New York Statutory Notices Required for California Foreclosure Consultants

Description

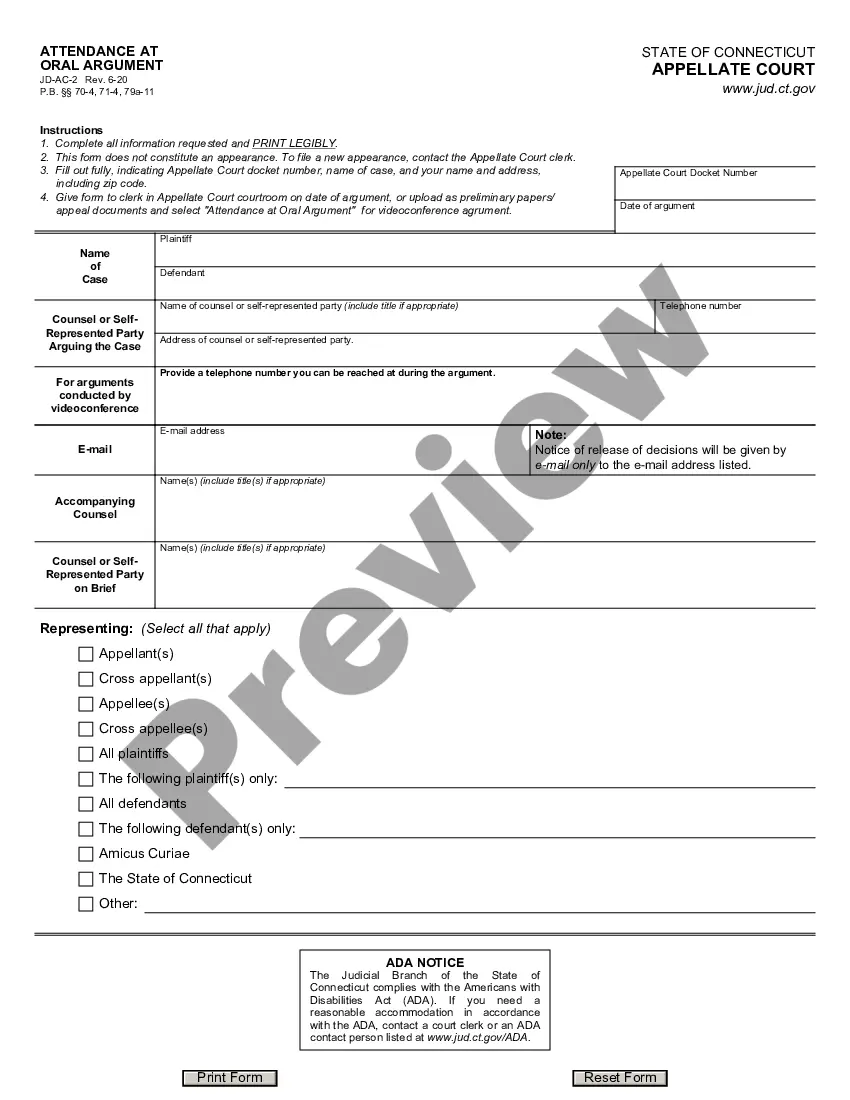

How to fill out Statutory Notices Required For California Foreclosure Consultants?

You might spend time online trying to locate the legal document template that satisfies the state and federal requirements you need.

US Legal Forms offers a vast number of legal forms that are reviewed by professionals.

You can easily download or create the New York Statutory Notices Required for California Foreclosure Consultants from this service.

If available, utilize the Preview button to examine the document template as well.

- If you possess a US Legal Forms account, you can Log In and click the Obtain button.

- Subsequently, you can complete, modify, print, or sign the New York Statutory Notices Required for California Foreclosure Consultants.

- Every legal document template you acquire is yours indefinitely.

- To get an additional copy of the purchased form, navigate to the My documents tab and click the corresponding button.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- First, ensure you have selected the correct document template for the state/city of your preference.

- Review the form description to confirm you have chosen the right one.

Form popularity

FAQ

The 120-day delinquency rule requires that a borrower must be at least 120 days overdue on their mortgage payments before a foreclosure can begin. This rule is crucial because it enables homeowners to seek assistance and explore alternatives to foreclosure. Understanding this rule is essential for both borrowers and California foreclosure consultants who must comply with the New York Statutory Notices Required for California Foreclosure Consultants. By staying informed, clients can navigate the complexities of foreclosure more effectively.

One prohibited practice for a foreclosure consultant includes misleading clients about their ability to delay foreclosure processes. Such actions undermine consumer trust and violate legal standards, including the New York Statutory Notices Required for California Foreclosure Consultants. It is critical for consultants to operate transparently and ethically. Tools and guidance from USLegalForms can help consultants identify and avoid these pitfalls.

A foreclosure consultant is a professional who provides services to homeowners facing potential foreclosure. They help navigate the complexities of foreclosure proceedings and may offer options for avoiding loss of property. It is essential for California foreclosure consultants to understand the New York Statutory Notices Required for California Foreclosure Consultants. Using platforms like USLegalForms can enhance your understanding of best practices and legal obligations.

When a licensee operates as a foreclosure consultant, the PhIFA law mandates that certain disclosures be made to avoid consumer deception. This includes providing a detailed analysis of any fees and the services offered. Familiarity with the New York Statutory Notices Required for California Foreclosure Consultants is crucial in ensuring compliance. Utilizing resources from USLegalForms can assist consultants in understanding these obligations thoroughly.

To file a notice of pendency in New York, you must prepare the document according to New York's specific legal standards. This document, which serves to notify potential purchasers and lenders of property interests, must be properly indexed and filed with the county clerk. Understanding the New York Statutory Notices Required for California Foreclosure Consultants can also guide you in this process. Platforms like USLegalForms can offer templates and step-by-step instructions to help you file correctly.

In New York, the ability for a mortgagee to advance to a foreclosure sale without specific statutory notices is often defined by existing legal frameworks. To ensure compliance, the New York Statutory Notices Required for California Foreclosure Consultants must be thoroughly understood. Accurate adherence to these notices can prevent delays and legal complications. Thus, consulting platforms like USLegalForms can provide detailed guidance on navigating these requirements.

The new foreclosure law in New York aims to strengthen homeowner protections and streamline the foreclosure process for both lenders and borrowers. It focuses on enhancing communication and providing timely information to homeowners facing foreclosure. Knowledge of this law is essential for California foreclosure consultants as it impacts their strategies when assisting clients dealing with similar situations in New York. Understanding the New York statutory notices required is key to navigating these changes successfully.

The new law for foreclosure in California introduces additional protections for homeowners at risk of losing their property. This law requires lenders to engage in a review process before initiating foreclosure, ensuring borrowers are informed about available alternatives. Staying updated on these California-specific guidelines is essential for consultants who service clients in both states. They must also be aware of the New York statutory notices required to provide comprehensive support.

A notice of intent to foreclose is a formal communication from a lender indicating their plan to initiate foreclosure proceedings due to missed payments. This notice is required to give homeowners a final opportunity to rectify their financial situation. It serves as a significant alert for homeowners, providing them with crucial timelines and options. California foreclosure consultants must understand this process and the related New York statutory notices required to guide their clients effectively.

In New York, a lender typically initiates foreclosure proceedings after a homeowner has missed three consecutive mortgage payments. However, the specific timeline may vary based on the lender's policies and the negotiations that take place. It’s advisable for homeowners to seek assistance as soon as they start struggling with payments to avoid reaching this critical point. California foreclosure consultants should remain informed about the New York statutory notices required to best support those at risk of foreclosure.