New York Breeder Agreement - Self-Employed Independent Contractor

Description

How to fill out Breeder Agreement - Self-Employed Independent Contractor?

Are you currently in the situation where you require documents for either business or personal purposes almost every day.

There are numerous authentic document templates available on the internet, but locating ones you can trust is not simple.

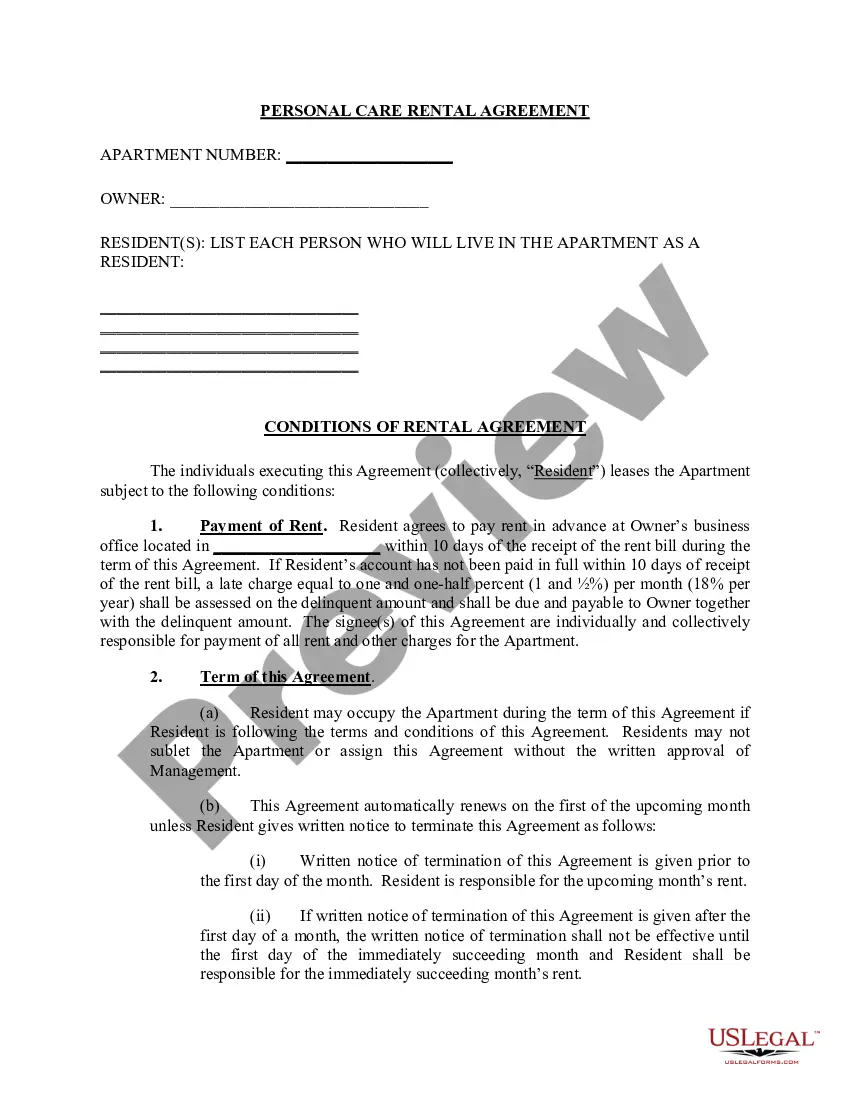

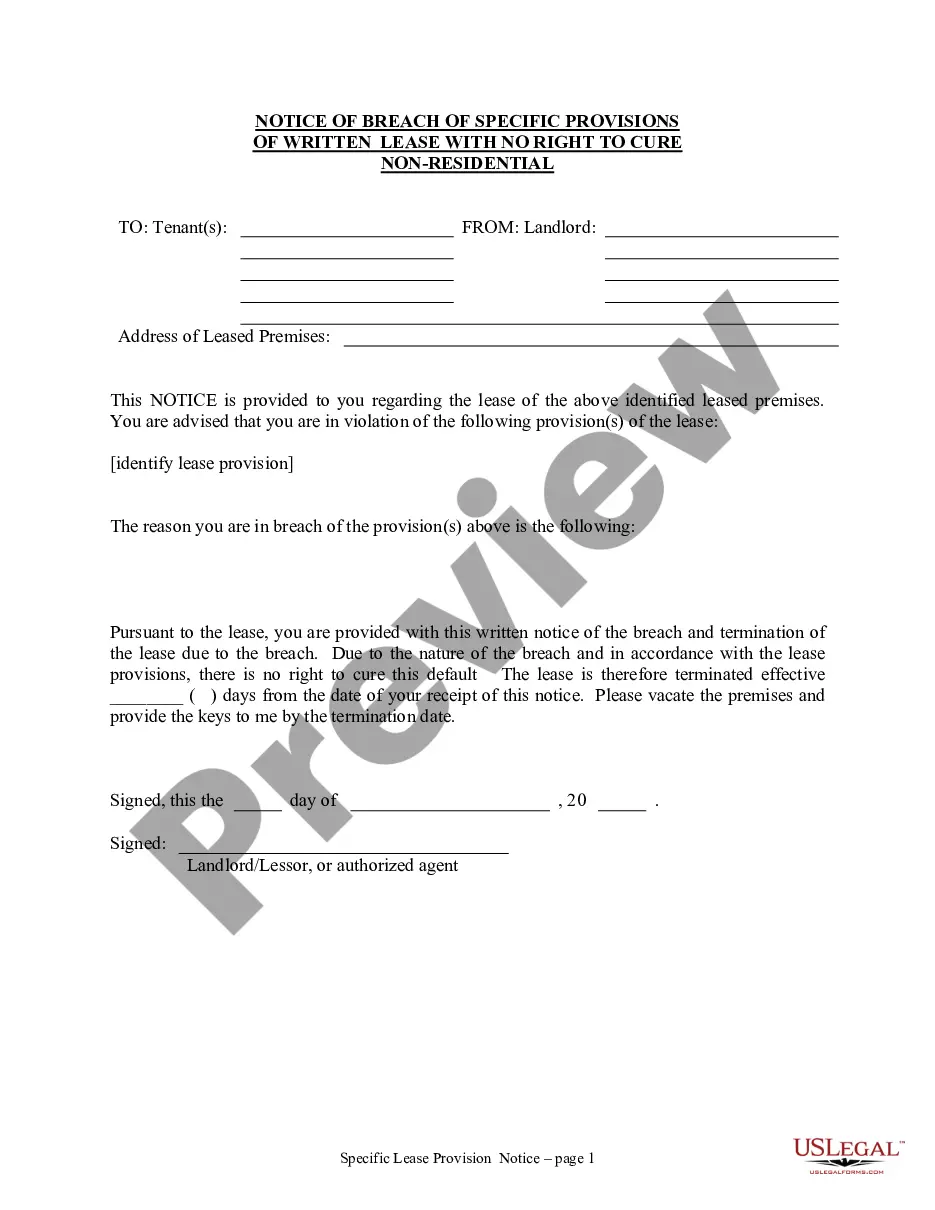

US Legal Forms offers thousands of form templates, such as the New York Breeder Agreement - Self-Employed Independent Contractor, which are designed to comply with state and federal requirements.

Once you obtain the correct form, click Purchase now.

Choose the payment plan you want, fill in the necessary information to create your account, and purchase your order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the New York Breeder Agreement - Self-Employed Independent Contractor template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/region.

- Use the Preview button to review the form.

- Read the description to confirm that you have selected the correct form.

- If the form is not what you are looking for, use the Lookup field to find the form that meets your requirements.

Form popularity

FAQ

To prove you are an independent contractor, gather documentation that highlights your business activities. This could include tax forms, invoices, and contracts that illustrate your work and payment arrangements. Keeping organized records will bolster your status and provide clear proof as needed. Additionally, referencing the New York Breeder Agreement - Self-Employed Independent Contractor can provide further clarity on your role and responsibilities in the eyes of the law.

To create an independent contractor agreement, start by clearly outlining the scope of work, payment terms, and deadlines. You should include rights, responsibilities, and any specific clauses relevant to your situation. Using a template can simplify this process, making it easier to ensure you have all necessary elements. Consider utilizing the New York Breeder Agreement - Self-Employed Independent Contractor template available on US Legal Forms to help streamline this task.

To write an independent contractor agreement, start with a clear title and date. Include the names of both parties, a detailed description of the services, and payment terms. Ensure to emphasize that this agreement reflects a New York Breeder Agreement - Self-Employed Independent Contractor relationship. By following these steps, you can create a legal document that outlines responsibilities and protects your interests.

When filling out an independent contractor form, begin by entering your personal information and the details of the contracting party. Describe the services you provide and outline payment terms. Incorporate your New York Breeder Agreement - Self-Employed Independent Contractor specifics to ensure clarity and compliance. This process sets a professional tone and establishes mutual expectations.

To fill out a declaration of independent contractor status form, start by providing your basic details, including your name, address, and contact information. Next, clearly define the scope of your work and the terms of your arrangement. Ensure you mention that you operate under a New York Breeder Agreement - Self-Employed Independent Contractor. By completing this form accurately, you can establish your status and protect your rights.

Yes, independent contractors file taxes as self-employed individuals. This means you report your earnings on Schedule C of your tax return. It's important to keep track of your income and expenses throughout the year. Using a New York Breeder Agreement - Self-Employed Independent Contractor can also aid in maintaining clear financial records, which is beneficial come tax season.

Filling out an independent contractor agreement requires clear understanding of the terms involved. First, outline the scope of work you will perform as a self-employed contractor. Next, include payment details, duration of contract, and any specific deliverables. By using a New York Breeder Agreement - Self-Employed Independent Contractor template from uslegalforms, you can streamline this process and ensure all essential aspects are covered.

Yes, independent contractors are considered self-employed individuals. This classification means you are responsible for paying your taxes and managing your business operations. As a self-employed dog groomer, you can enjoy greater flexibility and control over your work environment. Protect your interests with a New York Breeder Agreement - Self-Employed Independent Contractor.

Many roles can qualify as independent contractors, including freelance writers, graphic designers, and, of course, dog groomers. Independent contractors typically operate under a contract, setting their terms for work and payment. Understanding your classification is vital to avoid misclassification issues. Templates like the New York Breeder Agreement - Self-Employed Independent Contractor can help clarify these roles.

Using a 1099 form as an independent contractor can be confusing for dog groomers, particularly with misclassification issues. Misclassifying workers can lead to legal penalties and tax liabilities. It's important to ensure you are classified correctly to avoid misunderstandings with tax authorities. The legal framework in the New York Breeder Agreement - Self-Employed Independent Contractor can guide you.