This is an agreement between the firm and a new partner, for compensation based on generating new business. It lists the base draw and the percentage of fees earned by generating new business. It also covers such areas as secretarial help, office space, medical insurance, and malpractice insurance.

New York Agreement with New Partner for Compensation Based on Generating New Business

Description

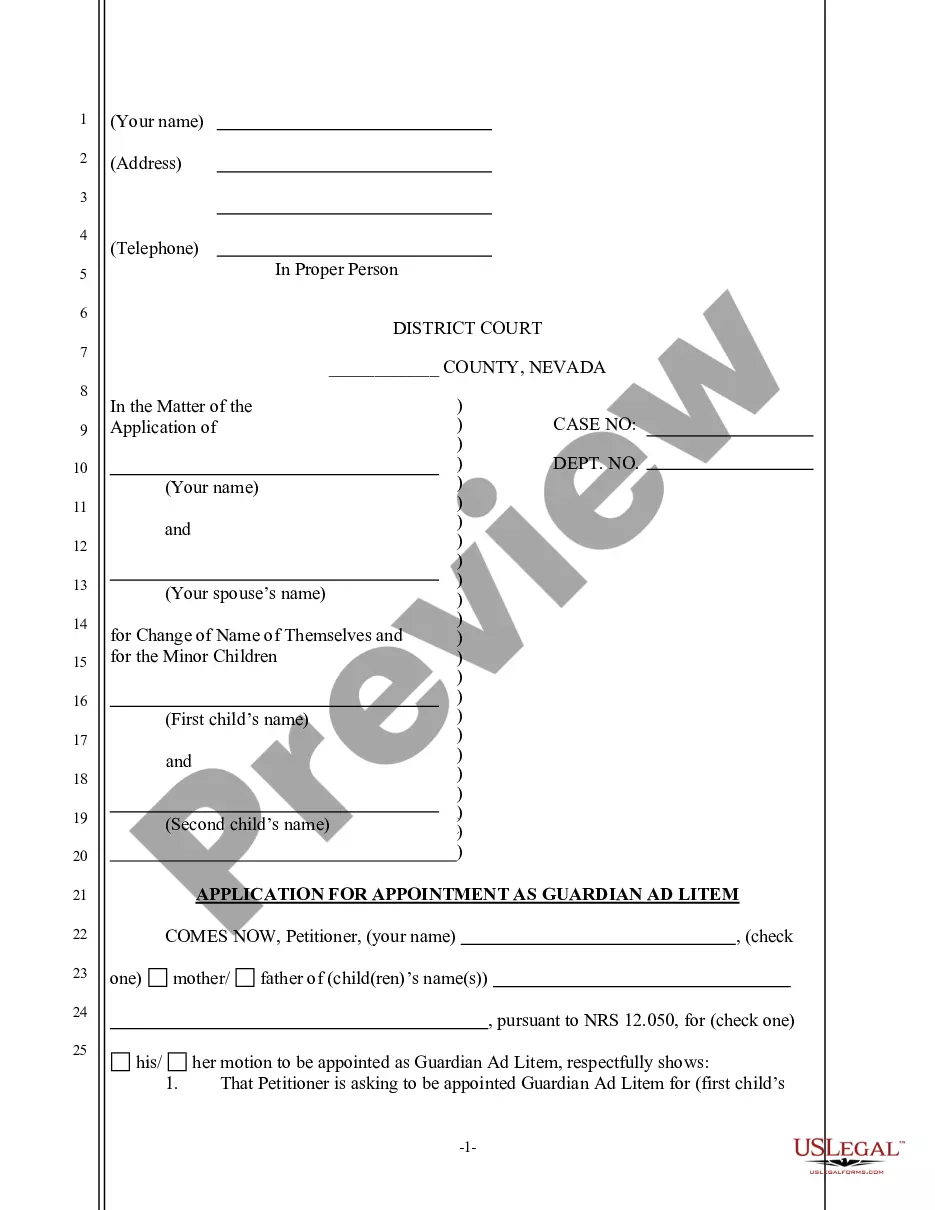

How to fill out Agreement With New Partner For Compensation Based On Generating New Business?

US Legal Forms - among the biggest libraries of lawful kinds in the USA - delivers a variety of lawful papers themes it is possible to acquire or produce. Making use of the site, you will get a large number of kinds for company and person functions, categorized by categories, says, or keywords and phrases.You will discover the most up-to-date variations of kinds such as the New York Agreement with New Partner for Compensation Based on Generating New Business in seconds.

If you already possess a registration, log in and acquire New York Agreement with New Partner for Compensation Based on Generating New Business from the US Legal Forms collection. The Download option will appear on each develop you look at. You have access to all earlier acquired kinds within the My Forms tab of your account.

If you would like use US Legal Forms the very first time, allow me to share straightforward directions to get you began:

- Be sure you have picked the correct develop for your personal metropolis/region. Go through the Review option to examine the form`s content. Browse the develop information to ensure that you have selected the correct develop.

- In case the develop doesn`t suit your needs, take advantage of the Lookup area towards the top of the display to find the one who does.

- If you are happy with the shape, confirm your decision by clicking the Acquire now option. Then, choose the pricing prepare you prefer and supply your credentials to register to have an account.

- Procedure the transaction. Use your credit card or PayPal account to perform the transaction.

- Choose the structure and acquire the shape on the gadget.

- Make alterations. Complete, change and produce and sign the acquired New York Agreement with New Partner for Compensation Based on Generating New Business.

Every template you added to your bank account does not have an expiry time and is your own permanently. So, if you would like acquire or produce an additional copy, just go to the My Forms segment and click on about the develop you will need.

Gain access to the New York Agreement with New Partner for Compensation Based on Generating New Business with US Legal Forms, probably the most considerable collection of lawful papers themes. Use a large number of expert and condition-certain themes that meet up with your organization or person requirements and needs.

Form popularity

FAQ

The partnership agreement spells out who owns what portion of the firm, how profits and losses will be split, and the assignment of roles and duties. The partnership agreement will also typically spell how out disputes are to be adjudicated and what happens if one of the partners dies prematurely.

A written partnership agreement should show the following to avoid confusion and disagreements: The name of your business. The contributions of each partner and the percentage of ownership. Division of profits and losses between the partners.

Elements of a Partnership Agreement Name Include the name of your business. Purpose Explain what your business does. Partners' information Provide all partner's names and contact information. Capital contributions Describe the capital (money, assets, tangible items, property, etc.)

How to Write a Partnership Agreement Outline Partnership Purpose. ... Document Partner's Name and Business Address. ... Document Ownership Interest and Partner Shares. ... Outline Partner Responsibilities and Liabilities. ... Consult With a Lawyer.

Speak to each of them and check that they will approve the addition of a new member, in line with your operating agreement. Then, hold a formal vote and document the results. Most operating agreements and default state laws will require unanimous approval from existing partners to add a new partner to the business.

A partnership agreement is a legal document that dictates how a small for-profit business will operate under two or more people. The agreement lays out the responsibilities of each partner in the business, how much of the business each partner owns, and how much profit and loss each partner is responsible for.

From an LLC to a general partnership, let's break down what you need to do now to prepare to add a partner to your business. Create a written partnership agreement. ... File for an EIN. ... Amend an LLC operating agreement. ... Ask yourself: is this the right partner for my business?

Line F1, Article 22: A partner that is an individual, partnership or LLC treated as partnership for federal purposes, a trust, or estate. Line F2, Article 9-A: A partner that is a C corporation or S corporation that is taxed as a general business corporation under Article 9-A of the New York State Tax Law.