New York Self-Employed X-Ray Technician Self-Employed Independent Contractor

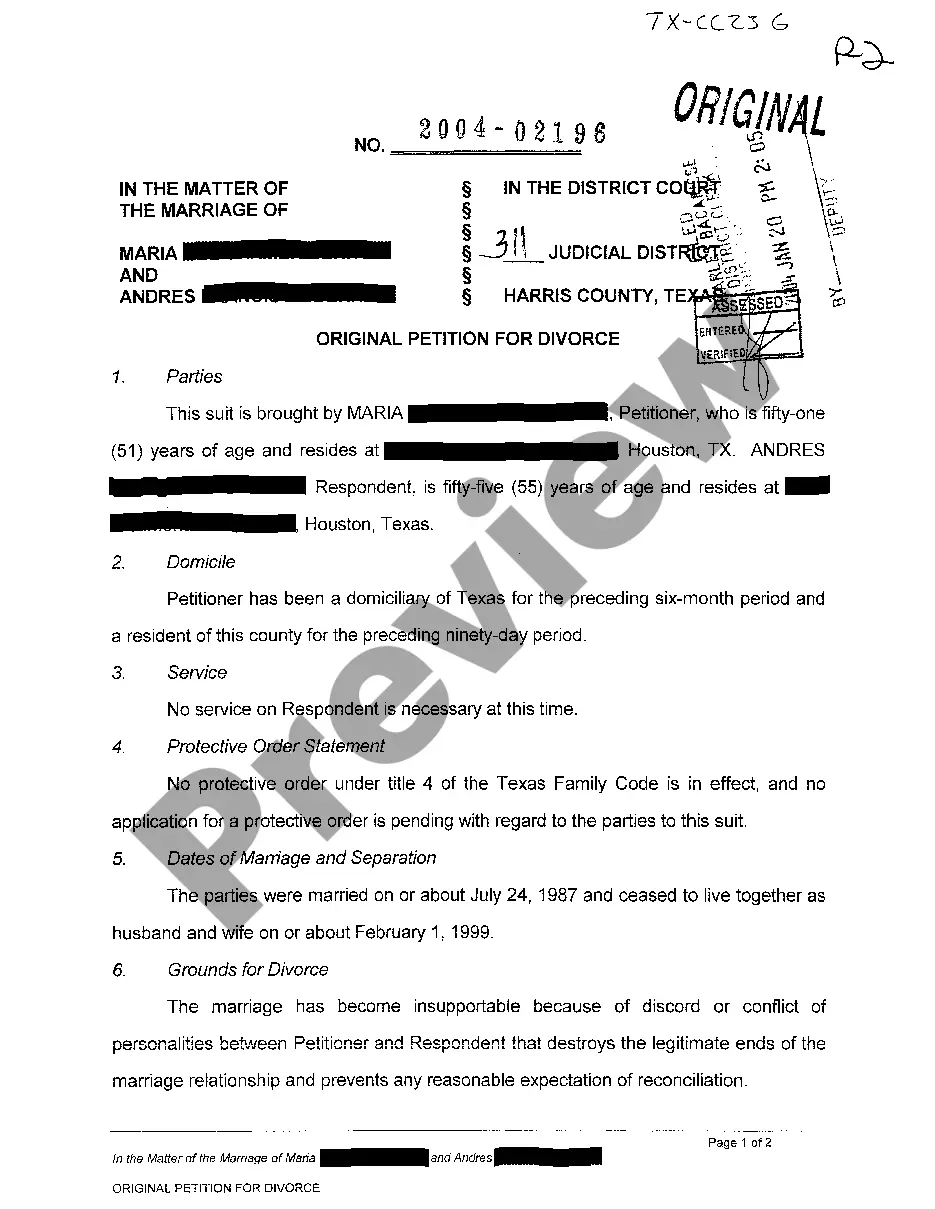

Description

How to fill out Self-Employed X-Ray Technician Self-Employed Independent Contractor?

Are you presently in the situation where you frequently require documents for business or particular purposes? There are numerous legal document templates accessible online, but locating reliable ones is not simple.

US Legal Forms offers thousands of template documents, including the New York Self-Employed X-Ray Technician Self-Employed Independent Contractor, which can be tailored to meet both state and federal requirements.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. After that, you can download the New York Self-Employed X-Ray Technician Self-Employed Independent Contractor template.

Select a suitable file format and download your copy.

You can find all the document templates you have purchased in the My documents section. You can acquire another copy of the New York Self-Employed X-Ray Technician Self-Employed Independent Contractor at any time. Just click on the required form to download or print the document template. Use US Legal Forms, the largest collection of legal documents, to save time and avoid errors. The service provides professionally crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start making your life easier.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct area/state.

- Use the Preview button to examine the form.

- Read the description to confirm that you have selected the right document.

- If the form does not meet your needs, utilize the Search section to find the form that fits your requirements.

- When you find the correct form, click Purchase now.

- Choose the payment plan you prefer, fill in the necessary information to create your account, and complete the transaction using your PayPal or credit card.

Form popularity

FAQ

The New York State Human Rights Law (NYSHRL) does not typically extend protections to independent contractors. This law primarily covers employees in a traditional employer-employee relationship. For New York Self-Employed X-Ray Technicians, understanding these legal distinctions is vital. Consulting resources like US Legal Forms can provide insights into your rights and responsibilities as an independent contractor in New York.

Absolutely, an independent contractor is classified as self-employed. This means you operate your own business, rather than being an employee of another company. For New York Self-Employed X-Ray Technicians who work as independent contractors, this status affects tax obligations and the ability to write off certain expenses. Utilize resources from US Legal Forms to ensure you understand your rights and responsibilities as a self-employed individual.

Yes, if you work as an independent contractor, you are generally considered self-employed. This classification means you manage your own business, set your own hours, and control your work environment. For those identifying as a New York Self-Employed X-Ray Technician Self-Employed Independent Contractor, understanding this distinction is crucial for tax purposes and benefits. You can find helpful resources on platforms like US Legal Forms to clarify your self-employment status.

As a New York Self-Employed X-Ray Technician Self-Employed Independent Contractor, you can show proof of income through various documents. Commonly accepted forms include bank statements, invoices sent to clients, and tax returns. Additionally, using platforms like uslegalforms can help you create professional invoices, making it easier to track your income and provide proof when needed.

Determining if you are a New York Self-Employed X-Ray Technician Self-Employed Independent Contractor involves assessing your work relationships. If you set your own hours, work for multiple clients, and do not receive employee benefits, you likely qualify as an independent contractor. It's important to review your contracts and the nature of your work to make this assessment accurately.

To qualify as a New York Self-Employed X-Ray Technician Self-Employed Independent Contractor, you must meet certain criteria. You typically work on a project basis, maintain control over how you perform your work, and are responsible for your own taxes. Additionally, you should have a contract with your clients outlining the services you provide, which solidifies your status as an independent contractor.

As a New York Self-Employed X-Ray Technician Self-Employed Independent Contractor, your hourly wage can vary significantly based on experience and location. On average, X-ray technicians in New York earn between $30 to $45 per hour. However, self-employed technicians often have the potential to earn more, depending on their client base and the demand for services.

Yes, being an independent contractor inherently means you are self-employed. This classification allows you to enjoy the benefits of managing your own business, including setting your hours and selecting your clients. As a New York Self-Employed X-Ray Technician Self-Employed Independent Contractor, this independence can lead to both professional and personal growth. Embracing this role can create exciting opportunities for your career.

Yes, if you receive a 1099 form, it typically indicates that you are self-employed. This form is used to report income earned as an independent contractor, highlighting your status as a New York Self-Employed X-Ray Technician Self-Employed Independent Contractor. It is important to report this income on your tax return. Maintaining clear records of your earnings will help you stay compliant.

Indeed, an independent contractor is classified as self-employed. This status empowers you to control your work environment and client relationships. As a New York Self-Employed X-Ray Technician Self-Employed Independent Contractor, you have the autonomy to set your rates and manage your schedule. This flexibility can lead to a more fulfilling career.