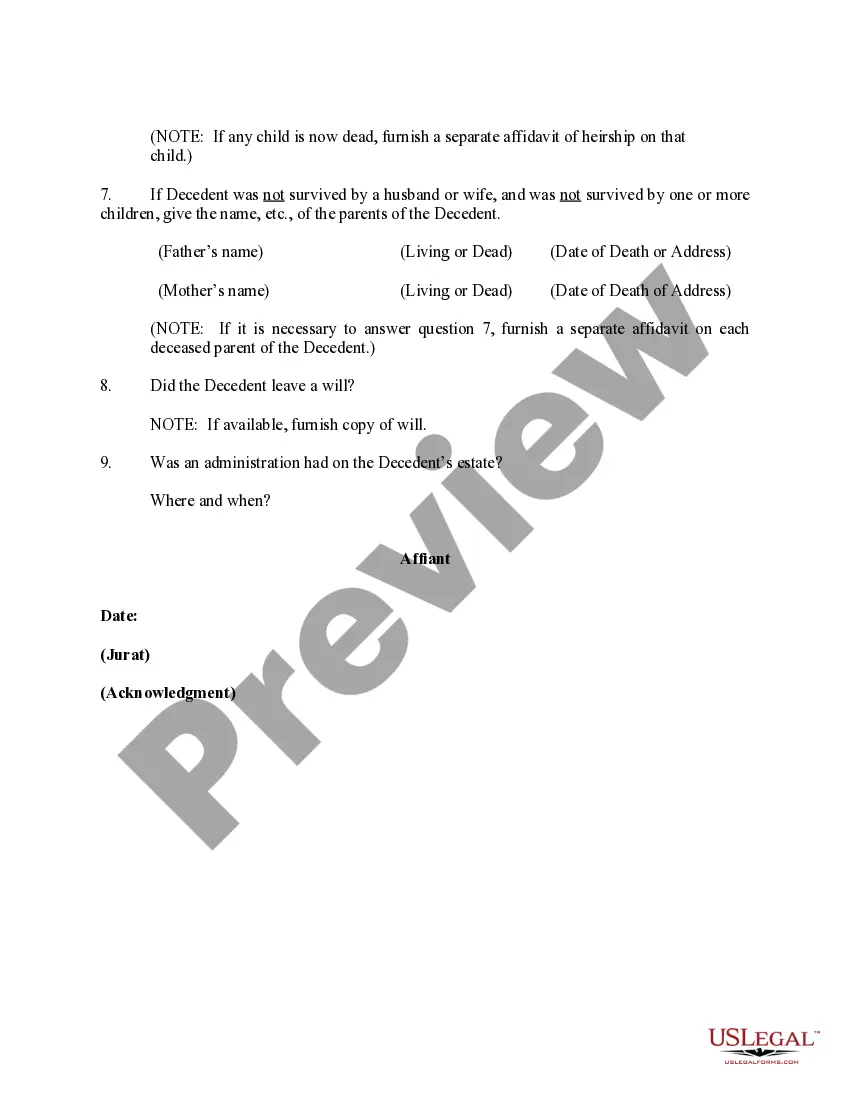

An affidavit of heirship is a document, sworn to under oath, that is submitted to the Surrogate's Court definitively identifying all of the people who may have a legal claim to inherit the decedent's assets or property.

The 1310 Affidavit, a gem hidden within New York's SCPA regulations, allows certain relatives and funeral creditors to collect a decedent's assets without filing any papers in court. This not only saves you time and money but also spares you the headache of navigating the bureaucratic maze of the legal system.

In New York, only estates valued higher than $50,000 need to pass through formal, full probate.

VOLUNTARY ADMINISTRATION or SMALL ESTATE PROCEEDING may be used when a fiduciary is needed to transfer estate assets (personal property only) and the value of the assets does not exceed $50,000, exclusive of property set off under EPTL 5-3.1.

Before attempting the file, the person who fills out the affidavit (known as ?the affiant?), should have: (i) the death certificate of the decedent; (ii) contact information for all other possible heirs; (iii) information regarding any unpaid creditors of the decedent; (iv) an enumeration of the estate's assets, as ...

The decedent's estate includes any real or personal property which was owned by the decedent alone. "REAL" property refers to land or anything attached to it. "PERSONAL" property is any property other than real estate, such as bank accounts, stocks, insurance policies, etc.

If Decedent owned real property jointly with another person and had less than $50,000 of personal property, then IT IS a small estate. If there's real property and a Will, then a probate proceeding should be filed. If there's no Will and real property then an administration proceeding should be filed.