New York Special Improvement Project and Assessment

Description

How to fill out Special Improvement Project And Assessment?

If you want to complete, acquire, or print legitimate document web templates, use US Legal Forms, the biggest variety of legitimate kinds, which can be found online. Utilize the site`s simple and easy practical lookup to discover the paperwork you want. Numerous web templates for organization and individual reasons are categorized by groups and states, or key phrases. Use US Legal Forms to discover the New York Special Improvement Project and Assessment within a number of mouse clicks.

When you are currently a US Legal Forms buyer, log in in your accounts and click the Download switch to have the New York Special Improvement Project and Assessment. You can also access kinds you in the past downloaded in the My Forms tab of the accounts.

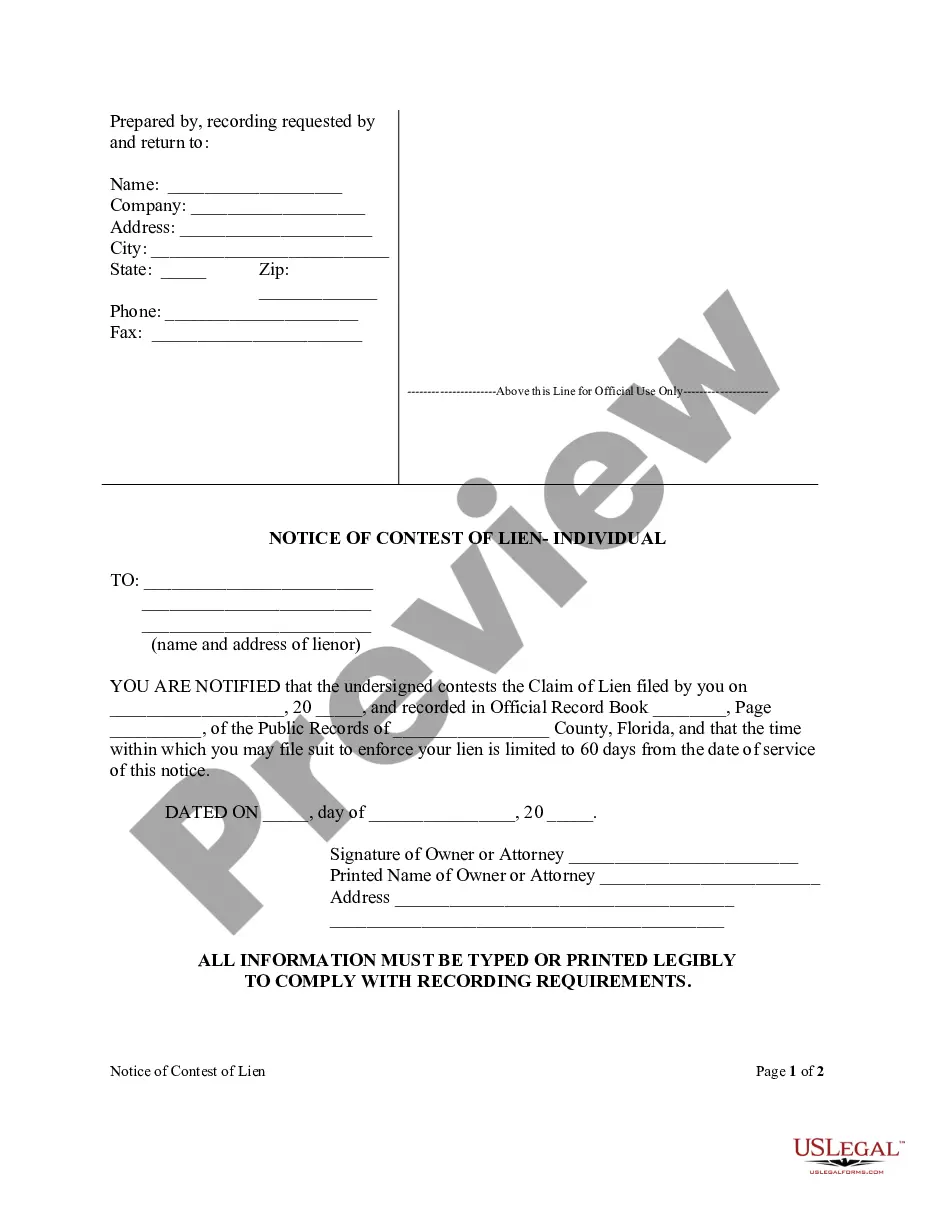

Should you use US Legal Forms the first time, follow the instructions below:

- Step 1. Ensure you have selected the form for your right city/region.

- Step 2. Utilize the Review option to examine the form`s information. Do not overlook to read the outline.

- Step 3. When you are not happy together with the form, use the Research discipline at the top of the display screen to discover other types of the legitimate form template.

- Step 4. Upon having located the form you want, select the Buy now switch. Opt for the prices prepare you prefer and add your credentials to register for an accounts.

- Step 5. Process the deal. You can utilize your bank card or PayPal accounts to accomplish the deal.

- Step 6. Choose the format of the legitimate form and acquire it on the system.

- Step 7. Total, revise and print or sign the New York Special Improvement Project and Assessment.

Every legitimate document template you buy is your own forever. You have acces to each form you downloaded inside your acccount. Click on the My Forms segment and pick a form to print or acquire once again.

Remain competitive and acquire, and print the New York Special Improvement Project and Assessment with US Legal Forms. There are millions of professional and condition-particular kinds you can use for the organization or individual requires.

Form popularity

FAQ

Fixing a flaw or design defect, enlarging a building's capacity, retrofitting a building to improve energy efficiency, and rebuilding a building after it has reached the end of its economic life, all fall under capital improvements as per IRS rules.

Credits may be applied to your taxes or be given to you as a refund check. Clergy Exemption. ... Construction and Renovation Benefits. ... Co-Op and Condo Abatement. ... Crime Victim Exemption. ... Disabled Homeowners' Exemption (DHE) ... Homeowner Tax Rebate Credit (HTRC) ... School Tax Relief (STAR) ... Senior Citizen Homeowners' Exemption (SCHE)

Some examples of repairs that are not considered capital repair/improvements and are simply maintenance expenses include: Fixing leaky pipes. Small new or replacement components. Replacing parts of hardware. Any minor property incidental repair.

Capital Improvements additions, such as a deck, pool, additional room, etc. renovating an entire room (for example, kitchen) installing central air conditioning, a new plumbing system, etc. replacing 30% or more of a building component (for example, roof, windows, floors, electrical system, HVAC, etc.)

A capital improvement is the addition of a permanent structural change or the restoration of some aspect of a property that will either enhance the property's overall value, prolong its useful life, or adapt it to new uses. Individuals, businesses, and cities can make capital improvements to the property they own.

The IRS indicates what constitutes a real property capital improvement as follows: Fixing a defect or design flaw. Creating an addition, physical enlargement or expansion.

If you are the customer and the work being performed will result in a capital improvement, fill out Form ST-124, Certificate of Capital Improvement, and give it to the contractor. You must give the contractor a properly completed form within 90 days after the service is rendered.

Better known as capital expenditures or improvements, these can include big-deal undertakings like carpet replacement, major lighting or landscape projects, pool deck refurbishment, security system upgrades or replacements, exterior painting, painting of garages, stairways, or hallways, and many more.